20/08/2025

Tin tức & Báo cáo mới nhất / Vietnam Briefing

Bình luận: Không có bình luận.

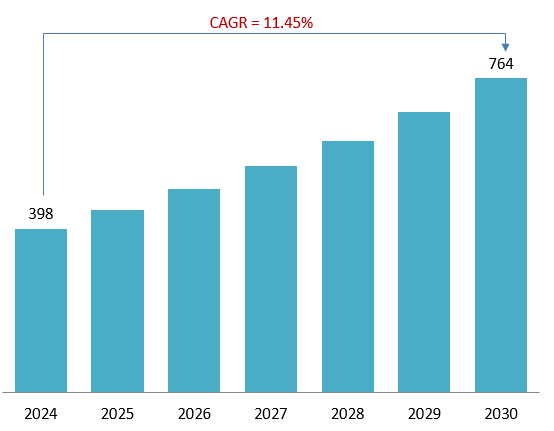

Thị trường y tế số Việt Nam được định giá 398,15 triệu đô la Mỹ vào năm 2024 và dự kiến sẽ chứng kiến sự tăng trưởng mạnh mẽ trong giai đoạn dự báo, với tốc độ tăng trưởng kép hàng năm (CAGR) là 11.45% đến năm 2030 [1]. Sự tăng trưởng này được thúc đẩy bởi nhu cầu về dịch vụ chăm sóc sức khỏe ngày càng tăng, đặc biệt là trong bối cảnh quá tải tại các bệnh viện công và mong muốn ngày càng tăng của người dân trong việc tiếp cận dịch vụ chăm sóc y tế chất lượng cao hơn.

Theo OECD, y tế số đề cập đến việc áp dụng các công nghệ số - chẳng hạn như y tế từ xa, trí tuệ nhân tạo (AI), dữ liệu lớn và các công cụ CNTT khác - để hỗ trợ và nâng cao hệ thống y tế và cung cấp dịch vụ chăm sóc sức khỏe. Nó mang lại những cơ hội đáng kể để cải thiện hiệu quả, khả năng tiếp cận và kết quả sức khỏe [2]

Thị trường sức khỏe số 2024 – 2030

Nguồn: Nghiên cứu khoa học công nghệ

Hỗ trợ của chính phủ

Chính phủ Việt Nam đóng vai trò tích cực trong việc thúc đẩy y tế số, không chỉ quản lý nó. Theo Chương trình chuyển đổi số quốc gia (Quyết định 749/QĐ-TTg đã chỉ định y tế là ngành ưu tiên hàng đầu. Các sáng kiến chính bao gồm:

– Bắt buộc áp dụng EHR: Tất cả các nhà cung cấp dịch vụ chăm sóc sức khỏe được yêu cầu triển khai Hồ sơ Sức khỏe Điện tử (EHR) vào năm 2025–2026, tạo ra nhu cầu B2B khổng lồ, không thể tùy chọn cho các giải pháp CNTT y tế. Những hồ sơ này tạo thành xương sống dữ liệu cho các dịch vụ kỹ thuật số trong tương lai như chẩn đoán AI và y học cá nhân hóa.

– Tích hợp VNeID:Việc liên kết EHR với hệ thống ID kỹ thuật số quốc gia (VNeID) sẽ thống nhất hồ sơ sức khỏe của gần 100 triệu công dân—mở ra tiềm năng to lớn cho dịch vụ chăm sóc sức khỏe dựa trên dữ liệu.

– Cơ sở hạ tầng chăm sóc sức khỏe từ xa:Một sáng kiến do nhà nước dẫn đầu đang kết nối hơn 1.000 bệnh viện và phòng khám thông qua y tế từ xa, giảm bớt tình trạng quá tải ở bệnh viện trung tâm và cho phép chăm sóc từ xa.

– Hỗ trợ chính sách và tài trợ:Chính phủ đã cam kết tài trợ đáng kể (ví dụ: 30 nghìn tỷ đồng hoặc ~1,26 tỷ đô la Mỹ) để đẩy nhanh quá trình số hóa chăm sóc sức khỏe.

Phân khúc thị trường cốt lõi: Trụ cột của Y tế số tại Việt Nam

Bối cảnh y tế số của Việt Nam được định hình bởi một số phân khúc cốt lõi, mỗi phân khúc đáp ứng các nhu cầu chăm sóc sức khỏe khác nhau thông qua các phương pháp công nghệ riêng biệt. Từ tư vấn từ xa đến chẩn đoán dựa trên AI, những phân khúc này tạo thành những trụ cột cấu trúc của một ngành công nghiệp đang phát triển nhanh chóng. Bảng dưới đây phác thảo các phân khúc chính, chức năng của chúng và những nhân tố đáng chú ý thúc đẩy đổi mới và ứng dụng trên toàn thị trường.

| Phân đoạn | Sự miêu tả | Những nhân vật đáng chú ý / Ví dụ |

| Y tế từ xa / Y tế từ xa | Tư vấn y tế từ xa và theo dõi bệnh mãn tính | Sức khỏe Jio, Med247, Bác sĩ điện tử |

| mHealth (Sức khỏe di động) | Ứng dụng sức khỏe/thể dục, theo dõi thuốc, thiết bị đeo được | Sức khỏe Jio, Med247, Bác sĩ điện tử, ứng dụng

FPT Long Châu / Pharmacity |

| Hệ thống CNTT Y tế (EHR/EMR/HIS) | Hồ sơ sức khỏe điện tử, Hồ sơ bệnh án điện tử, Hệ thống CNTT bệnh viện | FPT.eHospital, Viettel-HIS, DrAid™ |

| Nhà thuốc điện tử | Nền tảng trực tuyến để đặt hàng và giao thuốc | MuaMed, FPT Long Châu, Hiệu thuốc |

| AI & Y học chính xác | Chẩn đoán dựa trên AI, xét nghiệm bộ gen, y học cá nhân hóa | VinBrain, Giải pháp gen, Di truyền học |

Nguồn: Tổng hợp của B&Company

Một số nền tảng tại Việt Nam đã phát triển thành hệ sinh thái y tế số tích hợp, kết hợp nhiều tính năng để đáp ứng nhu cầu đa dạng của người dùng. Một số ví dụ đáng chú ý bao gồm:

– Sức khỏe Jio: Cung cấp giải pháp trọn gói với dịch vụ tư vấn từ xa, khám bệnh tại nhà, quản lý hồ sơ sức khỏe điện tử và đặt thuốc trực tuyến.

– Bác sĩ điện tử: Cung cấp dịch vụ tư vấn từ xa, theo dõi hồ sơ sức khỏe cá nhân, xét nghiệm tại nhà và theo dõi sức khỏe thông qua ứng dụng di động.

– Med247: Vận hành cả phòng khám thực tế và nền tảng kỹ thuật số, bao gồm dịch vụ y tế từ xa, đặt lịch hẹn, quản lý chăm sóc bệnh mãn tính và nhắc nhở uống thuốc.

– FPT Long Châu:Ngoài chuỗi nhà thuốc bán lẻ, nền tảng này còn hỗ trợ mua thuốc trực tuyến, tư vấn dược sĩ, quản lý đơn thuốc và liên kết đến các dịch vụ chăm sóc sức khỏe.

Chất xúc tác tăng trưởng: Điều gì tạo ra cơ hội trong cuộc cách mạng y tế số tại Việt Nam

Đặc điểm nhân khẩu học độc đáo của Việt Nam đang thúc đẩy nhu cầu tiêu dùng về các giải pháp y tế kỹ thuật số, cả về mặt cấu trúc dài hạn lẫn ngắn hạn. Một mặt, dân số Việt Nam đang già hóa nhanh chóng—đến năm 2050, hơn 25% dân số sẽ trên 60 tuổi, kèm theo sự gia tăng mạnh mẽ các bệnh không lây nhiễm mạn tính (NCD) như tiểu đường, tăng huyết áp và ung thư [4]. Không giống như các bệnh cấp tính, NCD đòi hỏi sự chăm sóc liên tục, theo dõi thường xuyên và sự tham gia tích cực của bệnh nhân—những nhu cầu này hoàn toàn phù hợp với các công cụ kỹ thuật số. Điều này đang tạo ra nhu cầu bền vững đối với các công nghệ như theo dõi bệnh nhân từ xa, chăm sóc người cao tuổi bằng AI và các nền tảng quản lý bệnh mãn tính.

Đồng thời, Việt Nam được hưởng lợi từ “cơ cấu dân số vàng”, với 70% công dân trong độ tuổi 15–64 và gần một nửa dưới 34 [4]. Thế hệ bản địa kỹ thuật số này đang thúc đẩy nhu cầu ngắn hạn mạnh mẽ đối với các ứng dụng sức khỏe di động, tư vấn bác sĩ trực tuyến, nền tảng thể dục và thiết bị đeo được - được thúc đẩy bởi sự thâm nhập điện thoại thông minh cao (trên 84%) và đô thị hóa ngày càng tăng [5]. Nhóm dân số trẻ, am hiểu công nghệ này đại diện cho một nhóm khách hàng lý tưởng cho các giải pháp sức khỏe di động (mHealth) và thiết bị đeo thông minh. Những công cụ này hỗ trợ sự chuyển dịch ngày càng tăng sang chăm sóc phòng ngừa và tự theo dõi, mở ra một phân khúc lớn và đang phát triển nhanh chóng của thị trường sức khỏe kỹ thuật số.

Góp phần vào đà tăng trưởng này là tầng lớp trung lưu đang phát triển nhanh chóng và thu nhập khả dụng ngày càng tăng của Việt Nam. Đến năm 2035, người tiêu dùng có thu nhập trung bình ở thành thị dự kiến sẽ chiếm 50% dân số, cho thấy sự ưa chuộng rõ ràng đối với các dịch vụ chăm sóc sức khỏe tư nhân, chất lượng cao và ứng dụng công nghệ hơn là các bệnh viện công quá tải [6]. Đại dịch COVID-19 càng thúc đẩy sự chuyển dịch này, bình thường hóa y tế từ xa và chăm sóc sức khỏe từ xa, đồng thời nâng cao kỳ vọng về sự tiện lợi, khả năng tiếp cận và sức khỏe cá nhân hóa. Do đó, nhu cầu về các công cụ tự theo dõi, ứng dụng theo dõi sức khỏe và các giải pháp chăm sóc phòng ngừa được thiết kế riêng cho người tiêu dùng chăm sóc sức khỏe hiện đại đang tăng nhanh chóng.

Những thách thức trong việc áp dụng chăm sóc sức khỏe kỹ thuật số

Khung pháp lý và quy định cho y tế số tại Việt Nam vẫn còn non trẻ, chưa hoàn thiện và đôi khi còn mơ hồ, gây ra sự không chắc chắn cho cả nhà đầu tư và nhà cung cấp dịch vụ. Luật Khám bệnh, chữa bệnh (2023) và các hướng dẫn kèm theo (ví dụ: Thông tư 30/2023/TT-BYT quy định về điều kiện khám chữa bệnh từ xa) đã thiết lập nền tảng pháp lý cho y tế từ xa [7]. Tuy nhiên, các chi tiết quan trọng như trách nhiệm pháp lý, phạm vi hành nghề, cơ chế hoàn trả và khả năng tương tác dữ liệu vẫn chưa rõ ràng.

– Thiếu khung hoàn trả: Hiện tại chưa có quy định rõ ràng về việc hoàn trả chi phí dịch vụ khám chữa bệnh từ xa của hệ thống Bảo hiểm y tế Việt Nam hoặc các công ty bảo hiểm tư nhân, gây ra rào cản lớn cho việc áp dụng rộng rãi của các nhà cung cấp.

– Sự mơ hồ về trách nhiệm pháp lý và cấp phép: Vẫn còn nhiều bất ổn xoay quanh trách nhiệm pháp lý y tế, yêu cầu cấp phép cho các nhà cung cấp dịch vụ chăm sóc sức khỏe từ xa, và tính hợp pháp của các buổi tư vấn xuyên biên giới. Sự mơ hồ về quy định này có thể tạo ra "bất lợi cho người tiên phong", khi những người áp dụng sớm có nguy cơ không tuân thủ hoặc không khả thi về mặt thương mại do những thay đổi chính sách đột ngột.

– Bảo mật dữ liệu và quyền riêng tư: Mặc dù Chính phủ đã ban hành Nghị định Bảo vệ Dữ liệu Cá nhân (Nghị định 13/2023/NĐ-CP), nhưng các quy định của Nghị định này vẫn còn chung chung và có thể được diễn giải theo nhiều cách khác nhau [8]. Ngoài ra, các yêu cầu về bản địa hóa dữ liệu theo Luật An ninh mạng có thể gây ra gánh nặng tuân thủ và chi phí hoạt động đáng kể cho các công ty nước ngoài.

