23/12/2025

Tin tức & Báo cáo mới nhất / Vietnam Briefing

Bình luận: Không có bình luận.

Thị trường quán cà phê Việt Nam đang trở thành một trong những phân khúc năng động nhất trong lĩnh vực thực phẩm và đồ uống, được thúc đẩy bởi sự mở rộng nhanh chóng của các chuỗi cửa hàng, đặt hàng trực tuyến và lòng trung thành mạnh mẽ đối với các thương hiệu trong nước. So với năm 2024, số lượng cửa hàng chuỗi cà phê năm 2025 có tăng nhẹ khi các chuỗi hàng đầu như Highlands Coffee, Phuc Long mở thêm cửa hàng mới tại TP. Hồ Chí Minh, Hà Nội và các thành phố/tỉnh khác. Sự thay đổi trong thói quen tiêu dùng, tần suất ghé thăm quán cà phê ngày càng tăng và các xu hướng thị trường mới đang định hình lại cạnh tranh và tạo ra những điểm thâm nhập mới cho các nhà đầu tư nước ngoài.

Tổng quan thị trường

Ngành thực phẩm và đồ uống (F&B) trong nước tại Việt Nam có các quán cà phê là phân khúc phát triển nhanh và tương đối cao cấp. Đến năm 2025, từ những quán cà phê nhỏ trong ngõ hẻm đến các chuỗi cà phê cao cấp, Việt Nam tự hào có hơn 500.000 quán cà phê.[1]Con số này cao hơn nhiều so với khoảng 317.299 cửa hàng cà phê và trà trên toàn quốc vào cuối năm 2023.[2].

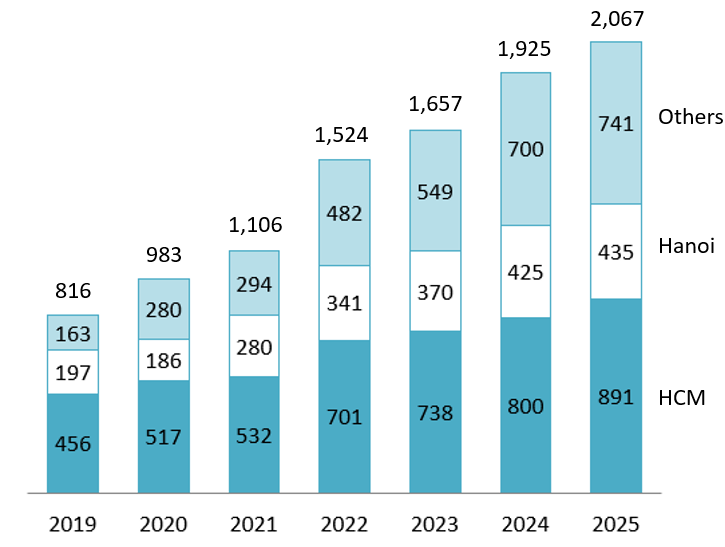

Mạng lưới chuỗi cà phê tại Việt Nam đã mở rộng mạnh mẽ từ năm 2019 đến năm 2025. Tổng số cửa hàng thuộc chuỗi đã tăng hơn gấp đôi, từ 816 cửa hàng năm 2019 lên 2.067 cửa hàng năm 2025. Thành phố Hồ Chí Minh vẫn là trung tâm lớn nhất, tăng từ 456 lên 891 cửa hàng, nhưng sự tăng trưởng không còn chỉ tập trung ở đó. Mạng lưới tại Hà Nội cũng mở rộng từ 197 lên 435 cửa hàng, trong khi sự thay đổi ngoạn mục nhất đến từ các thành phố và tỉnh khác, nơi số cửa hàng thuộc chuỗi tăng từ 163 lên 741, khiến nhóm này lớn hơn cả Hà Nội vào năm 2025.

