0512 月2025

最新消息及报道 / 越南简报

评论: 没有评论.

随着注重健康、可持续发展和伦理道德的消费者重塑越南餐饮业,越南素食正从寺庙厨房走向主流。调查显示,绝大多数越南人都吃过素食,许多人每周吃好几次,尤其是在大城市。[1]再加上纯素食包装食品市场的快速增长(2025年价值约为10亿至4万亿美元,预计到2034年将增长一倍以上),[2]这为外国投资者在餐饮、包装食品和原料供应领域创造了极具吸引力的机会。

越南素食行业

市场规模和增长

越南素食市场呈现出独特的双重性:它深深植根于传统的佛教文化,同时又受到现代健康、养生和食品安全趋势的推动。这种融合造就了一个蓬勃发展且快速扩张的行业。

尽管素食和纯素食食品市场发展迅速,但目前在越南庞大的餐饮业(预计到 2024 年将达到近 10 万亿越南盾)中仍只占很小一部分市场份额。[3]目前,素食市场在餐饮总收入中所占比例不到113万亿美元,预计到2025年将达到近141.12亿美元。[4]尽管基数较小,但该细分市场仍展现出强劲的增长势头,未来十年的复合年增长率将达到 8%。4.

截至2024年中期,Foody(一家领先的餐厅点评平台)的数据显示,越南63个省份中有51个省份设有素食餐厅。全国素食餐饮的普及率接近80%,这表明素食主义不再局限于大都市地区。[5].

胡志明市赢得了“素食之都”的美誉,早在2016年就被善待动物组织(PETA)评为“全球最适合素食者居住的城市”第九名。 [6]胡志明市的素食选择密度和多样性远远超过其他地区,这得益于当地更加国际化的人口和更高的佛教徒密度。

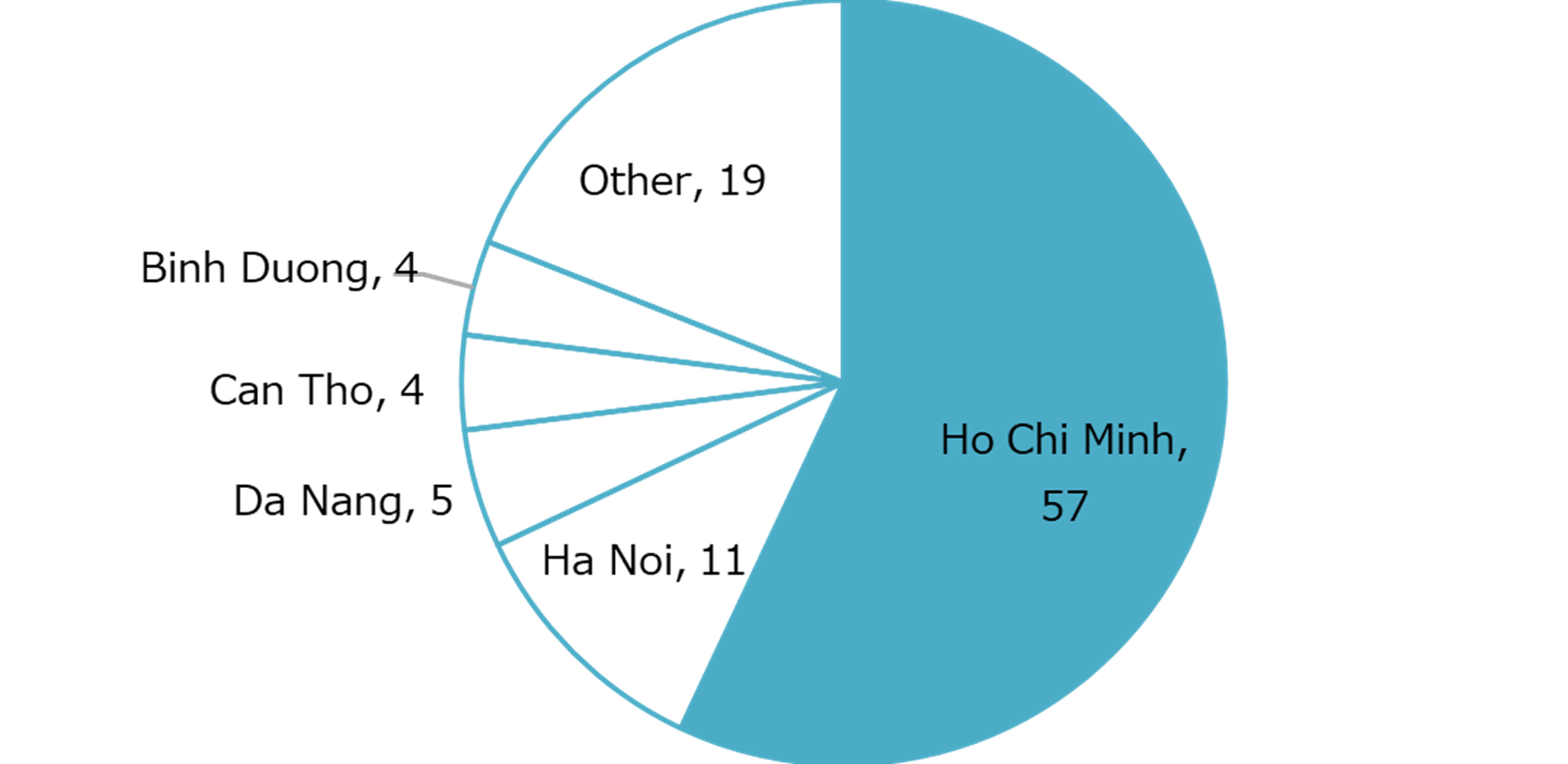

Ratio of vegetarian restaurants (%, 2024)

100% = 2,737 家门店

来源:Foody

市场呈现双轨结构。餐饮服务领域素食和纯素食餐厅迅速扩张,从高端体验式餐厅(例如 Hum Vegetarian、Ưu Đàm Chay)到价格亲民的自助餐连锁店(例如 Veggie Castle),应有尽有,这些餐厅致力于将素食推广为日常选择。与此同时,包装食品和快速消费品领域则以大众市场本土制造商(例如 Binh Tay Food、Bich Chi Food)为主导,这些制造商专注于生产素食方便面和米饭产品;此外,还有一些新兴品牌(例如 Loving Vegan Food)瞄准都市消费者,提供高端、健康定位的纯素零食和替代品。

消费者对素食的态度

越南素食已不再局限于小众的宗教饮食,如今吸引了大量弹性素食者。一项基于Statista的在线调查访问了2757名16岁及以上的受访者,结果显示,451名受访者每周食用植物性食物数次,通常是为了健康、宗教或仅仅是为了“感觉更轻松”。1.

人口中有 14% 人自认为是佛教徒。[7]农历正月初一和十五期间素食消费量激增,推动了当前市场扩张,而“弹性素食者”正是这一趋势的主要动力。这些弹性素食者主要是年轻一代(Z世代和千禧一代)以及都市白领,他们选择植物性饮食并非出于宗教信仰,而是为了获得诸如“善待身体”、体重管理和皮肤健康等个人益处。这种转变对投资者至关重要,因为它需要的是既美味又有营养价值的产品,而不仅仅是用于祭祀仪式的传统“仿肉”。

市场趋势

推动素食主义增长的主要动力已从佛教转向健康养生,而疫情后的意识觉醒加速了这一转变。这催生了“弹性素食者”群体,他们经常为了健康、体重管理或“排毒”而选择素食。值得注意的是,弹性素食者更倾向于选择加工最少的全植物性食品(沙拉、坚果奶),而不是传统的仿肉。

消费者愿意为品质买单,这催生了“大众高端”(masstige)市场。虽然近90%的消费者认为有机食品价格昂贵,但大多数人仍然愿意为安全的产品支付更高的价格。[8]这导致市场分化:低质量、无差异化的摊位举步维艰,而高端概念、经认证的有机零售商和高质量的本地植物基产品则凭借可追溯性和人们感知到的安全性蓬勃发展。

素食餐饮市场正迅速从河内和胡志明市向外扩张,餐厅和连锁店积极在郊区和邻近省份开设分店。这反映了地理可达性的提高和当地需求的增长。此外,国际旅游业也极大地促进了这一领域的发展,因为高端素食餐厅经常出现在旅游指南中,迎合了注重健康、寻求正宗而又干净的越南餐饮体验的外国游客。

渠道组合正从传统的农贸市场转向现代贸易(便利店)和加工食品的数字平台。外卖应用程序已成为关键基础设施。, 这种模式有利于“幽灵厨房”模式,可以轻松分销包装好的零食,减少对黄金零售空间的依赖。

消费者,尤其是Z世代,越来越倾向于选择拥有引人入胜、完整品牌故事的品牌。产品必须在环境影响方面做到“零负担”。品牌通过强调环保包装、透明的“从农场到餐桌”的采购流程以及本土文化根源,在对食品安全问题高度敏感的市场中建立信任,从而获得成功。

对外国投资者的影响

机会

越南市场呈现三大核心发展路径。首先,投资者可以与当地制造商合作开发融合本土风味与国际标准的素食产品,例如联名素食方便面、酱料和冷冻食品,既保留地道的本地风味,又符合国际质量标准。其次,对可扩展的餐饮模式进行战略投资至关重要;支持成熟模式的多店扩张,能够同时满足大众市场和高端市场的需求。最后,供应新一代植物基原料和技术蕴藏着巨大的发展潜力。外国供应商可以利用越南在大豆蛋白和组织化植物蛋白(TVP)方面的优势,将供应链从基本的豆腐/豆豉产品拓展到更高级的肉类和乳制品替代品。

挑战

外国投资者必须应对诸多挑战。市场竞争分散,仅凭“素食”定位难以建立清晰的品牌差异化。此外,价格敏感性仍然是一大障碍;在富裕阶层之外,纯进口或高端产品往往难以在价格上与本地素食菜肴竞争。缺乏官方法律定义也会引发信任问题,除非通过严格的认证来加以解决。与适应当地口味的产品相比,西式植物基产品(例如汉堡肉饼、香肠)的吸引力有限。越南消费者更喜欢与越南传统菜肴(如法棍、越南河粉或火锅)相契合的口感和风味。未能调整口味和产品形式以适应越南消费者口味的外国品牌,往往在最初的“好奇尝试”阶段后就难以留住客户。

*如果您想引用本文中的任何信息,请注明来源以及原始文章的链接,以尊重版权。

| B&Company

自 2008 年以来,日本第一家专门从事越南市场研究的公司。我们提供广泛的服务,包括行业报告、行业访谈、消费者调查、商业配对。此外,我们最近还开发了一个包含越南 900,000 多家公司的数据库,可用于搜索合作伙伴和分析市场。 如果您有任何疑问,请随时与我们联系。 信息@b-company.jp + (84) 28 3910 3913 |

[1] Statista。(2025年11月28日)。越南2024年植物性食品消费频率。https://www.statista.com/statistics/1073092/vietnam-frequency-of-plant-based-food-consumption/

[2] 越南素食市场规模、份额及2034年预测报告。(无日期)。https://www.imarcgroup.com/vietnam-vegan-food-market

[3] 越南投资评论。(2025年9月16日)。越南餐饮市场进入更加成熟的阶段。越南投资评论 – VIR。https://vir.com.vn/vietnams-fb-market-entering-more-mature-phase-136639.html

[4] 越南素食市场规模、份额及2034年预测报告。(nd-b)。https://www.imarcgroup.com/vietnam-vegan-food-market

[5] B公司(2025年8月19日)。胡志明市成为素食之都。植物性饮食趋势悄然蔓延——B公司。B公司。https://b-company.jp/ho-chi-minh-city-becomes-the-capital-of-vegetarians-plant-based-trends-quietly-spreading/

[6] Vietnam+。(2017年1月13日)。胡志明市入选亚洲十大最适合素食者居住的城市。Vietnam+(VietnamPlus)。https://en.vietnamplus.vn/hcm-city-named-in-10-most-vegan-friendly-cities-in-asia-post105797.vnp

[7] 2022年越南的宗教和宗教政策

[8] VnExpress. (2025年5月19日). 尽管有机食品价格翻倍,但需求依然旺盛。vnexpress.net。https://vnexpress.net/thuc-pham-huu-co-gia-cao-gap-doi-van-dat-khach-4886901.html