19/12/2025

Tin tức & Báo cáo mới nhất / Vietnam Briefing

Bình luận: Không có bình luận.

Được thúc đẩy bởi các sáng kiến của chính phủ nhằm thúc đẩy việc áp dụng Công nghiệp 4.0, chi phí lao động tăng cao và dòng vốn đầu tư trực tiếp nước ngoài đáng kể, Việt Nam đang nhanh chóng chuyển mình thành một trung tâm sản xuất công nghệ cao. Đối với các nhà đầu tư nhắm đến lĩnh vực “sản xuất thông minh”, đất nước này mang đến những cơ hội hấp dẫn: thị trường sản xuất thông minh được dự báo sẽ tăng trưởng mạnh mẽ, được hỗ trợ bởi chính phủ, chi phí lao động tăng cao và dòng vốn FDI. Đồng thời, các nhà đầu tư phải vượt qua những thách thức liên quan đến sự sẵn sàng của lực lượng lao động, chi phí triển khai cao và những điểm khác biệt về quy định. Việc thâm nhập thị trường chiến lược thông qua liên doanh, tập trung vào các lĩnh vực giá trị cao như điện tử và bán dẫn, và phù hợp với các ưu tiên của chính phủ có thể tối đa hóa thành công đầu tư trong thị trường năng động này.

Tổng quan thị trường

Ngành sản xuất đóng vai trò quan trọng trong nền kinh tế Việt Nam, với chỉ số sản xuất công nghiệp quý I năm 2025 tăng 7,61 tỷ taka/tấn so với năm trước.[1]Trong đó, lĩnh vực sản xuất và chế biến tăng trưởng 9,51 tỷ bảng Anh/3 tỷ đô la Mỹ (tăng 6,01 tỷ bảng Anh/3 tỷ đô la Mỹ trong năm 2024), đóng góp 7,9 điểm phần trăm vào tăng trưởng chung.

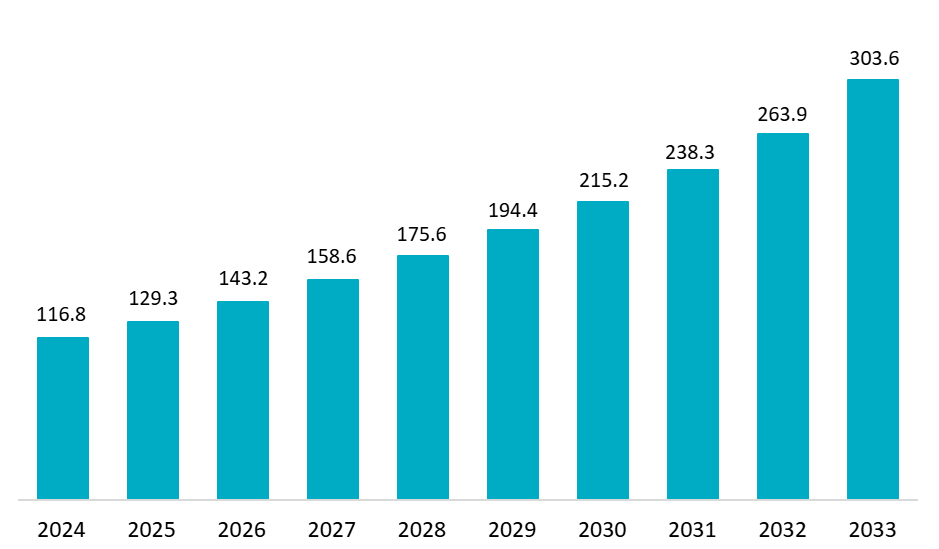

Thị trường sản xuất thông minh của Việt Nam là một trong những câu chuyện chuyển đổi công nghiệp năng động nhất Đông Nam Á. Giá trị thị trường đạt 116,8 tỷ USD vào năm 2024, với tốc độ tăng trưởng kép hàng năm (CAGR) là 10,71 nghìn tỷ nhân dân tệ, so với 8,041 nghìn tỷ nhân dân tệ của Đông Nam Á trong giai đoạn 2025-2033. Điều này đưa Việt Nam trở thành một nhân tố quan trọng trong hệ sinh thái sản xuất thông minh toàn cầu, khi đất nước đang nhanh chóng chuyển đổi từ sản xuất truyền thống thâm canh lao động sang các hệ thống sản xuất dựa trên công nghệ.[2].

Quy mô thị trường sản xuất thông minh của Việt Nam (2025 – 2033)

Đơn vị: tỷ USD

Nguồn: Imarc

Theo báo cáo năm 2023 của Ernst & Young Việt Nam, các xu hướng chính trong việc ứng dụng công nghệ số cho Sản xuất Thông minh 4.0 tại Việt Nam bao gồm: cơ sở hạ tầng kết nối 5G, máy bay không người lái (UAV), cảm biến thông minh, máy học, dữ liệu lớn, blockchain, thực tế ảo (VR) và in 3D, cùng nhiều công nghệ khác.[3].

Về mặt địa lý, việc áp dụng sản xuất thông minh tập trung ở các trung tâm công nghiệp trọng điểm. Thành phố Hồ Chí Minh và Hà Nội thống trị thị trường nhờ nền tảng công nghiệp vững mạnh, nguồn lao động lành nghề dồi dào và lượng đầu tư trực tiếp nước ngoài đáng kể. Những trung tâm đô thị này đóng vai trò là thỏi nam châm thu hút cả các công ty trong nước và quốc tế muốn tận dụng các công nghệ sản xuất tiên tiến để nâng cao hiệu quả hoạt động và khả năng cạnh tranh toàn cầu. Ngành điện tử và bán dẫn dẫn đầu về tỷ lệ áp dụng, tiếp theo là các ngành ô tô, dược phẩm, chế biến thực phẩm và đồ uống, và dệt may.[4].

Công ty nổi bật

Bức tranh tổng thể ngày càng được định hình bởi một nhóm các nhà sản xuất đã áp dụng tự động hóa tiên tiến, mô hình song sinh kỹ thuật số, hệ thống MES, giám sát IoT và robot trên quy mô lớn. Các nhà máy hàng đầu có vốn đầu tư nước ngoài như Samsung, Intel, Foxconn vận hành một số dây chuyền sản xuất công nghệ tiên tiến nhất trong nước, trong khi các doanh nghiệp lớn của Việt Nam như VinFast, Vinamilk đã đẩy nhanh quá trình chuyển đổi số thông qua các nhà máy thông minh với hệ thống dữ liệu tích hợp, hậu cần tự động và kiểm soát chất lượng được tăng cường bởi trí tuệ nhân tạo.

| Tên công ty | Năm thành lập

(bằng tiếng Việt) |

Quốc gia | Sản phẩm/Hoạt động chính | Hồ sơ ngắn |

| Samsung Electronics Việt Nam | 2009 | Hàn Quốc | Thiết bị điện tử tiêu dùng, điện thoại thông minh, linh kiện bán dẫn | Nhà đầu tư nước ngoài lớn nhất tại Việt Nam (đạt 22,4 tỷ USD vào năm 2024); vận hành các nhà máy thông minh tiên tiến tại Bắc Ninh và Thái Nguyên; ứng dụng công nghệ kiểm tra bằng trí tuệ nhân tạo, hệ thống quản lý sản xuất (MES), robot, mô hình song sinh kỹ thuật số để tối ưu hóa sản xuất.[5]. |

| Sản phẩm Intel Việt Nam | 2006 | Hoa Kỳ | Lắp ráp và kiểm tra chip bán dẫn, mạch tích hợp (IC), bộ xử lý | Một trong những nhà máy lắp ráp chip lớn nhất của Intel trên toàn cầu vận hành các dây chuyền sản xuất số hóa với hệ thống kiểm soát chất lượng tự động, phân tích dữ liệu và hệ thống chuỗi cung ứng tích hợp toàn cầu.[6]. |

| Tập đoàn công nghệ Foxconn | 2007 | Đài Loan | Sản xuất điện tử, lắp ráp bán dẫn, hệ thống sản xuất thông minh | Đầu tư mạnh vào Bắc Giang và Bắc Ninh; áp dụng dây chuyền SMT tự động hóa cao, robot và hệ thống giám sát thời gian thực; nhà cung cấp chính cho Apple và các thương hiệu công nghệ lớn.[7]. |

| Công ty VinFast | 2017 | Vietnam | Xe điện, pin, linh kiện ô tô | Vận hành một trong những nhà máy sản xuất ô tô tự động hóa cao nhất Đông Nam Á; ứng dụng robot (KUKA), mô hình kỹ thuật số song sinh, hệ thống kiểm soát chất lượng tiên tiến, bảo trì dự đoán dựa trên trí tuệ nhân tạo.[8]. |

| TAiLG Việt Nam | 2024 | Trung Quốc | Xe điện, sản xuất pin, lắp ráp tự động | Trung tâm sản xuất thông minh mới tại Hưng Yên (40.000 m²); sản lượng 350.000 sản phẩm/năm; triển khai mạnh mẽ hệ thống tự động hóa tích hợp và điều khiển số.[9]. |

| Nestlé Việt Nam | 1995 | Thụy Sĩ | Cà phê (Nescafé), đồ uống (Milo, Nestea), sản phẩm từ sữa và dinh dưỡng (Nan, Lactogen), sản phẩm nấu ăn (Maggi), nước đóng chai (La Vie) và ngũ cốc ăn sáng. | Công ty đã đầu tư hơn 770 triệu USD vào bốn nhà máy và hai trung tâm phân phối, trong đó nhà máy Tri An được công nhận là nhà máy thông minh tiên tiến nhất. Nhà máy sử dụng dây chuyền lắp ráp tự động hóa cao với robot, hệ thống kiểm tra bằng thị giác máy tính và hệ thống kỹ thuật số tinh gọn để nâng cao hiệu quả hoạt động.[10]. |

| Vinamilk | 1976 | Vietnam | Các sản phẩm từ sữa, sản phẩm dinh dưỡng cho trẻ em và người lớn, đồ uống chức năng, sữa tươi từ các trang trại bò sữa công nghệ cao. | Là nhà sản xuất sữa lớn nhất và là một trong những doanh nghiệp tiên tiến nhất trong khu vực về ứng dụng sản xuất thông minh. Công ty vận hành các dây chuyền sản xuất tự động hóa cao và hệ thống kho thông minh đẳng cấp thế giới, có khả năng vận hành hậu cần hoàn toàn tự động bằng xe tự hành AGV và tích hợp dữ liệu thời gian thực.[11] |

Biên soạn của B&Company

Bên cạnh những người dùng này là một hệ sinh thái đang phát triển nhanh chóng gồm các nhà cung cấp giải pháp như FPT, ABB, Siemens, Bosch Rexroth, Mitsubishi Electric,… Các công ty này cung cấp các công nghệ cốt lõi cho phép sản xuất số hóa, từ robot, PLC và hệ thống SCADA đến kiểm tra bằng AI, mô hình kỹ thuật số và nền tảng IoT công nghiệp.

| Tên công ty | Năm thành lập (tại Việt Nam) | Quốc gia | Giải pháp chính | Hồ sơ ngắn |

| Tập đoàn FPT | 1988 | Vietnam | Giải pháp sản xuất dựa trên AI, chuyển đổi số, IoT, điện toán đám mây | Tập đoàn công nghệ hàng đầu; phát triển hệ thống Kiểm tra Thông minh đạt độ chính xác phát hiện lỗi 99%; đối tác triển khai mạnh mẽ công nghệ Công nghiệp 4.0 cho các doanh nghiệp sản xuất.[12]. |

| Tập đoàn ABB | 1993 | Thụy Sĩ | Robot học, điện khí hóa, tự động hóa công nghiệp, hệ thống SCADA | Nhà cung cấp SCADA hàng đầu tại Việt Nam (150 hệ thống cho EVN); cung cấp robot và tự động hóa cho các ngành sản xuất, tiện ích và năng lượng.[13]. |

| Siemens AG | 1993 | Đức | Hệ thống tự động hóa công nghiệp, mô hình song sinh kỹ thuật số, SCADA, MES | Đóng góp quan trọng vào quá trình chuyển đổi nhà máy thông minh tại Việt Nam; cung cấp MindSphere, SIMATIC và các giải pháp tự động hóa tiên tiến cho ngành điện tử và ô tô. |

| Bosch Rexroth AG | Không có | Đức | Công nghệ truyền động và điều khiển, hệ thống thủy lực, linh kiện tự động hóa | Cung cấp các giải pháp tự động hóa toàn diện cho Công nghiệp 4.0; có vị thế vững chắc trong lĩnh vực sản xuất ô tô và máy móc. |

| NVIDIA Việt Nam | 2024 | Hoa Kỳ | Nền tảng điện toán AI, phần mềm GPU, khung học sâu | Trung tâm nghiên cứu và phát triển đầu tiên tại Việt Nam; hợp tác với chính phủ và các doanh nghiệp lớn để đẩy nhanh việc ứng dụng AI trong sản xuất, chăm sóc sức khỏe và tài chính. |

| Tập đoàn điện lực (GE) | 1993 | Hoa Kỳ | IoT công nghiệp, phần mềm tự động hóa, phân tích dự đoán | Cung cấp các giải pháp công nghiệp kỹ thuật số cho ngành năng lượng, hàng không và y tế; triển khai mạnh mẽ IIoT và tự động hóa trên khắp Việt Nam, sở hữu nhà máy thông minh tại VSIP Bình Dương. |

| Rockwell Automation | 2007 | Hoa Kỳ | PLC, MES, tự động hóa công nghiệp, tích hợp nhà máy thông minh | Cung cấp hệ thống FactoryTalk, ControlLogix được sử dụng rộng rãi trong ngành sản xuất ô tô, thực phẩm & đồ uống và điện tử tại Việt Nam.[14]. |

| Mitsubishi Electric Việt Nam | 1990 | Nhật Bản | Thiết bị FA, PLC, robot, tự động hóa công nghiệp | Nhà cung cấp chính các hệ thống tự động hóa và robot cho các nhà máy Nhật Bản tại Việt Nam (đặc biệt là ngành ô tô và điện tử). |

Biên soạn của B&Company

Xây dựng năng lực địa phương để đạt được vị thế thống trị quốc tế.

Bức tranh tổng quan về các doanh nghiệp tham gia thị trường này cho thấy một số thông tin quan trọng về cấu trúc thị trường sản xuất thông minh của Việt Nam. Thứ nhất, các tập đoàn quốc tế chiếm ưu thế trên thị trường, đặc biệt là các công ty Hàn Quốc, Mỹ, Đức và Đài Loan với nhiều thập kỷ kinh nghiệm sản xuất toàn cầu. Các tập đoàn đa quốc gia này mang đến công nghệ tiên tiến, nguồn vốn đầu tư đáng kể và khả năng hội nhập vào chuỗi cung ứng toàn cầu.

Vị thế nhà đầu tư nước ngoài lớn nhất của Samsung với 22,4 tỷ USD thể hiện cam kết lâu dài bền vững, trong khi 306 nhà cung cấp trong nước và các chương trình tư vấn nhà máy thông minh của hãng đang tích cực phát triển năng lực sản xuất nội địa.[15]Doanh thu 62,5 tỷ USD của công ty vào năm 2024 minh họa quy mô hoạt động khổng lồ, với khoảng một nửa sản lượng điện thoại thông minh toàn cầu của Samsung hiện tập trung tại Việt Nam. Họ đã bán được 2 tỷ thiết bị di động kể từ năm 2009, và khoản đầu tư 1,8 tỷ USD vào nhà máy OLED mới cho thấy sự mở rộng liên tục vào các công nghệ màn hình có giá trị cao hơn.

Sự nổi lên của nhà vô địch quốc nội

Các doanh nghiệp trong nước Việt Nam như Tập đoàn FPT đang nhanh chóng phát triển năng lực cạnh tranh trong lĩnh vực phần mềm, trí tuệ nhân tạo và dịch vụ chuyển đổi số. Những doanh nghiệp hàng đầu trong nước này hiểu rõ động lực thị trường và môi trường pháp lý của Việt Nam, đồng thời xây dựng năng lực kỹ thuật sánh ngang với tiêu chuẩn quốc tế.

Ví dụ, việc FPT thành lập Nhà máy AI đầu tiên của Việt Nam được trang bị hàng nghìn GPU NVIDIA H100 và H200 thể hiện một bước tiến vượt bậc trong cơ sở hạ tầng AI nội địa. Doanh thu 2,47 tỷ USD và vị thế là công ty dịch vụ CNTT lớn nhất Đông Nam Á, được liệt kê trong Fortune Southeast Asia 500, chứng minh quy mô và uy tín của công ty. Quan hệ đối tác của FPT với các nhà lãnh đạo toàn cầu như NVIDIA, Microsoft, Landing AI và Viện AI Mila-Quebec giúp tiếp cận các công nghệ tiên tiến nhất đồng thời duy trì năng lực AI nội địa.[16].

Cam kết đào tạo 50.000 chuyên gia trí tuệ nhân tạo và 10.000 kỹ sư bán dẫn vào năm 2030 của họ trực tiếp đáp ứng các ưu tiên phát triển nguồn nhân lực của Việt Nam. Bản ghi nhớ hợp tác chuyển đổi AI đa năm trị giá 30 triệu USD với một tập đoàn công nghiệp lớn ở Đông Nam Á khẳng định năng lực kỹ thuật và vị thế thị trường của FPT.

Đẩy nhanh đà đầu tư

Thị trường sản xuất thông minh đang ngày càng đa dạng hóa về các lĩnh vực công nghệ trọng tâm. Trong khi sản xuất phần cứng vẫn chiếm ưu thế, các giải pháp phần mềm, nền tảng đám mây, ứng dụng trí tuệ nhân tạo và dịch vụ phân tích dữ liệu đang ngày càng trở nên quan trọng. Sự chuyển dịch này phản ánh sự trưởng thành của thị trường từ tự động hóa cơ bản sang chuyển đổi số toàn diện. Việc các công ty như NVIDIA và TAILG gia nhập thị trường gần đây cho thấy niềm tin bền vững của các nhà đầu tư nước ngoài vào tiềm năng sản xuất thông minh của Việt Nam. Những doanh nghiệp mới này mang đến các công nghệ tiên tiến trong trí tuệ nhân tạo, xe điện và hệ thống sản xuất hiện đại, hứa hẹn sẽ thúc đẩy sự phát triển công nghệ của thị trường.

Những hàm ý có thể thực hiện được

Liên doanh với các đối tác địa phương

Để thâm nhập thành công vào thị trường sản xuất thông minh của Việt Nam, cần có các chiến lược phù hợp với bối cảnh pháp lý, công nghệ và nguồn nhân lực đặc thù của đất nước – những điều kiện chịu ảnh hưởng mạnh mẽ bởi quá trình chuyển đổi công nghiệp nhanh chóng của Việt Nam. Việc thành lập liên doanh hoặc hợp tác với các doanh nghiệp trong nước vẫn mang lại nhiều lợi thế, ngay cả khi hầu hết các ngành sản xuất cho phép sở hữu nước ngoài theo Điều 100% của Luật Đầu tư 2020.[17]Chỉ những ngành dịch vụ cụ thể (như viễn thông và logistics) mới duy trì giới hạn sở hữu nước ngoài 49%. Các công ty hợp tác với đối tác Việt Nam cho biết quá trình cấp phép diễn ra nhanh hơn, sự tham gia của chính phủ tốt hơn và khả năng tiếp cận thị trường được cải thiện – những lợi thế rất quan trọng trong bối cảnh công nghiệp cạnh tranh và phát triển nhanh chóng.

