2010월2025

최신 뉴스 및 보고서 / 베트남 브리핑

댓글: 댓글 없음.

일본 소매업체들은 활발한 소비자 수요, 활발한 도시화, 그리고 전자상거래와 결합된 현대적인 소매 모델의 매력 덕분에 베트남에서 빠르게 성장하고 있습니다. "일본 품질"이라는 장점은 일본 소매업체들이 쉽게 신뢰를 얻는 데 도움이 되며, 베트남 소비자들은 간소화된 디자인과 합리적인 가격을 갖춘 매장 경험, 서비스, 그리고 제품에 점점 더 관심을 보이고 있습니다.

베트남과 일본의 소매시장 개요

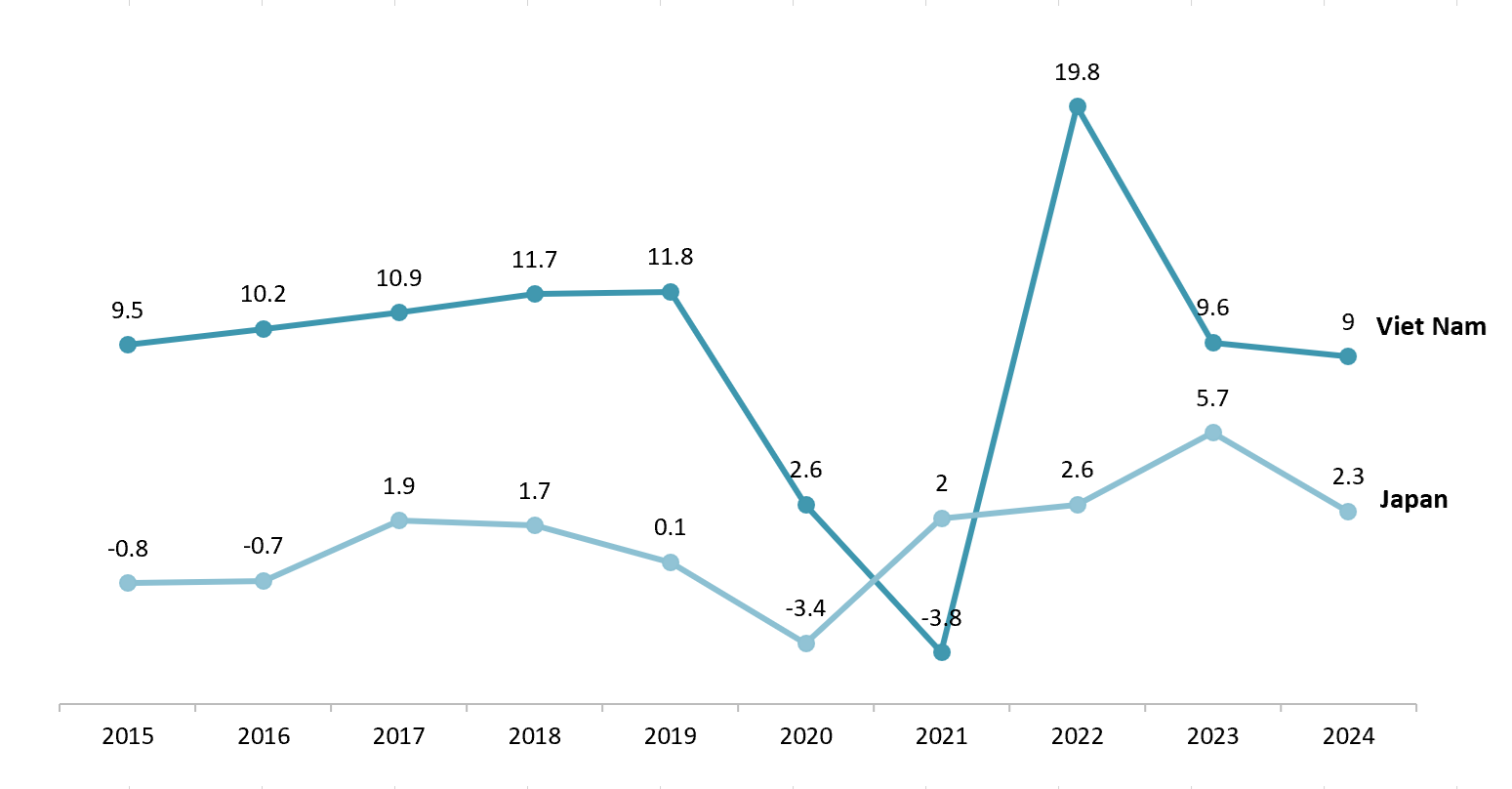

팬데믹 이후 일본의 명목 소매 성장률은 "반등 후 침체"의 궤적을 따릅니다. 2022년: +2.6%, 2023년: +5.7%, 2024년: +2.3%. 이는 2023년 구매력 회복 후, 물가 환경과 실질 소득이 소비에 압력을 가하면서 2024년 둔화될 것임을 시사합니다.[1]한편, 베트남의 상품 및 서비스 소매 판매 규모는 2022년 +19.8%, 2023년 +9.6%, 2024년 +9.0%로 빠르고 꾸준히 성장하고 있습니다. 이는 코로나19 이후 내수 회복, 서비스 관광 재개, 그리고 현대식 소매 채널 확장에 힘입어 고성장 체인을 형성하고 있습니다.[2]중장기적으로 베트남 소매 시장은 2030년까지 꾸준히 성장할 것으로 많은 자료에서 전망하고 있습니다. Mordor Intelligence에 따르면 시장 규모는 2025년 1,628억 7천만 달러, 2030년 2,091억 9천만 달러에 이를 것으로 예상되며, 2025~2030년 기간 동안 연평균 성장률은 ≈ 5.13%입니다.[3].

Nominal retail sales growth of goods and services in Vietnam and Japan

단위 : %

출처: 베트남 통계청 및 포커스 이코노믹스

또한 베트남의 소매 채널 구조도 변화하고 있습니다. 2020년부터 2024년까지의 종합 분석에 따르면, 전통 소매 채널의 비중은 73%에서 61%로 감소한 반면, "현대 소매 채널"은 22%에서 29%로, 전자상거래는 5%에서 10%로 증가했습니다. 이는 소매업체들이 체인 운영 및 포트폴리오 최적화 역량을 확보할 수 있는 넓은 공간을 제공합니다.[4].

입지 측면에서는 하노이와 호치민시가 여전히 '기관차' 역할을 하고 있지만, 박닌, 흥옌, 하이퐁, 빈즈엉, 동나이, 롱안 등 위성 산업 지역이 인구, 상업용 부지, 그리고 새로운 쇼핑센터 인프라를 바탕으로 부상하고 있습니다. AEON의 2030년까지 체인 확장 계획은 '이 지역 진출' 추세를 여실히 보여줍니다.[5].

베트남 내 일본 소매업체의 시장 동향

베트남에서 현대 무역이 발전함에 따라 일본 소매업체들은 입지를 더욱 강화하고 있습니다. 아래 트렌드는 다각화된 포맷, "일본 품질" 포지셔닝, 뷰티/헬스로의 카테고리 전환, 그리고 더욱 빠른 O2O 통합을 통해 일본 소매업체들이 어떻게 확장하고 있는지를 보여줍니다.

– 다양한 매장 모델 확대: 일본 유통업체들은 다양한 유형의 신규 매장 오픈을 가속화하고 있습니다. AEON은 교외 쇼핑몰과 도심 소규모 슈퍼마켓을 동시에 유치하여 시장 확대에 박차를 가하고 있습니다.[6].

– 브랜드 포지셔닝 및 일본식 경험: 일본 소매업체들은 품질과 서비스 면에서 독보적인 일본 경험을 제공하는 데 주력합니다. 일본 체인점의 제품은 우수한 품질과 엄격한 관리 절차로 높은 평가를 받고 있으며, 이러한 요소들이 베트남 사람들이 오랫동안 일본 제품을 신뢰하게 만드는 요인입니다.[7].

– 우선 제품 카테고리의 변경 사항: 이전에는 일본 체인점들이 주로 생활용품과 식품으로 유명했지만, 최근 화장품과 헬스케어 부문이 급성장하고 있습니다. 마츠모토 키요시(일본 최대 제약 및 화장품 체인)는 베트남에서 꾸준히 성장하며 베트남 사람들이 일본 화장품과 기능성 식품을 점점 더 선호하고 있음을 보여줍니다.[8].

– O2O 트렌드와 전자상거래의 역할: 2023년부터 2025년까지 일본 소매업체들은 온라인-오프라인 연계(O2O) 모델을 적극적으로 도입할 것으로 예상됩니다. 많은 일본 기업들이 이커머스 플랫폼에 제품을 출시하거나 자체 판매 웹사이트를 개설했습니다. 예를 들어, AEON 베트남은 멤버십 프로그램과 통합된 전화 쇼핑, AEON eshop 웹사이트, 홈 배송 등 다양한 채널 서비스를 개발했습니다.[9].

Matsumoto Kiyoshi Vietnam Store

원천: 바오 단 트리

기본 베트남의 일본 소매업체

베트남 소매 시장은 현재 쇼핑몰과 슈퍼마켓부터 편의점, 패션 및 라이프스타일, 가전제품, 제약 소매 체인까지 다양한 유형의 사업체가 자리 잡고 있습니다. 자회사부터 합작 투자까지 다양한 형태로 진출하고 있습니다. 지리적으로는 여전히 하노이-호치민시에 집중되어 있지만, 적합한 모델을 구축하면 브랜드가 산업 클러스터로 확장할 준비를 하는 데 도움이 될 것입니다.

| 유형 | 아니요 | 회사 | 베트남 입국 연도 | 매장 수 | 본점 위치 | 웹사이트 |

| 쇼핑몰 | 1 | 이온몰 VN | 2014 | 11 | 하노이, 호치민시 | https://aeonmall-vietnam.com |

| 2 | 다카시마야 VN | 2016 | 1 | 호치민시 | https://www.takashimaya-vn.com | |

| 슈퍼마켓 | 3 | AEON 맥스밸류 | 2014 | 20 | 하노이, 호치민시 | https://aeonmaxvalu.aeon.com.vn/ |

| 4 | 후지마트 | 2018 | 19 | 하노이 | https://fujimart.vn/ | |

| 편의점 | 5 | 미니스톱 | 2015 | ~ 187 | 하노이, 호치민시 | https://www.ministop.vn/vi |

| 6 | 패밀리마트 VN | 2009 | ~ 160 | 호치민시 | https://www.familymart.com.vn | |

| 7 | 세븐일레븐 VN | 2017 | ~130 | 호치민시 | https://www.7-eleven.vn | |

| 패션/라이프스타일 | 8 | 유니클로 | 2019 | 30 | 하노이, 호치민시 | https://www.uniqlo.com/vn |

| 9 | 무인양품 | 2020 | 17 | 하노이, 호치민시 | https://www.muji.com/vn | |

| 가전제품 | 10 | 코난 | 2016 | 16 | 하노이, 호치민시 | – |

| 11 | 다이소 | 2008 | 9 | 하노이, 호치민시 | https://www.daisovietnam.com/ | |

| 12 | 니토리 | 2023 | 4 | 호치민시 | https://www.nitori.com.vn/vi | |

| 약국 | 13 | 마쓰모토 기요시 VN | 2020 | 17 | 하노이, 호치민시 | https://matsumotokiyoshi.com.vn |

출처: B&Company 편집

일본 소매 체인점들은 두 가지 경로로 베트남에서 확장을 가속화하고 있습니다. (1) 주요 도시에서 포맷 출시와 네트워크 밀도를 가속화하고, (2) 현대적인 쇼핑 습관을 충족하기 위해 약국, 홈퍼니싱, 홈센터와 같은 새로운 틈새 시장을 추가합니다. 패션/라이프스타일 분야에서 유니클로는 하노이와 호치민에서 커버리지를 구축한 후 2025년 첫 번째 후에 매장을 통해 중부 지역으로 진출을 발표하며, 분산된 단일 지점이 아닌 지역별 확장 전략을 시사했습니다. 대형마트/몰 분야에서 AEON은 2030년까지 3배로 확장할 계획입니다(몰을 8개에서 16개로 늘리는 동시에 슈퍼마켓과 중소형 슈퍼마켓 포맷을 공격적으로 확장). 이를 통해 일본 제품과 스미토모의 후지마트(2025년 6월 기준 하노이에 19개 매장을 보유)와 같은 제휴 파트너를 위한 "소매 인프라"로서의 역할을 강화할 것입니다. 홈퍼니싱 부문에서 니토리는 2023년 12월 빈즈엉에 있는 SORA 가든 SC에 첫 매장을 오픈했으며, 추가 매장을 물색하고 있습니다. 이는 2016년 코난이 홈센터 시장에 진출한 이후 "일본식 인테리어 및 홈웨어" 열풍이 새로운 주기를 맞이하고 있다는 증거입니다. 건강 및 뷰티 부문에서는 마츠모토 키요시(2020년)에 이어 츠루하가 2025년 8월 호치민시에 첫 매장을 오픈하며, 서비스 표준과 자체 브랜드 상품을 중심으로 빠르게 확장할 수 있는 일본 약국 시장에서의 두 마리 토끼를 잡은 것으로 보입니다.

일본 소매업체의 시장 진출에 대한 의미

시장 진입 관점에서 볼 때, 베트남은 탄탄한 내수 수요를 유지하고 있으며, 체인점 형태와 네트워크 확장을 위한 안정적인 기반을 제공하고 있습니다. 젊고 빠르게 도시화되는 소비자층은 "품질-안전-신뢰성"을 중시하는 경향이 있으며, "Made in Japan"이라는 이미지는 고품질과 높은 구매 가치를 의미합니다. Q&Me와 같은 소비자 설문 조사에 따르면 일본은 "높은 품질/신뢰성/구매 가치"를 중시하는 것으로 나타났으며, 디지털 도입 가속화는 O2O 모델의 영역을 넓히고 일본 브랜드가 온라인과 오프라인을 원활하게 연결할 수 있도록 지원합니다.

하지만 기회에는 어려움이 따릅니다. 해외 기업과 국내 기업 간의 경쟁이 심화되면서 더욱 엄격한 카테고리 차별화와 운영 원칙이 요구되고 있습니다. 뷰티 업계에서는 한국과 현지 경쟁업체의 압박이 특히 이커머스 플랫폼에서 두드러지게 나타납니다. K-뷰티는 빠르게 성장하고 있으며(쇼피 코리아에 따르면 2021년부터 2023년까지 베트남으로의 주문량이 5배 이상 증가했습니다), 상당한 수입 점유율을 차지하고 있습니다. 일본 제품 라인업이 느리게 개선되거나 "진입가"가 부족하다면, 변화하는 트렌드에 뒤처질 위험이 있습니다.

전략적으로 일본 소매업체는 다음을 우선시할 수 있습니다.

- 을 위한 제품 및 브랜드일본 제품의 핵심 품질을 유지하면서 맛, 사이즈, 포장을 현지화하고, 출시 가격 및 한정판을 추가하여 모멘텀을 확보합니다. 혁신 주기를 분기/월 단위로 늘리고, 오프라인 확장 전에 온라인에서 빠르게 테스트하고 학습하여 재고 위험을 줄이고 제품 수명 주기를 최적화합니다.

- 에 채널쇼핑몰 위치와 소규모/콤팩트 매장을 결합하여 적용 범위와 비용 효율성을 개선하고, 클릭 앤 컬렉트, 매장 배송, 마켓플레이스 존재감을 구축하여 디지털 터치포인트를 확대합니다.

- 을 위한 위치 전략하노이와 호치민시를 넘어 중부 지역(후에/다낭), 남부 산업 지대(빈즈엉/동나이), 항구/산업 단지 근처의 북부 지방(하이퐁/박닌/타이응우옌)을 포함하는 것이 합리적입니다.

* 본 기사의 내용을 인용하고자 하시는 경우, 저작권을 존중하여 출처와 원 기사의 링크를 함께 명시해 주시기 바랍니다.

| 비앤컴퍼니

2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. info@b-company.jp + (84) 28 3910 3913 |