전자상거래 및 승차 서비스와 함께 베트남의 음식 배달 시장은 이 지역에서 가장 역동적인 시장 중 하나로, 수많은 주요 업체를 유치하고 있습니다. 베트남의 배달 서비스 수요는 팬데믹 동안 급증했으며, 합리적인 비용과 편의성 덕분에 일상 생활에 필수적인 부분이 되고 있습니다.

음식배달 플랫폼 시장 성장

베트남의 음식 배달 앱 시장(식사)은 최근 몇 년 동안 놀라운 성장을 경험했습니다. Momentum Works의 보고서에 따르면, 베트남의 음식 배달 플랫폼의 총 상품 가치(GMV)는 2023년에 $14억에 도달하여 27%가 증가했습니다. 이는 동남아시아에서 가장 높은 성장률입니다. 이 데이터는 Grab, ShopeeFood, Baemin, Gojek의 네 가지 주요 플랫폼에서 수집되었습니다.[1].

이러한 수치는 베트남에서 온라인 음식 주문이 증가하는 추세임을 보여주며, 전통적인 매장 내 식사와 더불어 F&B 사업체에게 수익성 있는 기회를 제공합니다.

음식배달 앱 소비자 행동

Grab의 2023년 식품 및 식료품 트렌드 보고서에 따르면[2]Grab의 배달 앱을 자주 사용하는 사람은 일반적으로 18~24세이며, 대부분 사무직 근로자, 미혼입니다. 소비자는 GrabFood나 ShopeeFood에만 의존하지 않기 위해 종종 2~3개의 앱을 설치합니다.[3]. 2023년에 그룹 주문이 4배로 증가했고, 사용자는 사무실 배달을 위해 점심시간에 주문하는 이러한 주문에 두 배 더 많은 비용을 지출했습니다. 또한 기술, 고객 데이터, 사용자 경험과 같은 요소는 음식 배달 플랫폼의 성공에 매우 중요합니다. 몇몇 유명 브랜드가 퇴장했음에도 불구하고 이러한 과제는 지속적인 시장 잠재력을 강조합니다.

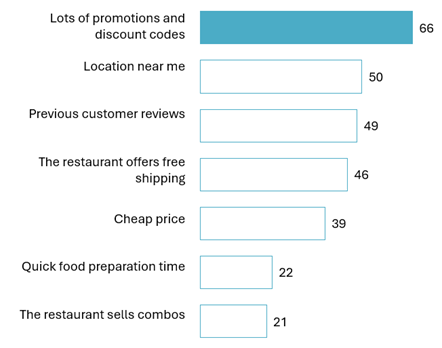

베트남 소비자들은 새로운 레스토랑과 요리를 탐색하기 위해 배달 앱을 점점 더 많이 사용하고 있으며, 이러한 플랫폼을 필수적인 발견 도구로 활용하고 있습니다. Grab에 따르면, 새로운 레스토랑이나 메뉴를 시도하는 주된 이유는 이용 가능한 오퍼와 긍정적인 리뷰입니다. 프로모션은 종종 낮은 가격보다 선호되는데, 이는 인식된 "할인" 느낌 때문입니다. iPOS.vn에서 지적한 대로, 주문에 영향을 미치는 주요 요인은 프로모션, 근접성, 고객 리뷰입니다.

Factors influencing food order decisions

단위 : %, N = 3,791

출처: iPOS.vn

음식배달 앱 시장 경쟁

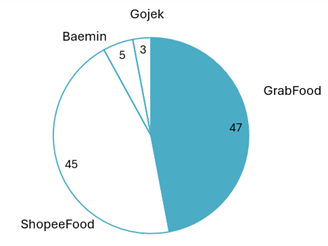

수익성이 있지만, 시장은 또한 매우 경쟁적입니다. Momentum Works의 데이터에 따르면 베트남 밀 배달 시장은 Grab과 ShopeeFood가 주도하고 있으며, 2023년에 각각 47%와 45%의 GMV 점유율을 보유하고 있습니다.

Proportion in Total GMV of food delivery platforms in Vietnam

100% = $14억

출처: Momentum Works

일부에서는 GrabFood와 ShopeeFood가 주요 경쟁자로 시장 경쟁이 끝나갈 것이라고 믿지만, 현실은 더 복잡합니다. 특히 소비자들이 새로운 로컬 애플리케이션이 등장하여 외국 애플리케이션이 지배하는 가운데 경쟁이 강화되기를 기대함에 따라 상당한 잠재력이 남아 있습니다.

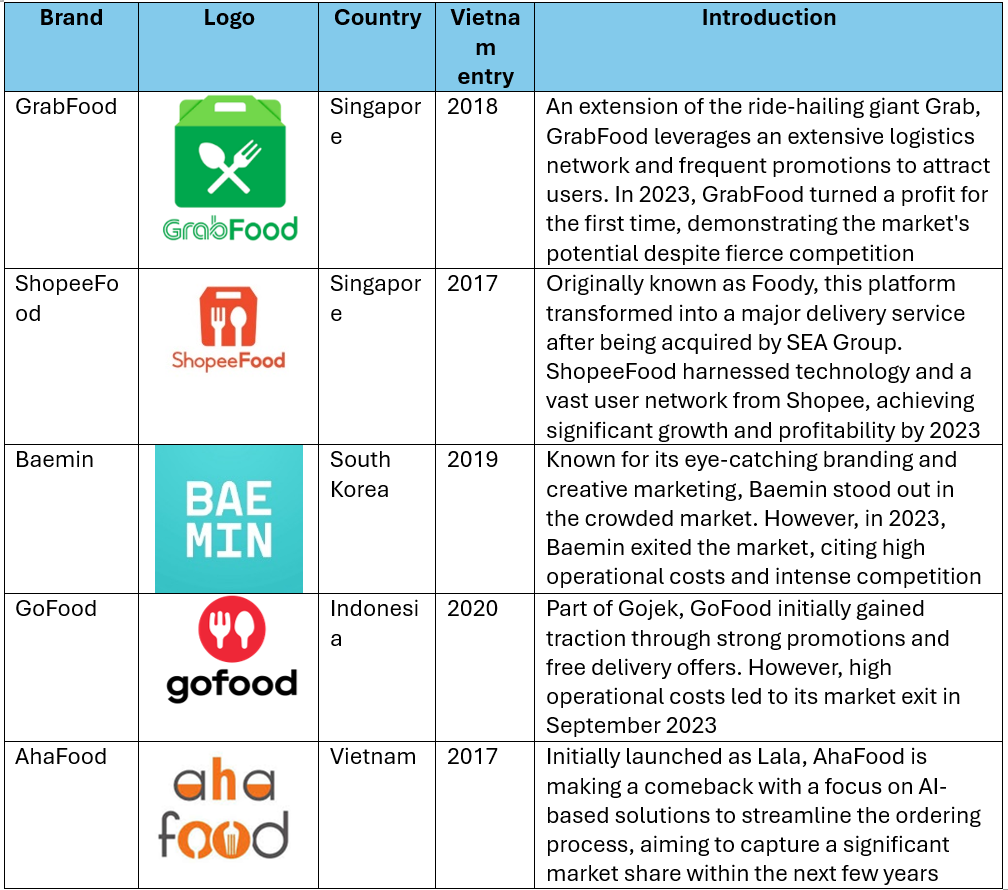

Key players in food delivery in Vietnam will continue to compete to attract consumers

원천: 뉴스

아래는 2023~2024년 기간 동안 식품 배달 산업의 주요 업체와 그들의 여정에 대한 간략한 소개입니다.

결론

베트남의 음식 배달 애플리케이션 시장은 소비자 수요 증가, 디지털 혁신, 주요 업체 간의 치열한 경쟁에 힘입어 지속적인 성장을 이룰 것으로 예상됩니다. 이러한 성장은 F&B 시장의 확장으로 크게 뒷받침되며, 2023년부터 2027년까지 CAGR 10.25%로 상승 궤도를 이어갈 것으로 예상되며, 2027년까지 3,411만 달러에 달할 것으로 추산됩니다. 이러한 요소들이 합쳐져 번창하는 음식 배달 산업을 위한 강력한 환경을 조성합니다.

또한, 현지 소비자 선호도를 이해하고 프로모션, 서비스 품질, 전략적 파트너십을 통해 경쟁 우위를 유지하는 것이 지속적인 성공에 필수적입니다. 산업이 진화함에 따라 기업에는 흥미로운 기회가, 베트남 소비자에게는 더 풍부한 식사 경험이 약속됩니다.

| 주식회사 비앤컴퍼니

2008년부터 베트남에서 시장 조사를 전문으로 하는 최초의 일본 기업입니다. 업계 보고서, 업계 인터뷰, 소비자 설문 조사, 비즈니스 매칭을 포함한 광범위한 서비스를 제공합니다. 또한, 최근 베트남에서 900,000개 이상의 기업에 대한 데이터베이스를 개발하여 파트너를 검색하고 시장을 분석하는 데 사용할 수 있습니다. 문의사항이 있으시면 언제든지 문의해주세요. info@b-company.jp + (84) 28 3910 3913 |

다른 기사를 읽어보세요