2025年7月15日

最新ニュースとレポート / ベトナムブリーフィング

コメント: コメントはまだありません.

米中貿易戦争の激化以降、積み替えと原産地偽装は米越貿易において大きな懸念事項となっている。米国による中国製品への関税引き上げは関税格差を生み出し、ベトナム経由の迂回輸入を助長した。米国の新たな関税政策、特に積み替え品に対する懲罰的関税は転換点を示唆しており、ベトナム企業はサプライチェーンの見直しと再構築を迫られている。

不正行為の検出

米国はベトナムからの輸出に対する貿易防衛調査を最も多く開始しており、2024年時点で64件が記録されています。特に、迂回行為防止調査がますます頻繁に行われています。一般的な不正行為の手口には以下が含まれます。

– ベトナムに表面的な生産ラインを設置し、実質的な変革の基準を満たさない基本的な組み立てや軽微な加工のみを行う。

・半製品を輸入し、最終段階の組み立てのみを行う。

– 完成した中国製品を輸入し、「ベトナム製」と再ラベルして輸出する。

注目すべき事例として、2020年に税関当局が広範囲にわたる原産地偽装を発見したことが挙げられます。自転車(4社)、太陽光パネル(5社)、木製家具(12社)を対象とした検査で、100%の違反が判明しました。これらの企業は主に部品または半製品を輸入し、製品の本質的な特性を変えることのない最小限の加工のみを行っていたため、ベトナム原産の資格を失いました。

ベトナム製品に対する米国の関税政策の推移(2025年4月~7月)

2025年7月2日に発表された米越貿易協定は、ベトナム産品の大半に対する20%一般関税の正式化と、40%懲罰的積み替え関税の導入により、交渉段階を終了しました。この政策転換は、当初の圧力措置から、外交協力を維持しながら原産地偽装に対抗することに重点を置いた、より体系的なアプローチへの移行を示しています。

米国のベトナム製品に対する関税の進捗状況

| 日付 | 政策措置 | ベトナム製品への関税 | 積み替え品に対する関税 | 根拠 |

| 2025年4月2日 | 関税発表 | 46%報復関税の脅威 | 明記されていないが、回避が重要な問題として挙げられている | 大きな貿易赤字と不公平な慣行に対処するため |

| 2025年4月9日~7月9日 | 90日間の交渉停止 | 10%の基本料金に引き下げ | 指定されていない | 二国間貿易交渉を円滑にするため、迂回行為の懸念を含む |

| 2025年7月2日 | 米国・ベトナム貿易協定 | ほとんどの商品に対する一般関税20% | 40%の関税 | ベトナム経由の迂回行為の抑制を目的とした二国間協定の成果 |

出典: B&Company 編集

影響を受ける産業と輸出データ

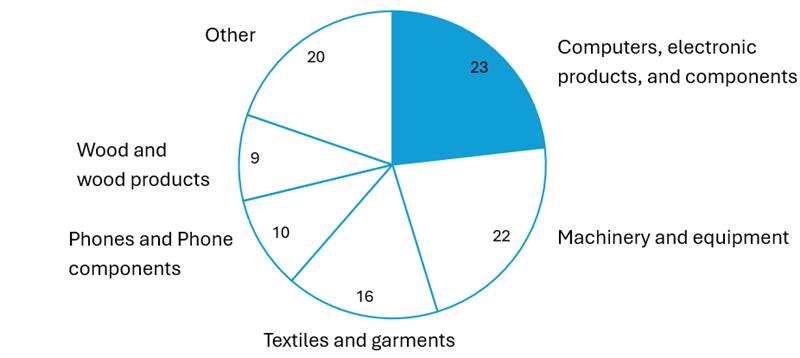

40%迂回関税は、ベトナムの対米主要輸出品すべて、特に中国製の原材料や部品に依存している製品に影響を及ぼす可能性があります。最も影響を受けやすい分野は、電子機器、機械、繊維、家具、履物などです。米国市場への依存度が高いため、新たな原産地規制および積み替え規制に伴うリスクは増大します。

2024年、ベトナムの対米輸出額は約1,200億米ドルとなり、前年比23%増(225億米ドル増)となり、ベトナムの総輸出額の30%を占めた。

2024年のベトナムの対米輸出構造

100%=1200億ドル

出典:ベトナム税関総局

ベトナム企業にとっての主なリスク

– 収益性と競争力40%関税は利益率を著しく低下させ、米国市場での製品の競争力を失わせ、企業撤退を余儀なくさせる可能性がある。

– コンプライアンスの負担: 輸出業者は、「ベトナム製」という主張を証明する全責任を負うことになりました。書類に曖昧な点があれば、懲罰的関税が課される可能性があります。

– サプライチェーン再構築コスト中国からの原材料に依存している企業は代替サプライヤーを探す必要があるが、これはコストがかかり複雑なプロセスであり、業務に支障をきたす可能性がある。

– 執行における不確実性明確で透明な施行ガイドラインがなければ恣意的な実施につながり、ビジネス環境が不安定になる可能性があります。

全体として、40% の迂回関税は大きな課題を提示している一方で、ベトナムの企業と経済全体にとって、能力を強化し、透明性を高め、長期的にはより持続可能な成長モデルを追求する機会も提供しています。

ベトナムにおける日本企業のビジネスチャンス

この変化する政策環境において、ベトナムに投資している日本企業は、以下の4つの主な利点により、独自の利益を享受できる立場にあります。

– 深い製造能力日本企業は通常、先進技術と洗練された生産プロセスに投資し、ベトナム国内で製品の大幅な改良を実現しています。これは、ベトナム原産品が真正であることを強く裏付けています。

– 透明なサプライチェーン日本の厳格なサプライチェーンガバナンスにより、ベトナムで生産された原材料と付加価値の明確な追跡が可能になり、積み替え疑惑に対抗する上で重要な証拠となります。

– コンプライアンスの評判日本企業は規制遵守に関して世界的に高い評価を得ており、米国税関当局との取引において信頼性の優位性を発揮しています。

– 実質的な投資戦略ベトナムへの移転は、便乗した租税回避ではなく、長期的な多角化戦略(すなわち「チャイナ・プラスワン」)に沿ったものです。これは、多額の持続的な投資コミットメントからも明らかです。

*ご注意: 本記事の情報を引用される場合は、著作権の尊重のために、出典と記事のリンクを明記していただきますようお願いいたします。

| B&Company株式会社

2008年に設立され、ベトナムにおける日系初の本格的な市場調査サービス企業として、業界レポート、業界インタビュー、消費者調査、ビジネスマッチングなど幅広いサービスを提供してきました。また最近では90万社を超える在ベトナム企業のデータベースを整備し、企業のパートナー探索や市場分析に活用しています。 お気軽にお問い合わせください info@b-company.jp + (84) 28 3910 3913 |