20/10/2025

Tin tức & Báo cáo mới nhất / Vietnam Briefing

Bình luận: Không có bình luận.

Các nhà bán lẻ Nhật Bản đang mở rộng nhanh chóng tại Việt Nam nhờ nhu cầu tiêu dùng sôi động, tốc độ đô thị hóa mạnh mẽ và sức hấp dẫn của mô hình bán lẻ hiện đại kết hợp với thương mại điện tử. Lợi thế “chất lượng Nhật Bản” giúp họ dễ dàng chiếm được lòng tin, trong khi người tiêu dùng Việt Nam ngày càng quan tâm đến trải nghiệm mua sắm, dịch vụ và sản phẩm với thiết kế tinh gọn và giá cả hợp lý.

Tổng quan về thị trường bán lẻ tại Việt Nam và Nhật Bản

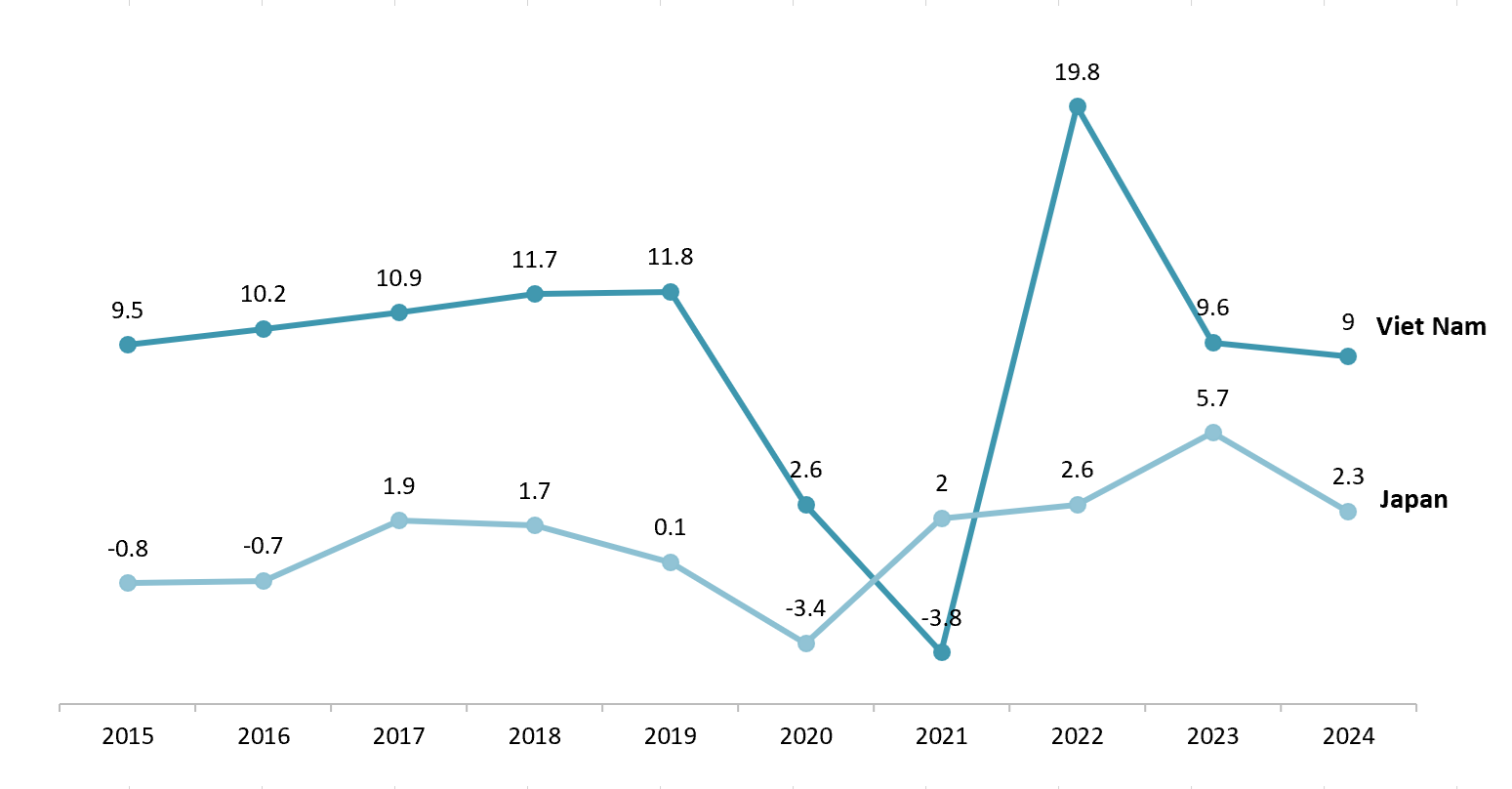

Tăng trưởng bán lẻ danh nghĩa của Nhật Bản sau đại dịch đi theo quỹ đạo "bật lên rồi hạ nhiệt": năm 2022: +2,6%, năm 2023: +5,7%, năm 2024: +2,3%. Điều này phản ánh sự phục hồi sức mua vào năm 2023, rồi chậm lại vào năm 2024 do môi trường giá cả và thu nhập thực tế gây áp lực lên tiêu dùng.[1]Trong khi đó, quy mô bán lẻ hàng hóa và dịch vụ tại Việt Nam đang tăng trưởng nhanh và ổn định: Năm 2022: +19,8%, năm 2023: +9,6%, năm 2024: +9,0%. Đây là chuỗi tăng trưởng cao nhờ nhu cầu nội địa phục hồi sau Covid, du lịch dịch vụ mở cửa trở lại và sự mở rộng của các kênh bán lẻ hiện đại.[2]. Về trung và dài hạn, nhiều nguồn tin dự báo thị trường bán lẻ Việt Nam sẽ tiếp tục tăng trưởng ổn định cho đến năm 2030. Theo Mordor Intelligence, quy mô thị trường dự kiến đạt 162,87 tỷ USD (năm 2025) và 209,19 tỷ USD (năm 2030), CAGR ≈ 5.13% trong giai đoạn 2025–2030[3].

