2025年7月30日

最新ニュースとレポート / ベトナムブリーフィング

コメント: コメントはまだありません.

ベトナムがグローバル市場への統合を深め、インダストリー4.0を推進する中で、農業セクターは大きな変革期を迎えています。伝統的な慣行はデジタル技術によって大きく変貌を遂げつつあり、トレーサビリティシステムは近代化の重要な柱として台頭しています。かつてはオプションだったこれらのシステムは、輸出要件、国内の食品安全への懸念、そして消費者の期待の高まりを背景に、今や不可欠なものとなっています。この変化は、小規模農家や協同組合に適応を迫るだけでなく、ベトナム農業の未来を形作ろうとする技術提供者、政策立案者、投資家にとって新たな機会をもたらします。

賢い消費者の台頭と市場からの圧力

約1億人のベトナム国内市場は、消費者行動に大きな変化を遂げています。テクノロジーに精通し、意識も高まっている現代の消費者は、価格だけでなく、製品の品質、食品の安全性、そして特に原産地の透明性に関して厳格な基準を求めています。約801億3千万のベトナム消費者が、清潔で安全な製品にはより高い価格を支払う意思があると回答しています[1]。これは、製品のトレーサビリティを信頼性をもって検証できる企業にとって大きなチャンスを生み出します。

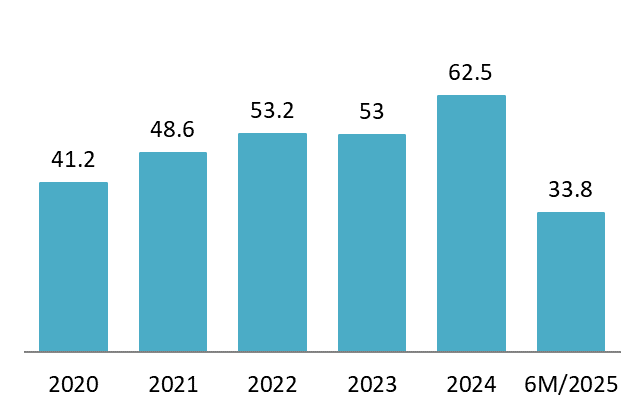

ベトナムは農林水産物の主要純輸出国であり、輸出額は2020年の412億米ドルから2024年には625億米ドルに増加し、2025年の最初の6ヶ月間で338億米ドルに達すると予想されています[2]。主要輸出品は果物、野菜、コーヒー、米、カシューナッツ、魚介類で、主に中国、米国、日本、EU向けです。これらの市場が認証やトレーサビリティの基準を引き上げるにつれ、ベトナムの生産者はより透明性と説明責任のあるシステムを導入するよう、ますます圧力を受けています。

ベトナムの農林水産物輸出額(2020年~2025年6ヶ月まで)

(十億USD)

出典: VnEconomy

非関税障壁と強制的な輸出市場要件

主要な農産物輸出国であるベトナムにとって、国際基準の遵守は決定的な要素となっている。トレーサビリティは、非関税障壁における重要な技術的障壁として浮上し、高付加価値でありながら要求の厳しい市場へのアクセスに必須の「パスポート」となっている。

主要市場では規制が厳格化しています。かつては緩いと考えられていた中国も、現在ではジャックフルーツやドリアンなど多くのベトナム産果物のトレーサビリティを義務付けています[3]。EUと米国は長年にわたり、残留農薬規制値、植物検疫要件、トレーサビリティシステムの義務化など、厳格な食品安全基準の遵守を義務付けてきました[4]。これらの基準を満たさない場合、競争力の喪失、あるいは市場からの完全な排除につながる可能性があります。

法的基盤と戦略的な政府の推進

ベトナム政府はトレーサビリティの戦略的役割を認識し、包括的な法的枠組みを構築することで積極的に主導的な役割を果たしています。

決定100/QĐ-TTg(2019年)は、全国規模でトレーサビリティシステムを制度化するという野心的な目標を設定しています。2025年までに、少なくとも30%のベトナム企業が国内または国際的なトレーサビリティ規格を採用することが期待されています。統一された国家トレーサビリティポータルは、関係するすべての省庁とセクターを結び付け、相互運用可能なデータエコシステムを実現し、ベトナムの経済主権を強化するものです[5]。

通達17/2021/TT-BNNPTNTは、農業省のトレーサビリティ要件を規定しています。この通達は、「一歩前進、一歩後退」の原則、詳細な記録保持、段階を跨いだ製品コードの適用を義務付け、サプライチェーンにおける完全な後方および前方トレーサビリティを確保しています[6]。

市場主導の引き(消費者需要)と政策主導の押し(政府規制と輸出基準)の組み合わせが前例のない勢いを生み出し、ベトナムの農業部門を透明性の高い生産へと導いています。

利用可能なトレーサビリティソリューション

サプライチェーンの透明性確保のため、ベトナム企業は現在、幅広いデジタルトレーサビリティ技術を活用できるようになりました。重要なのは、単一のツールに頼るのではなく、統合されたテクノロジースタックを構築することです。各ソリューションがそれぞれの役割を担い、市場規模、製品タイプ、投資能力に合わせて、堅牢で適応性の高いトレーサビリティシステムを構築します。

トレーサビリティ技術の比較

| 基準 | QRコード | RFID | ブロックチェーン |

| 仕組み | 各製品またはバッチには固有のQRコードが付与されています。消費者はスマートフォンでQRコードをスキャンするだけで、製品の詳細情報を即座に確認できます。これは、サプライチェーンのどの段階でもトレーサビリティ情報にアクセスできる、シンプルで低コストな方法です。 | RFIDシステムはタグとリーダーを使用します。タグは商品に取り付けられ、リーダーは電波を発信して遠くからデータを読み取ります。接触や直接の視認は必要ありません。保管中や輸送中の迅速かつ自動的な追跡が可能になります。 | ブロックチェーンは共有デジタル台帳です。取引や生産ログなどの情報は、チェーン状にリンクされた暗号化されたブロックに保存されます。データは複数のコンピューター間でコピーされ、単一の当事者によって変更または削除することはできません。 |

| 実装コスト | 低い | 高い | 非常に高い |

| セキュリティレベル | 低い

中央サーバーでデータを変更できる |

中~高

暗号化されたタグ |

非常に高い

不変、分散型 |

| ストレージ容量 | 中くらい

URL、基本テキストを保存 |

高い

複雑なデータをチップ上に保存 |

非常に高い

完全な取引履歴を保存する |

| ユースケース | 消費者との交流、基本的な偽造防止、マーケティング | 在庫管理、物流、コンテナ追跡、家畜管理 | 絶対的な信頼、スマートコントラクト、サプライチェーンファイナンス |

| 例 | チェック対象者, トレース検証済み | サトーベトナム, ハ・パンJSC | TE-FOOD, HCM57テクノロジー |

資料: B&Company

スマート農業の課題

農家の技術スキル不足

もう一つの大きな課題は、多くのベトナム農家のデジタルスキルと使用習慣が限られていることです。スマートフォンは広く普及していますが、ほとんどの農家は生産ツールとしてではなく、主にコミュニケーションや娯楽のために使用しています。従来の慣行からモバイルアプリへの圃場データの記録への移行は、しばしば不必要で煩わしいと見なされます。農業省デジタル変革局が2024年後半に指摘したように、デジタルに対する意識の低さは依然として大きなボトルネックとなっています。正確な入力データがなければ、どのような技術を使用しても、トレーサビリティシステムは脆弱で信頼性の低いものになります。

断片化された小規模生産

最も根本的な障壁の一つは、農業生産の断片化と小規模化です。ベトナムでは依然として、数百万の小規模農家が限られた規模で散在した場所で農業を営んでいます。この断片化により、技術の一貫した適用、均一な品質基準の確保、トレーサビリティのための正確なデータ収集が極めて困難になっています。ベトナムの農業は、小規模で断片化された生産を特徴としています。小規模農家は農地の大部分を所有し、農業生産面積全体の90%を占めています。農家1世帯あたりの平均耕作面積は0.68ha未満です[7]。協同組合は取り組みの調整に役立つ可能性がありますが、その役割は依然として限られています。2023年の調査では、インフラ、ガバナンス、技術能力の弱さにより、デジタルトレーサビリティを導入しているのはわずか26%にとどまりました[8]。多くの協同組合は、データ収集を調整したり、品質基準を効果的に施行したりするための技術インフラ、ガバナンス能力、研修が不足しています。この断片化により、技術の一貫した適用、均一な品質基準の確保、トレーサビリティのための正確なデータ収集が極めて困難になっています。