Tập trung vào các phân khúc giá trị cao

Các nhà đầu tư nên ưu tiên các phân khúc giá trị cao, ứng dụng công nghệ cao và phù hợp với chiến lược phát triển quốc gia. Chính phủ Việt Nam đã xác định rõ ràng sản xuất thông minh, tự động hóa dựa trên trí tuệ nhân tạo, chất bán dẫn và các công nghệ số tiên tiến là những lĩnh vực ưu tiên, như đã nêu trong Quyết định 667/QĐ-TTg (2024) và Chiến lược Công nghiệp 4.0 quốc gia. Chương trình Chuyển đổi số quốc gia còn đặt mục tiêu 45% doanh nghiệp sản xuất sẽ áp dụng công nghệ cao vào năm 2030.[18]Điều này cho thấy một sự thúc đẩy mạnh mẽ từ chính sách hướng tới các hệ thống sản xuất tiên tiến. Xu hướng này đã được thể hiện rõ trong xu hướng FDI: theo Cơ quan Đầu tư nước ngoài, năm 2023, 64,21 tỷ TP3T vốn FDI đăng ký đã chảy vào các dự án sản xuất.[19]Các nhà đầu tư chú trọng chuyển giao công nghệ, đào tạo và tích hợp chuỗi cung ứng thường nhận được đánh giá và hỗ trợ tích cực hơn từ chính quyền tỉnh.

Đầu tư phát triển nguồn nhân lực

Đầu tư vào năng lực nguồn nhân lực của Việt Nam là một yếu tố thành công quan trọng khác, đặc biệt là trong bối cảnh thiếu hụt kỹ năng cơ cấu của đất nước. Các sáng kiến phát triển nguồn nhân lực như hợp tác với các trường đại học kỹ thuật, học viện nội bộ và chương trình học nghề giúp giải quyết khoảng cách này đồng thời xây dựng lòng trung thành lâu dài của người lao động. Các trường hợp điển hình chứng minh hiệu quả của những khoản đầu tư này: Sự hợp tác giữa Samsung và Bộ Công Thương đã đào tạo hơn 200 kỹ sư Việt Nam về sản xuất tiên tiến và nâng cao năng suất, góp phần đáng kể vào năng lực và hiệu quả hoạt động của doanh nghiệp trong nước.[20].

Tận dụng các Hiệp định Thương mại Tự do

Các hiệp định thương mại tự do rộng khắp của Việt Nam cung cấp một đòn bẩy chiến lược khác cho các nhà sản xuất nước ngoài. Với 15 hiệp định thương mại tự do đang có hiệu lực, bao gồm CPTPP, EVFTA và RCEP, Việt Nam hiện được hưởng quyền tiếp cận ưu đãi vào các thị trường chiếm 601.300 tỷ USD GDP toàn cầu (Báo cáo FTA của Bộ Công Thương).[21]Riêng Hiệp định EVFTA đã giúp tăng kim ngạch thương mại EU-Việt Nam thêm 14,81 tỷ TỶ trong hai năm đầu tiên, với sự tăng trưởng đáng kể trong xuất khẩu hàng điện tử và máy móc. Việc cơ cấu lại chuỗi cung ứng và quy trình sản xuất để tối đa hóa các lợi thế về thuế quan này có thể thúc đẩy đáng kể khả năng cạnh tranh, đặc biệt đối với các công ty trong lĩnh vực sản xuất linh kiện điện tử, máy móc và linh kiện công nghệ cao.

Tương tác với các khu công nghiệp

Việc hợp tác với các khu công nghiệp và cơ quan kinh tế của Việt Nam sẽ củng cố hơn nữa khả năng thâm nhập thị trường. Tính đến năm 2024, Việt Nam vận hành 400 khu công nghiệp, trong đó 300 khu đang hoạt động, và tỷ lệ sử dụng đất tại các tỉnh trọng điểm như Bắc Ninh và Bình Dương vượt quá 801.000 tấn.[22]Các khu vực này cung cấp ưu đãi thuế, cơ sở hạ tầng sẵn có và thủ tục hành chính đơn giản hóa. Quan trọng hơn, sửa đổi năm 2024 theo Nghị quyết 57-NQ/TW của Việt Nam đã đưa ra các cơ chế đầu tư đặc biệt giúp rút ngắn thời gian phê duyệt cho các dự án công nghệ cao, bán dẫn và sản xuất chiến lược trong các khu công nghiệp và khu công nghệ cao.[23]Việc lựa chọn khu vực phù hợp và sớm tiếp xúc với ban quản lý có thể giảm thiểu đáng kể các rào cản trong hoạt động.

* Lưu ý: Nếu bạn muốn trích dẫn thông tin trong bài viết này, vui lòng ghi rõ nguồn và kèm theo link bài viết để đảm bảo tôn trọng bản quyền.

| B&Company, Inc.

Công ty nghiên cứu thị trường của Nhật Bản đầu tiên tại Việt Nam từ năm 2008. Chúng tôi cung cấp đa dạng những dịch vụ bao gồm báo cáo ngành, phỏng vấn ngành, khảo sát người tiêu dùng, kết nối kinh doanh. Ngoài ra, chúng tôi đã phát triển cơ sở dữ liệu của hơn 900,000 công ty tại Việt Nam, có thể được sử dụng để tìm kiếm đối tác kinh doanh và phân tích thị trường. Xin vui lòng liên hệ với chúng tôi nếu bạn có bất kỳ thắc mắc hay nhu cầu nào. info@b-company.jp + (84) 28 3910 3913 |

[1] https://www.nso.gov.vn/en/data-and-statistics/2025/04/index-of-industrial-production-in-march-of-2025/.

[2] https://www.imarcgroup.com/vietnam-smart-manufacturing-market

[3] https://vr360.com.vn/vi-du-ve-nha-may-thong-minh

[4] https://www.kenresearch.com/industry-reports/vietnam-smart-manufacturing-market

[5] https://vneconomy.vn/samsung-dua-du-an-1-8-ty-usd-moi-ve-bac-ninh.htm

[6] https://vir.com.vn/intel-reveals-plans-to-expand-operations-in-vietnam-139498.html

[7] https://www.redsunland.vn/foxconn-tap-doan-khkt-hong-hai-la-cong-ty-gi-suc-anh-huong-cua-foxconn-tai-viet-nam/

[8] https://vinfastauto.us/investor-relations/news/vinfast-inaugurates-electric-vehicle-plant-in-ha-tinh

[9] https://www.tailg.com/newsinfo-166.html

[10] https://baochinhphu.vn/nestle-viet-nam-tang-toc-chuyen-doi-so-dong-hanh-cung-nghi-quyet-so-57-10225071817281604.htm

[11] https://sbiz.vn/blog/case-study-5/case-study-mo-hinh-quan-ly-kho-thong-minh-au-tien-va-lon-nhat-tai-viet-nam-cua-vinamilk-94

[12] https://fptsoftware.com/services/digital-technologies-and-platforms/artificial-intelligence

[14] https://www.rockwellautomation.com/en-us/products/software/factorytalk/operationsuite/mes/automotive.html

[15] https://www.vietnam.vn/en/nha-dau-tu-nuoc-ngoai-lon-nhat-viet-nam-cung-viet-nam-vuon-minh

[16] https://fptsoftware.com/services/digital-technologies-and-platforms/artificial-intelligence

[17] https://english.luatvietnam.vn/legal-news/understanding-the-legal-framework-for-foreign-investment-in-vietnam-4729-100126-article.html

[18] https://vietnam.acclime.com/podcasts/transforming-vietnams-manufacturing-sector-from-low-cost-to-high-productivity/

[19] https://www.mpi.gov.vn/en/Pages/2023-12-29/FDI-attraction-situation-in-Vietnam-and-Vietnam-s-fh2c25.aspx

[20] https://vietnamnews.vn/economy/1654984/nic-partners-with-samsung-vietnam-in-developing-tech-talent.html

[21] https://en.baochinhphu.vn/ftas-facilitate-viet-nams-deeper-participation-in-global-supply-chain-111230803105008762.htm?

[22] https://www.vietnam-briefing.com/news/vietnams-industrial-zones-2025-2030-growth-outlook.html/

[23] https://vietnamnews.vn/economy/1666585/viet-nam-s-new-fast-track-policies-to-boost-high-tech-investment-environment-set-for-approval.html