Nominal retail sales growth of goods and services in Vietnam and Japan

Đơn vị: %

Nguồn: Tổng cục Thống kê Việt Nam và Kinh tế tập trung

Bên cạnh đó, cơ cấu kênh bán lẻ tại Việt Nam đang có sự dịch chuyển: theo tổng hợp từ năm 2020-2024, kênh truyền thống giảm tỷ trọng từ 73% xuống còn 61%, trong khi kênh bán lẻ hiện đại tăng từ 22% lên 29% và thương mại điện tử từ 5% lên 10%. Điều này tạo ra dư địa lớn cho các nhà bán lẻ có năng lực vận hành chuỗi và tối ưu hóa danh mục đầu tư.[4].

Xét về vị trí, Hà Nội và Thành phố Hồ Chí Minh vẫn là những “đầu tàu”, nhưng các tỉnh công nghiệp vệ tinh (Bắc Ninh, Hưng Yên, Hải Phòng; Bình Dương, Đồng Nai, Long An) đã nổi lên nhờ lực lượng lao động dồi dào, quỹ đất thương mại và cơ sở hạ tầng trung tâm thương mại mới. Kế hoạch mở rộng chuỗi đến năm 2030 của AEON là một minh chứng rõ nét cho xu hướng “hướng về tỉnh”.[5].

Xu hướng thị trường của các nhà bán lẻ Nhật Bản tại Việt Nam

Khi thương mại hiện đại phát triển mạnh mẽ tại Việt Nam, các nhà bán lẻ Nhật Bản đang ngày càng mở rộng sự hiện diện. Các xu hướng dưới đây cho thấy cách họ đang mở rộng hoạt động—thông qua các hình thức đa dạng, định vị “chất lượng Nhật Bản”, chuyển dịch danh mục sang làm đẹp/sức khỏe và tích hợp O2O nhanh hơn.

– Mở rộng đa dạng mô hình cửa hàng: Các nhà bán lẻ Nhật Bản đang đẩy mạnh việc mở các điểm bán hàng mới với nhiều loại hình. AEON đang đẩy mạnh cả các trung tâm thương mại ngoại thành và các siêu thị quy mô nhỏ trong nội thành để mở rộng thị trường.[6].

– Định vị thương hiệu và trải nghiệm phong cách Nhật Bản: Các nhà bán lẻ Nhật Bản chú trọng mang đến trải nghiệm Nhật Bản độc đáo về chất lượng và dịch vụ. Sản phẩm tại các chuỗi cửa hàng Nhật Bản được đánh giá cao nhờ chất lượng tốt và quy trình kiểm soát chặt chẽ – những yếu tố đã thuyết phục người Việt Nam tin dùng sản phẩm Nhật Bản trong nhiều năm qua.[7].

– Thay đổi về danh mục sản phẩm ưu tiên: Trước đây, các chuỗi cửa hàng Nhật Bản chủ yếu nổi tiếng với hàng gia dụng và thực phẩm, nhưng gần đây, nhóm mỹ phẩm và chăm sóc sức khỏe đã phát triển mạnh mẽ. Matsumoto Kiyoshi (chuỗi dược phẩm và mỹ phẩm hàng đầu Nhật Bản) liên tục mở rộng tại Việt Nam, cho thấy người Việt Nam ngày càng ưa chuộng mỹ phẩm và thực phẩm chức năng Nhật Bản.[8].

– Xu hướng O2O và vai trò của thương mại điện tử: Giai đoạn 2023–2025 sẽ chứng kiến các nhà bán lẻ Nhật Bản tích cực triển khai mô hình bán hàng trực tuyến đến ngoại tuyến (O2O). Nhiều doanh nghiệp Nhật Bản đã đưa sản phẩm lên các nền tảng thương mại điện tử hoặc mở website bán hàng riêng. Ví dụ, AEON Việt Nam đã phát triển các dịch vụ đa kênh như mua sắm qua điện thoại, website AEON Eshop, giao hàng tận nhà, tích hợp với chương trình thành viên.[9].

Matsumoto Kiyoshi Vietnam Store

Nguồn: Báo Dân Trí

Chủ yếu Các nhà bán lẻ Nhật Bản tại Việt Nam

Thị trường bán lẻ Việt Nam hiện có sự hiện diện của một số doanh nghiệp tiêu biểu, từ trung tâm thương mại, siêu thị đến cửa hàng tiện lợi, chuỗi bán lẻ thời trang và phong cách sống, đồ gia dụng và dược phẩm. Các hình thức hiện diện rất đa dạng, từ công ty con đến liên doanh. Về mặt địa lý, trọng tâm vẫn là khu vực Hà Nội - TP.HCM, nhưng các mô hình phù hợp sẽ giúp các thương hiệu sẵn sàng mở rộng sang các cụm công nghiệp.

| Kiểu | KHÔNG | Công ty | Năm nhập cảnh vào Việt Nam | Số lượng cửa hàng | Vị trí cửa hàng chính | Trang web |

| Trung tâm mua sắm | 1 | AEON Mall VN | 2014 | 11 | Hà Nội, TP.HCM | https://aeonmall-vietnam.com |

| 2 | Takashimaya VN | 2016 | 1 | TP.HCM | https://www.takashimaya-vn.com | |

| Siêu thị | 3 | AEON MaxValu | 2014 | 20 | Hà Nội, TP.HCM | https://aeonmaxvalu.aeon.com.vn/ |

| 4 | FujiMart | 2018 | 19 | Hà Nội | https://fujimart.vn/ | |

| Cửa hàng tiện lợi | 5 | Cửa hàng Ministop | 2015 | ~ 187 | Hà Nội, TP.HCM | https://www.ministop.vn/vi |