Yếu tố con người

Một thách thức lớn nằm ở lòng tin và hành vi của bệnh nhân, đặc biệt là ở người cao tuổi và người dân sống ở vùng nông thôn. Nhiều bệnh nhân vẫn ưa chuộng các buổi tư vấn trực tiếp truyền thống, vì họ cho rằng chúng đáng tin cậy và gần gũi hơn. Do đó, việc xây dựng niềm tin vào chẩn đoán ảo và nền tảng kỹ thuật số vẫn là một trở ngại dai dẳng, đặc biệt là ở những khu vực mà trình độ hiểu biết về công nghệ số vẫn còn thấp.

Về phía nhà cung cấp, sự phản kháng với sự thay đổi trong số các chuyên gia chăm sóc sức khỏe là một rào cản khác. Nhiều bác sĩ lâm sàng ngần ngại áp dụng các công nghệ mới làm gián đoạn quy trình làm việc hiện tại của họ. Lo ngại về trách nhiệm pháp lý, khối lượng công việc tăng lên và những hạn chế nhận thấy của dịch vụ chăm sóc ảo thường làm giảm mong muốn mở rộng các dịch vụ kỹ thuật số của họ.

Các khoảng cách về trình độ hiểu biết số cũng ảnh hưởng đến cả bệnh nhân và nhà cung cấp, đặc biệt là bên ngoài các trung tâm đô thị lớn. Để đảm bảo việc áp dụng rộng rãi, việc đầu tư đáng kể vào đào tạo, giáo dục và thiết kế nền tảng thân thiện với người dùng là điều cần thiết. Nếu không có những nỗ lực này, sức khỏe số có nguy cơ bị bỏ rơi bởi một bộ phận lớn dân số.

Cuối cùng, mối quan ngại về quyền riêng tư dữ liệu vẫn là một rào cản quan trọng. Cả người tiêu dùng và nhà cung cấp đều chưa sẵn sàng áp dụng hoàn toàn các nền tảng eHealth do thiếu các giao thức an ninh mạng rõ ràng, minh bạch và văn hóa bảo vệ dữ liệu mạnh mẽ. Niềm tin vào sự an toàn của dữ liệu sức khỏe cá nhân là nền tảng cho bất kỳ hệ thống y tế kỹ thuật số nào có khả năng mở rộng.

Kết luận

Thị trường y tế điện tử (eHealth) của Việt Nam có tiềm năng tăng trưởng mạnh mẽ, được thúc đẩy bởi các sáng kiến của chính phủ, xu hướng nhân khẩu học và nhu cầu ngày càng tăng về dịch vụ chăm sóc sức khỏe chất lượng cao, dễ tiếp cận. Tuy nhiên, vẫn còn nhiều thách thức như khoảng cách pháp lý, cơ chế hoàn trả hạn chế, rào cản về kiến thức số và mức độ tin tưởng thấp vào dịch vụ chăm sóc sức khỏe ảo. Việc vượt qua những rào cản này sẽ là chìa khóa để hiện thực hóa một hệ sinh thái y tế số thực sự có khả năng mở rộng và toàn diện.

[1] Nghiên cứu TechSci, Thị trường eHealth Việt NamTruy cập>

[2] OECD, Sức khỏe sốTruy cập>

[3] Quyết định 749/QĐ-TTgTruy cập>

[4] Tin tức Cộng sản, Già hóa dân số và tác động của nó đến Phát triển bền vững ngày nay – Hàm ý chính sách đối với Việt NamTruy cập>

[5] Tiền Phong, Từ xa xỉ đến bình dân: Cuộc cách mạng điện thoại thông minh cho mọi tầng lớp xã hội Việt NamTruy cập>

[6] Ngân hàng Thế giới, Báo cáo chung Việt Nam 2035Truy cập>

[7] Thông tư 30/2023/TT-BYTTruy cập>

[8] Nghị định 13/2023/NĐ-CPTruy cập>

B&Company, Inc.

Công ty nghiên cứu thị trường của Nhật Bản đầu tiên tại Việt Nam từ năm 2008. Chúng tôi cung cấp đa dạng những dịch vụ bao gồm báo cáo ngành, phỏng vấn ngành, khảo sát người tiêu dùng, kết nối kinh doanh. Ngoài ra, chúng tôi đã phát triển cơ sở dữ liệu của hơn 900,000 công ty tại Việt Nam, có thể được sử dụng để tìm kiếm đối tác kinh doanh và phân tích thị trường.

Xin vui lòng liên hệ với chúng tôi nếu bạn có bất kỳ thắc mắc hay nhu cầu nào.

info@b-company.jp + (84) 28 3910 3913