The Evolution of Social Commerce in Vietnam

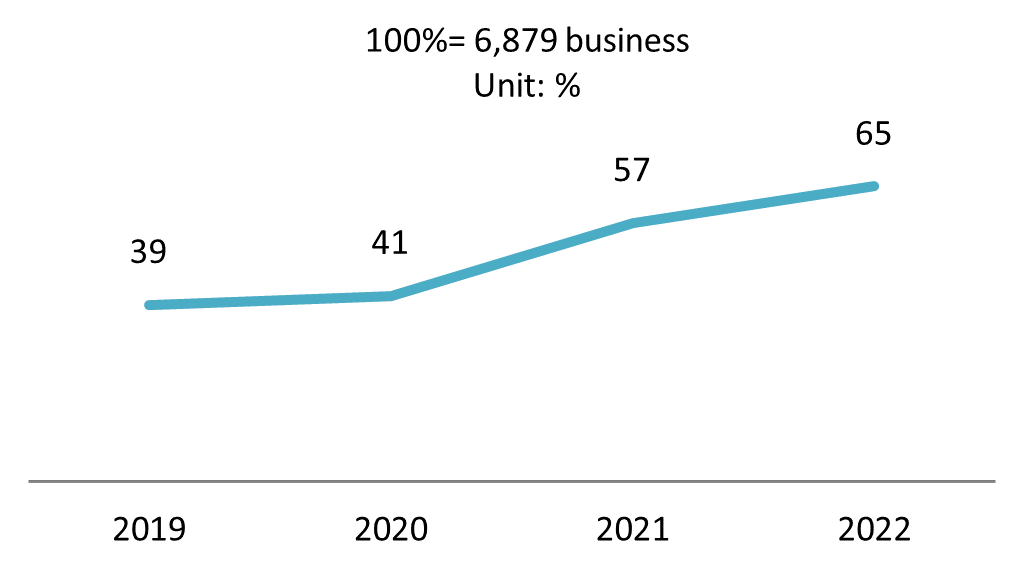

In the landscape of Vietnam’s digital economy, social commerce has emerged as an evolving mode of online shopping. According to the ResearchAndMarket Report, Vietnam’s social commerce industry was expected to reach nearly 2.2 bil. USD in 2022[1], with 65% of businesses indicating their use of these commercial methods[2] (see Figure 1).

Figure 1. Proportion of businesses conducting business through social (2019-2022)

Source: Vietnam E-Business Index 2023 Report

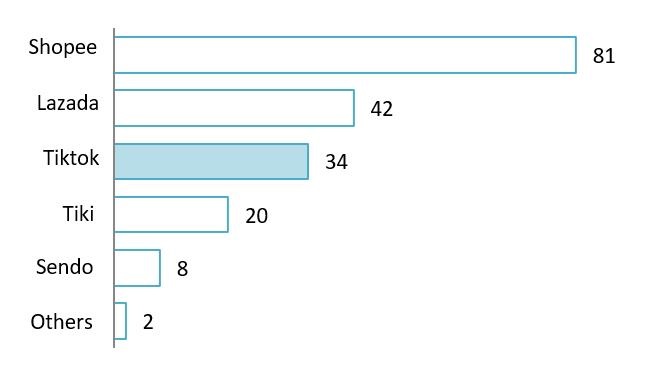

In terms of consumers, according to Vietnam E-Commerce White Book 2023, social media platforms have become the second most preferred channel for online shopping, with 55% of respondents reporting they use these platforms for their purchasing activities (only after e-commerce platforms as the 1st top market). In contrast, social media left the 3rd position far behind, which is businesses’ own websites, with (only 34% of users). Among online shopping platforms, TikTok is the top 3 platform preferred by customers, accounting for 34% of respondents (see Figure 2), which even surpasses other e-commerce platforms such as Tiki and Sendo.

Figure 2. Leading online shopping platforms among consumers in Vietnam

Unit: %

100%= 20,069 respondents

Source: Vietnam E-Commerce White Book 2023

Regarding products, according to the report of Decision Lab[3], fashion and cosmetics reign as the most popular goods categories on social commerce channels in general (61% and 48% of respondents respectively). This can be attributed to their synergy with the visual and trend-driven nature of social media. The captivating product imagery, tutorials, and influencer endorsements across these platforms allow consumers to closely inspect the style, quality, and transformative power of these items. In addition, the rapid dissemination of emerging trends on social media further fuels continuous consumer demand for the latest must-have products from these categories.

