13/01/2026

Tin tức & Báo cáo mới nhất / Vietnam Briefing

Bình luận: Không có bình luận.

Vietnam’s food delivery market reached a turning point in 2025 as the landscape became more concentrated following Gojek’s exit. While GrabFood and ShopeeFood now set the pace, newcomers like Xanh SM Ngon are shifting the competition from pure discounting to operational speed and reliability. Despite rising demand, restaurants face intensifying pressure from higher fees and ad costs, even as distinct usage patterns emerge between Hanoi and Ho Chi Minh City. Ultimately, the market has moved beyond simple expansion toward a high-stakes battle over service quality and efficiency.

Tổng quan thị trường

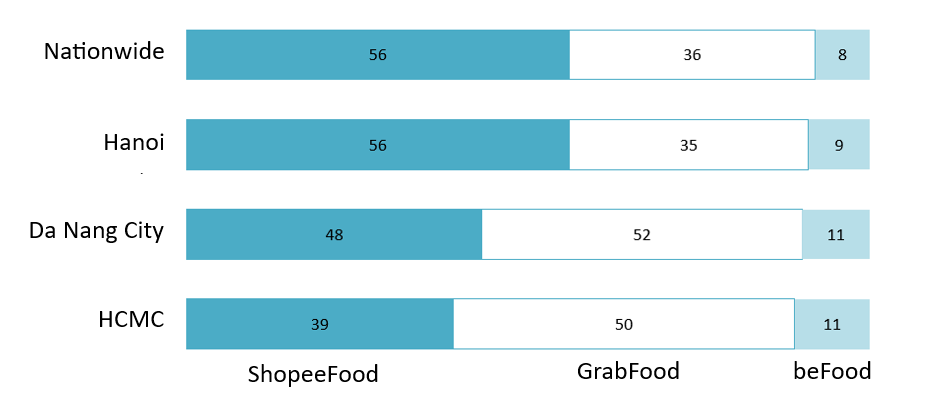

In 2025, according to estimates from Statista and VECOM, Vietnam’s food delivery market revenue reached nearly USD 3 billion in 2025, representing an approximate 15% increase compared to 2024.[1] This sector is also defined by a sharp regional bifurcation, with market leadership shifting based on local culture and logistics. Based on a survey in April 2025, in Hanoi, ShopeeFood maintains a dominant 56% market share. Conversely, GrabFood leads in Ho Chi Minh City with approximately 50% of the market, where its massive driver fleet and superior algorithms cater to the southern metropolis’s faster pace. BeFood also saw its strongest performance in Ho Chi Minh City, with an 11 per cent share compared to 9 per cent in Hanoi[2].

Vietnam’s online food delivery market in April 2025

Unit: % of respondents

Source: NielsenIQ, Decision Lab

According to a representative of ShopeeFood Vietnam, the number of orders in Q3 2025 increased by more than 30% year-on-year, with the highest demand coming from office workers and students. Especially, ShopeeFood resonates strongly with Gen Z (aged 16-24), leveraging its integration with the wider Shopee ecosystem and aggressive discounting to become the default choice for “snacking” occasions like bubble tea and street food. In contrast, GrabFood finds its stronghold among older professionals (aged 35+) and families, a segment that generates a higher Average Order Value (AOV) through full-meal orders3. For these users, service reliability and delivery speed take precedence over price sensitivity.

Xu hướng thị trường

Vietnam’s food delivery market is entering a clearer phase of consolidation. Gojek’s exit in September 2024 reduced the number of scaled competitors, pushing the market toward a more concentrated structure in 2025. With fewer large players, competition is increasingly defined by who can defend scale and strengthen retention, rather than simply expanding presence.

Despite this structural shift, growth in food delivery remains heavily promotion-led, and the economics are becoming more strained for both platforms and restaurants. Discounts and free shipping continue to play a central role in driving order volume, and platforms are reluctant to scale back incentives because users can switch apps with minimal friction. As a result, promotions remain a key demand lever even as profitability pressure intensifies.

On the merchant side, platform-related costs can add up quickly. Restaurants often face commissions of around 25%, plus taxes, and typically spend an additional 10–15% of revenue on in-app advertising to maintain visibility—sometimes even 10–20% in more competitive categories. In some cases, when fees, advertising, and participation in discount programs are combined, the total platform-linked burden can approach roughly 40–45% of revenue. This creates a situation where merchants may process more orders but retain significantly less profit.

These pressures are forcing many restaurants to adjust their operating strategies. Some increase menu prices to offset rising costs, while others prioritize higher-margin items such as drinks and snacks to protect profitability. At the same time, more merchants are attempting to build direct-to-customer channels to reduce dependence on paid in-app advertising and regain some control over customer relationships.

Meanwhile, the competitive battlefield is shifting from a pure price war toward service quality and delivery speed. A Q1 2025 survey across Vietnam’s major cities indicates that only 26% of users choose apps primarily based on low prices. Instead, nearly half of customers (47%) prioritize fast delivery, and 41% focus on driver professionalism and order accuracy. This suggests that being the cheapest is no longer sufficient to win urban users, as reliability and speed increasingly shape perceived value.

In response, platforms are reshaping operations to meet higher service expectations. For example, Xanh SM Ngon differentiates itself by promising not to merge orders, aiming to keep meals hot and minimize delivery errors through a one-rider-one-order approach. Similarly, GrabFood is leveraging AI to forecast demand and testing new delivery models to reduce average delivery times to around 20 minutes, particularly during peak morning and evening periods.

Người chơi chính

By mid-2025, Vietnam’s food delivery market was dominated by three main names: ShopeeFood, GrabFood, and BeFood. With the two leaders (ShopeeFood and GrabFood) controlling over 90% of the market, the sector is now highly concentrated. Additionally, Xanh SM Ngon officially launched its food delivery service in Ho Chi Minh City on July 23, 2025, featuring a no-order-batching policy, a key differentiating feature designed to deliver an optimal customer experience.

Food delivery apps in Vietnam

| STT | Thương hiệu | Quốc gia | Vietnam Entry | Short Description |

| 1 | ShopeeFood | Singapore | 2015 | A food delivery platform formerly known as “Now”, ShopeeFood is directly integrated into the Shopee e-commerce ecosystem. |

| 2 | GrabFood | Mã Lai | 2018 | A food delivery service within the Grab multi-service super-app, focusing on optimized driver dispatch technology and an extensive network of restaurant partners. |

| 3 | BeFood | Vietnam | 2022 | The food delivery arm of the Vietnamese ride-hailing app “Be” focuses on a user-friendly experience and competitive pricing for its customers. |

| 4 | Xanh SM Ngon | Vietnam | 2025 | A new player in the food delivery sector by GSM, operating on an eco-friendly, 100% electric vehicle platform. |

Nguồn: Tổng hợp của B&Company

Ý nghĩa

Vietnam’s food delivery market continues to present growth potential, but the nature of opportunity is changing. As the market becomes more concentrated around a smaller number of scaled platforms, competition is increasingly shaped by ecosystem depth (merchant supply, logistics capacity, user retention, and service consistency). For new entrants and supporting businesses, this does not automatically translate into easier entry; instead, it suggests that success is more likely when offerings complement existing platforms or address specific bottlenecks in the value chain rather than attempting to replicate full-scale marketplace models.

Within this context, several opportunity areas remain plausible. Merchant enablement—such as better tools for menu management, demand forecasting, and customer relationship management—can help restaurants operate more efficiently under rising platform-related costs. Packaging and food quality preservation (e.g., temperature retention and spill prevention) can also become more important as consumers place greater weight on delivery reliability. In parallel, logistics innovation (routing optimization, batching rules, and demand prediction) may create room for service providers that improve speed and accuracy without relying solely on heavier subsidies.

At the same time, the market is entering a more financially constrained phase. Promotion remains a major driver of orders, and platforms face trade-offs between defending volume and improving unit economics. Restaurants, meanwhile, continue to absorb a stack of platform-related costs—commissions, taxes, and the need for paid in-app advertising to secure visibility—often compounded by participation in discount campaigns. This dynamic can lead to higher-order volumes but weaker profitability for merchants, which may affect long-term willingness to rely heavily on platform channels and can increase churn risk on the supply side.

* Lưu ý: Nếu bạn muốn trích dẫn thông tin trong bài viết này, vui lòng ghi rõ nguồn và kèm theo link bài viết để đảm bảo tôn trọng bản quyền.

| B&Company, Inc.

Công ty nghiên cứu thị trường của Nhật Bản đầu tiên tại Việt Nam từ năm 2008. Chúng tôi cung cấp đa dạng những dịch vụ bao gồm báo cáo ngành, phỏng vấn ngành, khảo sát người tiêu dùng, kết nối kinh doanh. Ngoài ra, chúng tôi đã phát triển cơ sở dữ liệu của hơn 900,000 công ty tại Việt Nam, có thể được sử dụng để tìm kiếm đối tác kinh doanh và phân tích thị trường. Xin vui lòng liên hệ với chúng tôi nếu bạn có bất kỳ thắc mắc hay nhu cầu nào. info@b-company.jp + (84) 28 3910 3913 |

[1] https://thoibaonganhang.vn/mua-sam-va-dat-do-an-online-bung-no-thoi-quen-tieu-dung-so-nam-2025-173233.html

[2] https://dtinews.dantri.com.vn/vietnam-today/vietnams-food-delivery-market-booms-20250710142707966.htm