06Nov2024

Highlight content / Industry Reviews / Latest News & Report

Comments: No Comments.

Market overview and Key drivers for growth

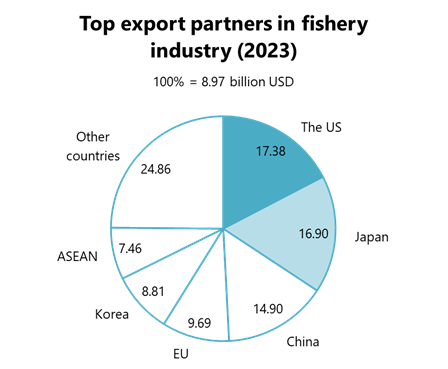

Vietnam has long been recognized as one of the world’s leading fishery producers and exporters[1]. Thanks to its geographical advantages, including more than 3,260 km of coastline and vast inland water resources[2], the country is well suited for aquaculture and fishing activities. According to VASEP (Vietnam Association of Seafood Exporters and Producers), Vietnam is currently one of the world’s top three fishery exporters, after China and Norway[3]. By 2024, Vietnam will have exported fishery to nearly 170 markets, including some of the largest and most demanding markets such as the EU, the United States, Japan, Australia, the UK and China[4]. To date, the fishery industry has developed rapidly, comprehensively and stably, becoming an important economic sector of the country. The fishery processing industry plays an important role in adding value to raw fishery products through freezing, packaging and improving shelf life, making Vietnam a global hub for processed fishery exports.

Source: GSO

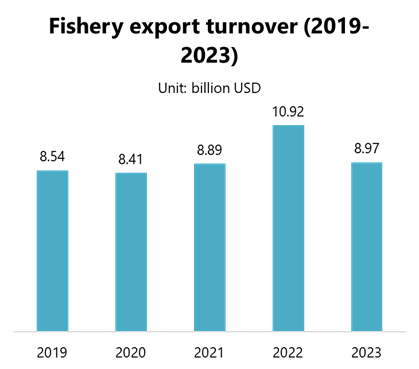

Although Vietnam’s fishery export volume in 2023 has decreased due to external economic factors such as high inflation in many of Vietnam’s export partners and the impact of the Russia-Ukraine conflict on logistics costs, the market still showed signs of recovery in 2024. In the third quarter of 2024, fishery exports reached 2.76 billion USD, up nearly 13% over the same period last year, in which key products also had a significant breakthrough compared to 2023[5].

Regarding key factors driving the growth of the fishery processing sector, there are several that can be considered. Firstly, rising global demand for fishery, driven by growing health consciousness and a shift to protein-rich diets, has boosted Vietnam’s exports. This demand is particularly strong in major markets such as the EU and the US, which have been two of the country’s top export partners for many years. Secondly, technological advances in fishery processing have helped companies in Vietnam improve their efficiency and product quality, helping them meet the high standards of international markets while keeping production costs low. Thirdly, Vietnam’s favorable geographical location and tropical climate has helped create ideal conditions for aquaculture and fishing, further boosting the development of shrimp and pangasius farming – which are considered the cornerstones of the country’s fishery exports. Finally, Vietnam’s competitive labor costs have made the fishery processing industry more attractive to foreign investors looking for cost-effective production solutions.

Government policies and support

With the goal of making Vietnam a global fishery processing hub, worthy of being in the top 5 countries in the world by 2030, the Vietnamese Government has issued many policies in recent years to facilitate the development of the fishery processing industry. These policies aim to encourage production along the value chain of fishery production, processing and consumption. A notable example being Decision No. 1408/QD-TTg[6], approved by the Prime Minister on August 16, 2021. This Decision outlines the Fishery Processing Industry Development Plan for the period 2021-2030, setting clear targets for 2030 as follows in the table below:

Target for the fishery processing sector until 2030

| Fishery growth rate | Export value ratio | Fishery processing facilities | Domestic fishery processing value |

| Over 6%/year | An average of 40%, of which:

– Shrimp: 60% – Pangasius: 10% – Tuna: 70% – Squid and octopus: 30% – Other fishery: 30% |

Over 70% meet advanced average production technology levels | Reaches 40,000 – 45,000 billion VND |

Source: Decision 1408/QĐ-TTg

To encourage investment and sustainable development in the fishery processing industry, the Government has also implemented a policy of reducing corporate income tax for fishery processing companies. According to Decree 218/2013/ND-CP, enterprises investing in new projects in the field of agricultural, forestry and fishery processing in disadvantaged areas are entitled to a preferential tax rate of 10% for 15 years, tax exemption for the first 4 years and a 50% reduction for the next 9 years[7]. In addition, Decree 57/2021/ND-CP also provides incentives for high-tech agricultural investment projects or projects set up in less privileged areas, encouraging companies to apply advanced technology to improve product quality and to protect the overall natural environment[8]. These policies have helped reduce financial costs, promote investment, and enhance the competitiveness of Vietnamese fishery processing industry in the international market.

Not only through paperwork, but the Government has also taken specific actions to support companies in the fishery processing sector. Notably, at the end of the second quarter of 2023, with Vietnam facing significant difficulties the export sector, the Prime Minister has listened to the proposal from various companies, issuing the State Bank to study and propose a 10,000 billion VND credit package to support businesses in the forestry and fishery processing sector[9].

Key players

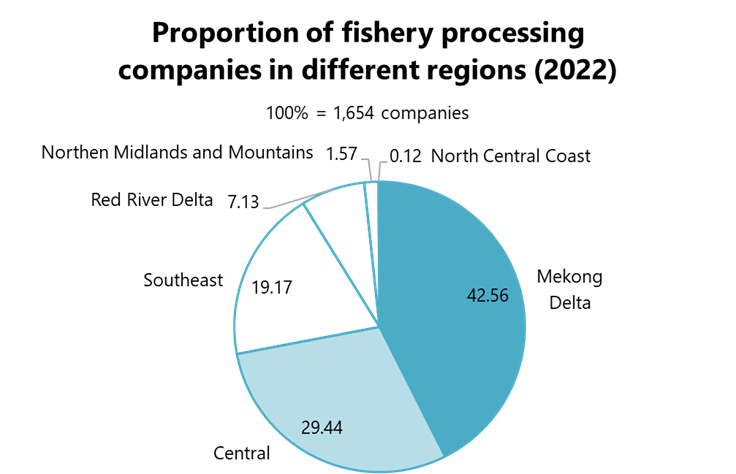

Fishery processing companies in Vietnam are mainly concentrated in the southern coastal areas and the Mekong Delta due to its rich natural resources. According to the Southern National Freshwater Aquaculture Center, the Mekong Delta is home to more than 250 freshwater fish species, of which about 50 species have a high economic value and nearly 20 species are considered rare[10]. For that reason, the most prominent names in the fishery processing industry in Vietnam are mainly concentrated in the South, more specifically the Mekong Delta region. This chart below shows the proportions in the number of fishery processing companies in different regions in Vietnam.

Source: B&Company’s database

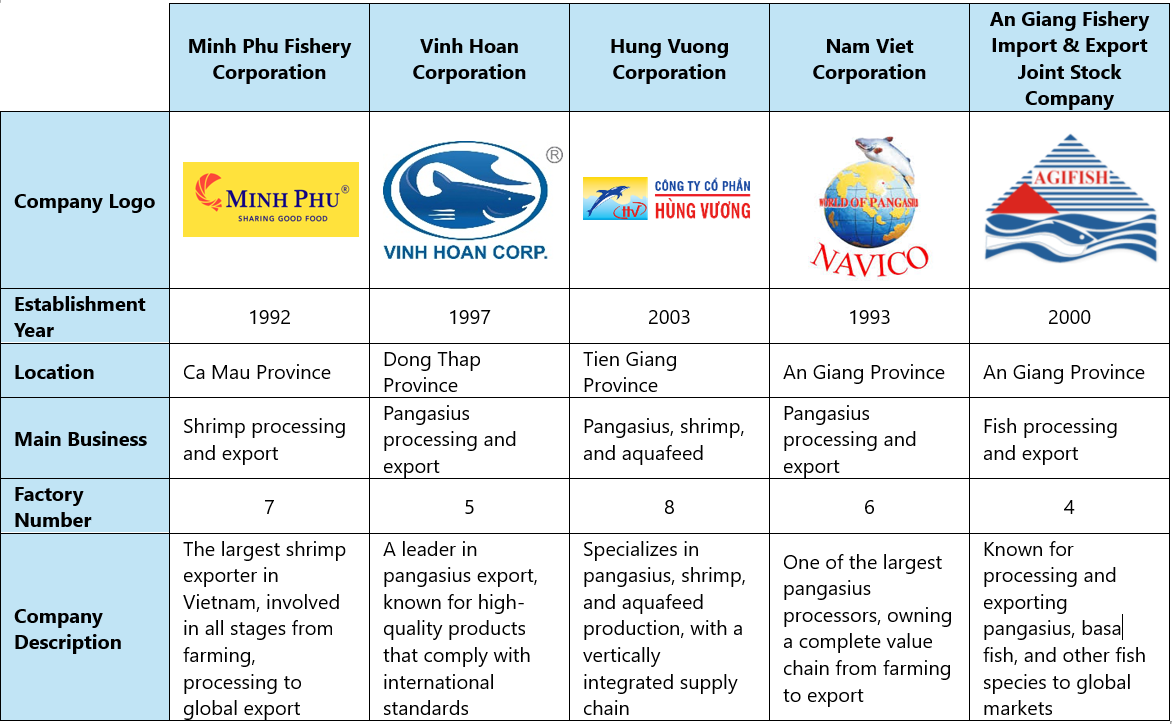

The table below highlights some of the key players in the fishery processing industry:

Key players in the fishery processing sector in Vietnam

Source: B&Company’s synthesis

Opportunities for foreign investors

Although facing significant difficulties in exporting fishery in 2023, fishery processing and exporting companies in 2024 have started to witness significant growth and revenue recovery. This is an opportunity for the Vietnamese fishery industry to accelerate in the coming months until the end of the year, with an outlook of reaching 9.5 billion USD – an increase of 7% compared to 2023[11]. This paved the way for promoting business investment from foreign companies. The Vietnamese fishery industry is taking advantage of new opportunities arising from international trade agreements, such as the Vietnam – EU Free Trade Agreement (EVFTA), opening potential export markets in Europe. With significant growth and untapped potential, the Vietnamese fishery industry is also attracting significant foreign direct investment (FDI). According to the IPAVIETNAM report in 2022, the fishery industry currently has more than 110 FDI projects, with a total accumulated investment capital exceeding 1 billion USD[12]. These FDI flows support Vietnam’s broader goal of strengthening its aquaculture and fishery processing sectors through improved infrastructure, technological advancements, and export promotion strategies.

Conclusion

Vietnam’s fishery processing market offers significant opportunities for foreign investors, driven by strong government support, a thriving export market, and growing global demand for fishery. While there are challenges, such as competition from established domestic players and the need for compliance with international standards, the potential rewards are considerable. By leveraging Vietnam’s natural advantages, government incentives, and expanding trade networks, foreign investors can play a crucial role in further advancing the country’s position as a global fishery leader.

[1] The main fishery products of Vietnam currently reported by Vietnam Association of Seafood Exporter and Producers (VASEP) include shrimp, pangasius, tuna, squid and octopus, mollusks, and crabs

[2] National Institute for Finance (2018). Developing Vietnam’s marine economy: It is necessary to promote potential and comparative advantages. <Assess>

[3] WTO Center (2024). Vietnam becomes the world’s third-largest fishery exporter. <Assess>

[4] Ministry of Industry and Trade (2023). Promoting Trade – Efforts to Recover Growth in Fishery Exports. <Assess>

[5] VASEP (2024). Fishery exports in Q3/2024 reached USD 2.76 billion. <Assess>

[6] Prime Minister (2021). Approval of the Project on the Development of the Fishery Processing Industry for the 2021-2030 Period. <Assess>

[7] The Government (2014). Detailed regulations and guidance for the implementation of the Law on Corporate Income Tax. <Assess>

[8] The Government (2021). Regarding corporate income tax incentives for projects producing supporting industrial products. <Assess>

[9] State Bank of Vietnam (2024). Preferential credit package demonstrates effectiveness. <Assess>

[10] Southern Water Resources Planning. The resources of the Mekong Delta. <Assess>

[11] VnEconomy (2024). Fishery exports in 9 months reached over 7 billion USD, with shrimp and pangasius products grew rapidly. <Assess>

[12] IPAVIETNAM (2022). Vietnam Fishery Industry Comprehensive Report. <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

- All

- Administrative

- Agriculture

- Economic

- Education & Training

- Entertainment & Media

- Exhibition

- Food & Beverage

- Healthcare

- Human Resources

- Life / Public Service

- Lifestyle

- Politics

- Retail & Distribution

- Seminar

- Trade