| 6 | FamilyMart VN | 2009 | ~ 160 | TP.HCM | https://www.familymart.com.vn | |

| 7 | 7-Eleven VN | 2017 | ~130 | TP.HCM | https://www.7-eleven.vn | |

| Thời trang/ Phong cách sống | 8 | Uniqlo | 2019 | 30 | Hà Nội, TP.HCM | https://www.uniqlo.com/vn |

| 9 | MUJI | 2020 | 17 | Hà Nội, TP.HCM | https://www.muji.com/vn | |

| Thiết bị gia dụng | 10 | Kohnan | 2016 | 16 | Hà Nội, TP.HCM | – |

| 11 | Daiso | 2008 | 9 | Hà Nội, TP.HCM | https://www.daisovietnam.com/ | |

| 12 | Nitori | 2023 | 4 | TP.HCM | https://www.nitori.com.vn/vi | |

| Hiệu thuốc | 13 | Matsumoto Kiyoshi VN | 2020 | 17 | Hà Nội, TP.HCM | https://matsumotokiyoshi.com.vn |

Nguồn: Tổng hợp của B&Company

Các chuỗi bán lẻ Nhật Bản đang đẩy nhanh quá trình mở rộng tại Việt Nam theo hai hướng: (1) đẩy nhanh việc triển khai mô hình và mật độ mạng lưới tại các thành phố lớn, và (2) bổ sung thêm các phân khúc mới—hiệu thuốc, đồ gia dụng và trung tâm gia dụng—để đáp ứng thói quen mua sắm hiện đại. Trong lĩnh vực thời trang/phong cách sống, sau khi xây dựng độ phủ sóng tại Hà Nội và TP.HCM, UNIQLO đã công bố việc tiến vào khu vực miền Trung với cửa hàng đầu tiên tại Huế vào năm 2025, báo hiệu chiến lược mở rộng theo từng khu vực thay vì các điểm bán lẻ rải rác. Trong lĩnh vực đại siêu thị/trung tâm thương mại, AEON có kế hoạch tăng gấp ba quy mô vào năm 2030 (từ 8 lên 16 trung tâm thương mại trong khi vẫn tích cực phát triển các siêu thị và mô hình siêu thị vừa và nhỏ), củng cố vai trò là “cơ sở hạ tầng bán lẻ” cho hàng hóa Nhật Bản và các đối tác liên minh như FujiMart của Sumitomo (đã đạt 19 cửa hàng tại Hà Nội tính đến tháng 6 năm 2025). Trong lĩnh vực đồ gia dụng, Nitori đã khai trương cửa hàng đầu tiên tại SORA gardens SC (Bình Dương) vào tháng 12 năm 2023 và đang tìm kiếm thêm các địa điểm khác—bằng chứng cho thấy làn sóng “nội thất & đồ gia dụng Nhật Bản” đang bước vào một chu kỳ mới sau khi Kohnan gia nhập thị trường trung tâm gia dụng vào năm 2016. Trong lĩnh vực sức khỏe & sắc đẹp, sau Matsumoto Kiyoshi (2020), Tsuruha đã khai trương cửa hàng đầu tiên tại TP.HCM vào tháng 8 năm 2025, cho thấy cuộc đua song mã tại các hiệu thuốc Nhật Bản có thể mở rộng nhanh chóng về tiêu chuẩn dịch vụ và các loại sản phẩm nhãn hiệu riêng.

Ý nghĩa đối với nhà bán lẻ Nhật Bản khi thâm nhập thị trường

Xét về góc độ thâm nhập thị trường, Việt Nam đang duy trì nhu cầu nội địa mạnh mẽ, tạo nền tảng vững chắc cho các mô hình chuỗi cửa hàng và mở rộng mạng lưới. Cơ cấu người tiêu dùng trẻ, đô thị hóa nhanh chóng có xu hướng ưu tiên “chất lượng - an toàn - tin cậy”, trong khi hình ảnh “Sản xuất tại Nhật Bản” thường gắn liền với chất lượng cao và đáng đồng tiền bát gạo. Các khảo sát người tiêu dùng như Q&Me liên tục cho thấy Nhật Bản được định vị là “Chất lượng cao/Tin cậy/Đáng đồng tiền bát gạo”, và việc áp dụng kỹ thuật số ngày càng tăng đang mở rộng không gian cho các mô hình O2O, cho phép các thương hiệu Nhật Bản kết nối liền mạch giữa trực tuyến và ngoại tuyến.

Tuy nhiên, cơ hội đi kèm với thách thức. Cạnh tranh giữa các doanh nghiệp trong và ngoài nước đang ngày càng gay gắt, đòi hỏi sự phân hóa ngành hàng rõ nét hơn và kỷ luật vận hành. Trong lĩnh vực làm đẹp, áp lực từ Hàn Quốc và các đối thủ nội địa đặc biệt rõ nét trên các nền tảng thương mại điện tử: K-beauty đã tăng tốc nhanh chóng (Shopee Hàn Quốc báo cáo rằng đơn hàng được vận chuyển đến Việt Nam đã tăng hơn năm lần trong giai đoạn 2021–2023) và chiếm thị phần nhập khẩu đáng kể. Nếu các sản phẩm Nhật Bản làm mới chậm hoặc thiếu mức giá khởi điểm, chúng có nguy cơ tụt hậu so với xu hướng đang thay đổi.

Về mặt chiến lược, các nhà bán lẻ Nhật Bản có thể ưu tiên:

- Vì sản phẩm và thương hiệu, giữ vững giá trị cốt lõi của chất lượng Nhật Bản đồng thời bản địa hóa hương vị, kích cỡ và bao bì; thêm mức giá khởi điểm và các phiên bản giới hạn để tạo đà. Tăng cường nhịp độ đổi mới (hàng quý/hàng tháng) và sử dụng phương pháp kiểm tra và học hỏi trực tuyến nhanh chóng trước khi mở rộng quy mô ngoại tuyến để giảm thiểu rủi ro tồn kho và tối ưu hóa vòng đời sản phẩm.

- TRÊN kênh, kết hợp các địa điểm trung tâm thương mại với các cửa hàng nhỏ/gọn để cải thiện phạm vi phủ sóng và hiệu quả về chi phí, đồng thời triển khai dịch vụ Nhấp và Nhận, giao hàng từ cửa hàng và hiện diện trên thị trường để mở rộng các điểm tiếp xúc kỹ thuật số.

- Vì chiến lược vị trí, ngoài Hà Nội và TP.HCM, một quỹ đạo hợp lý bao gồm khu vực miền Trung (Huế/Đà Nẵng), vành đai công nghiệp phía Nam (Bình Dương/Đồng Nai) và các tỉnh phía Bắc gần cảng/khu công nghiệp (Hải Phòng/Bắc Ninh/Thái Nguyên).

* Lưu ý: Nếu bạn muốn trích dẫn thông tin trong bài viết này, vui lòng ghi rõ nguồn và kèm theo link bài viết để đảm bảo tôn trọng bản quyền.

| B&Company, Inc.

Công ty nghiên cứu thị trường của Nhật Bản đầu tiên tại Việt Nam từ năm 2008. Chúng tôi cung cấp đa dạng những dịch vụ bao gồm báo cáo ngành, phỏng vấn ngành, khảo sát người tiêu dùng, kết nối kinh doanh. Ngoài ra, chúng tôi đã phát triển cơ sở dữ liệu của hơn 900,000 công ty tại Việt Nam, có thể được sử dụng để tìm kiếm đối tác kinh doanh và phân tích thị trường. Xin vui lòng liên hệ với chúng tôi nếu bạn có bất kỳ thắc mắc hay nhu cầu nào. info@b-company.jp + (84) 28 3910 3913 |

[2] NSO Việt Nam+2NSO Việt Nam+2.