23Jan2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s e-commerce market experienced remarkable growth in 2024, solidifying its position as one of Southeast Asia’s digital powerhouses. Driven by increasing smartphone penetration, a tech-savvy young population, and supportive government policies. As 2025 approaches and the future ahead, Vietnam’s e-commerce landscape is poised for transformation, sustainability efforts, and cross-border trade opportunities.

Vietnam E-Commerce Market in 2024

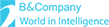

Vietnam’s e-commerce market is estimated to surpass USD 25 billion in 2024, marking a 20% increase compared to 2023. E-commerce in Vietnam accounts for two-thirds of the total value of the country’s digital economy and 9% of the total retail goods and consumer service revenue nationwide[1]. Within the Southeast Asian region, Vietnam’s e-commerce market ranks 3rd in size, following Indonesia and Thailand

Vietnam’s e-commerce market value from 2020 to 2024

Unit: Billion USD

Source: Ministry of Industry and Trade

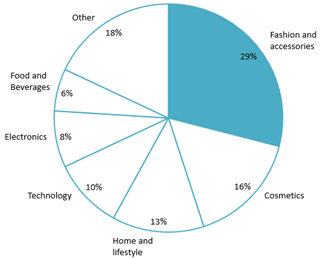

In addition, Vietnam’s e-commerce platforms have seen significant growth, particularly TikTok Shop and Shopee, with revenue in 2024 increasing by 151% and 66%, respectively. By June 2024 alone, the total revenue from all e-commerce platforms in Vietnam reached 3 billion USD. Among product categories, fashion and accessories led the market, generating nearly 1 billion USD. Other top-performing categories included cosmetics, home and lifestyle products, technology, and household appliances.

Revenue of e-commerce platform in Vietnam by segment by June 2024

Source: AccessTrade

The rapid growth of e-commerce has also paved the way for favorable export growth through online platforms. Vietnam’s B2C e-commerce export value is projected to reach nearly 6 billion USD by 2028, with Micro, Small, and Medium-sized Enterprises (MSMEs) contributing 25% to this growth[2]. Key export destinations for MSMEs include major markets such as China, the USA, and Japan, as well as emerging opportunities in England, Europe, and East Asia[3].

Opportunities and Challenges for Market Growth

By 2024, Vietnam has approximately 79 million internet users, accounting for 79% of the country’s population[4]. Coupled with nearly 100% mobile connectivity, e-commerce has been able to expand widely, reaching both urban and rural areas[5]. In the same year, the online payment market reached USD 149 billion, an 18% increase from the previous year, and is projected to hit USD 350 billion by 2030[6]. The rise of digital payment platforms has facilitated smoother transactions, making it easier for customers to shop online. This shift toward cashless payments is integral to e-commerce growth, providing secure and efficient options for consumers. In a recent Q&Me survey of 300 respondents, 81% reported making purchases at least once a month, while the remaining 19% shopped less frequently, about once a month or less.

Despite progress in urban areas, delivering goods to remote and rural regions remains a challenge due to underdeveloped infrastructure. This limitation impacts delivery times and raises operational costs, hindering e-commerce expansion into these areas[7]. Additionally, counterfeit and low-quality goods remain a prevalent issue on major e-commerce platforms such as Shopee and TikTok Shop. Many sellers openly market counterfeit products from well-known brands like Rolex, Adidas, Nike, Cerave, etc. This has heightened consumer concerns about product authenticity, leading some customers to prefer purchasing directly from trusted physical stores[8].

Another critical challenge is the shortage of high-quality human resources in Vietnam. According to an AccessTrade survey of 200 MSMEs, 95% of respondents reported facing difficulties due to a lack of skilled labor. Key roles identified as most in demand include e-commerce software developers (67%), digital marketing specialists (63%), supply chain and logistics experts (62%), and multilingual customer service representatives (49%). These gaps significantly impact the ability of businesses to meet operational demands and sustain growth in the e-commerce sector[9].

The prospect of Vietnam E-Commerce Market in the Future

Vietnam continues to maintain steady e-commerce growth with a projected CAGR of 18–20% in the coming years. By 2030, the market is expected to reach a revenue of USD 63 billion. Vietnam’s strategic location and its participation in trade agreements such as the CPTPP, EVFTA, and RCEP position it as a hub for cross-border e-commerce, further enhancing export opportunities. The integration of social commerce platforms like TikTok Shop and Shopee is reshaping how businesses engage with younger, tech-savvy demographics. Combined with the government’s draft of the National Master Plan for E-Commerce Development for the period 2026 to 2030, expected to be released in 2025, which outlines goals and responsibilities for ministries and agencies, Vietnam aims to establish itself as a leading e-commerce center in Southeast Asia.

– E-commerce retail sales are expected to grow by 20–30% annually, accounting for 20% of the total national retail sales of goods.

– The proportion of businesses adopting e-commerce is targeted to exceed 70%.

– 60% of higher education and vocational training institutions are set to implement specialized training programs in e-commerce-related fields.

The e-commerce market is expected to thrive even further in the future with the participation of various international e-commerce platforms. Specifically, in 2024, Vietnam welcomed the entry of two major platforms, Temu and Shein, from China. However, these two e-commerce giants were required to halt operations shortly after due to the need to complete necessary procedures[10]. Nonetheless, this situation highlights the potential of Vietnam’s e-commerce market, as many prominent players are either ready to enter or planning to tap into this highly attractive market.

Conclusion

Vietnam’s e-commerce market is a key driver of Southeast Asia’s digital economy, with strong growth fueled by rising internet access, and supportive government policies. While challenges like infrastructure and consumer trust remain, cross-border trade still presents immense opportunities. By addressing these hurdles, Vietnam is on track to solidify its position as a regional leader in e-commerce, offering a promising future for businesses and consumers.

[1] Ministry of Industry and Trade Web Portal (2025). E-commerce Accounts for Two-thirds of Vietnam’s Digital Economy. <Access>

[2] The Vietnam Plus Newspaper (2024). Vietnam E-commerce Boom in 2024 <Access>

[3] Access Partnership (2024). The E-commerce Revolution in Vietnam <Access>

[4] Datareportal (2024). Vietnam’s Digital in 2024 <Access>

[5] Lao Dong Newspaper (2024). Vietnam’s Mobile Connectivity Rate Reached Nearly 100% <Access>

[6] Google E-conomy SEA (2024). Vietnam’s E-conomy Report <Access>

[7] Savills Vietnam (2024). Ecommerce in Vietnam: Rapid Growth and Market Expansion <Access>

[8] Dai Bieu Nhan Dan Newspaper (2023). Counterfeit Products on E-commerce Platforms <Access>

[9] Access Partnership (2024). The E-commerce Revolution in Vietnam <Access>

[10] Reuters (2024). Temu and Shein Suspend Vietnam Operations <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |