2026年2月3日

Highlight content / Highlight Content JP / Highlight content vi / Latest News & Report / Vietnam Briefing

コメント: コメントはまだありません.

The New U.S. Tariff Framework: Setting the Context

On July 2, 2025, the United States and Vietnam agreed on a new trade framework introducing a 20 percent general tariff on most Vietnamese goods and a 40 percent “transshipment tariff” on products suspected of being re-exported after minimal processing in Vietnam. The measures aim to prevent origin fraud and enhance transparency in regional trade flows.

Building on Vietnam’s deep trade integration, supporting industries play a critical role in linking imported inputs with domestic production, supplying key materials to sectors such as electronics, automobiles, textiles, and consumer goods. As the U.S. transshipment tariff introduces stricter origin verification and supply-chain audits, these industries have moved to the center of compliance and competitiveness concerns. For Vietnam, the new tariff regime represents both a risk and a reset—highlighting the need to strengthen supply-chain transparency, diversify sourcing, and expand domestic value creation.

Against this backdrop, the article focuses on three strategically significant segments of Vietnam’s supporting industries: electronics and electrical components, mechanical engineering, and materials for textiles and footwear.

Vietnam’s Supporting Industries Exports to the U.S.

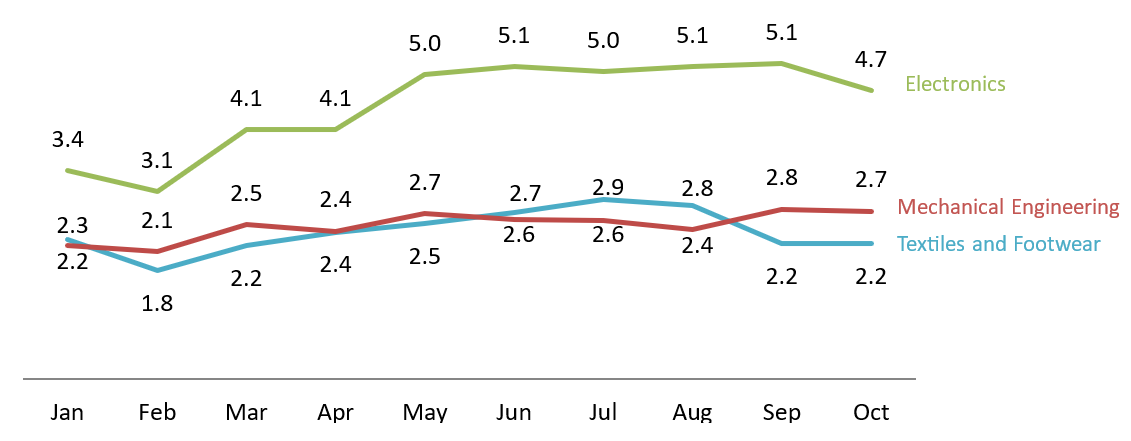

Exports of electronics, mechanical engineering, and textiles-footwear to the U.S. show signs of a shift after the U.S. tariff took effect in early August 2025. All three sectors recorded strong growth in the first half of the year. After August, export values flattened or declined, particularly in textiles and electronics. The pattern suggests that the tariff did not immediately collapse demand but weakened export momentum for supporting-industry outputs that rely heavily on imported inputs. Examining their import structures helps clarify Vietnam’s exposure to tariff risks and its opportunities for industrial upgrading.

Vietnam’s export value to the U.S. by outputs of Supporting Industries (Jan-Oct 2025)

(十億USD)

出典:Vconnex 統計総局

Input Sourcing for Key Supporting Industries in Vietnam

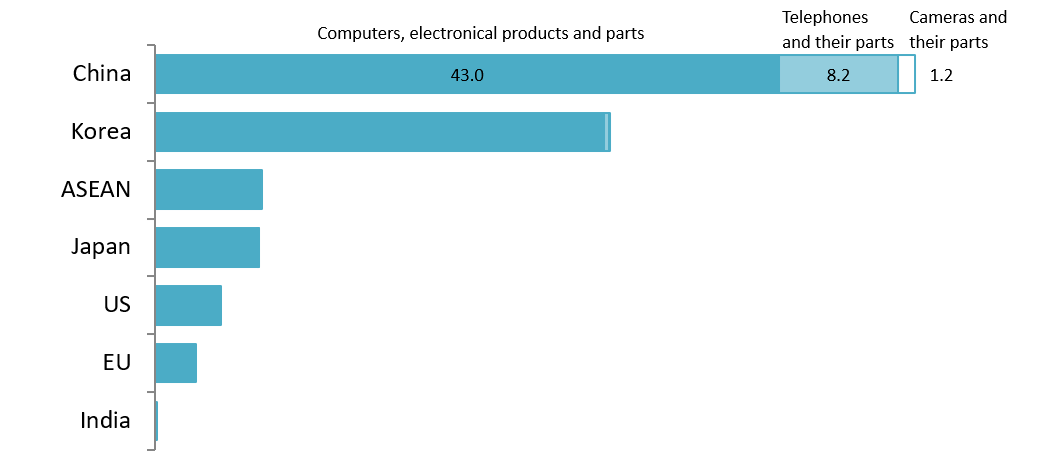

(i) エレクトロニクス

Electronics lie at the core of Vietnam’s manufacturing base, accounting for more than one-third of total exports and positioning the country as the world’s fifth-largest exporter of electronics, computers, and related components[1]. However, in the first ten months of 2025, Vietnam imported approximately USD 43 billion worth of electronics-related inputs from China, accounting for nearly half of total imports in this sector. This pattern underscores Vietnam’s heavy reliance on Chinese upstream inputs for critical manufacturing stages.

Electronics Imports by Major Partners (Jan–10月 2025)

(十億USD)

出典:Vconnex 統計総局

This production structure exposes the electronics sector to heightened risks under the U.S. transshipment tariff regime. With up to 80 percent of components imported and more than 90 percent of Tier-1 suppliers being foreign-owned[2], domestic value creation remains largely concentrated in assembly and other lower value-added stages. As a result, Vietnamese firms are particularly vulnerable to external policy shifts and supply chain disruptions.

Industry experts increasingly view the U.S. tariff not merely as a constraint, but as a catalyst for structural transformation. Rising compliance costs and evolving global supply chains are prompting Vietnam to reconsider its role as a pure assembly hub. In response, recent policy initiatives have focused on strengthening local research, design, and manufacturing capabilities, while attracting high-tech investment in advanced electronics, semiconductors, and AI-related applications[3].

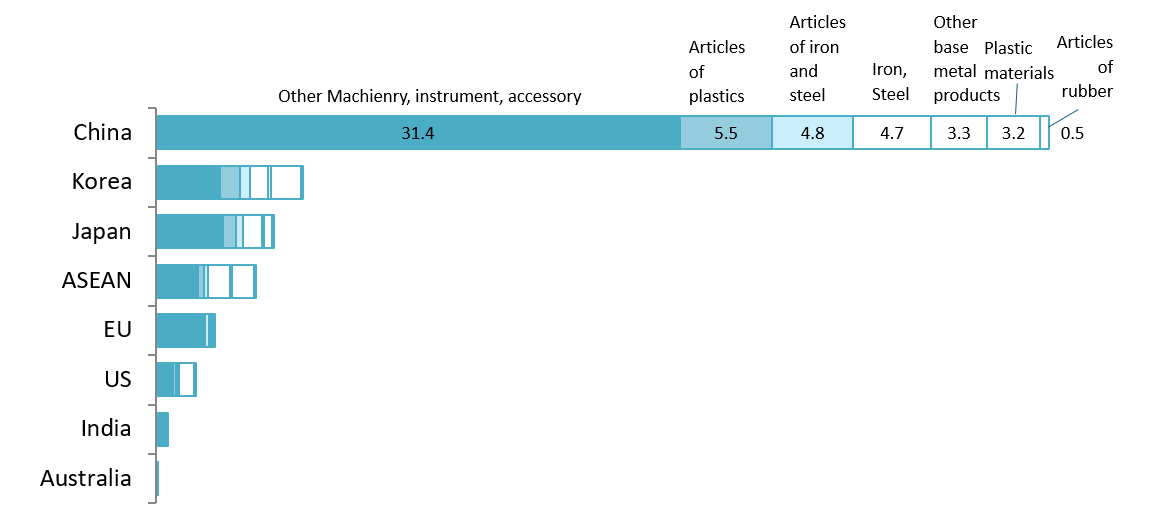

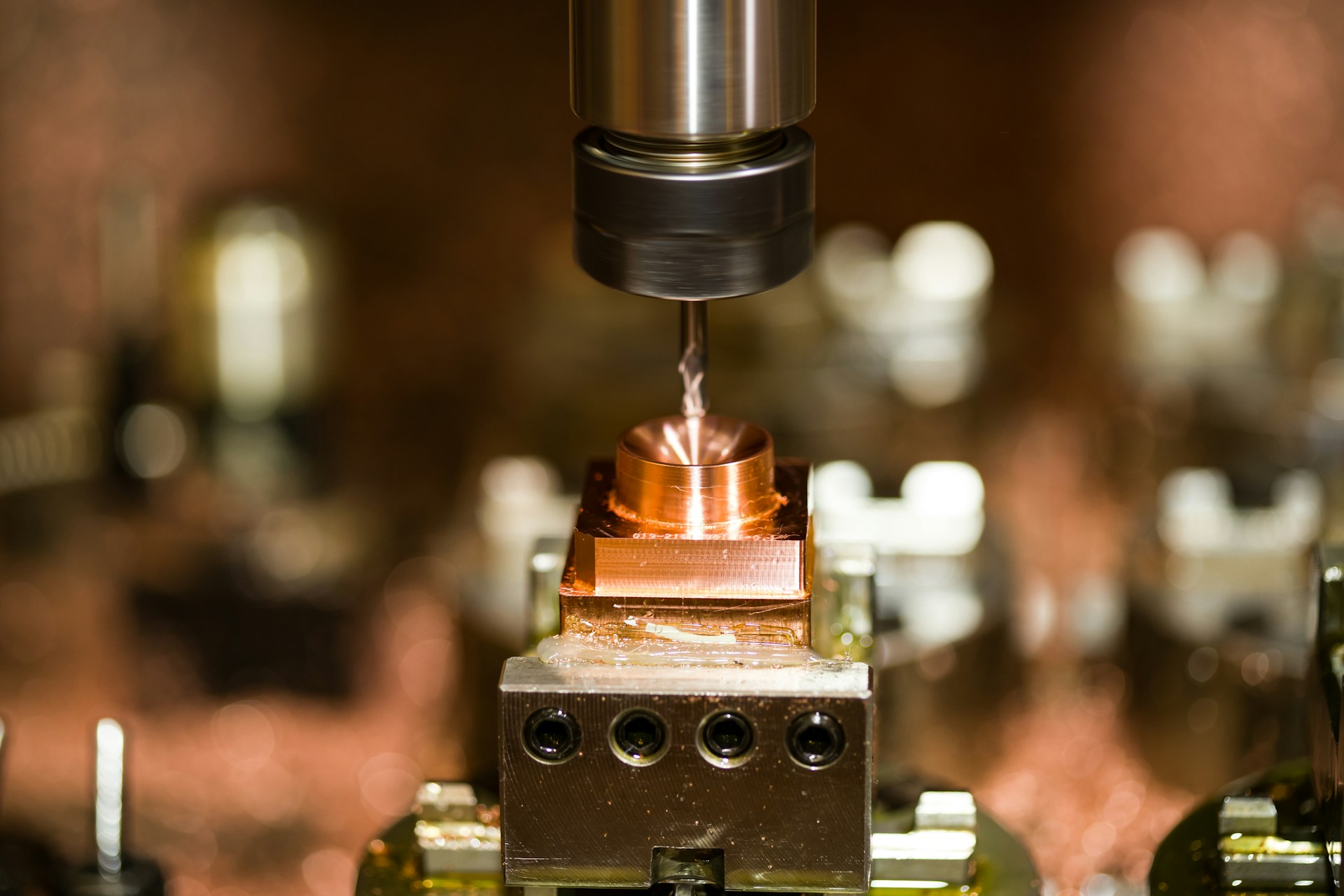

(ii) Mechanical Engineering

The mechanical engineering industries form the backbone of Vietnam’s industrialisation, supplying machinery, components, and equipment critical to manufacturing expansion and infrastructure development. In the first ten months of 2025, Vietnam imported more than USD 53 billion worth of mechanical-related inputs—including iron and steel, base metals, plastics, rubber, and industrial machinery—from China, accounting for the majority of import value in this category. This pattern highlights Vietnam’s continued dependence on foreign machinery and materials, particularly for precision engineering and heavy industrial production.

Mechanical Engineering Imports by Major Partners (Jan–10月 2025)

(十億USD)

出典:Vconnex 統計総局

At the M-TALKS 2025 forum[4], experts highlighted that mechanical engineering is assuming an increasingly strategic role amid global supply-chain realignment. Large public infrastructure projects, such as the North–South Expressway and Long Thanh International Airport, are accelerating domestic demand for advanced equipment, machining solutions, and automation systems. Yet, at the same time, U.S. reciprocal and transshipment tariffs have raised operating costs and tightened origin-verification requirements, prompting concerns about order losses and declining competitiveness.

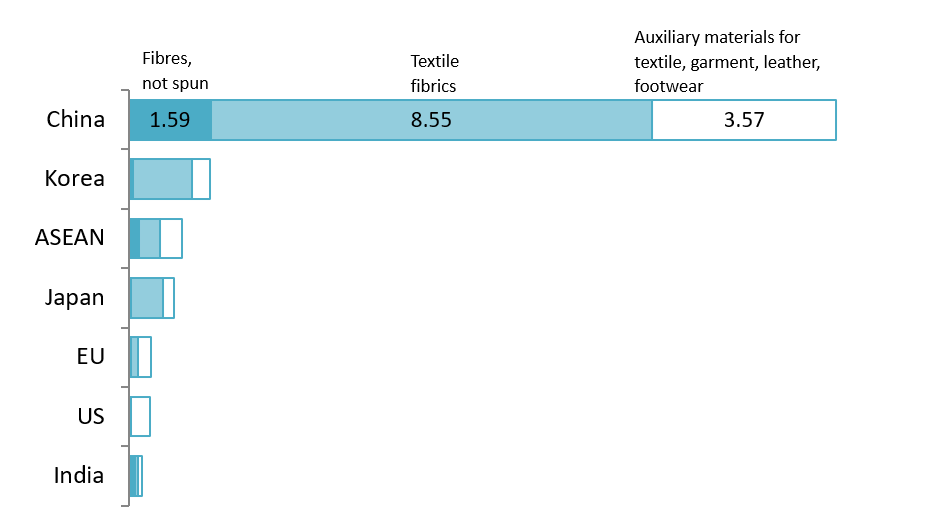

(iii) Textiles and Footwear Materials

The textile and footwear sector is one of Vietnam’s economic mainstays, generating over 71 billion USD in exports in 2024[5]. The United States accounts for more than one-third of this value, making the industry particularly exposed to U.S. tariff adjustments and trade-compliance requirements.

Regarind supply of material, in the first ten months of 2025, Vietnam imported approximately USD 13.7 billion worth of fibres, fabrics, and auxiliary materials from China, highlighting the sector’s heavy reliance on external inputs.

Textiles and Footwear Materials Imports by Major Partners (Jan–10月 2025)

(十億USD)

出典:Vconnex 統計総局

Besides, Textile and footwear producers rely heavily on foreign suppliers (mainly from China and South Korea) for fabrics and trims[6]. This structural reliance complicates origin verification, raises compliance costs, and limits firms’ flexibility in responding to stricter trade enforcement.

Japan’s Role in Vietnam’s Supply Chain Shift Under the U.S. Tariff Framework

Across electronics, mechanical engineering, and textile–footwear, the U.S. transshipment tariff has made clear a common challenge in Vietnam’s manufacturing sector: strong export growth continues to rely heavily on imported inputs, especially from China. This dependence increases compliance risks, raises costs, and leaves firms exposed to sudden policy changes.

In electronics, value creation remains concentrated in assembly. In mechanical engineering, reliance on foreign machinery and materials limits technological autonomy. In textile and footwear, heavy dependence on imported fabrics complicates origin verification. While the impacts differ by sector, all three face similar pressure to improve traceability, raise local content, and move up the value chain.

At the same time, the new tariff environment is pushing for necessary change, it encourages Vietnam to strengthen supporting industries, improve production standards, and build more transparent supply chains.

In this transition, Japanese firms are particularly well positioned to contribute to—and benefit from—Vietnam’s supply-chain upgrading. Japanese companies place strong emphasis on process control, clear documentation, and supply-chain traceability. These strengths closely match the stricter origin and compliance requirements under the U.S. tariff framework. As global manufacturers continue to diversify supply chains, Japanese firms can help fill gaps or work alongside Chinese suppliers, especially in areas such as high-quality materials, technical textiles, precision components, and industrial machinery.

Vietnam’s improving policy environment further supports this shift. Industrial incentives, ongoing infrastructure upgrades, and participation in trade agreements such as CPTPP, RCEP make Vietnam an increasingly attractive base for high-quality manufacturing. Surveys by JETRO also show that many Japanese firms plan to expand operations in Vietnam, with a greater focus on local sourcing and supplier development.

Taken together, these trends suggest that Japan is becoming a key partner in helping Vietnam build more reliable, transparent, and compliant supply chains, while also supporting longer-term value creation under the changing U.S. tariff landscape.

*ご注意: 本記事の情報を引用される場合は、著作権の尊重のために、出典と記事のリンクを明記していただきますようお願いいたします。

| B&Company株式会社

2008年に設立され、ベトナムにおける日系初の本格的な市場調査サービス企業として、業界レポート、業界インタビュー、消費者調査、ビジネスマッチングなど幅広いサービスを提供してきました。また最近では90万社を超える在ベトナム企業のデータベースを整備し、企業のパートナー探索や市場分析に活用しています。 お気軽にお問い合わせください info@b-company.jp + (84) 28 3910 3913 |

Read more

参照:

[1] https://en.vneconomy.vn/electronics-sector-needs-to-be-in-transformation.htm

[2] https://en.vneconomy.vn/electronics-sector-needs-to-be-in-transformation.htm

[3] https://en.vietnamplus.vn/pm-chairs-national-committees-meeting-on-semiconductor-development-post323916.vnp

[4] https://vietnamnews.vn/economy/1722033/viet-nam-s-manufacturing-sector-pushes-for-strategic-breakthrough-amid-global-shifts.html

[5] https://vir.com.vn/textile-garment-and-footwear-see-export-turnover-of-71-billion-120729.html&link=autochanger

[6] https://www.rmit.edu.vn/news/all-news/2025/may/impact-of-us-tariffs-on-vietnams-textile-clothing-and-footwear-sector.