2511월2025

최신 뉴스 및 보고서 / 베트남 브리핑

댓글: 댓글 없음.

베트남의 식음료 시장은 지난 10년 동안 빠르게 성장해 왔으며, 동남아시아에서 가장 유망한 소비 시장 중 하나로 자리매김하고 있습니다. 모든 현지 시장 중에서도 하노이는 높은 도시 인구 밀도, 탄탄한 중산층 성장, 그리고 활기찬 외식 문화로 두각을 나타냅니다. 하지만 하노이를 매력적으로 만드는 바로 그 특징들이 하노이를 경쟁이 매우 치열하게 만드는 요인이기도 합니다. 특히, 실수의 여지가 적은 신규 진입 업체들에게는 더욱 그렇습니다. 적절한 식음료 매장 위치를 선택하는 것은 레스토랑, 카페, 패스트 캐주얼 브랜드, 또는 디저트 체인이 내려야 할 가장 전략적인 결정 중 하나가 되었습니다.

베트남 F&B 시장 개요

베트남의 F&B 서비스 산업은 규모가 크고 계속 성장하고 있습니다. Statista는 이 부문의 가치가 2025년에 247억 7천만 달러를 넘어섰으며, 2027년 초에는 368억 6천만 달러에 이를 것으로 예상합니다.[1]이는 연평균 성장률(CAGR) 9.7%에 해당합니다. 2024년 말까지 베트남은 약 323,010개의 사업체를 운영하여 전년 대비 1조 8,100억 동(TP3T) 증가했습니다. 2024년 총 사업체 매출은 688조 8,000억 동(269억 6,000만 달러)으로 추산되며, 이는 2023년 대비 16조 6,100억 동(TP3T) 증가한 수치입니다.[2].

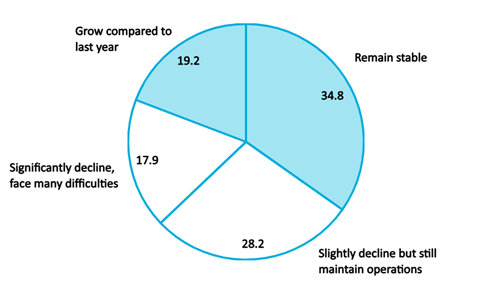

2025년 상반기 약 3,000개 음식점과 카페를 대상으로 한 조사에 따르면, 54.0%가 안정적인 매출을 유지하거나 성장을 달성하여 전년 동기 40.2%보다 긍정적인 전망을 보였습니다. 그러나 시장은 여전히 강력한 필터링을 겪고 있으며, 17.9%의 사업체가 심각한 감소세를 보이고 있으며, 또 다른 부문은 운영상의 어려움에 직면해 있습니다.[3]이러한 수치는 전반적인 수요가 회복되고 있음에도 불구하고 많은 사업자가 여전히 비용 상승과 경쟁 압박에 취약하다는 것을 보여줍니다.

F&B 기업 경영실적(2025년 상반기)

100% = 3,000개의 식당과 카페

(원천: iPOS.vn과 네슬레)

또한, 2020년 이전에는 대부분의 브랜드가 유동 인구가 많은 모든 소매 공간을 공략하며 공격적으로 사업을 확장했습니다. 하지만 그 시대는 끝났습니다. 기획투자부에 따르면, 2024년 첫 9개월 동안 베트남 전역에서 51,000개 이상의 레스토랑, 카페, 길거리 음식 매장, 그리고 식음료 매장이 문을 닫았습니다.[4]이러한 폐업의 물결은 임대료 상승, 인플레이션 압박, 치열한 경쟁, 그리고 점점 더 까다로워지는 소비자 기반을 반영합니다.

주요 도시에서는 앉아서 먹는 음식이 여전히 지출의 대부분을 차지하지만, Decision Lab의 2024년 온라인 음식 배달 보고서에 따르면 음식 배달은 현재 전체 F&B 거래 가치의 10-12%를 차지하며, 2018년에는 3%에 불과했습니다. 배달 수용률이 높다는 것은 3-5km 반경 내 배달을 통해 상당한 수익을 얻을 수 있다면 사업자가 프리미엄 중심 위치에 과도한 비용을 지불하지 않아야 함을 의미합니다.

하노이 F&B 시장에서 입지 전략의 중요한 역할

하노이는 베트남의 정치 및 행정 수도일 뿐만 아니라, 소비 중심 도시 중 하나이기도 합니다. 통계청은 2024년 하노이가 베트남 전체 인구에서 차지하는 비중은 훨씬 작음에도 불구하고, 베트남 전체 외식 지출의 22% 이상을 차지할 것으로 추산합니다. 67% 이상의 주민이 40세 미만으로, 카페, 디저트 체인점, 캐주얼 다이닝 레스토랑, 배달 음식에 유리한 인구 구조를 형성하고 있습니다. 동시에 가계 소득도 빠르게 증가하고 있습니다. B&Company에 따르면, 2020년에서 2024년 사이 하노이의 평균 가계 소득은 월 1,520만 동에서 2,280만 동으로 45% 증가했습니다. 바딘, 떠이호, 꺼우저이, 탄쑤언 등 주요 도시 지역은 현재 월 소득이 2,400만~2,800만 VND를 넘는 것으로 보고되고 있는데, 이는 외식과 고급 F&B에 대한 지출 의지가 강한 중산층 소비자 기반이 빠르게 확대되고 있음을 보여줍니다.

임대료 압박과 운영 비용 상승

도시 소매업이 성숙해짐에 따라, 임대인들은 특히 유동 인구와 브랜드 노출도가 높은 핵심 상업 지구를 중심으로 임대료를 인상하여 수요에 대응해 왔습니다. CBRE 베트남의 2024년 소매 시장 전망에 따르면 하노이에서 가장 번화한 지역의 주요 도로변 임대료는 전년 대비 8~15% 상승했습니다.[5]그리고 어떤 경우에는 거시경제적 심리가 약함에도 불구하고 금리가 계속 상승했습니다.

호안끼엠, 하이바쯩 등 하노이 중심가의 평균 1층 임대료는 2024년 1m²당 172.7달러/월에 도달했습니다.[6]반면 빈컴, 롯데, 이온, 짱띠엔 플라자와 같은 프리미엄 쇼핑몰은 훨씬 더 높은 가격을 책정할 수 있습니다. 결과적으로 현재 많은 쇼핑몰 운영업체의 총 매출 중 임대료만 20~55%에 달하며, 이는 글로벌 벤치마크보다 2~3배 높습니다.[7]. 이는 고객 수요가 있더라도 입지가 좋지 않으면 고정 비용 부담을 수익으로 보상하지 못해 수익성이 파괴될 수 있음을 의미합니다.

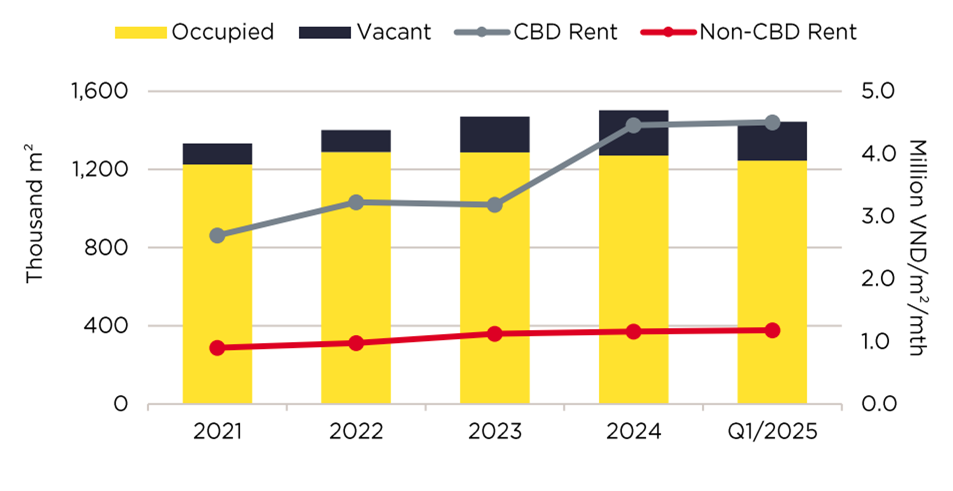

Retail Occupancy and Rental Price Trends (Hanoi, 2021-Q1 2025)

원천: 세빌스 베트남

Savill Vietnam에 따르면 2021년부터 2025년 1분기까지 중심 상업 지구(CBD) 임대료는 최고 입지에 대한 치열한 경쟁을 반영하여 약 460만~470만 VND/m²/월로 급등했으며, 교외 소비 및 배달 수요가 확대됨에 따라 비 CBD 임대료도 꾸준히 증가했습니다.[8]. 이러한 임대료 격차 확대는 향후 F&B 성장이 인구 밀도 증가로 지속 가능한 단위 경제를 뒷받침하는 저렴한 비CBD 지역으로 점차 이동하게 될 것임을 시사합니다.

또한 베트남의 F&B 시장은 동남아시아에서 가장 포화된 F&B 경쟁 지역 중 하나로 자리매김했습니다. 유로모니터는 2022년부터 2024년까지 베트남에 수백 개의 새로운 매장이 문을 열 것으로 추산하며, 이러한 추세는 꺼우저이, 쑤언투이, 타임스 시티, 구시가지 등 주요 거리에서 두드러지게 나타납니다. 이러한 신규 매장 오픈과 더불어, 많은 소규모 독립 업체들이 임대료 상승, 낮은 고객 유지율, 그리고 마케팅 비용 부담으로 인해 사업을 접고 있습니다.

배달 중심 소비로 인해 거리 가시성에 대한 의존도가 감소하고 있습니다.

두 번째 동인은 온라인 음식 배달로의 전환으로, 번화가에 위치한다는 기존 이점이 약화되고 있다는 것입니다. Decision Lab의 2024년 온라인 음식 배달 보고서에 따르면, 배달 수익은 전국 식음료 지출의 약 12%를 차지하는데, 이는 5년 전 3%에 불과했던 것과 비교됩니다. GrabFood, ShopeeFood와 같은 음식 배달 플랫폼 간의 경쟁이 심화되면서, 레스토랑들은 더 이상 물리적인 유동 인구에만 의존하여 매출을 늘릴 수 없게 되었습니다. 결과적으로 레스토랑들은 유동 인구를 넘어서는 전략을 생각해야 합니다. 빠른 픽업, 효율적인 승객 접근성, 최적화된 주방 처리량, 또는 넓은 배달 반경을 지원하지 않는 인기 있는 주소라도 더 이상 성과를 보장할 수 없습니다. 배달 운영을 효과적으로 통합하지 못하는 매장은 고급 도로에 위치하더라도 실적이 저조한 경향이 있습니다.

브랜드 포지셔닝의 구성 요소로서의 위치

세 번째 동인은 해당 지역의 브랜딩 가치입니다. 고급 컨셉은 주변 환경이 프리미엄 포지셔닝을 전달할 때만 성공합니다. 패밀리 캐주얼 레스토랑은 유동 인구가 규칙적이고 예측 가능한 학교, 사무실, 또는 아파트 단지 근처에서 가장 큰 성과를 냅니다. 디저트 및 커피 체인점은 학생과 젊은 직장인들로 가득한 젊은 층이 밀집한 지역에 크게 의존합니다. 베트남 소비자들은 브랜드 품질을 식음료 매장 자체와 연관 짓는 경향이 점점 더 커지고 있습니다. 이것이 저소득층 지역에 위치한 프리미엄 레스토랑이나 반대로 마진이 낮은 메뉴를 판매하는 고가의 쇼핑몰 매장이 손익분기점에 도달하는 데 어려움을 겪는 이유입니다. 잘못된 상권 선택은 가격, 인지도, 그리고 구매력 간의 불균형을 초래합니다.

하노이의 다양한 F&B 모델을 위한 입지 전략

하노이의 F&B 시장은 전통적인 도심 밀집 지역에서 교외 확장, 인구 이동, 그리고 디지털 소비에 의해 형성된 더욱 분산된 모델로 전환되고 있습니다. 구매력이 외곽으로 확산되고 대규모 주거 타운십이 성숙해짐에 따라, 향후 3~7년 동안 가장 수익성이 높은 지역은 지난 10년과는 매우 다른 모습을 보일 것입니다.

프리미엄 다이닝 및 목적지 컨셉

하노이의 고급 레스토랑

원천: GU 비스트로노미

호안끼엠, 떠이호, 바딘, 찌푸트라, 스타레이크, 그리고 빈콤 메트로폴리스, 롯데센터, 이온몰 롱비엔과 같은 A급 쇼핑몰에서는 고급 레스토랑, 체험형 카페, 와인 바, 일식/한식 바비큐 시설 등 프리미엄 다이닝 및 관광 명소 콘셉트가 여전히 강세를 보였습니다. 이러한 지역은 부유층 주민, 관광객, 그리고 임원진이 높은 비중을 차지하고 있습니다. 세빌스 리테일 인사이트 2024년 4분기 보고서에 따르면 하노이의 고급 쇼핑몰은 931,000명 이상의 투숙객을 수용했으며, 식음료 부문은 가장 수요가 높은 임차인 카테고리 중 하나였습니다.[9]베트남 레스토랑 협회(2023)에 따르면, 프리미엄 레스토랑의 매출 중 75~90%는 여전히 매장 내 식사에서 발생하며, 이는 물리적 위치가 핵심 가치 동인으로 남아 있음을 의미합니다.

하지만 미래는 역사 지구를 넘어 변화하고 있습니다. 빈홈 오션 파크(지아람), 더 매너 센트럴 파크(호앙마이-탄찌), 찌푸트라, 스타레이크와 같은 새로운 고급 타운십은 국제 학교, 고급 콘도, 그리고 상업 거리를 갖춘 고소득 허브로 발전하고 있습니다. 이러한 지역은 혼잡한 도심에서 벗어나 젊고 부유한 가구와 외국인 커뮤니티를 유치하고 있습니다. 프리미엄 브랜드의 경우, 이러한 지역에 조기에 진입하는 것이 선점자로서의 이점을 제공하고 가격 상승 전 임대 위험을 낮출 수 있습니다.

미드 캐주얼, 패스트 캐주얼, 라이프스타일 카페 체인점

Mid-casual restaurant in Hanoi

출처: 이온몰 하동점

패스트 캐주얼 레스토랑과 밀크티, 피자/버거 브랜드, 한국식 핫팟, 그리고 대부분의 커피 프랜차이즈를 포함한 라이프스타일 카페 체인점들은 전통적으로 꺼우저이, 하동, 탄쑤언, 하이바쯩 지역에 집중되어 왔습니다. 이 지역들은 학생과 직장인들로 매일 많은 유동 인구를 보입니다. iPOS.vn과 네슬레에 따르면, 18~30세 하노이 시민의 30%가 일주일에 3~4회 외식하거나 카페에서 음료를 구매하는 것으로 나타났습니다.[10]. 이 지역의 임대료는 호안끼엠의 주요 지역보다 20-40% 낮게 유지되어, 고급 가격보다는 높은 방문 빈도에 의존하는 체인점에 더 지속 가능한 비용 구조를 제공합니다.

이 부문의 미래 성장은 전통적인 상업 거리 대신 빠르게 도시화되는 지역에서 가장 강력합니다. 첫째, 새로운 대학, R&D 허브, 그리고 기술 기업들이 밀집해 있는 호아락 하이테크 파크 축은 수만 명의 젊은 소비자들을 유치할 것으로 예상됩니다. 둘째, 빈홈즈 오션 파크, 이온 몰 롱비엔, 그리고 스마트시티 프로젝트로 활성화되는 롱비엔-자럼 지역은 라이프스타일 중심의 주거 중심지로 자리매김하고 있습니다. 하이브리드 근무로 통근 시간이 감소함에 따라, 소비는 지역 카페와 집 근처 패스트푸드점으로 이동할 것입니다. 2022년에서 2028년까지 이러한 "라이프스타일 지역"은 소비 지출 측면에서 꺼우자이와 탄쑤언을 따라잡을 수 있을 것입니다.

가치 세그먼트, 대량 판매 및 배송 우선 형식

국수집, 밥집, 치킨집, 음료 키오스크, 클라우드 키친 등 가치 중심, 대량 주문, 배달 중심의 형태가 가장 큰 지리적 재배치를 겪고 있습니다. 이러한 모델은 더 이상 눈에 띄는 거리 공간을 필요로 하지 않습니다. 대신 낮은 임대료, 인구 밀도, 그리고 물류 접근성에 의존합니다. 호앙마이, 박뜨리엠, 동아인, 탄찌와 같은 지역은 도심보다 임대료가 40~60% 저렴하면서도 아파트 단지의 빠른 성장을 경험하고 있습니다. Statista에 따르면 베트남의 온라인 음식 배달 시장은 2023년에 13억 달러에 도달했으며 2027년에는 20억 달러에 이를 것으로 예상됩니다. GrabFood와 ShopeeFood는 고층 주거 지역과 젊은 세대의 증가로 인해 하노이 교외 지역에서 배달 주문이 가장 빠르게 증가하고 있습니다.

향후 10년간 배송 중심 운영에 있어 가장 전략적으로 중요한 통로는 노이바이-녓탄 다리-동아인 개발 벨트입니다. 하노이의 2030년 확장 계획에 따라 동아인은 주요 신도시로 전환될 것으로 예상됩니다. 초기 F&B 업체들은 새로운 주거 지역, 공항 근로자, 산업 단지를 아우르는 넓은 배송 반경을 확보하게 될 것입니다.

더욱이 호아이득, 자럼, 동안, 꾸옥오아이와 같은 교외 지역(월 소득 2천만~2천3백만 동, 2020년 1천1백만~1천5백만 동)의 빠른 소득 증가세(+60-80%)는 중저가 F&B에 대한 수요 증가를 시사합니다. 이러한 지역은 신규 아파트 단지에 거주하는 젊은 세대의 인구가 증가하고 있어, 카페, 베이커리, 배달 전문점 등 임대료가 저렴한 곳에 매력적인 지역입니다.

결론

모든 부문에서 최적의 식음료 매장 입지에 대한 정의가 변화하고 있습니다. 미래는 전통적인 상업 거리가 아닌, 거대 도시권, 대학가, 기술 단지, 그리고 배달에 최적화된 교외 지역과 같은, 설계된 소비자 생태계에 달려 있습니다. 성공하는 브랜드는 인구, 가처분 소득, 그리고 배달 패턴이 과거가 아닌, 가속화되는 곳을 파악하는 브랜드가 될 것입니다. 이러한 맥락에서, 선도적인 사업자들은 유동 인구 관찰에만 의존하는 대신, 이미 인프라 파이프라인, 주택 예측, 그리고 소매 개발 계획을 분석하고 있습니다.

* 본 기사의 내용을 인용하고자 하시는 경우, 저작권을 존중하여 출처와 원 기사의 링크를 함께 명시해 주시기 바랍니다.

| 비앤컴퍼니

2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. info@b-company.jp + (84) 28 3910 3913 |

[1] Singh, S. (2025년 9월 12일). 외국 식품 체인점들이 베트남의 성장하는 F&B 시장에서 성공을 거두고 있습니다. 베트남 브리핑. 출처: https://www.vietnam-briefing.com/news/foreign-food-chains-thrive-in-vietnams-growing-fb-market.html/

[2] VietNamNet. (2025년 3월 21일). 베트남 F&B 시장, 지속 가능한 성장에 집중. VietNamNet Global. 에서 가져옴 https://vietnamnet.vn/en/vietnam-s-f-b-market-focuses-on-sustainable-growth-2382873.html (vietnamnet.vn)

[3] iPOS.vn 및 Nestlé Professional. (2025년 10월 12일). 통칭: iPOS.vn 및 Nestlé Professional이 Báo cáo에 대해 Kinh doanh Ẩm thực tại Viet Nam에서 2025년 6월에 시작함. 에서 검색됨 https://ipos.vn/thong-cao-bao-chi-ipos-vn-va-nestle-professional-cong-bo-bao-cao-thi-truong-kinh-doanh-am-thuc-tai-viet-nam-6-thang-dau-nam-2025/

[4] B&Company. (2025년 11월 4일). 2025년 상반기 F&B 매장 대량폐쇄 추세. https://b-company.jp/the-trend-of-mass-closure-of-fb-stores-in-the-first-half-of-2025/ (b-company.jp)

[5] CBRE 베트남(2024년 1월 24일). 베트남 시장 전망 2024년. 에서 검색됨 https://www.cbrevietnam.com/insights/books/vietnam-market-outlook-2024

[6] CBRE 베트남. (2024년 10월 29일). 하노이 2024년 3분기 수치. 에서 검색됨 https://www.cbrevietnam.com/insights/figures/hanoi-figures-q3-2024 (cbrevietnam.com)

[7] iPOS.vn. (2025년 5월 16일). F&B의 2025년 – 2026년: Doanh nghiep bị “vỡ mộng” hay khai phá hớng đi riêng? iPOS.vn. https://ipos.vn/buc-tranh-toan-canh-xu-huong-fb-2025-2026/ (ipos.vn)

[8] 세빌스 베트남(2025). 2025년 1분기 하노이 시장 보고서 [PDF]. https://www.savills.com.vn/pdf-folder/hanoi-mrq12025-en-1.pdf에서 가져옴

[9] 세빌스 베트남(2024년 4월 2일). 베트남 소매 부동산 시장: 2024년 4분기 실적 및 2025년 전망. 에서 검색됨 https://www.savills.com.vn/blog/article/220402/vietnam-eng/retail-real-estate-market-in-viet-nam–q4-2024-performance-and-2025-outlook.aspx 세빌스닷컴(savills.com.vn)

[10] 베트남넷 글로벌. (2024년 4월 13일). 경제난에도 불구하고 외식하는 베트남인 증가. 베트남넷 글로벌. https://vietnamnet.vn/en/more-vietnamese-going-out-to-eat-despite-economic-difficulties-2269252.html