112월2025

최신 뉴스 및 보고서 / 베트남 브리핑

댓글: 1개의 댓글.

베트남의 승차 공유 시장은 동남아시아에서 가장 역동적인 분야 중 하나로, 베트남의 급속한 도시화와 디지털 전환을 반영합니다. 볼트가 최근 베트남에 진출하면서 시장은 더 많은 경쟁에 직면하게 되었습니다.

베트남의 승차 서비스 시장 개요

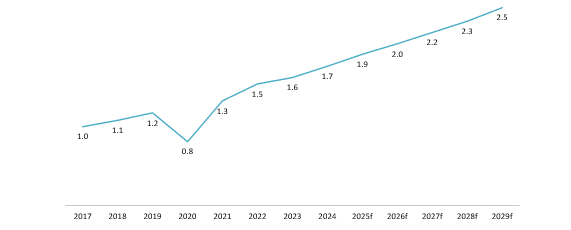

베트남은 승차 공유 서비스의 핫스팟으로 부상했습니다. 2024년 베트남의 승차 공유 시장 규모는 17억 달러로 9%의 성장률을 기록했습니다.[1]. 급성장하는 시장은 2020년 COVID-19 팬데믹 이후 빠르게 회복되어 2021년 13억 달러에서 2029년 25억 달러로 증가하여 8% 이상의 CAGR을 기록했습니다. 승차 공유 서비스 채택도 꾸준히 증가하여 2017년에서 2024년 사이에 2,280만 명에서 2,810만 명으로 증가했고, 2029년에는 3,700만 명의 사용자에게 도달하여 36%의 침투율에 해당합니다. 호치민과 하노이와 같은 주요 도시는 업계의 대부분 활동을 보고 승차 공유 서비스는 일상 활동의 필수적인 부분이 되었습니다.[2].

베트남 승차 공유 시장 총 수익 (단위: 10억 달러)

원천: Statista 시장 통찰력

모바일 앱을 통한 주문형 교통을 포함하는 승차 공유 시장은 베트남의 디지털 경제 확대와 저렴하고 편리한 교통 수단에 대한 수요로 인해 번창하고 있습니다. 2023년에 4G 모바일 브로드밴드가 전국의 99.8%를 커버하고 스마트폰 보급률이 84%에 달하면서 승차 공유 앱은 사용자와 운전자 모두에게 쉽게 접근할 수 있습니다.[3]. 베트남은 시민의 요구를 충족시킬 수 있는 포괄적이고 적절한 대중 교통 시스템이 부족하여 승차 공유 서비스가 매우 바람직합니다.[4]. 또한, 승차 공유 서비스는 저렴한 가격 책정 방식을 통해 잠재적인 젊은 사용자를 유치하여 사용자 기반을 확대하고 있습니다.[5]. 일반적인 이륜차 주행은 처음 2km는 약 13,000 VND(0.5 USD)이고, 그 다음 1km당 5,000 VND($0.2)입니다. 사륜차 요금은 약 29,000 VND(1.2 USD)에서 시작하여 10,000 VND(0.4 USD)씩 증가합니다.

표 1: 베트남 주요 승차 공유 앱의 호치민시 승차 요금

| 아니요. | 서비스 | 차량 | 최초 2km 최소요금 (단위: VND) | 추가 km당 요금

(단위: VND/km) |

| 1 | 그랩바이크 | 이륜차 | 11,700 – 16,000 | 4,300 – 5,300 |

| 2 | 비바이크 | 이륜차 | 13,2000 – 14,500 | 4,328 – 5,000 |

| 3 | Xanh SM 자전거 | 이륜차 | 12,200 – 15,700 | 4,200 – 5,200 |

| 4 | 그랩카 | 사륜차 | 26,700 – 34,200 | 9,100~13,000 |

| 5 | 베카 | 사륜차 | 30,500 – 36,400 | 10,300 – 12,400 |

| 6 | Xanh SM 그린카 | 사륜차 | 20,000 (기본요금) | 12,000 – 15,500 |

원천: 붙잡다, BE, 잔 SM, B&Company 합성

새로운 트렌드는 서비스 품질과 사용자 경험을 계속 향상시키고 있습니다. 젊은 소비자들에게 인기 있는 MoMo, ZaloPay, VNPay와 같은 모바일 지갑은 원활한 무현금 결제를 가능하게 하기 위해 승차 공유 플랫폼과 협력했습니다.[6]. 또한, 오토바이 택시, 배달, 음식 배달을 포함한 서비스의 다각화는 소비자 참여를 촉진하기 위해 베트남의 빠르게 움직이는 도시 생활 방식에 맞는 생태계를 만듭니다. 마지막으로, 선도적인 승차 공유 회사는 러시아워의 과제를 해결하기 위해 노력해 왔으며, Grab은 러시아워 승차를 더 저렴하게 만들기 위해 새로운 앱 내 기능을 개발해 왔습니다.[7].

베트남 승차 공유 시장의 경쟁 환경

국내 승차 공유 시장은 잦은 개편과 함께 치열한 경쟁이 특징입니다. 현재 시장은 Grab, Xanh SM(GSM), Be의 3개 업체가 주로 주도하고 있습니다.

- 붙잡다: Grab은 2014년 베트남에 진출한 이래 시장 선도적 지위를 유지해 2023년 말까지 60% 점유율을 확보했습니다.[8]. 그 성공은 승차 서비스, 음식 배달, 금융 서비스를 포함한 광범위한 서비스 포트폴리오와 광범위한 운전자 네트워크, 공격적인 프로모션에서 비롯되었으며, 이를 통해 가장 먼저 떠오르는 브랜드가 되었습니다.[9].

– GSM: GSM은 가장 최근에 진입한 기술 중 하나임에도 불구하고 빠른 성장을 이루었으며, 2023년 출시 후 7개월 만에 18% 시장 점유율을 기록하며 2위에 올랐습니다.[10]. 국내에서의 급속한 확장 외에도 GSM은 인도네시아에 전략적으로 진출하여 해당 국가 최초의 전기 승차 공유 서비스가 되는 등 국제 시장에도 진출했습니다.[11].

- BE: 2018년에 출시된 베트남 스타트업 Be는 강력한 현지 경쟁자로 떠올랐으며 2023년에는 9% 시장 점유율을 확보했습니다.[12]. "올인원" 플랫폼으로 자리매김한 Be는 GSM을 통한 전기 2륜차 승차 공유 및 FWD Vietnam Insurance와의 협력을 통한 금융 서비스와 같은 대안을 제공하는 전략적 파트너십을 통해 차별화를 꾀하고 있습니다.[13].

Be’s collaboration with Hanoi Metro to promote green transportation

원천: 카페F

떠오르는 승차 공유 브랜드의 부상은 다른 업계 참여자들의 몰락을 앞당깁니다. 2024년, 당시 인도네시아의 저명한 업계 참여자였던 GoJek은 시장 점유율이 2022년 30%에서 2024년 7%로 떨어진 후 시장에서 철수했습니다.[14]. 2018년, 업계의 거인인 우버는 베트남 시장에서 4년을 보내고 350,000명의 운전자와 협력한 후 동남아시아 사업을 직접 경쟁자인 그랩에 매각해야 했습니다. 이러한 격변은 베트남의 승차 공유 시장의 변동성과 경쟁력을 더욱 부각시킵니다.

볼트, 베트남 승차공유 시장 진출 가능성

치열한 경쟁에도 불구하고 베트남의 승차 서비스 시장은 여전히 매력적이며, 승차 서비스 및 음식 배달 유니콘인 볼트가 잠재적인 진입을 예고하고 있습니다.

2013년에 설립된 에스토니아 스타트업은 50개국 600개 이상의 도시로 확장되었습니다.[15]. 2024년에는 21억 달러의 매출을 기록하며 유럽과 아프리카에서 가장 빠르게 성장하는 기술 기업 중 하나로 우버와 경쟁했습니다. 동남아시아에서 볼트는 태국(2020년)과 말레이시아(2024년)에 출시되었습니다.

베트남은 IPO 전 글로벌 확장을 앞두고 있는 Bolt의 다음 목적지로 보입니다. 이 회사는 호치민시에 여러 구인 공고를 발표하고, 앱을 대중에게 공개 다운로드할 수 있도록 했으며, 베트남어를 해당 앱 내 언어 중 하나로 소개했습니다. 아직 공식적으로 발표된 것은 없지만, 이러한 조치는 Bolt가 이 나라에 설립될 가능성을 시사합니다.

Bolt’s website introduces Vietnamese layout, signifying possible market entry

원천: 볼트

Bolt의 진입은 국내 시장을 뒤흔들 태세에 있습니다. 전통적인 승차 공유 서비스를 넘어 음식 및 식료품 배달, 렌털, 기업 모빌리티 솔루션을 제공할 것으로 예상됩니다. 경쟁 우위는 운전자 및 파트너와의 경쟁적 커미션 시스템, 경쟁사보다 낮은 요금, 젊은 고객을 타겟으로 하는 젊은 브랜드 이미지에 있습니다.[16]. 경쟁력 있는 서비스 제공과 전략적 시장 접근 방식을 통해 Bolt는 두 베트남 기업의 강력한 성장 모멘텀을 깨고 국내 시장에서 Grab의 지배력을 더욱 침식할 수 있습니다.

결론

베트남의 승차 공유 시장은 동남아시아에서 가장 역동적이고 경쟁이 치열한 부문 중 하나로, 급속한 도시화, 디지털 전환, 소비자 수용 증가에 의해 주도되고 있습니다. 이 시장은 치열한 경쟁과 새로운 플레이어의 빠른 성장으로 인해 주요 퇴출이 빈번하게 발생하면서 잦은 흔들림을 보였습니다. Bolt의 잠재적 진입과 같은 새로운 진입자와 혁신은 베트남 승차 공유 산업의 미래를 형성하는 데 중요한 역할을 할 것입니다.

[1] Statista Market Insights. 승차 공유 서비스 – 베트남평가하다>

[2] Vietnamnews. 승차 공유 시장, 치열한 경쟁평가하다>

[3] Vietnamplus. 디지털 인프라 개발은 국가 디지털 혁신의 돌파구를 마련합니다.평가하다>

[4] VnEconomy. 대중교통 시장 점유율을 35%로 늘리기 위한 과제, 하노이, 전용 버스 차선 도입평가하다>

[5] VnExpress. 젊은이들이 러시아워에 승차 서비스를 선택하는 이유평가하다>

[6] Vietnambiz. 승차 공유 앱이 전자 지갑과 협력: 생존을 위한 공생 관계?평가하다>

[7] VnExpress. 젊은이들이 러시아워에 승차 서비스를 선택하는 이유평가하다>

[8] Vietnamnet. 베트남의 승차 공유 시장이 2029년까지 US$21억 6천만 달러에 도달할 것으로 예상평가하다>

[9] Vietnamnews. 승차 공유 시장, 치열한 경쟁평가하다>

[10] Vietnamnet. 베트남의 승차 공유 시장이 2029년까지 US$21억 6천만 달러에 도달할 것으로 예상평가하다>

[11] Vietnamplus. Xanh SM, 인도네시아에 출시, 최초의 전기 택시가 되다평가하다>

[12] Vietnamnet. 베트남의 승차 공유 시장이 2029년까지 US$21억 6천만 달러에 도달할 것으로 예상평가하다>

[13] BrandsVietnam. 순수한 승차 공유 앱에서 Be는 어떻게 다중 서비스 소비자 플랫폼으로 발전했을까요?평가하다>

[14] 투자 뉴스. 베트남의 승차 공유 시장: 고젝 철수, 3자 경쟁 심화평가하다>

[15] VIR. 우버 경쟁사 볼트, 베트남 승차 공유 시장 진출평가하다>

[16] VIR. 베트남의 승차 공유 시장은 글로벌 및 지역 경쟁을 끌어들입니다.평가하다>

* 본 기사의 내용을 인용하고자 하시는 경우, 저작권을 존중하여 출처와 원 기사의 링크를 함께 명시해 주시기 바랍니다.

| 비앤컴퍼니

2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. info@b-company.jp + (84) 28 3910 3913 |

관련기사

1개의 댓글

댓글은 닫혔습니다.

“Bolt科技据称考虑通过IPO推流网约车业务” – Realnews my