08Oct2024

Industry Reviews / Latest News & Report

Comments: No Comments.

Overview of the Vietnamese aging population and addressing the importance of elderly healthcare

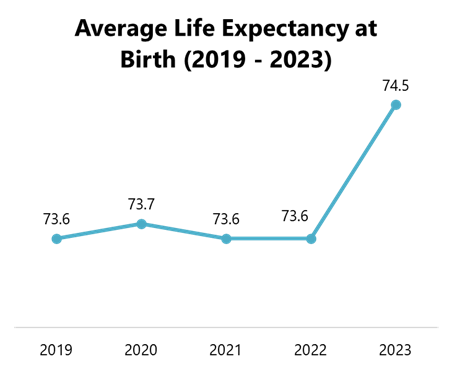

As of 2023, Vietnam is estimated to have 100.3 million people[2], the third most populous country in Southeast Asia (after Indonesia and the Philippines) and ranks 15th in the world[3]. According to the United Nations Population Fund, Vietnam is one of the most rapidly aging countries in the world, and it is predicted that by the year 2036 will transition from an “aging” to an “aged” society[4]. Data from the 2023 population report from the General Statistics Office (GSO) shows that the proportion of those aged 60 and over has risen rapidly, from 11.9% in 2019 to 13.9% in 2023[5]. This demographic change is occurring not only due to a reduction in mortality and an increase in life expectancy but also due to a sharp decline in fertility, leading to a rapid aging process.

Number of elderly people in Vietnam (2019-2023)

| Year | 2019 | 2020 | 2021 | 2022 | 2023 |

| Number of elders | 11.4 million | 11.6 million | 12.6 million | 11.8 million | 13.9 million |

Source: GSO

The table above shows that the number of elderly people quickly rebounded in the post Covid-19 period (2022 compared to 2023), this reflects the rapid aging of the country’s population.

Source: GSO

This underscores the urgent need for a healthcare system capable of addressing the unique needs of older adults, including chronic disease management, long-term care, and mental health support. Ensuring that the elderly receive appropriate care is not only crucial for enhancing their quality of life but also for maintaining the sustainability of the country’s healthcare system.

Current state of the elderly healthcare situation

The Vietnamese elderly healthcare market is facing numerous challenges, among which three stand out as particularly significant: a lack of dedicated caretakers, financial constraints, and inadequate infrastructure in rural areas.

Firstly, regarding caretakers, an ideal traditional family model is a multi-generational family, where multiple members often live together across three or more generations: grandparents, parents, and children. This family model was quite common in the past, allowing elderly individuals to live with their families who took care of them in their final years. However, currently, the multi-generational family model seems to be decreasing due to the impact of economic development, industrial lifestyles, and the influence of international integration trends. As a result, the nuclear family model may become more prevalent in the future, where grown children want their own living space and move out from their elderly parents. Even those grown children who live with their elderly parents may not be present often as work and responsibilities increase, resulting in some families relying on untrained helpers, leading to a lack of dedicated caretakers. According to the Head of the Department of Cultural and Social Research at the Ho Chi Minh City Development Research Institute, in Ho Chi Minh City, 99.5% of elderly individuals receive care at home, while a small number are cared for in institutional settings, mostly those who are elderly, alone, without support, or eligible for Government assistance[6].

Secondly, regarding financial constraints, many elderly people are also relying on limited pensions and insurance, which often do not provide sufficient financial support for decent medical care when needed.

Thirdly, regarding overall infrastructure, particularly in rural areas, is not always accessible for the elderly, making it difficult for them to navigate within their communities, especially those using wheelchairs. The healthcare system for the elderly faces many challenges, particularly for those in remote areas without regular income, as regular health check-ups are not feasible. Consequently, most elderly patients are diagnosed at advanced stages of their illnesses, leading to difficult and costly treatments[7]. These issues highlight the need for improved support and resources for the aging population.

Government policies and support for the elderly care market

The Vietnamese government has recognized the importance of addressing elderly care and has started implementing various policies to support this sector. Several appropriate policies have been issued to ensure all appropriate rights and opportunities for the elderly. Among them, Decision No. 1579/QD-TTg dated October 13, 2020 approving the program for elderly healthcare until 2030[8], and Decision No. 2156/QD-TTg dated December 21, 2021, approving the National Action Program for the Elderly for the 2021–2030 period[9] are the most notable with their consistent goal, that is to ensure legal aid for the elderly is a key priority for the state.

Throughout the years, the Vietnamese Government has had many actions to support the elderly in ensuring their life quality. In Decree No. 76/2024/ND-CP dated July 1, 2024[10], the Government has also timely adjusted the standard of assistance for social protection beneficiaries, including the elderly, to 500,000 VND per month. Additionally, there are 400 private social protection centers nationwide, and more than 200 state-established and managed social protection centers[11]. Relevant agencies also regularly organize legal education and dissemination activities for the elderly.

Opportunities and case studies

The evolving landscape of elderly healthcare in Vietnam with its challenges presents several opportunities to grow, among which two opportunities stand out: elderly care facilities and machinery support for elderly care.

Regarding opportunities for elderly care facilities, the growing needs of the elderly population demand for specialized healthcare services. However, they often face dilemmas in choosing appropriate care services. The idea of moving from family care to a nursing home, where they would spend 24/7 away from their loved ones and familiar surroundings, can cause many elderly people to hesitate, as mentioned above, most Vietnamese elders are used to receiving care from their families in their final years. This situation creates a growing demand for specialized services that offer alternatives to separation from home.

Technological advancements, such as health monitoring devices and mobile applications also provide innovative solutions to enhance elderly care by enabling remote consultations and continuous health monitoring, thereby improving access to care and efficiency in managing elderly health. In 2021, UNFPA cooperated with the Ministry of Health to officially launch the S-Health mobile application, a new platform specifically designed for remote health care for the elderly[12]. In addition, hardware solutions such as monitoring cameras, bed-based heart rate and GPS watches are also in demand. Companies that invest in developing and supplying these solutions can meet the needs of families seeking reliable care solutions for their elderly loved ones.

Some case studies have illustrated both the progress and potential within Vietnam’s elderly care sector. For instance, to meet the need to stay with their families while ensuring thorough care when no family members are available at home, a new model of semi-nursing homes was introduced in 2022 in Hanoi. Nhan Ai Daycare, inspired by elderly care models in Japan, aims to create a safe and enjoyable living environment for the elderly, providing opportunities for social interaction during the day when their family members cannot care for them, while allowing them to return home in the evening[13]. The effectiveness of this model got spread in 2024 when the Khoi Nguyen Investment Group and Genki Living Energy Co., Ltd. officially launched the Genki House care center with a similar semi-nursing home model in Ho Chi Minh City[14].

| Nhan Ai Daycare

Pricing: 600,000 VND/day |

Genki House

Pricing: 533,000 VND/day |

Source: Nhan Ai Daycare[15] and Genki House official website[16]

Conclusion

In conclusion, the elderly healthcare industry in Vietnam is at a crucial turning point. The increasing elderly population presents both challenges and opportunities for growth and improvement. By addressing existing gaps, leveraging Government support, and exploring innovative solutions, Vietnam can develop a more effective healthcare system for its aging population while also allowing this sector to produce economical results.

[1] According to Law No.39/2009/QH12 from the National Assembly, elderly people are Vietnamese citizens aged 60 and above

[2] General Statistics Office. Press release on population, employment status in the 4th quarter and 2023 <Assess>

[3] UN data (2023). Population, surface area and density <Assess>

[4] United Nation Populations Fund (2024). Ageing. <Assess>

[5] General Statistics Office. Press release on population, employment status in the 4th quarter and 2023 <Assess>

[6] VTV (2023). How do elderly choose their healthcare services? <Assess>

[7] VOV (2024). Adapting to population ageing and elderly healthcare. <Assess>

[8] Prime Minister (2020). Approve of the healthcare program for the elderly until 2030. <Assess>

[9] Prime Minister. (2021). Approve of the national action program for the elderly for the period 2021-2030. <Assess>

[10] The Government (2024). Amends for Decree No. 20/2021/ND-CP dated March 15, 2021 about social assistance policies. <Assess>

[11] Journal of State Management (2024). Ensuring social security for the elderly in the context of promoting the construction and improvement of the socialist rule of law state in Vietnam today. <Assess>

[12] UNFPA (2021). Launching the “S-Health” application focusing on elderly care <Assess>

[13] VnExpress (2023). Semi-nursing home. <Assess>

[14] Laborer (2024). Ho Chi Minh City introduces “semi-nursing home” for the elderly. <Assess>

[15] Nhan Ai Daycare service pricing <Assess>

[16] Genki House service pricing <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

- All

- Apparel

- Business

- Business Matching

- Economic

- Energy

- Environment

- Equipment & Appliances

- Exhibition

- Food & Beverage

- Investment

- IT & Technology

- Lifestyle

- M&A

- Manufacturing

- Multi-country Research

- Retail & Distribution

- Temporarily closed

- Tet

- Trade