Overview of the Agricultural Machinery Market

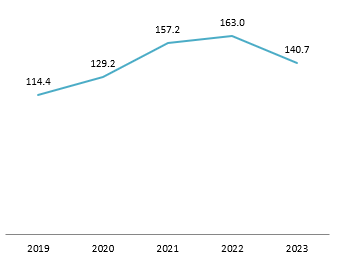

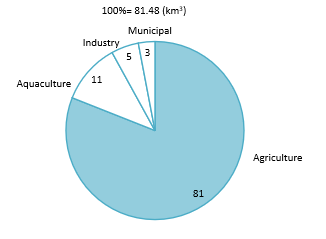

The Vietnamese agricultural machinery market is forecasted to experience a compound annual growth rate (CAGR) of 5.5% from 2022 to 2027, reaching 428 million USD, according to Ken Research (2024). This growth is primarily driven by the rising demand for food and the government’s efforts to mechanize agriculture. Regarding food demand, the domestic and global populations are increasing, leading to greater needs for food production and supply. Vietnam’s population increased by 4% compared to 2019, reaching over 100.3 million people in 2023. Agricultural mechanization is essential to meet this demand.

Vietnam’s average population 2019-2023

Unit: Million people

Source: GSO

Regarding government efforts, Vietnam has introduced several policies to support farmers in utilizing mechanized equipment in agricultural production and to boost productivity and modernization in the agricultural manufacturing sector. The government’s support policy focuses on financial assistance to facilitate the application of machinery in agriculture.

Some policies and strategies of the government

| Document number | Title | Details |

| Decision 68/2013/QĐ-TTg | Support policies to reduce losses in agriculture | For farmers, the government offers providing 100% interest subsidies for the first two years and 50% for the third year on loans to purchase agricultural machinery and equipment, with the loan amount up to 100% of the equipment’s value |

| Decree 57/2018/ND-CP

|

Mechanism and policies to encourage enterprises to invest in agriculture and rural areas | For enterprises, providing support for agricultural machinery manufacturers by covering 60% of their investment costs |

| Decision 858/QĐ-TTg | Strategy for the development of agricultural mechanization and agro-forestry-fishery processing until 2030 | The objectives include achieving 70% mechanization in crop production, 60% in livestock farming, 90% in aquaculture, 95% in fishing and preservation, 50% in forestry, and 90% in salt production |

| Decision 2771/QĐ-BNN-KH | Issuing the Action Plan of the Ministry of Agriculture and Rural Development to implement Resolution No. 111/NQ-CP dated July 22, 2024, of the Government, which issues the Action Program for implementing Resolution No. 29-NQ/TW dated November 17, 2022, of the Party Central Committee (13th tenure) on continuing to promote industrialization and modernization of the country until 2030, with a vision to 2045 | Prioritizing the development of national standards for agricultural machinery and technology and focusing on updating tax incentives and credit policies to promote agricultural mechanization and processing for manufacturing enterprises or farmers (newly issued in 2024, the action plan presenting goals and to do tasks but details such as actual tax incentives are not discussed). |

Source: B&Company’s compilation

Despite the efforts to support domestic agricultural machinery manufacturing, most of the agricultural machinery used in Vietnam is imported. In 2023, the country has 1,803 mechanical enterprises, but they only meet about 32% of the domestic demand for agricultural machinery.This is partly due to the underdeveloped nature of the local manufacturing industry, which lacks comprehensive investment in technology and technical expertise. Additionally, challenges in accessing capital, raw materials, and a shortage of high-quality human resources are significant obstacles to the growth of domestic production. Asian suppliers from China, South Korea, and Japan are dominating the agricultural machinery market in Vietnam. Kubota, CLAAS KGaA mbH, Yanmar, Iseki, CNH, and VEAM are the biggest agricultural machinery providers in the Vietnamese market.

Vietnam imported value of machinery equipment, tools, other spare parts (2019-2023)

Unit: Billion USD

Source: GSO

Introduction of some potential types of agricultural machinery

Lawn mowers

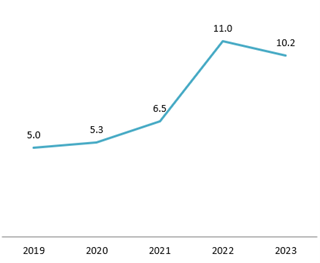

Lawn mowers are an indispensable tool in Vietnam’s agriculture sector, with demand growing due to large farming areas, and the increasing trend toward clean and sustainable farming practices. In crop cultivation, lawn mowers help clear weeds, promoting better plant growth, while in livestock farming, they provide fresh, clean grass for feeding, improving livestock product quality. Vietnam has seen a rise in lawn mower imports to meet farmers’ needs. The import value of this machinery surged in 2022 and slightly decreased in 2023, reaching 10.2 million USD. This may present a significant opportunity for lawn mower suppliers, particularly for compact, user-friendly models suited to Vietnam’s diverse farming terrain. Some of Japanese lawn mowers brands in Vietnam are Maruyama, Mitsubishi, Honda, Makita, …

Import value of lawnmowers in Vietnam 2019-2023

Unit: Million USD

Source: Trademap (HS Code 843311 and 843319)

Soil tillage

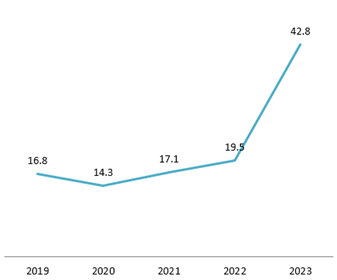

Vietnam’s diverse and complex terrain, including plains, mountains, plateaus, and an intricate river system, poses significant challenges for agricultural cultivation. The geographical differences between regions such as the Red River Delta, Mekong Delta, Central Highlands, and Northern mountainous areas demand the use of modern agricultural machinery tailored to specific terrains to improve productivity and efficiency. The import value of land preparation machinery has been risen notably and reached 42.8 million USD in 2023. According to the Cooperative Economic and Rural Development Department under the Ministry of Agriculture and Rural Development, from 2011 to 2022, mechanization in rice production, specifically in plowing and land preparation, reached 94%, while mechanization in sowing reached 42%. This reflects Vietnam’s continuous efforts to modernize its agricultural sector to overcome the challenges posed by its varied topography and improve overall production efficiency. Some of the Japanese soil tillage brands in Vietnam are Kubota, Yanmar, Iseki, Shibaura, Mitsubishi,…

Import value of tillage in Vietnam 2019-2023

Unit: Million USD

Source: Trademap (HS Code 8432)

Agricultural sprayers

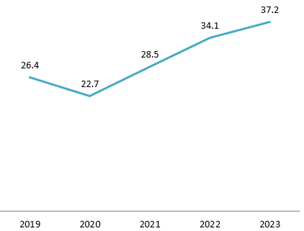

The Vietnamese agricultural sprayer market is experiencing rapid growth due to the increasing demand for effective pest and disease control in agriculture. Vietnam’s hot and humid climate creates favorable conditions for the development of various plant diseases, posing a serious threat to crop productivity and quality. To protect their crops, Vietnamese farmers are shifting to modern farming practices, and the use of accurate and efficient sprayers is essential. Sprayers help ensure the even and economical application of pesticides, increasing the effectiveness of disease control and meeting farmers’ demands for higher crop yields and quality. The Department of Cooperative Economics and Rural Development (under the Ministry of Agriculture and Rural Development) reported that the number of plant protection sprayers in use in Vietnam increased by 3.5 times from 2011 to 2022. The import value of agricultural sprayers in 2019-2023 also increased with the CAGR of the period is 8.9%. Some of the Japanese agricultural sprayer brands in Vietnam are Maruyama, Kioritz (Echo), Yamaha, Mitsubishi, Honda, …

Import value of agricultural sprayers in Vietnam 2019-2023

Unit: Million USD

Source: Trademap (HS Code 842441 and 842449)

Water pump

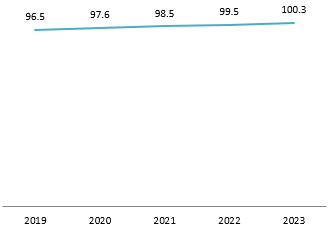

Water pumps hold great potential in Vietnam’s agricultural sector, especially as climate change and the growing demand for stable irrigation create new challenges. Most water withdrawals in Vietnam serve for agricultural purpose. Water withdrawal for agricultural irrigation is estimated at 66 km3 per year which is as high as 81% of the total water use in the country. Vietnam’s extensive network of rivers and canals, particularly in the lowland regions, serves as a crucial natural irrigation source for large-scale farming. To ensure stable and consistent water supply, especially during the dry season, water pumps are widely utilized to channel water from rivers, lakes, and canals into rice fields, industrial crops, and vegetable plots. According to the Cooperative Economic and Rural Development Department of the Ministry of Agriculture and Rural Development, the number of water pumps increased by 60% from 2011 to 2022. These pumps allow farmers to control water distribution more effectively, reducing their dependency on unpredictable weather conditions.

Percentage of water withdrawals by sectors in Vietnam

Source: World Bank

Challenges

Vietnam’s agriculture is characterized by small-scale, fragmented production. Smallholder farmers own most agricultural land, account for 90% of the total agricultural production area and the average cultivating area of a farming household is under 0.68 ha. The reason is the policy of allocating agricultural land to families and individuals for ensuring that producers have land for cultivation. In addition, farmers often grow different types of plants to utilize the land resource. The small-scale and simultaneous types of plants make it difficult to implement large-scale production or adopt advanced technologies to boost productivity.

Agricultural activities in Vietnam

Source: VnEconomy

Low farmer incomes and limited access to maintenance services further restrict mechanization. Rural areas, where most agricultural land is located, have low average incomes, causing reluctance to invest in machinery. Moreover, maintenance facilities are often in urban centers, leading to long wait times and difficulties in equipment use.

The majority of imported agricultural machinery comes from China. When comparing similar types of machinery, domestically produced machines are typically 20-30% more expensive than those from China. The trade agreements between China and ASEAN specify certain products to receive tax incentives, allowing Chinese products to maintain competitive pricing. Such as, under ASEAN- China Free Trade Agreement, agricultural machinery products are listed in the Special Preferential Import Tariff Schedule for the 2022–2027 period released with Decision 118/2022/ND-CP of the Government, reducing the import tariff to 0% for Vietnam.

Opportunities for imported products

Developing low-cost and simple machinery may be a potential strategy due to the small-scale and fragmented agricultural production in Vietnam. Since most users are farmers, they need equipment that is simple to use, easy to maintain, and affordable. Machinery that meets the requirements of small-scale production at an affordable price can help them improve production efficiency without requiring large investments.

In addition, providing warranty services and usage instructions is also necessary. Building a network of service centers reaching rural areas to support users after the equipment is sold is important. This approach can create a positive impression among users and help reach more customers

Collaborating with domestic companies to transfer advanced technologies can utilize local labor while also gaining more insights into the local agricultural characteristics. For companies investing in technology transfer, this collaboration ensures a stable and expanding market for their products, while also creating opportunities for joint ventures and long-term growth. Such collaborations can also foster long-term partnerships, leading to increased trade, investment, and technological advancements for both countries.

Conclusion

The agricultural machinery market in Vietnam is presenting opportunities for businesses, especially in the context of agricultural modernization and the growing demand for increased productivity. The surge in investment in agricultural technology, coupled with supportive government policies, is driving this trend. However, the segment of small-scale farmers in rural areas remains a largely untapped market. Therefore, businesses can leverage this opportunity by developing suitable, affordable, and accessible machinery solutions to meet the increasing demand for agricultural mechanization in these areas.

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles