베트남 제과 시장 개요

베트남의 제과 시장은 인구가 빠르게 증가하고, 평균 소비자 소득이 증가하고, 일년 내내 축제와 공휴일이 자주 거행되기 때문에 꾸준히 유망한 분야로 여겨지고 있습니다. 베트남은 음력설, 중추절, 다양한 종교 및 문화 명절 등 많은 축제를 기념합니다. 이러한 이벤트는 선물에 대한 수요를 높이고, 제과 제품은 선물용으로 특히 인기가 있습니다.

베트남의 휴일 선물 세트의 예

출처: Shopee

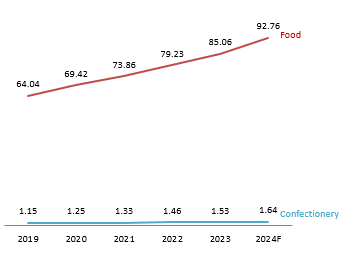

베트남 제과 시장은 2024년까지 16억 4천만 달러에 도달할 것으로 예상됩니다. 빵과 시리얼 제품이 주로 주도하는 베트남의 식품 시장과 비교했을 때, 제과 부문은 규모는 작지만 여전히 주목할 만한데, 연평균 성장률(CAGR)이 7.3%로 2019-2024년 기간 동안 식품 시장의 연평균 성장률 7.6%와 거의 일치합니다. 제과 시장의 주요 부문은 구운 제품과 비스킷이며, 그 다음으로 사탕, 아이스크림, 마지막으로 초콜릿이 뒤를 따릅니다.

베트남 제과 및 식품 시장 수익 2019-2024F

단위: 10억 달러

원천: 스타티스타

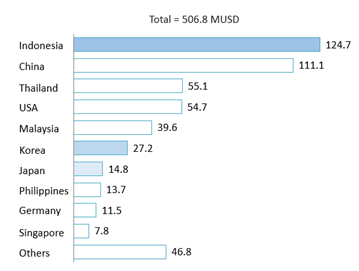

베트남의 제과 시장에서 수입 가치는 매년 증가하고 있습니다.Trademap 데이터에 따르면 일본 제과 수입은 2019년(740만 달러)에서 2023년(1480만 달러)까지 2.5배 증가했습니다.2023년 일본 제과 중 가장 높은 수입 가치는 빵, 페이스트리, 케이크, 비스킷(57%)이고, 그 다음은 설탕 제과와 초콜릿(둘 다 19%)이고, 마지막으로 아이스크림(5%)입니다.그러나 다른 제과 수출국과 비교했을 때 일본의 수입은 전체 수입의 2.9%에 불과했으며 2023년 베트남의 제과 수출 상위 10개국 중 7위를 차지했습니다.베트남이 가장 많은 제과를 수입한 국가는 인도네시아로 수입 가치가 1억 2,470만 달러였습니다. 그러나 베트남에서 가장 우세한 제과 브랜드는 네슬레, 몬델레즈 인터내셔널, 퍼페티 반 멜레를 포함한 미국과 유럽 브랜드입니다. 이러한 브랜드는 인도네시아와 중국에 수출을 위한 생산 시설을 설립했으며, 이는 다른 국가에 비해 이러한 국가의 수입량이 더 높은 이유를 설명합니다. 일본 바로 앞에는 한국이 있으며, 수출 가치는 일본의 두 배입니다.

Top 10 confectionery exporters to Vietnam in 2023

단위: 백만 달러

출처: Trademap

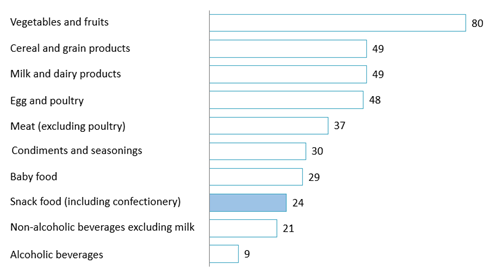

베트남의 유기농 제과 개요

소득 증가는 건강을 고려한 선택에 대한 소비자 관심 증가와 맞물려 있습니다. 유로모니터 보고서 베트남의 유기농 제품 매출은 2020년 대비 약 20% 증가해 2022년에는 1억 달러에 도달한 것으로 나타났습니다. Tetra Pak의 인덱스 2023 베트남 소비자들이 건강과 음식 선택의 환경적 영향에 대해 점점 더 의식하고 있다는 것을 보여줍니다. 야채, 과일, 곡물, 견과류, 유제품과 같은 일상 필수품이 가장 많이 구매되는 유기농 품목입니다. 4,649명의 베트남 응답자를 대상으로 한 Rakuten Insight 설문 조사에 따르면 80%가 유기농 야채와 과일을 구매했으며, 그 다음으로 곡물, 견과류, 유제품을 구매했습니다. 유기농 과자는 아직 많은 사람들에게 최우선 순위는 아니지만 인기를 얻고 있습니다. 특히, 응답자의 24%가 유기농 과자와 간식을 적어도 한 번은 구매했다고 보고하여 유기농 식품 및 과자 시장에서 더 건강한 간식 대안에 대한 관심이 커지고 있음을 보여줍니다.

Most important organic food categories among consumers in Vietnam in 2023

단위 : %

원천: 라쿠텐

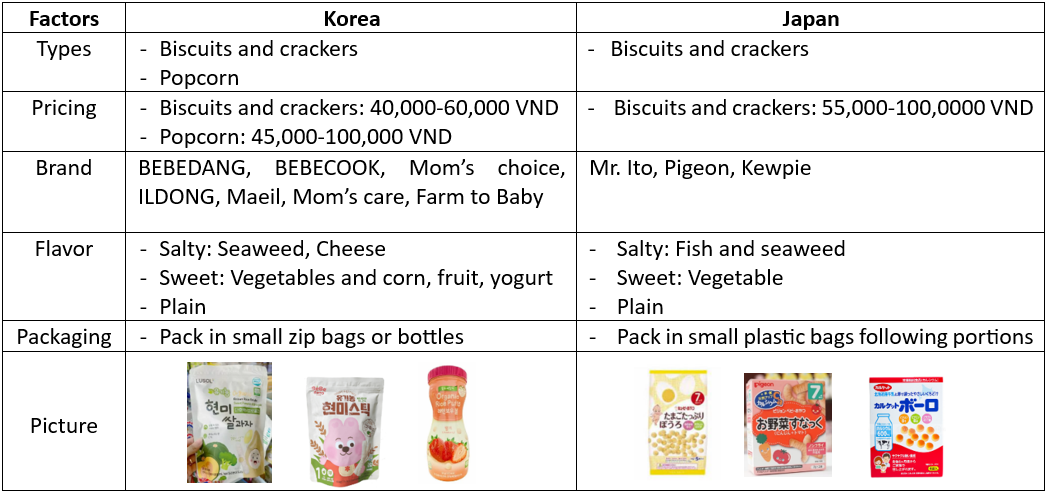

베트남의 유기농 제과 시장은 주로 어린이용 제품, 특히 유기농 아기 간식에 의해 주도됩니다. 전자상거래 플랫폼인 Shopee에서 검색하면 5,000개가 넘는 유기농 아기 간식 제품과 어린이용 향신료, 파스타와 같은 다른 유기농 제품이 나옵니다. 이러한 어린이용 유기농 제과 대부분은 한국과 일본에서 수입됩니다. 일본의 유기농 제과는 맛이 적고 가격이 비싼 경향이 있는 반면, 한국 제품은 더 저렴한 가격에 더 다양한 맛을 제공하여 더 광범위한 소비자 선호도를 충족합니다. 또한 베트남의 유기농 제과 시장에는 다이어트 쿠키, 사탕, 젤리, 초콜릿, 아이스크림과 같은 품목도 포함되어 있어 베트남 소비자에게 제공되는 건강한 간식 옵션의 범위가 확대됩니다.

Comparison of organic baby snacks between Korea and Japan

출처: Shopee에서의 편집

유기농 제품은 일반적으로 슈퍼마켓, 모자 및 유아용품 매장, 특수 수입 매장을 통해 유통됩니다. 온라인 판매도 크게 성장하여 소비자에게 비용 효율적인 옵션을 제공합니다.

베트남의 유기농 제품은 주로 슈퍼마켓, 모자용품 매장, 수입 전문점을 통해 유통됩니다. 그러나 온라인 판매는 상당한 성장을 보이며 소비자에게 비용 효율적이고 편리한 옵션을 제공합니다. 라이브스트림 쇼핑과 비디오의 제품 링크가 증가하면서 특히 모자용품 브랜드의 강력한 마케팅 전략이 되었습니다. 브랜드는 판매를 늘리기 위해 인플루언서 마케팅을 점점 더 활용하고 있습니다. A 2023 Rakuten Insight 설문 조사 베트남 소비자의 79%가 인플루언서 추천에 따라 제품을 구매했다고 보고했으며, 이는 쇼핑 결정에 미치는 영향력을 강조합니다. 공식 브랜드와 모자 슈퍼마켓 체인이 유명인이나 인플루언서와 협력하여 Shopee, Lazada, TikTok Shop과 같은 전자 상거래 플랫폼에서 라이브 스트리밍 판매를 하는 추세가 커지고 있습니다. 예를 들어, 모자 슈퍼마켓 체인 콘 쿵 웹사이트, 앱, Shopee를 포함한 여러 플랫폼에서 라이브 스트리밍을 진행하는 한편, 특히 "핫 맘"으로 알려진 엄마들과 같은 인플루언서들과 협력합니다. 이러한 인플루언서들은 Facebook 및 TikTok과 같은 소셜 미디어 채널을 통해 제품을 홍보하는 데 도움을 줍니다. 라이브 스트리밍은 유아용 수유 의자, 푸드 프로세서, 유기농 유아용 식품과 같은 인기 있는 유아용 제품을 특징으로 하며, 유기농 제품 판매를 촉진하는 역동적이고 매력적인 방법을 제공합니다.

결론

유기농 제품 시장이 성장하고 있지만 유기농 제과 부문은 여전히 상당히 미개발 상태입니다. 이러한 격차는 일본 브랜드가 제품을 확장하고 베트남에서 증가하는 건강한 간식에 대한 수요를 충족할 수 있는 중요한 기회를 제공합니다. 더 다양한 맛과 형태를 도입하고 건강상의 이점과 친환경성을 강조함으로써 일본 제과 브랜드는 베트남의 확장 시장에서 전략적으로 입지를 굳건히 할 수 있습니다. 전자 상거래 플랫폼 및 라이브 스트리밍 쇼핑과 같은 기존 소매 및 온라인 채널을 모두 활용하면 일본 브랜드가 베트남 소비자 사이에서 증가하는 건강한 간식 옵션 수요를 활용할 수 있습니다. 이 전략을 통해 일본 기업은 건강을 의식하는 시장의 선호도에 부응하는 동시에 경쟁이 치열한 유기농 제과 부문에서 입지를 강화할 수 있습니다.

| 주식회사 비앤컴퍼니

2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. info@b-company.jp + (84) 28 3910 3913 |

다른 기사를 읽어보세요