25/11/2025

Tin tức & Báo cáo mới nhất / Vietnam Briefing

Bình luận: Không có bình luận.

Thị trường thực phẩm và đồ uống Việt Nam đã phát triển nhanh chóng trong thập kỷ qua và tiếp tục là một trong những lĩnh vực tiêu dùng đầy hứa hẹn nhất Đông Nam Á. Trong số tất cả các thị trường nội địa, Hà Nội nổi bật nhờ mật độ dân số đô thị dày đặc, sự tăng trưởng mạnh mẽ của tầng lớp trung lưu và văn hóa ẩm thực sôi động. Tuy nhiên, chính những yếu tố làm nên sức hấp dẫn của Hà Nội cũng khiến nơi đây trở nên cạnh tranh khốc liệt, đặc biệt là với những doanh nghiệp mới gia nhập thị trường với rất ít cơ hội để mắc sai lầm. Việc lựa chọn địa điểm kinh doanh F&B phù hợp đã trở thành một trong những quyết định chiến lược nhất mà bất kỳ nhà hàng, quán cà phê, thương hiệu đồ ăn nhanh bình dân hay chuỗi cửa hàng tráng miệng nào cũng phải đưa ra.

Tổng quan thị trường F&B Việt Nam

Ngành dịch vụ F&B của Việt Nam rất lớn và vẫn đang tiếp tục tăng trưởng. Statista ước tính ngành này đạt giá trị hơn 24,77 tỷ USD vào năm 2025 và dự kiến đạt $36,86 tỷ USD vào đầu năm 2027.[1], tương đương với tốc độ tăng trưởng kép hàng năm (CAGR) là 9,7%. Tính đến cuối năm 2024, Việt Nam có khoảng 323.010 cơ sở kinh doanh đang hoạt động, tăng 1,81 nghìn tỷ đồng so với cùng kỳ năm trước. Tổng doanh thu toàn ngành năm 2024 ước đạt 688,8 nghìn tỷ đồng (1 nghìn tỷ đồng, 26,96 tỷ USD), tăng 16,61 nghìn tỷ đồng so với năm 2023.[2].

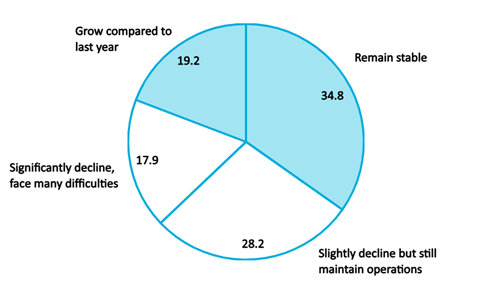

Trong nửa đầu năm 2025, khảo sát khoảng 3.000 nhà hàng và quán cà phê cho thấy 54,0% duy trì doanh thu ổn định hoặc đạt tăng trưởng, cho thấy triển vọng tích cực hơn so với cùng kỳ năm ngoái là 40,2%. Tuy nhiên, thị trường vẫn đang trải qua quá trình sàng lọc mạnh mẽ, với 17,9% doanh nghiệp bị sụt giảm nghiêm trọng và một phân khúc khác tiếp tục gặp khó khăn trong hoạt động.[3]Những con số này cho thấy rằng trong khi nhu cầu chung đang phục hồi, nhiều nhà khai thác vẫn dễ bị tổn thương trước chi phí tăng cao và áp lực cạnh tranh.

Hiệu quả kinh doanh của các doanh nghiệp F&B (nửa đầu năm 2025)

100% = 3.000 quán ăn và quán cà phê

(Nguồn: iPOS.vn và Nestlé)

Ngoài ra, trước năm 2020, hầu hết các thương hiệu đều mở rộng mạnh mẽ, nhắm đến bất kỳ không gian bán lẻ nào có lưu lượng khách hàng cao. Thời kỳ đó đã kết thúc. Theo Bộ Kế hoạch và Đầu tư, hơn 51.000 nhà hàng, quán cà phê, quán ăn đường phố và ki-ốt F&B trên khắp Việt Nam đã đóng cửa chỉ trong chín tháng đầu năm 2024.[4]Làn sóng đóng cửa này phản ánh tình trạng tiền thuê nhà tăng, áp lực lạm phát, cạnh tranh gay gắt và cơ sở người tiêu dùng ngày càng kén chọn.

Theo Báo cáo giao đồ ăn trực tuyến năm 2024 của Decision Lab, tại các thành phố lớn, hình thức ăn uống tại chỗ vẫn chiếm ưu thế, nhưng giao đồ ăn hiện chiếm 10-12% tổng giá trị giao dịch F&B, tăng từ mức chỉ 3% vào năm 2018. Tỷ lệ áp dụng giao hàng cao cũng ngụ ý rằng các nhà điều hành nên tránh trả quá nhiều tiền cho các địa điểm trung tâm cao cấp nếu có thể thu được một phần đáng kể doanh thu thông qua dịch vụ giao hàng trong bán kính 3-5 km.

Vai trò quan trọng của chiến lược địa điểm trong thị trường F&B Hà Nội

Hà Nội không chỉ là thủ đô chính trị và hành chính của Việt Nam; đây còn là một trong những thành phố có mức tiêu dùng cao nhất. Tổng cục Thống kê ước tính rằng vào năm 2024, Hà Nội chiếm hơn 22% tổng chi tiêu cho dịch vụ thực phẩm của Việt Nam, mặc dù chỉ chiếm một tỷ lệ nhỏ hơn nhiều trong dân số cả nước. Hơn 67% cư dân dưới 40 tuổi, tạo ra một cơ cấu nhân khẩu học thuận lợi cho các quán cà phê, chuỗi cửa hàng tráng miệng, nhà hàng ăn uống bình dân và các hình thức thực phẩm thân thiện với giao hàng. Đồng thời, thu nhập hộ gia đình đang tăng nhanh chóng. Cụ thể, theo B&Company, từ năm 2020 đến năm 2024, thu nhập hộ gia đình trung bình của Hà Nội đã tăng từ 15,2 triệu đồng lên 22,8 triệu đồng mỗi tháng, tăng 45%. Các quận nội thành trọng điểm như Ba Đình, Tây Hồ, Cầu Giấy và Thanh Xuân hiện báo cáo thu nhập hàng tháng trên 24-28 triệu đồng, phản ánh cơ sở người tiêu dùng thuộc tầng lớp trung lưu đang mở rộng nhanh chóng với mong muốn chi tiêu mạnh mẽ hơn cho các hình thức ăn uống ngoài trời và F&B cao cấp.

Áp lực thuê nhà và chi phí hoạt động tăng cao

Khi thị trường bán lẻ đô thị phát triển, các chủ nhà đã đáp ứng nhu cầu bằng cách tăng giá thuê, đặc biệt là tại các khu vực kinh doanh cốt lõi, nơi lượng khách hàng và mức độ phủ sóng thương hiệu mạnh nhất. Báo cáo Triển vọng Thị trường Bán lẻ năm 2024 của CBRE Việt Nam cho biết giá thuê mặt tiền đường cao cấp tại các quận sầm uất nhất Hà Nội đã tăng 8-15% so với năm trước.[5]và trong một số trường hợp, lãi suất vẫn tiếp tục tăng mặc dù tâm lý kinh tế vĩ mô yếu.

Giá thuê mặt bằng tầng trệt trung bình tại các quận trung tâm Hà Nội như Hoàn Kiếm, Hai Bà Trưng đạt 172,7 USD/m²/tháng vào năm 2024[6]Trong khi các trung tâm thương mại cao cấp như Vincom, Lotte, Aeon và Tràng Tiền Plaza có thể tính giá cao hơn nhiều. Kết quả là, chỉ riêng tiền thuê mặt bằng hiện đã chiếm 20-55% tổng doanh thu của nhiều đơn vị vận hành, cao gấp 2-3 lần so với chuẩn mực toàn cầu.[7]Điều này có nghĩa là vị trí kém có thể phá hủy lợi nhuận ngay cả khi nhu cầu của khách hàng vẫn tồn tại, vì doanh thu có thể không bù đắp được gánh nặng chi phí cố định.

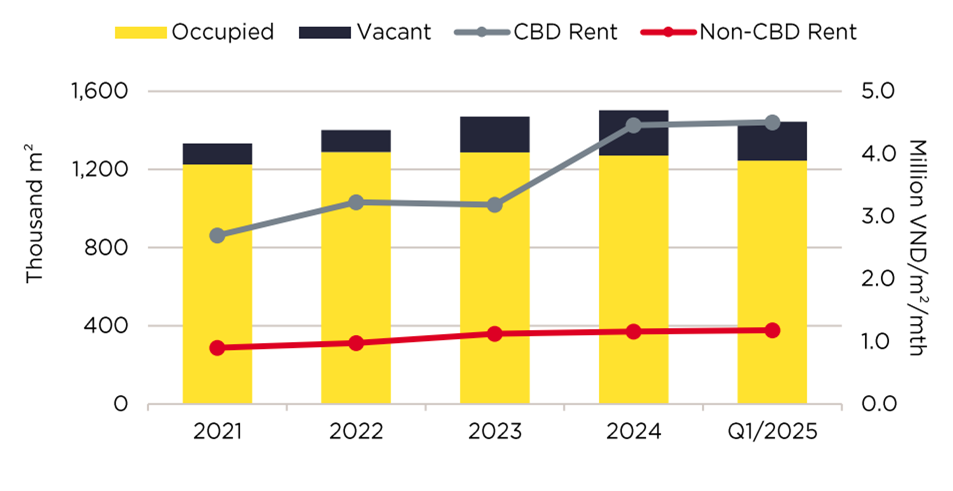

Retail Occupancy and Rental Price Trends (Hanoi, 2021-Q1 2025)

Nguồn: Savills Việt Nam

Theo Savill Việt Nam, từ năm 2021 đến quý 1/2025, giá thuê khu trung tâm thương mại (CBD) tăng mạnh lên gần 4,6-4,7 triệu đồng/m²/tháng, phản ánh sự cạnh tranh mạnh mẽ về vị trí đắc địa, trong khi giá thuê ngoài khu vực trung tâm cũng tăng đều đặn do nhu cầu tiêu dùng và giao hàng ở khu vực ngoại thành tăng lên.[8]Khoảng cách tiền thuê ngày càng lớn này cho thấy sự tăng trưởng của ngành F&B trong tương lai sẽ ngày càng chuyển dịch sang các khu vực ngoài trung tâm có giá cả phải chăng, nơi mật độ dân số tăng hỗ trợ nền kinh tế đơn vị bền vững.

Ngoài ra, thị trường F&B Việt Nam cũng đang trở thành một trong những thị trường F&B bão hòa nhất Đông Nam Á. Euromonitor ước tính hàng trăm cửa hàng mới đã mở tại thành phố trong giai đoạn 2022-2024, một xu hướng dễ nhận thấy trên các tuyến phố chính như Cầu Giấy, Xuân Thủy, Times City và Phố Cổ. Bên cạnh những cửa hàng mới mở này, nhiều nhà hàng độc lập quy mô nhỏ hơn cũng đang rút lui do chi phí thuê mặt bằng tăng cao, tỷ lệ giữ chân khách hàng thấp và chi phí tiếp thị tốn kém.

Tiêu dùng theo hướng giao hàng đang làm giảm sự phụ thuộc vào tầm nhìn đường phố

Động lực thứ hai là sự chuyển dịch sang giao đồ ăn trực tuyến, làm giảm lợi thế truyền thống của việc tọa lạc trên một con phố đông đúc. Báo cáo Giao đồ ăn Trực tuyến năm 2024 của Decision Lab chỉ ra rằng doanh thu giao hàng chiếm gần 12% tổng chi tiêu cho F&B trên toàn quốc, so với chỉ 3% của năm năm trước. Các nền tảng giao đồ ăn như GrabFood, ShopeeFood đã làm tăng cường cạnh tranh, có nghĩa là các nhà hàng không còn có thể chỉ dựa vào lượng người đi bộ thực tế để thúc đẩy doanh số. Do đó, các nhà hàng phải nghĩ xa hơn lượng người đi bộ. Một địa chỉ phổ biến không còn đảm bảo hiệu suất nếu vị trí không hỗ trợ nhận hàng nhanh, lối vào hiệu quả cho người lái xe, thông lượng bếp được tối ưu hóa hoặc phạm vi bán kính giao hàng tốt. Các cửa hàng không thể tích hợp hoạt động giao hàng hiệu quả có xu hướng hoạt động kém hiệu quả, ngay cả khi tọa lạc trên những con phố cao cấp.

Vị trí như một thành phần của định vị thương hiệu

Yếu tố thứ ba là giá trị thương hiệu của địa điểm. Một khái niệm cao cấp chỉ thành công nếu môi trường xung quanh thể hiện được định vị cao cấp. Một nhà hàng bình dân gia đình hoạt động tốt nhất gần trường học, văn phòng hoặc khu chung cư, nơi lượng khách qua lại thường xuyên và dễ đoán. Các chuỗi cửa hàng cà phê và tráng miệng phụ thuộc rất nhiều vào các khu vực tập trung đông đảo giới trẻ, nơi có sinh viên và người đi làm trẻ. Người tiêu dùng Việt Nam ngày càng gắn kết chất lượng thương hiệu với chính địa điểm kinh doanh F&B. Đây là lý do tại sao một nhà hàng cao cấp tọa lạc tại khu dân cư thu nhập thấp, hoặc ngược lại, một cửa hàng trong trung tâm thương mại cho thuê cao cấp bán các món ăn có lợi nhuận thấp, thường gặp khó khăn trong việc hòa vốn. Việc chọn sai khu vực kinh doanh sẽ tạo ra sự không phù hợp giữa giá cả, nhận thức và khả năng chi tiêu.

Chiến lược vị trí cho các mô hình F&B khác nhau tại Hà Nội

Thị trường F&B Hà Nội đang chuyển đổi từ mô hình tập trung truyền thống tại trung tâm thành phố sang mô hình phân tán hơn, được định hình bởi sự mở rộng ra ngoại ô, sự dịch chuyển dân số và tiêu dùng kỹ thuật số. Khi sức mua lan tỏa ra bên ngoài và các khu đô thị dân cư quy mô lớn phát triển, những địa điểm sinh lời nhất trong 3-7 năm tới sẽ rất khác so với thập kỷ trước.

Khái niệm ẩm thực cao cấp và điểm đến

Nhà hàng sang trọng tại Hà Nội

Nguồn: GU Bistronomy

Các mô hình ẩm thực cao cấp và điểm đến như nhà hàng cao cấp, quán cà phê trải nghiệm, quán bar rượu vang và các địa điểm BBQ Nhật Bản/Hàn Quốc vẫn hoạt động mạnh mẽ tại Hoàn Kiếm, Tây Hồ, Ba Đình, Ciputra, Starlake và các trung tâm thương mại hạng A như Vincom Metropolis, Lotte Center và Aeon Mall Long Biên. Các khu vực này vẫn duy trì mật độ dân cư giàu có, khách du lịch và nhân viên văn phòng cao cấp. Báo cáo Bán lẻ Quý 4/2024 của Savills cho thấy các trung tâm thương mại cao cấp tại Hà Nội đạt công suất thuê 93%+, trong đó F&B là một trong những phân khúc khách thuê có nhu cầu cao nhất.[9]Theo Hiệp hội Nhà hàng Việt Nam (2023), 75-90% doanh thu của các nhà hàng cao cấp vẫn đến từ việc ăn tại chỗ, nghĩa là vị trí thực tế vẫn là động lực giá trị cốt lõi.

Tuy nhiên, tương lai đang dịch chuyển vượt ra ngoài những khu vực lịch sử. Các khu đô thị hạng sang mới như Vinhomes Ocean Park (Gia Lâm), The Manor Central Park (Hoàng Mai - Thanh Trì), Ciputra và Starlake đang phát triển thành những trung tâm thu nhập cao, được hỗ trợ bởi các trường học quốc tế, căn hộ cao cấp và các tuyến phố thương mại. Những khu vực này đang thu hút các hộ gia đình trẻ, giàu có và cộng đồng người nước ngoài đang rời xa các trung tâm thành phố đông đúc. Đối với các thương hiệu cao cấp, việc sớm gia nhập những khu vực này mang lại lợi thế tiên phong và giảm thiểu rủi ro cho thuê trước khi giá tăng cao.

Chuỗi quán cà phê Mid-Casual, Fast-Casual và Lifestyle

Mid-casual restaurant in Hanoi

Nguồn: Aeon Mall Hà Đông

Các nhà hàng bình dân và chuỗi quán cà phê phong cách sống, bao gồm trà sữa, pizza/burger, lẩu Hàn Quốc và hầu hết các chuỗi cà phê nhượng quyền, trước đây thường tập trung ở Cầu Giấy, Hà Đông, Thanh Xuân và Hai Bà Trưng. Các quận này có lượng khách hàng đông đúc hàng ngày, chủ yếu là sinh viên và nhân viên văn phòng. iPOS.vn và Nestlé cho thấy 30% người Hà Nội trong độ tuổi 18-30 ăn ngoài hoặc mua đồ uống tại quán cà phê 3-4 lần mỗi tuần.[10]Giá thuê tại các quận này vẫn thấp hơn 20-40% so với các địa điểm chính ở Hoàn Kiếm, tạo ra cơ cấu chi phí bền vững hơn cho các chuỗi cửa hàng phụ thuộc vào tần suất ghé thăm cao thay vì giá cao cấp.

Tăng trưởng trong tương lai của phân khúc này sẽ mạnh nhất ở các hành lang đô thị hóa nhanh chóng thay vì các tuyến phố thương mại truyền thống. Thứ nhất, trục Khu công nghệ cao Hòa Lạc, nơi tập trung các trường đại học mới, trung tâm R&D và các nhà tuyển dụng công nghệ, dự kiến sẽ thu hút hàng chục nghìn người tiêu dùng trẻ. Thứ hai, khu vực Long Biên - Gia Lâm, được thúc đẩy bởi Vinhomes Ocean Park, Aeon Mall Long Biên và các dự án thành phố thông minh, đang trở thành trung tâm dân cư theo phong cách sống. Khi công việc kết hợp giảm thiểu việc đi lại, tiêu dùng sẽ chuyển sang các quán cà phê địa phương và các nhà hàng phục vụ nhanh gần nhà. Đến năm 2022-2028, những "khu phố phong cách sống" này có thể sánh ngang với Cầu Giấy và Thanh Xuân về chi tiêu tiêu dùng.

Định dạng phân khúc giá trị, khối lượng lớn và giao hàng trước

Các mô hình phân khúc giá trị, khối lượng lớn và ưu tiên giao hàng, bao gồm các cửa hàng mì, chuỗi cửa hàng cơm gà, ki-ốt đồ uống và bếp đám mây, đang trải qua quá trình dịch chuyển địa lý lớn nhất. Những mô hình này không còn đòi hỏi mặt tiền đường dễ thấy nữa. Thay vào đó, chúng dựa vào giá thuê thấp, dân số đông đúc và khả năng tiếp cận hậu cần. Các quận như Hoàng Mai, Bắc Từ Liêm, Đông Anh và Thanh Trì có giá thuê rẻ hơn 40-60% so với khu vực trung tâm thành phố trong khi giá căn hộ tăng nhanh. Theo Statista, thị trường giao đồ ăn trực tuyến của Việt Nam đạt 1,3 tỷ đô la vào năm 2023 và dự kiến sẽ đạt 2 tỷ đô la vào năm 2027. GrabFood và ShopeeFood báo cáo mức tăng trưởng đơn hàng giao hàng nhanh nhất ở vùng ngoại ô Hà Nội do các khu dân cư cao tầng và các gia đình trẻ.

Hành lang chiến lược quan trọng nhất cho các hoạt động giao hàng trong thập kỷ tới là Nội Bài – Cầu Nhật Tân – vành đai phát triển Đông Anh. Theo quy hoạch mở rộng của Hà Nội đến năm 2030, Đông Anh dự kiến sẽ chuyển mình thành một trung tâm đô thị mới trọng điểm. Những doanh nghiệp F&B tiên phong sẽ được tiếp cận phạm vi giao hàng rộng lớn, phục vụ các khu dân cư mới, công nhân sân bay và khu công nghiệp.

Hơn nữa, sự tăng trưởng thu nhập nhanh chóng tại các huyện cận ngoại thành như Hoài Đức, Gia Lâm, Đông Anh và Quốc Oai, nơi thu nhập hàng tháng hiện đạt 20-23 triệu đồng so với chỉ 11-15 triệu đồng năm 2020, chứng kiến mức tăng trưởng thu nhập nhanh nhất (+60-80%), cho thấy nhu cầu ngày càng tăng đối với các mô hình F&B giá trung bình. Những khu vực này ngày càng có nhiều gia đình trẻ sống trong các cụm chung cư mới, khiến chúng trở nên hấp dẫn đối với các mô hình quán cà phê, tiệm bánh và dịch vụ giao hàng tận nơi với chi phí thuê vừa phải.

Kết luận

Trên tất cả các phân khúc, định nghĩa về một địa điểm F&B tối ưu đang thay đổi. Tương lai thuộc về các hệ sinh thái tiêu dùng được thiết kế bài bản: các siêu đô thị, hành lang đại học, khu công nghệ và các vùng ngoại ô được tối ưu hóa giao hàng thay vì các tuyến phố thương mại truyền thống. Những thương hiệu thành công sẽ là những thương hiệu nắm bắt được xu hướng dân số, thu nhập khả dụng và mô hình giao hàng đang tăng tốc, chứ không phải những gì đã từng diễn ra. Trong bối cảnh này, các nhà điều hành hàng đầu đã và đang phân tích các dự án cơ sở hạ tầng, dự báo nhà ở và kế hoạch phát triển bán lẻ thay vì chỉ dựa vào quan sát lưu lượng người đi bộ.

* Lưu ý: Nếu bạn muốn trích dẫn thông tin trong bài viết này, vui lòng ghi rõ nguồn và kèm theo link bài viết để đảm bảo tôn trọng bản quyền.

| B&Company, Inc.

Công ty nghiên cứu thị trường của Nhật Bản đầu tiên tại Việt Nam từ năm 2008. Chúng tôi cung cấp đa dạng những dịch vụ bao gồm báo cáo ngành, phỏng vấn ngành, khảo sát người tiêu dùng, kết nối kinh doanh. Ngoài ra, chúng tôi đã phát triển cơ sở dữ liệu của hơn 900,000 công ty tại Việt Nam, có thể được sử dụng để tìm kiếm đối tác kinh doanh và phân tích thị trường. Xin vui lòng liên hệ với chúng tôi nếu bạn có bất kỳ thắc mắc hay nhu cầu nào. info@b-company.jp + (84) 28 3910 3913 |

[1] Singh, S. (2025, ngày 12 tháng 9). Các chuỗi cửa hàng thực phẩm nước ngoài phát triển mạnh mẽ trên thị trường F&B đang phát triển của Việt Nam. Tóm tắt về Việt Nam. Lấy từ https://www.vietnam-briefing.com/news/foreign-food-chains-thrive-in-vietnams-growing-fb-market.html/

[2] VietNamNet. (21/03/2025). Thị trường F&B Việt Nam tập trung vào tăng trưởng bền vững. VietNamNet Global. Lấy từ https://vietnamnet.vn/en/vietnam-s-f-b-market-focuses-on-sustainable-growth-2382873.html (vietnamnet.vn)

[3] iPOS.vn & Nestlé Professional. (12 tháng 10 năm 2025). Thông báo báo chí: iPOS.vn và Nestlé Professional công bố báo cáo Thị trường Kinh doanh Ẩm thực tại Việt Nam 6 tháng đầu năm 2025. Lấy từ https://ipos.vn/thong-cao-bao-chi-ipos-vn-va-nestle-professional-cong-bo-bao-cao-thi-truong-kinh-doanh-am-thuc-tai-viet-nam-6-thang-dau-nam-2025/

[4] B&Company. (2025, ngày 4 tháng 11). Xu hướng đóng cửa hàng loạt cửa hàng F&B trong nửa đầu năm 2025. https://b-company.jp/the-trend-of-mass-closure-of-fb-stores-in-the-first-half-of-2025/ (b-company.jp)

[5] CBRE Việt Nam. (24 tháng 1 năm 2024). Triển vọng thị trường Việt Nam năm 2024. Lấy từ https://www.cbrevietnam.com/insights/books/vietnam-market-outlook-2024

[6] CBRE Việt Nam. (29 tháng 10 năm 2024). Số liệu Hà Nội quý 3 năm 2024. Lấy từ https://www.cbrevietnam.com/insights/figures/hanoi-figures-q3-2024 (cbrevietnam.com)

[7] iPOS.vn. (16/05/2025). Bức tranh toàn cảnh & xu hướng kinh doanh F&B năm 2025 – 2026: Doanh nghiệp bị “vỡ mộng” hay khai phá hướng đi riêng? iPOS.vn. https://ipos.vn/buc-tranh-toan-canh-xu-huong-fb-2025-2026/ (ipos.vn)

[8] Savills Việt Nam. (2025). Báo cáo thị trường Hà Nội Q1 2025 [PDF]. Lấy từ https://www.savills.com.vn/pdf-folder/hanoi-mrq12025-en-1.pdf

[9] Savills Việt Nam. (2024, ngày 2 tháng 4). Thị trường bất động sản bán lẻ Việt Nam: Kết quả kinh doanh quý 4/2024 và triển vọng năm 2025. Lấy từ https://www.savills.com.vn/blog/article/220402/vietnam-eng/retail-real-estate-market-in-viet-nam–q4-2024-performance-and-2025-outlook.aspx savills.com.vn

[10] VietNamNet toàn cầu. (2024, ngày 13 tháng 4). Người Việt Nam đi ăn ngoài nhiều hơn bất chấp khó khăn kinh tế. VietNamNet Toàn cầu. https://vietnamnet.vn/en/more-vietnamese-going-out-to-eat-despite-economic-difficulties-2269252.html