システム間の相互運用性の欠如

さらに、様々なソリューションプロバイダーが開発したシステム間の相互運用性が欠如しているため、トレーサビリティの状況は断片化しています。各プラットフォームはそれぞれ異なる技術標準とデータ構造に従っているため、混乱、非効率性、そして作業の重複が生じており、特に複数の要件に対応しなければならない農家や協同組合にとっては大きな問題となっています。一部の専門家は、問題の核心は、集中化されたセクター横断的なデータインフラストラクチャの欠如にあると主張しています[9]。トレーサビリティデータは、生産、検査、流通の各段階を結び付ける統一された識別システムがないまま、省庁間でサイロ化されたままです。例えば、農業農村開発省(MARD)は、CheckVNや作付け地域コードシステムなどのプラットフォームを通じて、農産物や生鮮食品のトレーサビリティシステムを実装しています[10]。一方、商工省(MOIT)は、itrace247 [11]など、工業製品、加工食品、輸出製品を追跡するための個別のプラットフォームを管理しています。その結果、ほとんどのトレーサビリティ実装は表面的なレベルにとどまり、サプライチェーンにおける製品の完全な経路を反映できていません。

断片化を機会に変える

ベトナムの農業セクターがデジタル変革を進める中、トレーサビリティは食品安全、輸出コンプライアンス、そして消費者の信頼の基盤として急速に重要になっています。しかしながら、生産の分散化、デジタルリテラシーの不足、そして省庁間のデータシステムのサイロ化などにより、効果的なトレーサビリティへの道は依然として複雑です。

この状況は困難ではあるものの、先進的なテクノロジープロバイダーにとって魅力的な機会となります。スマートでローカライズされ、相互運用可能なソリューションを設計する企業は、競争優位性を獲得するだけでなく、ベトナムの農業・食品システムの近代化に大きく貢献することができます。プロバイダーにとって、これは単なる課題ではなく、次のようなソリューションを提供する絶好の機会です。

– モバイルファースト: 技術の低い農家や協同組合向けにカスタマイズされたユーザーフレンドリーなアプリを設計します。

– モジュール化を維持: 0.7ヘクタールの稲作農場と協同組合の両方で機能するスケーラブルなツールを構築する

– 統合と調整: itrace247 や CheckVN などの国内プラットフォームへの準拠を確保し、GS1 または同等のグローバル スタンダードをサポートします。

– ローカルに考え、グローバルに同期: ベトナムの作物、現地の言語、オフラインでの使用、シームレスな API ベースのデータ交換をサポートします。

– ベストプラクティスを活用する: 日本のシステムは、ユーザー中心設計と機関間の統合に関する教訓を提供しており、それをベトナムの状況に適応させます。

[1] ベトナムプラス、グリーン消費 - プラスチック廃棄物削減の鍵

[2] VnEconomy、農業部門が躍進、農林水産物の輸出が目標を上回る。

[3] 農村企業とブランド誌、中国が規制を強化する中、ベトナムの農産物輸出はどのように適応しているのか?

[4] ベトナムプラス、ベトナムの農産物輸出はより厳しい要件に直面している

[5] ベトナム政府ポータル、首相決定第100/QĐ-TTg号:トレーサビリティシステムの実施、適用、管理に関する計画の承認

[6] ベトナム政府ポータル、農業農村開発省が発行した回状第17/2021/TT-BNNPTNT号:農業農村開発省の管理範囲におけるトレーサビリティ、リコール、および安全でない食品の取り扱いに関する規則。

[7] 農業農村開発省ポータルサイト:稲作地の現状と食料安全保障を確保するための稲作地の管理と利用に関する土地法改正案における改正案

[8] Le Anh Hoang、Nguyen Dinh Tinh、Vu Duong Quynh、Pham Quang Ha、「ベトナムの農業協同組合の生産と事業におけるデジタルトレーサビリティ技術の応用の現状と解決策」

[9] VnExpress、ベトナムにおける製品トレーサビリティの課題

[10] VCCI、トレーサビリティのデジタル化:農産物をグローバルサプライチェーンに参加させるためのプラットフォーム

[11] 商工省、商工省が貿易促進のためのブロックチェーンベースの追跡システムを導入

| B&Company株式会社

2008年に設立され、ベトナムにおける日系初の本格的な市場調査サービス企業として、業界レポート、業界インタビュー、消費者調査、ビジネスマッチングなど幅広いサービスを提供してきました。また最近では90万社を超える在ベトナム企業のデータベースを整備し、企業のパートナー探索や市場分析に活用しています。 お気軽にお問い合わせください info@b-company.jp + (84) 28 3910 3913 |