Number of coffee chain stores in Ho Chi Minh, Ha Noi, and others

Đơn vị: cửa hàng

Nguồn: Hỏi & Đáp

Người chơi chính

Các thương hiệu nội địa chiếm ưu thế áp đảo trên thị trường quán cà phê, không chỉ về số lượng cửa hàng mà còn cả về doanh thu, với Highlands Coffee và Phuc Long dẫn đầu về doanh thu. Mặc dù thị trường được phân khúc rõ ràng, các thương hiệu nước ngoài như Starbucks vẫn giữ vị trí trong phân khúc cao cấp, trong khi các thương hiệu trong nước như Trung Nguyên lại định hình phân khúc truyền thống và văn hóa. Các chuỗi quán cà phê trẻ, thời thượng của Việt Nam như Katinat đã cho thấy sự tăng trưởng nhanh chóng, thu hẹp khoảng cách với các thương hiệu lâu đời không chỉ thông qua mở rộng mặt bằng mà còn thông qua sự linh hoạt về sản phẩm. Những ngôi sao đang lên này đang định nghĩa lại ngành bằng cách vượt ra ngoài cà phê truyền thống; họ tích cực thu hút khách hàng bằng cách giới thiệu các loại đồ uống mới lạ, theo xu hướng, chẳng hạn như trà trái cây, matcha fusion và các concept theo mùa, vào thực đơn để đáp ứng thị hiếu luôn thay đổi của thế hệ Z.

Về quy mô cửa hàng, ước tính đến năm 2025, Milano sẽ đạt 2000 cửa hàng và Highlands Coffee đạt khoảng 855 cửa hàng. Các chuỗi cửa hàng lớn khác cũng là những đối thủ đáng gờm: Phuc Long đã phát triển lên khoảng 237 cửa hàng, Katinat lên khoảng 93 cửa hàng và Starbucks lên 127 cửa hàng.[3].

Danh sách một số chuỗi cửa hàng cà phê lớn tại Việt Nam

| STT | Thương hiệu cà phê | Năm thành lập | Thành phố đầu tiên | Quê hương | Số lượng cửa hàng cà phê năm 2025 |

| 1 | Milano | 1996 | TP.HCM | Vietnam | 2000 |

| 2 | Cao nguyên | 1999 | TP.HCM | Vietnam | 855 |

| 3 | Trung Nguyên | 1996 | TP.HCM | Vietnam | 464 |

| 4 | Cà phê Viva Star | 2013 | TP.HCM | Vietnam | 329 |

| 5 | Phúc Long | 2000 | TP.HCM | Vietnam | 237 |

| 6 | Starbucks | 2013 | TP.HCM | Hoa Kỳ | 127 |

| 7 | Quán cà phê Guta | 2016 | TP.HCM | Vietnam | 96 |

| 8 | Quán cà phê | 2014 | TP.HCM | Vietnam | 93 |

| 9 | Katinat | 2016 | TP.HCM | Vietnam | 93 |

| 10 | Đam mê | 2006 | TP.HCM | Vietnam | 88 |

Nguồn: Hỏi & Đáp

Xu hướng thị trường

Các chuỗi cà phê hàng đầu đang mở rộng chiến lược bằng cách vượt ra khỏi các khu thương mại trung tâm (như Quận 1 và khu vực Landmark 81) vào các khu ngoại ô và các thành phố cấp 2, tận dụng thu nhập ngày càng tăng và các dự án phát triển bán lẻ mới.[4]Đồng thời, các thương hiệu này đang thử nghiệm nhiều hình thức khác nhau. Bên cạnh các cửa hàng truyền thống có chỗ ngồi, các mô hình như cửa hàng drive-thru của Highlands Coffee cho thấy các chuỗi cửa hàng đang thích ứng với giao thông chủ yếu là xe máy ở Việt Nam và thói quen tích hợp điểm dừng chân uống cà phê vào hành trình đi lại hàng ngày. Hình thức này giúp mở rộng phạm vi tiếp cận và phản ánh sự dịch chuyển rộng hơn của thị trường hướng tới tốc độ và sự tiện lợi trong lĩnh vực thực phẩm và đồ uống.

Song song với việc mở rộng mạng lưới, các thương hiệu quán cà phê lớn đang định hình lại thực đơn và định vị của mình. Nhiều chuỗi cửa hàng đang dần chuyển hướng khỏi việc chỉ tập trung vào cà phê và hiện hoạt động như những thương hiệu đồ uống đa dạng hơn. Trà, trà trái cây và matcha đã trở thành những động lực tăng trưởng chính, với một phần doanh thu đáng kể đến từ các mặt hàng không phải cà phê. Sự phát triển này đặc biệt rõ nét trong chiến lược của Phuc Long và Katinat, những thương hiệu tích cực sử dụng các loại đồ uống đầy màu sắc, sáng tạo để thu hút thế hệ Z. Thế hệ Z ngày nay thể hiện sự ưa thích đối với cà phê lạnh và các khái niệm kết hợp sáng tạo, chẳng hạn như kết hợp matcha với nước dừa, hơn là các loại đồ uống nóng truyền thống. Theo Brands Vietnam (2025), nhóm đối tượng này rất bị thu hút bởi các thương hiệu được coi là “hợp thời”, “thân thiện” và “trẻ trung”. [5]

Số hóa là yếu tố thiết yếu, với các chuỗi cửa hàng lớn triển khai ứng dụng di động, chương trình khách hàng thân thiết và tích hợp chặt chẽ với các nền tảng giao hàng (ShopeeFood, GrabFood). Highlands, Katinat và Starbucks tích cực quảng bá việc đặt hàng qua ứng dụng và các lợi ích dành cho thành viên để khuyến khích khách hàng quay lại và tiếp thị dựa trên dữ liệu. Điều này được bổ sung bởi thiết kế cửa hàng như những “không gian thứ ba” hướng đến trải nghiệm, dành cho làm việc và giao lưu. Các ý tưởng như cửa hàng “kiểu biệt thự” của Katinat khuyến khích thời gian lưu lại lâu hơn, giá trị giao dịch cao hơn và tần suất ghé thăm thường xuyên hơn, củng cố vai trò của quán cà phê như điểm đến hàng ngày chứ không phải là nơi chỉ để thư giãn thỉnh thoảng.

Năm 2024, cuộc khảo sát gần 3.000 nhà hàng, quán ăn và quán cà phê cùng 4.000 người tiêu dùng trên cả nước cho thấy 30,41% người tham gia đến quán cà phê một hoặc hai lần một tuần, tăng 7,8 điểm phần trăm.[6]Xu hướng này đặc biệt được thúc đẩy bởi phân khúc thu nhập trung bình trong năm 2025: một báo cáo chỉ ra rằng người tiêu dùng có thu nhập từ 5-10 triệu đồng/tháng có tần suất ghé thăm cao nhất (1-3 lần/tuần), tiếp theo sát là nhóm có thu nhập từ 10-20 triệu đồng/tháng. Khách hàng thuộc các nhóm thu nhập này chủ yếu là nhân viên văn phòng, người làm tự do và sinh viên. Đáng chú ý, 40% khách hàng lựa chọn quán cà phê vì mục đích công việc, bên cạnh các lý do khác như thư giãn, thử đồ uống mới hoặc bắt đầu một ngày mới.[7].

Cuối cùng, sự gắn kết thương hiệu được khuếch đại thông qua mạng xã hội và hàng hóa. Các chiến dịch lan truyền xoay quanh những chiếc cốc phiên bản giới hạn, các ý tưởng theo mùa và hàng hóa độc quyền hiện là đòn bẩy tiếp thị cốt lõi cho các thương hiệu như Katinat, Starbucks và Highlands, tạo ra hiệu quả lan truyền trực tuyến và thu hút khách hàng đến cửa hàng. Ví dụ, Starbucks đã ra mắt phiên bản tiếng Việt của chiếc cốc sứ Phúc Long nhân dịp lễ duyệt binh ngày 30 tháng 4, và Highlands đã khởi động chiến dịch “Tự hào về tinh hoa cà phê Việt Nam”.[8]

Ý nghĩa đối với các nhà đầu tư nước ngoài

Thị trường quán cà phê Việt Nam mang đến những cơ hội hấp dẫn được củng cố bởi nhu cầu bền vững, với tần suất ghé thăm cao của người tiêu dùng thành thị đảm bảo sự ổn định ngay cả trong bối cảnh biến động kinh tế. Mặc dù hiện nay cạnh tranh rất gay gắt, vẫn còn nhiều khoảng trống để định vị khác biệt, đặc biệt là trong các phân khúc chuyên biệt như cà phê thế hệ thứ ba/cà phê nguyên chất, thực đơn tốt cho sức khỏe và thực vật, và các mô hình tiện lợi cao như bán hàng qua cửa sổ ô tô. Hơn nữa, thị trường này rất hấp dẫn cho việc mở rộng quốc tế do môi trường pháp lý thuận lợi hỗ trợ nhượng quyền thương mại, với nhiều nhà đầu tư trong nước đang tích cực tìm kiếm đối tác để trở thành nhà nhượng quyền chính cho các thương hiệu quán cà phê quốc tế uy tín.

Tuy nhiên, những thách thức chính trong ngành cà phê Việt Nam xoay quanh sự cạnh tranh gay gắt về giá cả và vị trí, khi các địa điểm đắc địa tại Hà Nội và Thành phố Hồ Chí Minh đã bị các thương hiệu nội địa hàng đầu thống trị, dẫn đến giá thuê cao và áp lực lớn lên giá đồ uống. Điều này buộc các doanh nghiệp mới gia nhập thị trường phải trả giá cao để thuê cửa hàng flagship hoặc đổi mới bằng cách sử dụng các mô hình nhỏ hơn như ki-ốt và bán hàng qua cửa sổ ô tô. Hơn nữa, các công ty phải vượt qua rào cản về sở thích ẩm thực địa phương đã ăn sâu, vì người tiêu dùng Việt Nam rất ưa chuộng cà phê robusta, sữa đặc và các loại đồ uống ngọt, có vị trà. Các thương hiệu cố gắng theo đuổi hương vị "phương Tây" thuần túy sẽ chỉ mãi ở phân khúc thị trường nhỏ nếu không thể bản địa hóa thực đơn cho phù hợp với những sở thích phổ biến này.

* Lưu ý: Nếu bạn muốn trích dẫn thông tin trong bài viết này, vui lòng ghi rõ nguồn và kèm theo link bài viết để đảm bảo tôn trọng bản quyền.

| B&Company, Inc.

Công ty nghiên cứu thị trường của Nhật Bản đầu tiên tại Việt Nam từ năm 2008. Chúng tôi cung cấp đa dạng những dịch vụ bao gồm báo cáo ngành, phỏng vấn ngành, khảo sát người tiêu dùng, kết nối kinh doanh. Ngoài ra, chúng tôi đã phát triển cơ sở dữ liệu của hơn 900,000 công ty tại Việt Nam, có thể được sử dụng để tìm kiếm đối tác kinh doanh và phân tích thị trường. Xin vui lòng liên hệ với chúng tôi nếu bạn có bất kỳ thắc mắc hay nhu cầu nào. info@b-company.jp + (84) 28 3910 3913 |

[1] https://vietnamnews.vn/economy/1692991/viet-nam-s-coffee-shops-boom-amid-business-closures.html

[2] https://vietnamnews.vn/economy/1656282/fierce-battle-for-billion-dollar-market-share-between-coffee-chains-in-viet-nam.html

[3] https://cafef.vn/cuoc-chien-chuoi-ca-phe-phuc-long-tang-79-cua-hang-katinat-duoi-sat-nut-rieng-the-coffee-house-ngam-ngui-dong-cua-1-3-188250516080502639.chn

[4] https://vir.com.vn/beverage-chains-take-on-new-models-122342.html

[5] https://www.brandsvietnam.com/congdong/topic/346424-ipos-vn-va-nestle-professionalcong-bo-bao-cao-thi-truong-kinh-doanh-am-thuc-tai-viet-nam-nam-2024

[6] https://e.vnexpress.net/news/business/economy/vietnamese-consumers-eat-out-visit-cafes-more-often-4727722.html

[7] https://mibrand.vn/wp-content/cache/all/tin-tuc/mibrand-40-khach-hang-lua-chon-quan-ca-phe-cho-muc-dich-lam-viec/index.html

[8] https://younetmedia.com/en/introducing-the-h1-2025-coffee-shop-social-media-report-announcing-the-top-10-most-prominent-brands/