The Drivers of Social E-commerce

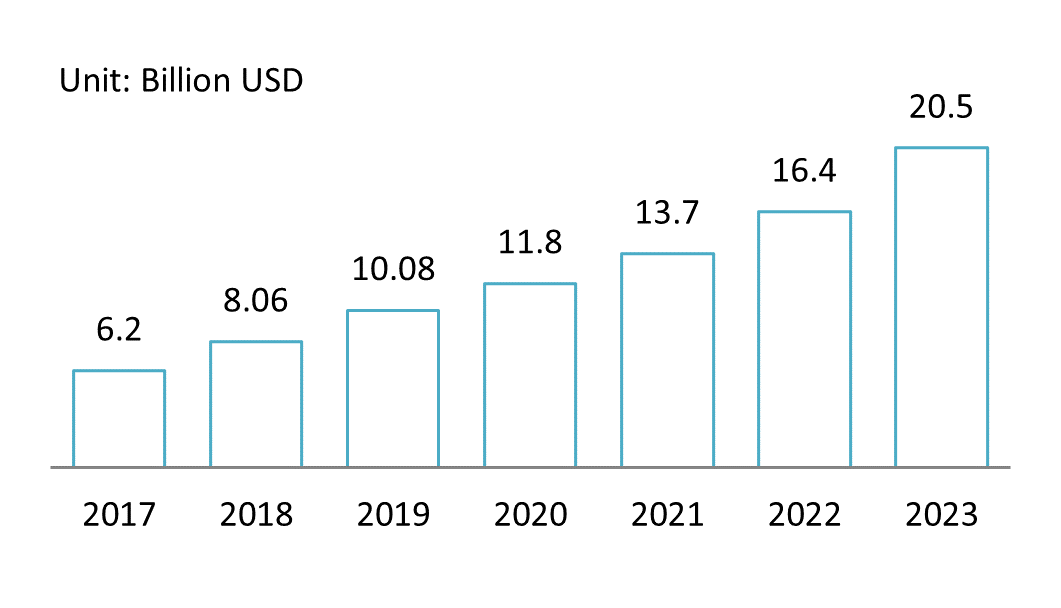

Social commerce is considered a promising business model in Vietnam with the following drivers. Firstly, Vietnam’s journey into the realm of social commerce is closely linked with the rapid expansion of its e-commerce sector. to Vietnam E-commerce White Book in 2023[4], the CAGR of e-commerce retail revenue over 6 years (2017-2023) reached 22.1%, hitting 20.5 billion USD in 2023.

Figure 3. Revenue of B2C e-commerce in Vietnam (2017-2023)

Source: Vietnam E-commerce White Book in 2023

Looking from consumers’ perspective, Vietnam boasts a high number of social media users, and these platforms significantly influence customer consumption behaviour. As of January 2023, Vietnam had 70 million social media users, representing 71% of the population[5]. These users seem to prefer to seek product reviews on social media before making purchasing decisions. According to the E-commerce White Book 2023, 52% of users rely on comments and ratings on social media to gather information when making purchases[6]. Additionally, livestreaming, one of the social commerce business models, is significantly impacting shopping behaviour. Data from the platform shows that around 77% of survey participants have watched a live-stream sale, of which 71% have made a purchase. The key strengths of livestreaming are the easy interaction between buyers and sellers and the ability for buyers to closely observe products in detail[7].

Opportunities and Challenges of Social E-commerce

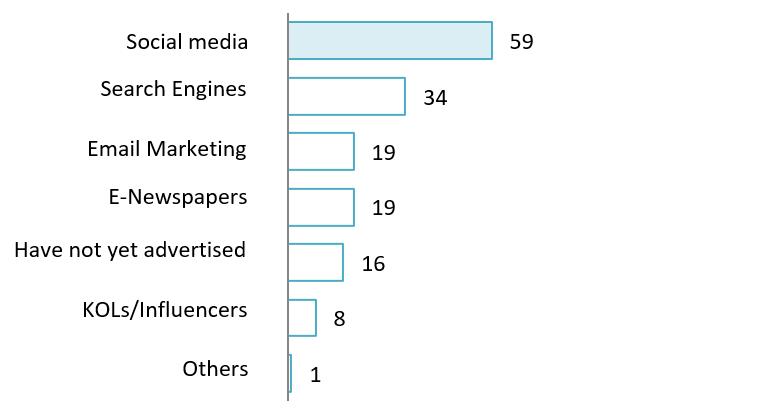

The evolution of social commerce in Vietnam offers numerous opportunities for businesses to excel in this dynamic market. Firstly, businesses can leverage access to millions of social media users, thereby enhancing brand awareness and promoting their products/services. This will also help in generating organic reach[8] through user sharing and interaction. According to Vietnam E-Business Index 2023 [9], of surveyed businesses with websites/mobile apps reported advertising their channels through social media (Figure 5).

