18Jul2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

The animal feed industry in Vietnam is vital for supporting the country’s growing demand for livestock products. As consumption increases, there is a strong push for innovation and sustainable practices within the sector. This research examines the key trends in Vietnam’s animal feed industry, including the adoption of biotechnology, local sourcing of alternative ingredients, and a focus on sustainability. It also addresses the challenges faced by the industry, such as reliance on imported raw materials, and the opportunities to shift towards more eco-friendly and cost-effective practices. The ultimate goal is to drive long-term, sustainable growth while meeting both market demands and environmental standards.

Market overview

The compound feed market in Vietnam is projected to reach $12.2 billion in 2024 and is expected to grow to $16.2 billion by 2029, at a compound annual growth rate (CAGR) of 5.8% [1]. This growth is primarily driven by the rising domestic demand for livestock products. This trend is clearly reflected in domestic production data, with key products such as eggs (+24.6%), meat (+23.6%), and fresh milk (+20.2%) all showing significant increases in output.

Domestic production of Meat, Eggs, and Fresh Milk (2019-2023)

| Products | Unit | 2019 | 2020 | 2021 | 2022 | 2023 | Difference 2019- 2023 (%) |

| Meat | Thous. tons | 6,345 | 6,480 | 6,855 | 7,359 | 7,846 | 23.6 |

| Eggs | Million | 15,355 | 16,656 | 17,626 | 18,261 | 19,146 | 24.6 |

| Fresh milk | Thous. tons | 986,1 | 1,049.3 | 1,062 | 1,125 | 1,185 | 20.2 |

Source: GSO

Although Vietnam’s industrial animal feed output remains high at around 20 million tons annually, the sector faces a significant challenge: heavy reliance on imported raw materials. Despite producing around 20 million tons of animal feed annually, Vietnam heavily relies on imported raw materials like corn and soybeans, as these are not major crops (unlike rice). Domestic production is limited by outdated technology and small scale, leading to higher costs and instability in supply due to weather and seasonal factors. To meet the production level, Vietnam imports 60-70% of its total raw material demand, including essential components like corn, soybean meal, wheat, vitamins, and minerals, mainly from American countries, such as Argentina, the USA, and Brazil [2]. Imported inputs account for up to 85% of industrial feed production. The import value of raw materials and animal feed increases by around 1 billion USD annually.

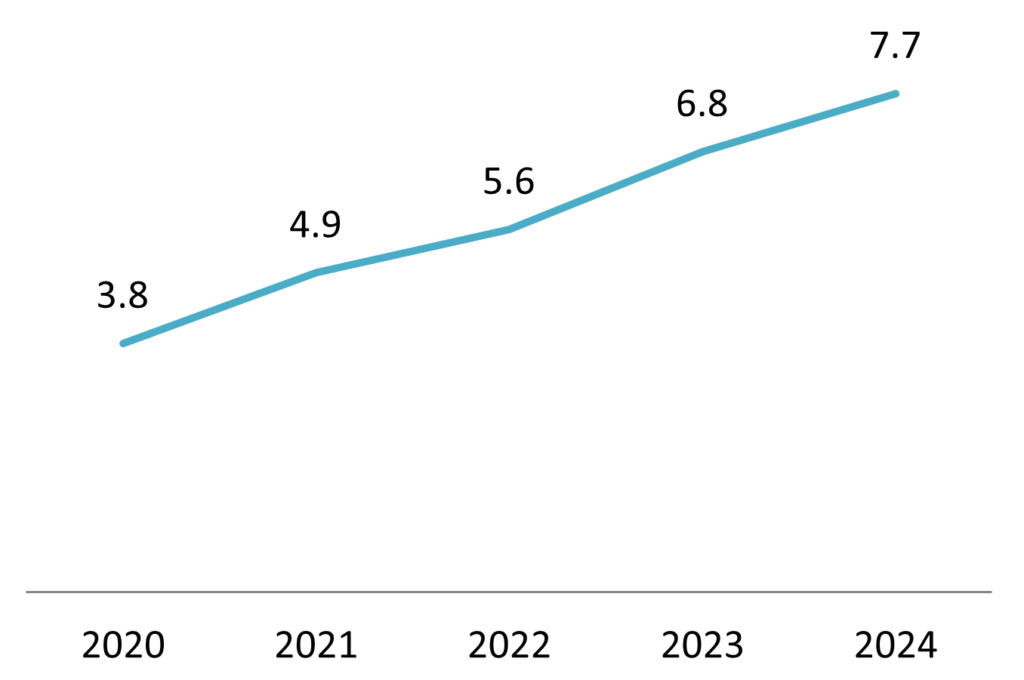

Import value of raw materials and animal feed 2020 – 2024

Unit: Billion USD

Source: B&Company compilation

Innovations in Animal Feed Development in Vietnam

Biotechnology

The revolution in animal feed production is being led by biotechnology. The use of biological additives such as probiotics, prebiotics, and enzymes is becoming an inevitable trend. These technologies not only help improve gut health and enhance nutrient absorption in livestock, but also provide a sustainable alternative to antibiotics, meeting the increasingly stringent food safety standards for both domestic and export markets. Many companies in Vietnam have successfully applied these products, opening up a vast market for providers of advanced biotechnology solutions. For example, TVOne Vietnam is one of the pioneers in developing plant-extract-based feed additives, replacing antibiotics with probiotics and prebiotics. These products help improve gut health, enhance nutrient absorption, and reduce dependence on antibiotics, while ensuring compliance with strict food safety requirements both locally and internationally.

Self-sufficiency through locally sourced alternative ingredients

With the need to reduce environmental impact and increase sustainability, the animal feed industry is shifting towards using alternative ingredients such as insect protein, algae, and agricultural by-products. This helps reduce dependence on imported materials, lower costs, and open long-term development opportunities for the sector. Insect protein, particularly from companies like Entobel (specializing in black soldier fly) and CricketOne (specializing in crickets), is gaining traction. Insect protein helps replace traditional sources like soy and fishmeal, offering high nutrition while reducing pollution. Additionally, crop by-products are also a rich source of fiber, and Vietnam is known for its diverse agricultural crops. Alternative ingredients not only ensure nutrition but also help reduce pollution by creating a sustainable protein source from recycled agricultural by-products.

Opportunities for investors

The increasing focus on the quality of animal feed presents a significant opportunity for Japanese technology companies. In Japan, livestock farming is closely linked with high-tech solutions and sustainable agriculture, which aligns with Vietnam’s current development trends. Japanese companies, with their expertise in advanced technologies such as automation, data management, and biotechnology, have the potential to collaborate with Vietnam’s livestock sector to improve feed quality, optimize production processes, and enhance sustainability in farming practices.

Conclusion

The future of Vietnam’s animal feed industry is marked by significant growth, driven by increasing domestic demand for livestock products. While the sector faces challenges such as heavy reliance on imported raw materials, innovations in biotechnology and the shift towards locally sourced, sustainable ingredients like insect protein and algae are shaping a more resilient and eco-friendly industry. Vietnam’s livestock sector is poised for long-term development, offering attractive opportunities for investors, to collaborate and introduce high-tech solutions. Ultimately, these trends reflect the industry’s commitment to sustainability, efficiency, and meeting global food safety standards.

[1] Mordor Intelligence, Vietnam compound feed market <Access>

[2] VnEconomy, The Livestock Feed Industry Faces a Trade Deficit of 2.65 Billion USD <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |