21/10/2025

Tin tức & Báo cáo mới nhất / Vietnam Briefing

Bình luận: Không có bình luận.

Mạng lưới cảng biển Việt Nam đang trong quá trình chuyển đổi mạnh mẽ từ mô hình mở rộng truyền thống sang phát triển thông minh, bền vững và tích hợp công nghệ. Được hỗ trợ bởi các chính sách của Chính phủ như Nghị quyết số 81/2023/QH15,[1] (Nghị quyết của Quốc hội về Quy hoạch tổng thể phát triển kinh tế - xã hội quốc gia giai đoạn 2021-2030, tầm nhìn đến năm 2050) và Quyết định số 442/QĐ-TTg (năm 2024)[2] (phê duyệt điều chỉnh Quy hoạch Tổng thể Phát triển Hệ thống Cảng biển Việt Nam giai đoạn 2021–2030, tầm nhìn đến năm 2050), chiến lược cảng biển của Việt Nam tập trung vào tự động hóa, năng lượng xanh và hệ thống logistics ứng dụng công nghệ 5G. Sự chuyển dịch này mở ra tiềm năng đầu tư dài hạn đáng kể trên nhiều lĩnh vực cơ sở hạ tầng, công nghệ và năng lượng tái tạo, định vị lĩnh vực cảng thông minh của Việt Nam là một trung tâm chiến lược ở Đông Nam Á bất chấp những thách thức đang diễn ra.

Tổng quan về hệ thống cảng biển Việt Nam

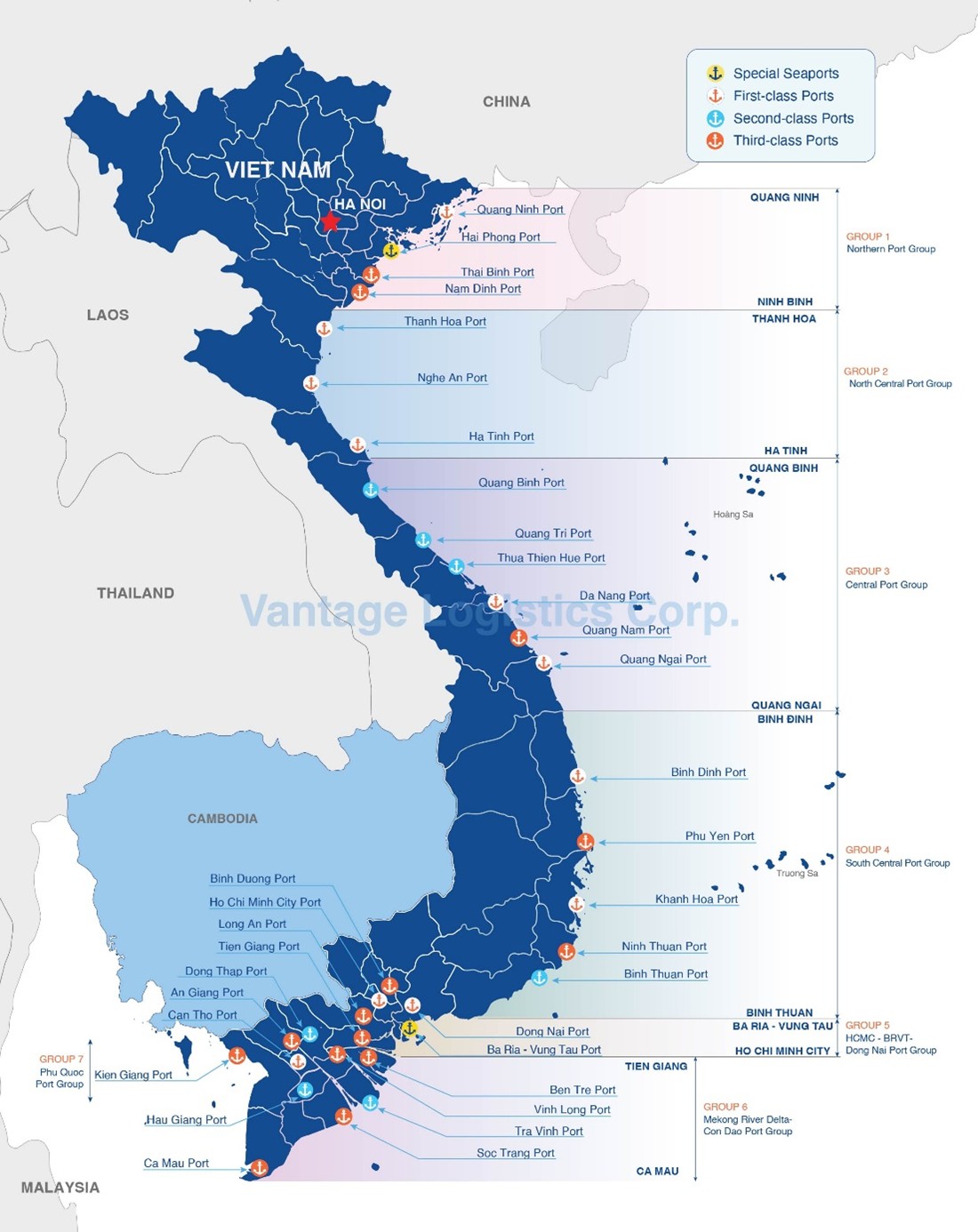

Việt Nam sở hữu một trong những hệ thống cảng biển rộng lớn nhất Đông Nam Á, trải dài trên 3.260 km bờ biển. Theo Quyết định số 804/QĐ-TTg (2022),[3], mạng lưới quốc gia bao gồm 34 cảng biển, được phân loại như sau:

- a/ Theo cụm: Sáu cụm khu vực từ Quảng Ninh ở phía Bắc đến Cà Mau ở phía Nam.

- b/ Theo quy mô:

– 2 cảng chuyên dùng: Hải Phòng và Bà Rịa – Vũng Tàu (cửa ngõ quốc tế chính)

– 11 cảng hạng nhất (trung tâm khu vực)

– 7 cảng loại 2 (đầu mối logistics tỉnh)

– 14 cảng hạng ba (hỗ trợ thương mại và công nghiệp địa phương)

Hệ thống này tạo thành xương sống cho hoạt động thương mại hàng hải và kết nối logistics của Việt Nam.

Map: List and classification of Vietnam seaports

Nguồn: Vantage-logistics.com.vn

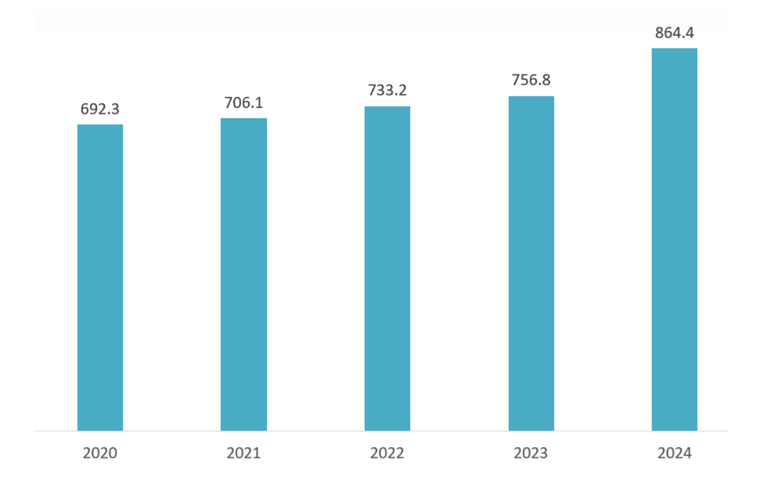

Khi cơ sở hạ tầng cảng biển của quốc gia được mở rộng, quy mô hàng hóa thông qua phản ánh sự năng động ngày càng tăng này. Từ năm 2020 đến năm 2024, tổng khối lượng hàng hóa thông qua các cảng biển Việt Nam đã tăng đều đặn từ 692,3 triệu tấn lên 864,4 triệu tấn, đánh dấu mức tăng trưởng chung khoảng 251 tấn/năm chỉ trong vòng 5 năm.[4]Xu hướng tăng trưởng này nhấn mạnh vai trò ngày càng tăng của Việt Nam trong chuỗi cung ứng toàn cầu và mối liên kết chặt chẽ giữa việc mở rộng cảng biển, tăng trưởng công nghiệp và đa dạng hóa xuất khẩu. Điều này cũng củng cố chiến lược chuyển đổi cảng biển thông minh và xanh của đất nước, nhằm nâng cao hiệu quả, giảm chi phí logistics và định vị Việt Nam là một trung tâm hàng hải cạnh tranh ở châu Á trong nhiều thập kỷ tới.

Volume of goods passing through seaports in the period 2020-2024 in Vietnam

Đơn vị: Triệu tấn

Nguồn: dnse.com.vn

Sự phát triển của cảng thông minh Việt Nam: Từ năng lực đến trí tuệ

Trong những năm gần đây, Việt Nam đã định hình lại chiến lược phát triển hàng hải, không chỉ đơn thuần là mở rộng năng lực cảng biển mà còn ưu tiên hiệu quả, tự động hóa, bền vững và tích hợp số. Hiệp hội Cảng biển Việt Nam (VPA) và các cơ quan quản lý hàng hải hiện coi việc phát triển cảng biển thông minh và xanh là nền tảng cho năng lực cạnh tranh quốc gia.[5]Theo Kế hoạch phát triển cảng biển giai đoạn 2021–2030, tầm nhìn đến năm 2050, Việt Nam đặt mục tiêu xử lý từ 1,14 đến 1,423 tỷ tấn hàng hóa, bao gồm 38 đến 47 triệu TEU vào năm 2030. Để đạt được mục tiêu này, các khoản đầu tư đang được chuyển hướng vào các cụm cửa ngõ quan trọng như Lạch Huyện ở phía Bắc, Cái Mép–Thị Vải ở phía Nam và cảng trung chuyển Cần Giờ được đề xuất gần Thành phố Hồ Chí Minh, được thiết lập để trở thành trụ cột chính của mạng lưới cảng thông minh hiện đại và kết nối.[6].

Để hỗ trợ những tham vọng này, Việt Nam đã điều chỉnh chương trình phát triển cảng biển phù hợp với các mục tiêu quốc gia về bảo vệ môi trường và chuyển đổi số. Từ năm 2022, Chính phủ đã triển khai lộ trình chuyển đổi sinh thái hàng hải và thiết lập các tiêu chuẩn quốc gia về cảng xanh. Các chính sách này thúc đẩy việc sử dụng thiết bị điện và thiết bị phát thải thấp, quản lý năng lượng và nước hiệu quả, xử lý chất thải, hệ thống logistics ứng dụng công nghệ thông tin và giám sát khí thải liên tục.[7]. Một số cảng, chẳng hạn như Tân Cảng - Cát Lái, đã đạt được chứng nhận Cảng Xanh APEC, trong khi các nhà ga mới hơn như Gemalink đang được xây dựng với hệ thống điện khí hóa hoàn toàn và quản lý thông minh[8].

Bổ sung cho các sáng kiến này, chính phủ đã cam kết khoảng 13 tỷ đô la Mỹ từ cả nguồn công và tư để nâng cấp cơ sở hạ tầng cảng đến năm 2030.13Khoản tài trợ này không chỉ nhằm mục đích mở rộng năng lực vật chất mà còn thúc đẩy số hóa, cải tạo xanh và hiện đại hóa hệ thống. Những chính sách và khoản đầu tư này đánh dấu một bước chuyển đổi quyết định từ tăng trưởng dựa trên năng lực sang hệ sinh thái hàng hải bền vững và định hướng công nghệ, qua đó củng cố năng lực cạnh tranh của Việt Nam trong thương mại toàn cầu.

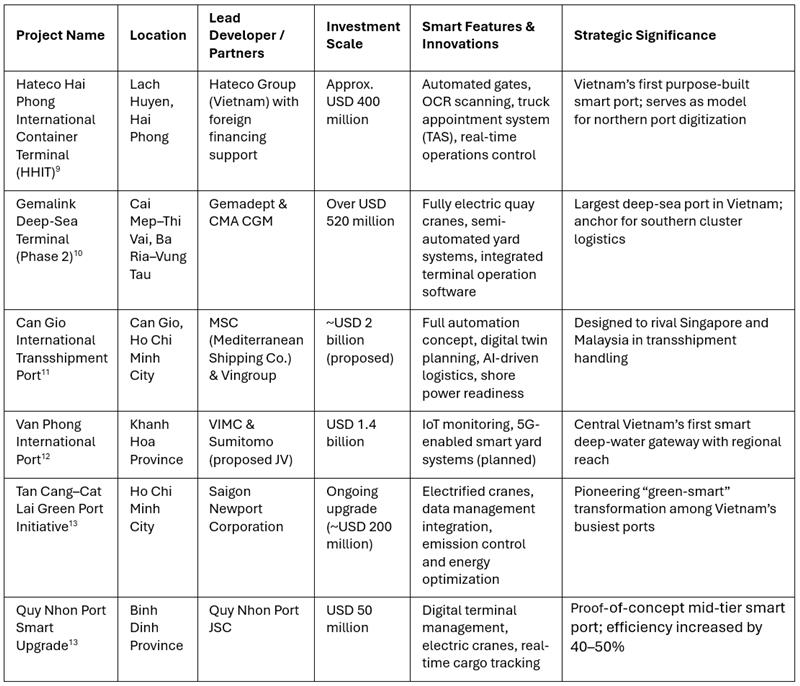

Phản ánh sự chuyển dịch chiến lược này, một số dự án cảng thông minh hàng đầu đang được hình thành trên khắp cả nước. Các dự án này kết hợp công nghệ tiên tiến, thiết kế bền vững và vị trí địa lý chiến lược để tạo ra một mạng lưới hàng hải kết nối kỹ thuật số, thân thiện với môi trường và hội nhập toàn cầu. Mỗi sáng kiến đóng góp một vai trò cụ thể trong khuôn khổ logistics quốc gia, tạo nền tảng cho hệ thống cảng thông minh đang nổi lên của Việt Nam. Bảng dưới đây tóm tắt một số dự án nổi bật nhất, quy mô đầu tư, những đổi mới quan trọng và tầm quan trọng chiến lược của chúng trong bối cảnh hàng hải Việt Nam.

Bảng 1. Các dự án cảng thông minh hàng đầu tại Việt Nam

Nguồn: Tổng hợp của B&Company

Các dự án trọng điểm nêu trên chứng minh năng lực ngày càng tăng của Việt Nam trong việc tích hợp công nghệ, tính bền vững và hiệu quả hậu cần, tạo nền tảng vững chắc cho việc tiếp tục đầu tư và đổi mới trong toàn ngành hàng hải.

Bối cảnh đầu tư và những thách thức chính

Ngành cảng thông minh của Việt Nam mang lại tiềm năng đầu tư mạnh mẽ nhờ tăng trưởng thương mại nhanh chóng, vị trí địa lý chiến lược, chính sách tiến bộ và công nghệ tiên tiến. Khi chuỗi cung ứng toàn cầu đa dạng hóa, Việt Nam đã trở thành một trung tâm sản xuất lớn, tạo ra nhu cầu bền vững về logistics hàng hải hiệu quả. Năm 2023, các cảng biển của Việt Nam đã xử lý khoảng 756 triệu tấn hàng hóa.[14] và gần 25 triệu TEU[15], phản ánh cả quy mô và tiềm năng tăng trưởng. Nằm dọc theo các tuyến đường vận tải biển Đông-Tây quan trọng, các cảng phía Bắc và phía Nam của Việt Nam có vị thế thuận lợi để đón đầu luồng hàng hóa trung chuyển khu vực thông qua các dự án phát triển như Cần Giờ.[16] và Vân Phong[17], nhằm mục đích thu hút lưu lượng hàng hóa có giá trị cao hơn.

Tuy nhiên, việc hiện thực hóa những cơ hội này phụ thuộc vào việc giải quyết những thách thức chính. Kết nối vùng sâu vùng xa còn hạn chế.[18], quy định phức tạp[19]và khoảng cách về kỹ năng của lực lượng lao động[20] có thể làm chậm tiến độ. Thuế cảng thấp[21] và cạnh tranh khu vực cũng có thể hạn chế lợi nhuận, trong khi an ninh mạng[22] và rủi ro tích hợp hệ thống đòi hỏi sự quản lý chặt chẽ. Thành công sẽ phụ thuộc vào việc lập kế hoạch phối hợp, phát triển nguồn nhân lực, mô hình kinh doanh linh hoạt và bảo vệ dữ liệu chặt chẽ. Với chiến lược đúng đắn, các nhà đầu tư có thể tham gia vào quá trình chuyển đổi của Việt Nam thành một trung tâm hàng hải hiện đại, bền vững và hiệu suất cao.

Triển vọng chiến lược: 2025–2030 và xa hơn

Từ năm 2025 đến năm 2030, Việt Nam dự kiến đẩy nhanh tiến độ hiện đại hóa các cụm cảng biển lớn như Lạch Huyện, Cái Mép, Thị Vải và Cần Giờ. Các cảng này sẽ áp dụng hệ thống thông minh được hỗ trợ bởi công nghệ 5G, kết nối cáp quang và Hệ thống Cộng đồng Cảng (Port Community Systems) kết nối các nhà khai thác logistics, hải quan và các công ty vận tải biển. Đến năm 2030, tất cả các cảng dự kiến đạt tiêu chuẩn xanh và thông minh, với sản lượng xử lý lên tới 1,42 tỷ tấn hàng hóa và gần 47 triệu TEU mỗi năm.[23].

Sau năm 2030, Việt Nam đặt mục tiêu xây dựng mạng lưới logistics hoàn chỉnh, kết nối cảng biển với nhà máy và vận tải nội địa thông qua trí tuệ nhân tạo và quản lý dữ liệu thời gian thực.[24]Mặc dù các quốc gia như Singapore và Malaysia đã phát triển hơn, nhưng tốc độ tăng trưởng nhanh chóng, cam kết chính sách và đầu tư ngày càng tăng của Việt Nam đang đặt Việt Nam vào vị thế thuận lợi để thu hẹp khoảng cách. Đối với các nhà đầu tư, những năm tới mang đến những cơ hội đáng kể về cơ sở hạ tầng, hệ thống số, năng lượng tái tạo và dịch vụ logistics, hỗ trợ quá trình chuyển đổi này hướng tới một mạng lưới hàng hải hiện đại và bền vững.

Kết luận

Sự phát triển cảng thông minh của Việt Nam đánh dấu một bước ngoặt quan trọng trong quá trình hiện đại hóa hàng hải và chuyển đổi kinh tế của đất nước. Với khuôn khổ chính sách vững chắc, dòng chảy thương mại gia tăng và đầu tư công - tư ngày càng tăng, nền tảng cho một hệ thống cảng biển số hóa, bền vững và kết nối toàn cầu hiện đã được thiết lập vững chắc. Vị trí chiến lược của Việt Nam dọc theo các tuyến vận tải biển chính, cùng với tham vọng phát triển cơ sở hạ tầng cảng xanh và thông minh, định vị Việt Nam trở thành một trung tâm logistics tương lai ở Đông Nam Á.

Đối với các nhà đầu tư, cơ hội không chỉ nằm ở việc xây dựng cảng mà còn ở hệ sinh thái rộng lớn hơn về tích hợp công nghệ, năng lượng tái tạo, logistics và các dịch vụ dựa trên dữ liệu, những yếu tố sẽ định hình thế hệ cơ sở hạ tầng hàng hải tiếp theo. Mặc dù vẫn còn nhiều thách thức về kết nối, hài hòa hóa quy định và sự sẵn sàng của lực lượng lao động, nhưng cam kết cải cách và đổi mới của chính phủ cho thấy tiềm năng tăng trưởng dài hạn. Khi Việt Nam hướng tới các mục tiêu 2030 và 2050, các nhà đầu tư và đối tác công nghệ tiên phong sẽ đóng vai trò quyết định trong việc định hình một trong những bối cảnh cảng thông minh đầy hứa hẹn nhất châu Á, biến tầm nhìn chính sách thành hiện thực sinh lời và bền vững.

* Lưu ý: Nếu bạn muốn trích dẫn thông tin trong bài viết này, vui lòng ghi rõ nguồn và kèm theo link bài viết để đảm bảo tôn trọng bản quyền.

| B&Company, Inc.

Công ty nghiên cứu thị trường của Nhật Bản đầu tiên tại Việt Nam từ năm 2008. Chúng tôi cung cấp đa dạng những dịch vụ bao gồm báo cáo ngành, phỏng vấn ngành, khảo sát người tiêu dùng, kết nối kinh doanh. Ngoài ra, chúng tôi đã phát triển cơ sở dữ liệu của hơn 900,000 công ty tại Việt Nam, có thể được sử dụng để tìm kiếm đối tác kinh doanh và phân tích thị trường. Xin vui lòng liên hệ với chúng tôi nếu bạn có bất kỳ thắc mắc hay nhu cầu nào. info@b-company.jp + (84) 28 3910 3913 |

[1] https://english.luatvietnam.vn/xay-dung/resolution-81-2023-qh15-national-overall-master-plan-for-the-2021-2030-period-241503-d1.html

[2] https://vanban.chinhphu.vn/

[3] https://english.luatvietnam.vn/decision-no-804-qd-ttg-dated-july-8-2022-of-the-prime-minister-promulgating-the-list-of-vietnams-seaports-225299-doc1.html

[4] https://www.dnse.com.vn/senses/tin-tuc/nganh-cang-bien-viet-nam-nhung-sieu-cang-ket-noi-chuoi-cung-ung-toan-cau-va-tam-nhin-vuon-xa-34094273

[5] https://en.vcci.com.vn/vietnam%E2%80%99s-seaport-system-a-vital-link-in-global-supply-chains

[6] https://www.vpa.org.vn/vietnams-seaports-set-handle-1-14-1-42-billion-tonnes-cargo-2030/

[7] https://vietnamnews.vn/economy/1338567/roadmap-to-develop-green-ports-in-viet-nam.html

[8] Ngành Hàng hải Xanh của Việt Nam dẫn đầu xu hướng tăng trưởng: Cẩm nang Ngành

[9] https://hhit.com.vn/

[10] https://reallogistics.vn/insights/market-updates/official-gemalink-port-gmd-licensed-to-welcome-232000-dwt-mega-vessels-elevating-vietnams-maritime-position

[11] https://vimc.co/en/can-gio-intl-container-transhipment-port-project-a-boost-for-hcm-citys-port-system/

[12] https://www.sumitomocorp.com/

[13] https://saigonnewport.com.vn/en/article/operation-news/tan-cang-hiep-phuoc-cat-lai-terminal-d-welcomes-the-new-service-line-of-sinolines-cvt1.html

[14] https://en.vneconomy.vn/cargo-transport-via-seaports-up-5-in-2023.htm

[15] https://container-news.com/shipping-titans-top-container-handling-countries-by-teu-volume/

[16] https://theinvestor.vn/bright-prospects-for-maritime-giant-vimc-with-can-gio-super-port-d14402.html

[17] https://vinalift.vn/en/vietnams-seaport-development-plan-2021-2030-with-a-vision-for-2050/

[18] https://www.researchgate.net/

[19] https://www.oecd.org/

[20] https://www.researchgate.net/

[21] https://container-news.com/vietnam-shipping-sector-navigates-trade-turbulence/

[22] https://www.eeas.europa.eu/esiwa-roundtable-hanoi-0925_en

[23] https://www.vpa.org.vn/vietnams-seaports-set-handle-1-14-1-42-billion-tonnes-cargo-2030/

[24] https://www.trade.gov/market-intelligence/vietnam-seaport-development