189 月2025

精彩内容 / 行业评论 / 最新资讯及报告

评论: 没有评论.

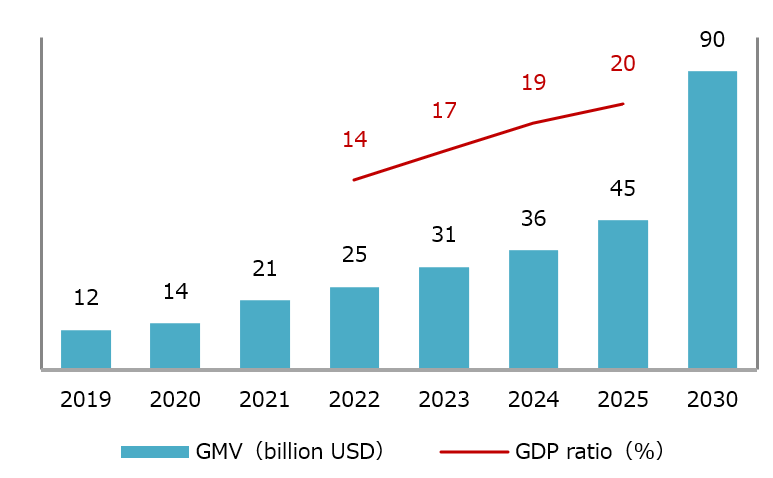

越南数字经济正处于转折点[1]预计2024年市场规模将达到约360亿美元[2]占GDP的18.%以上[3]预计到2025年,GDP将扩大到450亿至520亿美元之间,占GDP的25%左右。[4]。此外,目标是到 2030 年达到 900 亿美元,这明确表明数字化将在国家增长战略中发挥核心作用[5]但这种增长集中在电商、金融科技、物流等核心领域,结构性调整是可持续发展的必然要求。

越南数字经济的增长

来源: 2024年东南亚电子经济、信息通信部(麦克风)

电子商务:税改挑战增长

电子商务仍然是最大的增长引擎,到 2024 年将占整个市场的约 60%(约 220 亿美元)[6]. 虾皮, 拉扎达, 和 TikTok商店 正在扩大其影响力,与上一年相比增长率达到约 20%[7].

然而,一项将于2025年7月生效的新政府法令将要求平台运营商代为纳税。这可能会导致数百万小卖家因负担加重而退出。预计大型运营商将转向企业卖家,同时改善税收支持工具,这将显著改变行业结构。

金融科技:维持增长需要重构模式

预计到 2024 年中期,电子钱包用户数量将达到 5000 万,同比增长约 40%[8]. 莫莫 (交易份额约为 68%)将保持领先地位,其次是 ZaloPay (约53%)[9]然而,激进的促销费用给利润带来压力,许多运营商仍在亏损运营。

此外,他们将被迫应对来自银行应用程序日益激烈的竞争(VCB、数字银行, 科技商业银行, MB银行等)以及更严格的监管。基于传统返现计划的增长已达到极限,个性化金融以及与保险和资产管理的垂直整合将成为其下一个收入模式的关键。

物流:脱碳压力推动业务重组

物流行业作为电子商务的基础持续增长,相关商品交易总额 (GMV) 预计在 2024 年达到 210 亿美元[10]然而,为了实现政府到2050年实现碳中和的目标,迫切需要采取环境措施。

主要运营商(生长激素缺乏症, 盖特克, 越南电信邮政, 艾哈迈德, 洛希普等企业已开始试行电动配送车辆和碳追踪技术,但充电基础设施的缺乏和高昂的投资成本阻碍了其大规模应用。未来,建立符合ESG要求的系统,例如人工智能优化和绿色仓库的建设,将带来竞争优势。

品质的改变决定未来

越南数字经济正从表面扩张转向深化提质。电商被迫向“合规化、专业化”转型,金融科技被迫从“用户获取”向“可持续价值创造”转型,物流被迫从“增长”向“脱碳化、效率化”转型。

下一代赢家将是那些不仅规模增长,而且能够有效整合技术投资、治理和 ESG 战略的公司。

[1] 数字经济:基于数字技术和平台的经济活动。包括电子商务、数字支付、金融科技、物流、在线内容和数据驱动服务,支持商品和服务的生产、分配和消费。

[2] 来源:政府新闻,” Viet Nam 的 今年数字经济规模将达到360亿美元 ”(2024年11月)

[3] 来源:越南新闻网,《数字 经济预计将达到越南GDP的18.6% ”(2024年11月)

[4] 资料来源:谷歌、淡马锡、贝恩公司” 2024年东南亚电子经济报告 ”(2024年11月)

[5] 资料来源:美国商务部国际贸易管理局,” 越南数字经济 ”(2024年9月)

[6] 资料来源:谷歌、淡马锡、贝恩公司” 2024年东南亚电子经济报告 ”(2024年11月)

[7] 来源:东盟简报” 越南的机遇和主要趋势 的 电子商务的未来 ”(2024年12月)

[8] 资料来源:《越南投资评论》 电子钱包公司重组以维护客户利益 ”(2024年6月)

[9] 资料来源:《越南投资评论》 电子钱包企业寻求抓住市场空白 ”(2024年8月)

[10] 来源:河内时报,” Vietnam 的 数字经济有望在2024年大幅增长 ”(2024年11月)

*如果您想引用本文中的任何信息,请注明来源以及原始文章的链接,以尊重版权。

| B&Company

自 2008 年以来,日本第一家专门从事越南市场研究的公司。我们提供广泛的服务,包括行业报告、行业访谈、消费者调查、商业配对。此外,我们最近还开发了一个包含越南 900,000 多家公司的数据库,可用于搜索合作伙伴和分析市场。 如果您有任何疑问,请随时与我们联系。 信息@b-company.jp + (84) 28 3910 3913 |