식품 콜드 체인은 육류, 해산물, 유제품, 과일, 채소를 포함한 부패하기 쉬운 제품의 안전성, 품질, 신선도를 유지하는 데 중요한 역할을 합니다. 베트남에서는 식품 콜드 체인에 대한 수요가 엄청나지만 시설은 아직 충분히 개발되지 않았습니다.

The increase of key sector demand urging for the development of cold storage

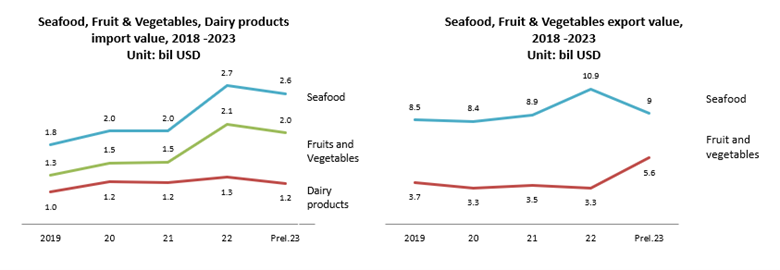

베트남 브리핑에 따르면, 베트남의 냉동보관 물류 산업은 2025년까지 1조 4,295억 달러에 이를 것으로 예상됩니다.[1]. 냉장 보관의 발전을 주도하는 핵심 요인 중 하나는 식품 소비에 대한 수요 증가입니다. 베트남 통계청(GSO)에 따르면 냉동 및 신선 식품은 1인당 월평균 지출이 상당히 높습니다. 예를 들어 육류(2.6kg), 새우 및 생선(1.1kg), 과일 및 채소(3.1kg)(2022년)입니다. 냉장 보관이 필요한 베트남의 식품(수산물, 육류, 신선 과일 및 채소)의 수입 및 수출 가치는 5년 동안 증가했습니다. 신선 식품에 대한 소비자 선호도가 높아지고 국제 수출 표준에 대한 기준이 높아짐에 따라 콜드 체인은 향후 몇 년 동안 번창할 것으로 예상됩니다.

출처: GSO, General Statistic Year Book (2023)

게다가, 특히 COVID-19 팬데믹 이후 전자상거래와 온라인 식료품 플랫폼의 부상은 부패하기 쉬운 상품을 배달하기 위한 효율적인 콜드체인 솔루션에 대한 필요성을 심화시켰습니다. Tiki, Shopee, Lazada와 같은 회사도 제3자와 협력하여 신선식품 배달 서비스의 효율성을 확대했습니다.

식품 콜드체인 인프라 상황

수요가 높지만, 그렇지 않은 인프라는 여전히 미개발 상태이며, 국가의 농업 무역 확대, 현대 소매 부문, 냉장 및 냉동 식품에 대한 소비자 선호도의 변화로 인해 증가하는 수요를 충족하기 위해 고군분투하고 있습니다. Euromonitor에 따르면, 2019년 12월 베트남에는 총 600,000개 팔레트를 수용할 수 있는 냉장 창고가 48개에 불과합니다.[2]. 게다가 베트남의 냉동 보관 시설은 남부 지역, 특히 해산물 가공이 두드러지는 메콩 삼각주에 집중되어 있어 북부와 중부 지역은 서비스가 부족합니다. 예를 들어, Lineage Logistics와 같은 대기업은 남부에서 상당히 확장되어 빈즈엉에 36,650개의 팔레트가 있는 반면 박닌에는 20,000개의 팔레트가 있습니다.[3]. 마찬가지로 AJ Total은 롱안에서 31,000개의 팔레트를 운영하는 반면 흥옌에서는 23,000개의 팔레트만 보유하고 있습니다.[4].

주요 플레이어

베트남의 식품 콜드체인 시장은 매우 분산되어 있으며, 국내 및 외국 기업이 섞여 있습니다. 국내 기업은 경쟁력 있는 가격을 제공하는 반면, 외국 기업은 일반적으로 첨단 기술과 인프라로 인해 프리미엄 서비스를 제공하는 것으로 간주됩니다. 냉장 보관 및 냉장 운송 부문의 주요 기업 중 일부는 용량별 시장 점유율을 기준으로 다음과 같습니다.

리니지 로지스틱스

| 홈페이지 | https://www.onelineage.com/ |

| 설립년도 | 2012 |

| 국적 | 미국 |

| 개요 | Lineage Logistics는 세계 최대의 온도 조절 물류 공급업체 중 하나입니다. 베트남을 포함한 여러 국가에 전략적으로 위치한 시설 네트워크를 보유하고 있습니다. |

| 사업분야 | 온도 조절 보관, 운송, 항구 물류 및 공급망 관리 솔루션은 특히 식품 산업에 적합합니다. |

| 용량 | 81,000 팔레트(냉장고), 빈즈엉, 호치민시, 박닌에 주요 창고가 있음 |

Transimex

| 홈페이지 | https://transimex.com.vn/ |

| 설립년도 | 1990 |

| 국적 | Vietnam |

| 개요 | Transimex는 베트남 콜드체인 시장에서 가장 큰 현지 업체 중 하나입니다. 이 회사는 창고 및 운송을 포함한 다양한 서비스를 제공하며 남부 지역의 증가하는 수요를 충족하기 위해 꾸준히 냉장 보관 시설을 확장해 왔습니다. |

| 사업분야 | 2PL, 3PL, 계약물류, 일반창고, 냉장보관

냉장창고, CFS창고, 보세창고, 문서보관, 크로스도킹서비스, 부가가치서비스 |

| 용량 | 호치민시에 메인 창고를 두고 17,000개 팔레트(냉장고) |

ABA Cooltrans

| 홈페이지 | https://aba.com.vn/ |

| 설립년도 | 2008 |

| 국적 | Vietnam |

| 개요 | Aba Cooltrans는 냉장 운송 및 냉장 보관에 특히 중점을 둔 콜드 체인 물류를 전문으로 하는 베트남의 선도적 기업 중 하나입니다. ABA Cooltrans는 식품 및 음료 부문의 기업을 위한 엔드투엔드 콜드 체인 솔루션을 제공함으로써 해산물, 육류, 과일, 채소 및 가공 식품을 포함한 부패하기 쉬운 상품의 신선도와 안전을 보장하는 데 중요한 역할을 합니다. |

| 사업분야 | 냉장 운송, 냉장 보관, 최종 마일 배송 |

| 용량 | 하노이와 호치민시에 주요 창고를 두고 265,000개의 팔레트(냉장 운송) |

기회

신선 및 냉동 식품에 대한 수요가 증가함에 따라 더 높은 품질 보증에 대한 필요성이 높아지고 있으며, 이는 효과적인 식품 보존의 중요성을 강조합니다. 이러한 추세는 콜드 체인 산업의 확장에 직접적인 영향을 미치는데, 최적의 온도와 보관 조건을 유지하는 것이 제품 품질과 안전을 보장하는 데 필수적이기 때문입니다. 식품 산업이 성장함에 따라 부패하기 쉬운 제품의 무결성을 관리하고 보호하기 위해 고급 콜드 체인 솔루션에 대한 필요성이 중요해지면서 콜드 체인 부문 내 투자와 개발이 증가하고 있습니다.

- 수출 식품 품질 향상: 베트남의 식품 수출, 특히 해산물과 열대 과일은 국제 품질 기준을 충족하기 위해 콜드체인 물류에 크게 의존하며, 특히 미국, EU, 일본과 같은 시장에서 그렇습니다. CPTPP와 EVFTA와 같은 자유무역협정(FTA)은 수출 성장을 지원하기 위한 고급 콜드체인 인프라에 대한 필요성을 더욱 강화합니다.

- 콜드체인에 대한 투자 증가: 특히 콜드체인 서비스에 대한 접근성이 제한적인 농촌 농업 지역에서 냉장 보관 시설 확장에 대한 투자 잠재력이 상당합니다. IoT 기반 온도 모니터링, 추적성을 위한 블록체인, 에너지 효율적인 냉장 시스템과 같은 기술적 발전은 효율성과 지속 가능성을 개선할 수 있는 기회를 제공합니다.

전반적으로 베트남의 냉장 유통 부문은 국내 및 해외 기업 모두에게 엄청난 기회를 제공합니다. 특히 인프라 개발, 기술 도입, 수출 물류 분야에서 큰 기회를 제공합니다.

도전 과제

성장 전망에도 불구하고, 베트남의 식품 냉장 유통 부문은 지속가능한 장기적 성공을 위해 해결해야 할 몇 가지 과제에 직면해 있습니다.

- 높은 에너지 비용: 냉장 보관 및 운송은 에너지 집약적인 작업입니다. 전기 및 연료 비용 상승은 시장에서 경쟁력 있는 가격을 유지하는 데 상당한 어려움을 안겨줍니다. 회사는 신뢰할 수 있는 냉장 보관 서비스에 대한 필요성과 운영 비용 관리의 과제 사이에서 균형을 맞춰야 합니다.

- 분열된 시장 구조: 베트남의 냉장 유통 시장은 매우 분산되어 있으며, 많은 소규모 공급업체가 대형 국제 기업의 역량과 기술적 정교함이 부족합니다. 이러한 분산은 비효율성으로 이어질 수 있으며, 특히 냉장 운송에서 독립적인 공급업체가 엄격한 품질 기준을 준수하지 않을 수 있습니다.

- 주요 지역의 공급 과잉: 냉장 보관 인프라에 대한 투자는 활발했지만, 특히 베트남 남부의 특정 지역은 냉장 보관 시설의 공급 과잉에 직면해 있습니다. 이로 인해 용량 활용도가 낮고 점유율이 낮아져 수익성에 영향을 미칠 수 있습니다. 공급업체는 시장 포화가 더 심해지는 것을 피하기 위해 확장 계획을 신중하게 관리해야 합니다.

결론

베트남의 식품 콜드체인 부문은 소비자 수요 증가, 수출 시장 확대, 국내 및 해외 기업의 지속적인 투자로 인해 상당한 성장을 이룰 준비가 되어 있습니다. 그러나 이 산업은 높은 운영 비용, 시장 분열, 지역적 공급 과잉을 포함한 어려움에도 직면해 있습니다. 이러한 어려움을 헤쳐나가면서 기술 발전과 신흥 시장 기회를 활용할 수 있는 기업은 베트남의 진화하는 콜드체인 환경에서 성공할 가능성이 높습니다.

[1] https://www.vietnam-briefing.com/doing-business-guide/vietnam/sector-insights/vietnam-s-cold-storage-industry-drivers-challenges-and-market-entry

[2] https://vir.com.vn/cold-chain-logistics-in-high-demand-92343.html

[3] https://www.eria.org/uploads/media/7_RPR_FY2018_11_Chapter_3.pdf

[4] https://vnexpress.net/kho-lanh-rong-hang-chuc-nghin-m2-cua-aj-total-viet-nam-4371882.html

| 주식회사 비앤컴퍼니

2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. info@b-company.jp + (84) 28 3910 3913 |

다른 기사를 읽어보세요