Figure 4. Advertising methods of businesses

Unit: %

100%= 6,879 business

Source: Vietnam E-Business Index 2023

Secondly, social media platforms enhance advertising effectiveness for businesses through advanced analytics tools like Instagram Insights and Facebook Audience Insights, which provide granular demographic and audience data to help craft more targeted and impactful social commerce campaigns compared to traditional retail. Thirdly, social commerce helps gather shopping journeys from discovering products, and price comparisons to making purchases in one place and fasten customers’ decision-making. Fourthly, this business model motivates interaction between buyers and sellers and strengthens customer relationships by enabling easy access to detailed product information and guidance through messaging, chatbots, and brand social media pages, as well as providing prompt customer support. Finally, social commerce enhances timely feedback collection and improves actions. By incorporating customer feedback from these social media posts, businesses can adjust their products/services to meet customer expectations.

However, alongside the opportunities, there are also challenges. On the business side, the level of competition is quite high due to the relatively low entry barriers to the social commerce market. Furthermore, the intense level of competition is reflected, as it is not only between enterprises but also among individual sellers.

Personal data protection laws, such as Decree 52/2013/ND-CP, Decree 13/2022/ND-CP, the Law on Protection of Personal Information, and the draft Decree on Penalties in Cybersecurity, are viewed as challenges for the social commerce model with the following reasons. Firstly, compliance can be a challenge due to the complex and diverse nature of personal data processing, given the increasing number of consumers participating in online shopping and using services. For instance, swiftly meeting consumers’ requests to delete their personal data within 72 hours can be difficult to achieve given the large user base, potentially leading to delayed responses. However, failing to comply can result in administrative penalties. Compliance costs could increase, particularly for smaller players in the market. Additionally, these rules may place stricter requirements on customer data usage, impacting the targeting and personalization capabilities that are often critical for success in e-commerce.

On the customer side, trust is considered the biggest concern, with deceptive advertising being a constant problem. 60% of reported that “products do not match advertised images” when asked about negative experiences with social commerce. To mitigate this issue, consumers instead choose other purchasing methods such as family stores (75%) or online stores with a physical presence (48%)[10].

Outlook in the future

In the future, the report of ResearchandMarket forecasted that the social commerce industry is expected to grow steadily, recording a CAGR of 31.1% during 2024-2029[11] (2024: 4.5 Billion USD). In this context, this market is expected to develop particularly towards live-stream selling and KOL.To capitalize on the transformative potential of social commerce, businesses should consider integrating live-streaming capabilities that enable more engaging and personalized shopping experiences for consumers. Simultaneously, leveraging the influence of Key Opinion Leaders (KOLs) – by featuring their endorsements, reviews, and guidance within live-streaming content – can further amplify the impact, driving increased product discovery and sales.

To sum up, within Vietnam’s vibrant digital economy, the development of social commerce is seen as a pathway to numerous opportunities for success in this dynamic market. EC businesses therefore should quickly study and adapt to the evolving social commerce landscape and its new tools.

[1] Vietnam Social Commerce Market Intelligence and Future Growth Dynamic Databook <Assess>

[2] Vietnam E-Business Index 2023 Report (2023), Towards sustainable e-commerce development <Assess>.

[3] Decision Lab (2022), The State of Social Commerce & Live-streaming in Vietnam; N=999 <Assess>

[4] Vietnam E-commerce White Book in 2023 <Assess>

[5] VNETWORK, Internet Vietnam 2023 (Data from GWI and ai.data) <Assess>

[6] E-commerce White Book 2023 <Assess>

[7] CocCoc (2024), ‘2023 and new trends of Vietnamese users’ <Assess>

[8] Organic reach is the number of people who see content on social media without paid promotion. It includes users who discover the content naturally, rather than through advertising.

[9] Vietnam E-Business Index 2023 Report (2023), ‘Towards sustainable e-commerce development’ <Assess>.

[10] Decision Lab (2022), The State of Social Commerce & Live-streaming in Vietnam; N=999 <Assess>

[11] Vietnam Social Commerce Market Intelligence and Future Growth Dynamic Databook <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles