058 月2025

最新消息及报道 / 越南简报

评论: 没有评论.

越南碳市场潜力:规模与财务前景

越南拥有发展碳市场的巨大潜力,得益于优越的自然条件以及林业和农业等碳排放行业。该国可产生约5700万个碳信用额[1]。以每个信用额5美元的适中价格计算,这相当于3亿美元的收入;如果价格上涨至10至20美元,年收益可达4亿至10亿美元。

越南已展现出其实力。2024年3月,越南以5150万美元的价格向世界银行的森林碳排放权框架(FCPF)出售了1030万个森林碳信用额[2]。截至2023年底,已有超过300个项目根据国际标准(清洁发展机制(CDM)、可比碳信用体系(VCS)、黄金标准)注册,其中150个项目共计发放了4020万个信用额,其中许多信用额在全球范围内交易[3]。

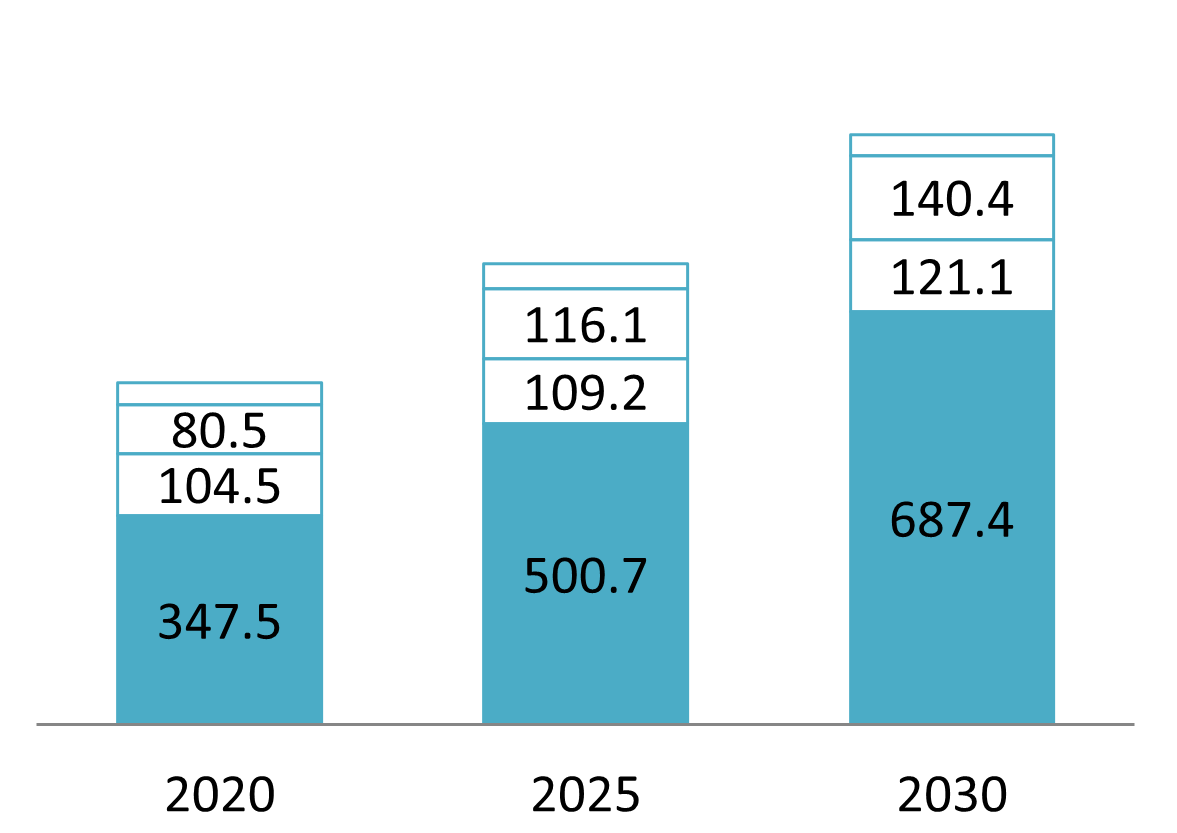

Vietnam carbon credit resource

单位:百万吨二氧化碳

资料来源:金融投资版块 – 《西贡 Giải Póng 报》

在农业领域,虽然农业是重要的排放源,但也具有每年产生高达5700万个碳信用额的潜力[5]。关键举措包括水稻种植中的干湿交替 (AWD) 技术、有机农业、沼气系统和肥料优化。世界银行资助的湄公河三角洲地区1.2亿美元的低排放水稻种植项目是一个显著的推动因素[6]。

能源和废物管理行业也提供了额外的碳信用额来源。由于市场饱和,风能和太阳能项目产生的信用额往往较低,但通过生物质发电、垃圾填埋场甲烷回收以及废物能源化技术可以获得更高的回报。成功案例包括薄寮风力发电厂和西宁的污水处理项目[7, 8]。

除了传统行业的减排外,越南还受益于林业和蓝碳带来的天然碳排放。林业被认为是一座潜在的“绿色金矿”。越南拥有1490万公顷森林,通过REDD+计划、重新造林和可持续森林管理,该行业可以产生5000万至7000万个信用额[9]。蓝碳是一个新兴的前沿领域。越南拥有100万平方公里的海域和丰富的沿海生态系统——红树林、海草床和湿地——拥有强大的潜力,可以产生高价值的信用额,同时带来生物多样性保护、沿海保护和当地生计支持等协同效益。

碳信用额:从合规成本到战略资产

碳信用额正在从一种合规工具演变为可持续发展背景下的战略资产。根据越南2020年《环境保护法》的定义,碳信用额代表排放一吨或当量二氧化碳的权利,可以在“限额与交易”制度下进行交易。在该制度下,政府设定排放限额并向企业分配排放配额[10]。排放量低于限额的企业可以将剩余的信用额出售给排放量超过限额的企业,从而创建一个碳市场。

这一机制不仅确保了合规性,还释放了创收机会。对于高排放企业而言,购买信用额度是一项必要的支出,同时也是推动清洁技术发展的动力。与此同时,积极减排或开发重新造林或可再生能源等项目的企业可以出售多余的信用额度,将其转化为稳定的收入和金融资产。在某些情况下,信用额度甚至可以用作获得绿色融资的抵押品。

除了财务价值之外,参与碳市场还能提升品牌形象和ESG绩效,这对于吸引负责任的投资至关重要。随着投资者日益关注可持续性,良好的碳排放状况有助于提升资本获取渠道。在越南,私营部门参与者已经率先行动。例如,CT集团在政府运营的交易所之前推出了东盟碳信用交易平台(CCTPA),这表明其对低碳经济的战略远见和早期准备[11]。

解读法律框架——越南碳排放权市场的“游戏规则”

三大基本法律支柱

越南碳信用市场建立在三个关键法律文书之上,构成了从政策导向到实施的全面框架:

– 2020年环境保护法 (自2022年1月1日起生效):该法首次正式引入了国内碳市场的概念,并对碳信用额进行了法律定义[10]。它为利用经济手段管理排放、应对气候变化奠定了基础。

–第06/2022/ND-CP号法令:该法令实施了《环境保护法》,并概述了发展碳市场的两阶段路线图(2028年前和2028年后)[12]。它还定义了温室气体清单责任、碳补偿机制和报告方法。

–第 13/2024/QD-TTg 号决定:该决定更新了必须进行温室气体清单编制的设施清单,将范围扩大至2166家设施[13]。该清单将作为未来排放配额分配的基础。

第119/2025/ND-CP号法令:市场激活的重大变革

第119/2025号法令于2025年6月9日颁布,并于2025年8月1日起生效,标志着越南碳市场正式启动的关键里程碑[14]。该法令对第06号法令中的关键条款进行了修订和补充,以提高可行性并体现政府的适应性方针。碳市场将分两个阶段实施:

- 试点阶段(2025 年 8 月 - 2028 年 12 月): 重点是制定详细法规,建立国家碳排放登记系统,并试点碳排放权交易。在此阶段,国际碳排放权交易将受到限制,以优先保障国内供应,并确保与越南的国家自主贡献(NDC)保持一致。

– 运营阶段(自2029年起): 市场将全面运行,开展排放配额拍卖和国际信用交易,增强市场竞争力,吸引全球气候资金。

一项显著的改进是碳补偿配额的增加,超额排放限额从10%增加到30%。这一调整为企业提供了更大的灵活性,并在初期提升了市场流动性。

企业合规路线图

在法律基础到位的情况下,企业(尤其是强制名单上的企业)必须积极主动地履行关键的合规义务:

– 温室气体清单: 根据第 13/2024 号决定确定的 2,166 家设施必须完成其 2024 年排放清单,并在 2025 年 3 月 31 日之前提交报告。报告将每两年一次。

– MRV系统(测量-报告-验证): 企业必须建立可靠的MRV系统,并符合国家技术指南和标准,例如TCVN ISO 14064-1:2011。温室气体清单必须经认证的第三方机构验证后才能提交给主管部门。

越南碳信用市场的关键里程碑(2024-2030年)

| 时间线 | 主要活动 | 法律依据 | 受影响的利益相关者 |

| 2024 | 首份温室气体清单 | 第13/2024/QD-TTg号决定 | 2,166家受监管设施 |

| 截至 2025 年 3 月 31 日 | 2024年温室气体清单提交截止日期 | 第06/2022/ND-CP号法令 | 2,166家受监管设施 |

| 2025年8月1日 | 第119/2025号法令生效 | 第119/2025/ND-CP号法令 | 所有碳市场利益相关方 |

| 2025 年底 | 碳排放权交易试点启动 | 全国碳市场规划 | 企业、投资者、机构 |

| 2025–2028 | 全国试点阶段(无国际贸易) | 第119/2025/ND-CP号法令 | 国内演员 |

| 从 2029 年起 | 全面运营、配额拍卖、全球连通 | 第119/2025号法令,《环境法》 | 整个经济、国际投资者 |

展望:净零领导力的历史机遇

越南正处于关键时刻。凭借快速发展的法律框架、丰富多样的自然资源以及强大的国际支持,越南完全有能力构建一个透明、充满活力且高效的碳市场。如果能够有效实施,越南不仅能够实现其2050年净零排放目标,还能成为区域优质碳排放额度的中心。这将使越南能够将气候挑战转化为绿色增长和长期繁荣的新引擎。

[1] Vietnamnet,越南5700万个森林碳信用额的价格是多少?使用权>

[2] 世界银行,越南获得 $5150 万世界银行付款,用于通过森林保护减少排放使用权>

[3] 气候变化部,出售碳信用额时需谨慎使用权>

[4] Sài Gòn Giải Póng报纸,货物和贸易方已为碳信用市场做好准备使用权>

[5] 越南包装回收组织,《出售碳信用额:农业领域巨大潜力》使用权>

[6] VnEconomy,百万公顷优质水稻项目将获得世界银行141.2亿塔卡资金支持。使用权>

[7] Báo Kinh tế Đô thị, Bac Lieu Wind Power 通过销售碳信用额赚取 180 万欧元使用权>

[8]《碳市场新闻》,10 个越南项目已成功向国际市场出售碳信用额使用权>

[9] 人民报,推动建立碳排放权交易交易所使用权>

[10] 国会,越南 2020 年环境保护法使用权>

[11] 东盟碳信用,越南推出首个碳信用交易交易所使用权>

[12] 政府第 06/2022/NĐ-CP 号法令,《关于减少温室气体排放和保护臭氧层的规定》使用权>

[13] 总理第 13/2024/QĐ-TTg 号决定:发布需要进行温室气体清单的行业和设施更新清单使用权>

[14] 政府第 119/2025/NĐ-CP 号法令:修改和补充 2022 年 1 月 7 日第 06/2022/NĐ-CP 号法令关于减少温室气体排放和保护臭氧层的若干条款使用权>

*如果您想引用本文中的任何信息,请注明来源以及原始文章的链接,以尊重版权。

| B&Company

自 2008 年以来,日本第一家专门从事越南市场研究的公司。我们提供广泛的服务,包括行业报告、行业访谈、消费者调查、商业配对。此外,我们最近还开发了一个包含越南 900,000 多家公司的数据库,可用于搜索合作伙伴和分析市场。 如果您有任何疑问,请随时与我们联系。 信息@b-company.jp + (84) 28 3910 3913 |