208 月2025

最新消息及报道 / 越南简报

评论: 没有评论.

越南制造业已成为经济增长的主要驱动力,贡献了该国约四分之一的GDP[1]受越南低廉的劳动力成本和贸易优惠政策的吸引,外国直接投资(FDI)持续涌入该行业。越南政府积极推动工业扩张,并已向外资开放了大部分制造业领域。[2]。B&Company 的这份概述提供了有关市场规模和预测、行业特征和 FDI 趋势、监管环境以及主要参与者概况的数据驱动洞察。

越南制造业市场规模及预测

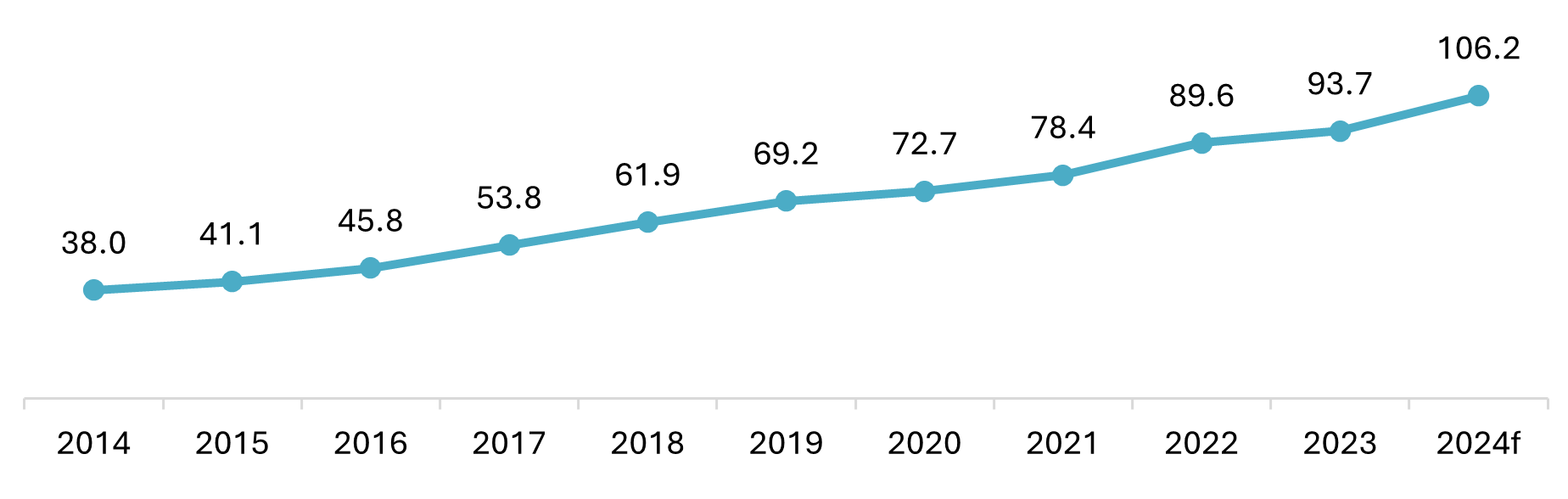

自2005年以来,越南制造业持续强劲增长,成为国民经济的最大贡献者之一。数据显示,2019年至2023年,制造业产值增长了29%,从2019年的795.3亿美元增至2023年的1026亿美元。预计2023年越南GDP总量约为4300亿美元。[3]制造业约占国民生产总值的24-25%,凸显了其在经济增长中的核心作用。政府设定的目标是,到2025年,制造业占GDP的比重将维持在25%左右,到2030年则提升至30%。[4].

Vietnam’s Manufacturing Industry Output at Current Prices (2014–2024)

单位:亿美元

来源:NSO[5]

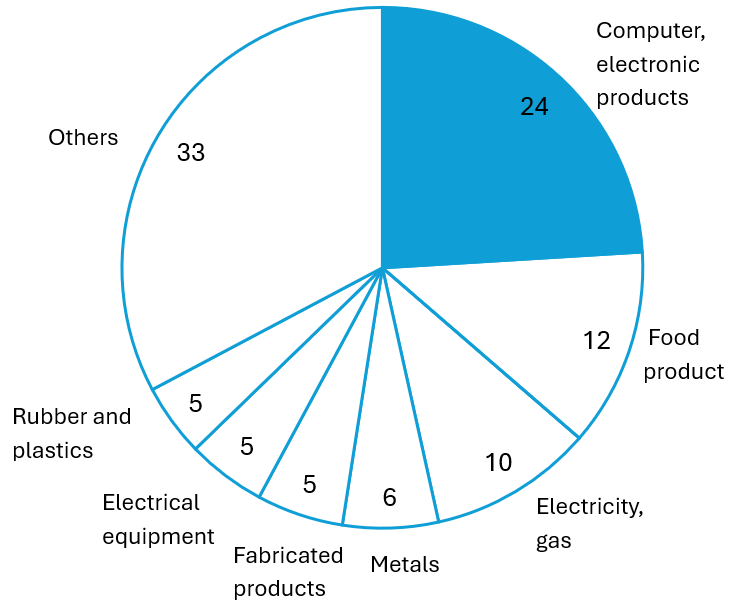

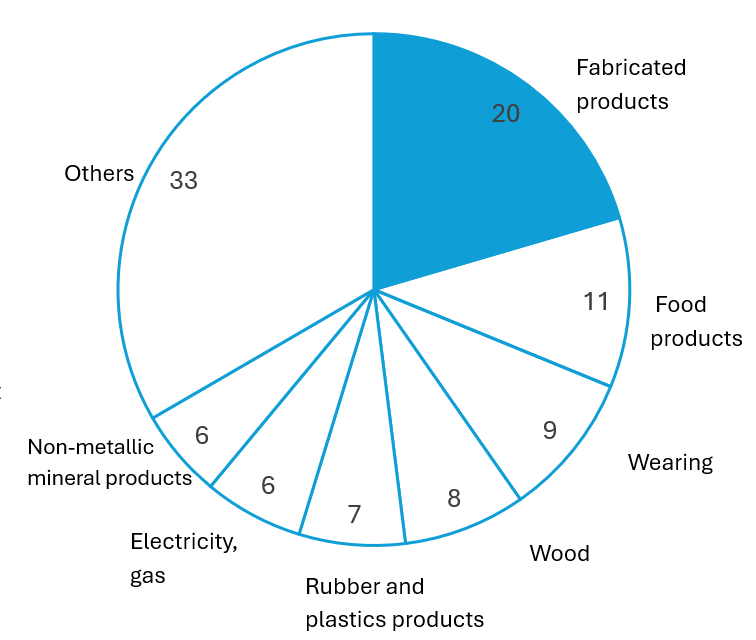

下图基于B&Company的企业数据库,展示了2023年制造业收入及各子行业的企业分布情况。电子产品和食品类产品在收入方面占主导地位,而金属制品、食品和服装类产品在企业数量方面则位居前列,凸显了越南制造业基础的多样性。

| 制造业收入 按子行业划分,2023 年 单位:100% = 5380亿美元 |

制造公司数量 按子行业划分,2023 年 单位:100%=135,642家公司 |

|

|

资料来源:B&Company 的 EDB

越南制造业的市场特征

越南制造业市场由其强大的出口导向和行业专业化塑造。国内企业在钢铁、化工、农业综合企业和消费品等行业占据竞争优势,而电子、手机、纺织、鞋类和机械等高科技领域则主要由大规模出口生产驱动。

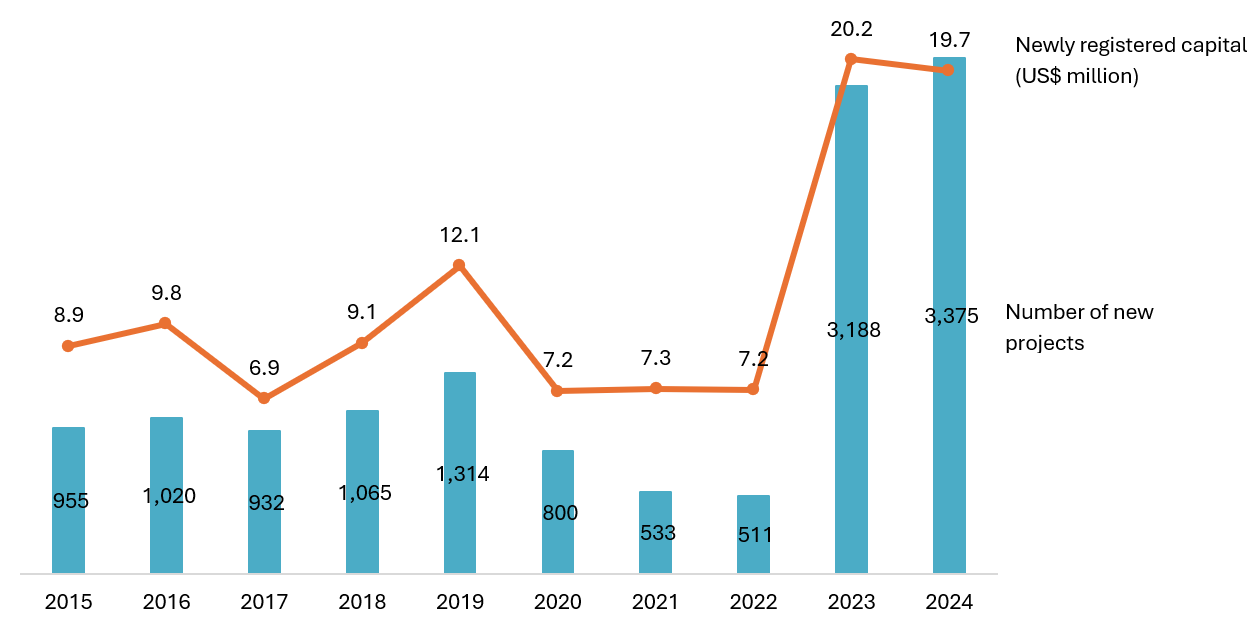

外商直接投资驱动 生长

越南制造业受到外商投资的强劲推动。2015年至2024年,加工制造业每年注册的外商直接投资在70亿至100亿美元之间,而2023年和2024年则飙升至200亿美元以上。即使在疫情期间,由于全球企业寻求实现供应链多元化,该行业的资金流入依然保持强劲。2024年,制造业占已支付外商直接投资的最大份额,约为206亿美元。这一势头延续到了2025年,前七个月吸引了241亿美元的注册外商直接投资,其中61%(约121亿美元)流向了制造业。近期项目包括新的电子工厂、可再生能源设备工厂和汽车装配厂。主要投资者仍然来自韩国、新加坡、中国大陆、日本和台湾,这既反映了高科技扩张,也反映了区域供应链的转变。

FDI into the Manufacturing Sector by Year (2015–2024)

来源: 开放发展越南/MPI[6]

具有竞争力的劳动力和成本

越南制造业保持着显著的成本优势。平均工厂工人每小时工资约为3美元,不到中国的一半。[7]加上年轻的劳动力,这吸引了服装、鞋类和电子产品组装等劳动密集型制造业。到2023年,制造业劳动力将达到1200万人,约占总就业人数的23%。[8]。工资正在逐步上涨,因此提高生产率对于保持竞争力至关重要。

与此同时,中国成本上升和地缘政治不确定性加速了工厂向东南亚迁移的趋势,越南成为主要受益者之一。越南具有竞争力的工资、稳定的投资政策和广泛的贸易协定吸引了众多投资者,使其成为一个极具吸引力的替代生产基地。这种转变巩固了越南在全球供应链中的地位,但也增加了其基础设施升级和生产力提升的需求,以保持长期竞争力。

多元化产业基地

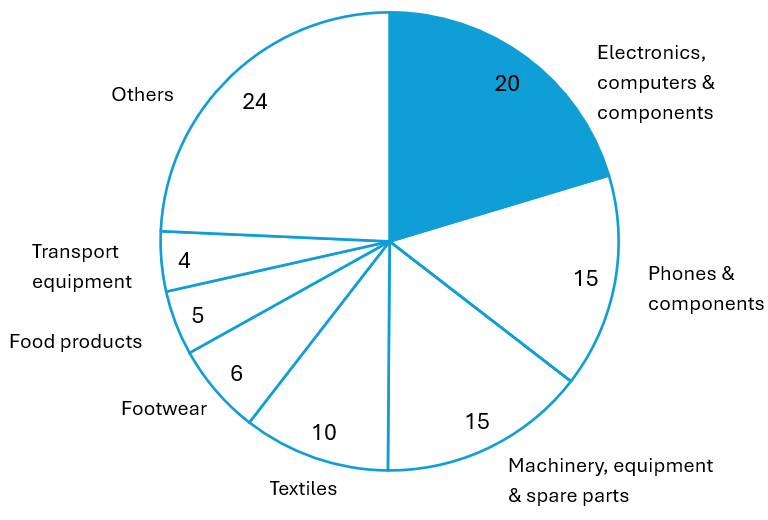

越南制造业涵盖多个关键行业,从高科技电子行业到传统的劳动密集型行业。电子产品、手机和机械设备合计占越南出口总额的40%以上,主要由三星、LG和英特尔等跨国公司推动。同时,纺织品、服装和鞋类仍然是强劲的传统支柱产业,得益于熟练劳动力和广泛的贸易协定。半导体、运输设备和高价值木制品等新兴领域也呈现稳步增长,反映出该国正在向更加多元化的工业基础转型。值得注意的是,半导体组装和测试已开始吸引大量外国投资,使越南成为全球半导体供应链的潜在枢纽。

Vietnam Manufacturing Export Breakdown (2024)

100%=3567亿美元[9]

资料来源:交易经济学[10],GSO

2024年,制造业出口主导着越南的贸易表现,达到3567.4亿美元,占该国出口总额的88%。其中,电子产品、计算机及零部件以726亿美元的出口额领跑该行业,占所有制造业出口的20%以上。这凸显了制造业作为越南出口经济支柱以及电子产品作为其最大、最具竞争力的单一驱动力的双重重要性。

贸易支持政策

越南制造业的增长得益于其通过超过15项自由贸易协定融入全球贸易网络,其中包括CPTPP和欧盟-越南自由贸易协定,这些协定为越南提供了进入国际市场的优惠条件。越南拥有380多个工业园区,并为高科技和配套产业提供税收优惠,为投资者营造了良好的生态系统。[11].

依赖进口原材料和中间产品

目前,越南制造业的大部分生产仍然集中在基础组装阶段,导致其国内生产率与地区其他国家相比相对较低。此外,该行业还面临基础设施瓶颈,例如偶尔出现的电力短缺和港口拥堵,以及先进制造业持续存在的技能差距。劳动生产率虽然有所提高,但仍落后于一些邻国。为了解决这些问题,政府正在投资基础设施升级,推动工业4.0的采用,并扩大职业培训以提高劳动力能力。尽管面临这些挑战,越南制造业仍然保持着快速增长、对外商直接投资依赖度高和多元化程度不断提高的优势,并正逐步从低技术、劳动密集型生产转向电子产品和汽车等更复杂、更高价值的生产活动。随着改革和投资的持续推进,越南已做好准备,巩固其作为东南亚领先制造业中心的地位。

越南制造业法规及投资环境

越南制造业在很大程度上对外国投资者开放,并拥有明确的法规和竞争性激励措施,同时保持对少数战略性行业的控制。注册手续简化,大多数工厂都位于基础设施完善、通关便捷的工业园区。

根据2020年《投资法》和2020年《企业法》,外国投资者通常可以设立所有权为100%的制造企业,并且不像一些邻国那样有统一的合资要求。根据越南法律,某些活动仍然“有条件”(《投资法》附录四和第31/2021/ND-CP号法令),需要当地合作伙伴或外资所有权上限——例如,制造29座以上的汽车、飞机、烟草和特定化学品。完全禁止的制造活动很少见,仅涵盖麻醉品、某些化学品和国防相关武器等敏感物品。

激励措施包括优惠的企业税率、免税期以及面向高科技和出口导向型项目的土地使用优惠。出口加工区(EPZ)和配套工业园区等特殊区域还提供额外优惠,例如进口投入品免税。第1658/QD-TTg号决定等政策旨在促进绿色增长、先进制造业和能源效率。

越南的世贸承诺和贸易协定(例如CPTPP、EVFTA)进一步放宽了市场准入,但某些产品仍需遵守特定法规(例如关于车辆的第70/2018号法令)。劳动、安全和环境法律全面适用,高风险项目需要进行环境影响评估。

虽然越南的投资框架总体开放,但制造业仍存在一些限制。根据《投资法》,许多活动被列为“有条件的”,例如汽车生产、烟草、制药和化学品,这些行业的外资持股比例受到限制,或需要与当地合作伙伴建立合资企业。投资者还需在高风险行业获得额外许可,并遵守更严格的环境和劳动法规。此外,税收和土地使用激励措施主要集中在工业园区和高科技项目,这意味着这些园区以外的制造商可能无法获得同等待遇。

越南制造业的主要参与者

越南制造业由领先的外资企业和具有竞争力的国内企业共同构成。三星、LG 和英特尔等跨国公司在电子和半导体等高科技领域占据主导地位,而 VinFast、Vinamilk 和和发集团等本土龙头企业则在汽车、消费品和重工业领域发挥着关键作用。

越南制造业的一些主要参与者

| 公司 | 国家 | 成立 | 总部 | 网站 | 部门 |

| 三星电子越南 | 韩国 | 2008 | 北宁省 | https://www.samsung.com/vn | 手机和电子产品 |

| LG Display越南 | 韩国 | 2016 | 海防市 | https://www.lgdisplay.com | OLED显示屏 |

| 英特尔产品越南 | 美国 | 2006 | 胡志明市 | https://www.intel.com | 计算机芯片 |

| 文法斯特 | Vietnam | 2017 | 河内 | https://vinfastauto.com | 汽车 |

| 越南牛奶 | Vietnam | 1976 | 胡志明市 | https://www.vinamilk.com.vn | 乳制品 |

| 和发集团 | Vietnam | 1992 | 河内 | https://www.hoaphat.com.vn | 钢 |

| 马山消费者 | Vietnam | 1996 | 胡志明市 | https://www.masanconsumer.com | 食品和饮料 |

| 越南宝成 | 台湾 | 1994 | 同奈 | https://www.pouchen.com | 鞋类 |

| 台塑河静钢铁 | 台湾 | 2008 | 河静省 | https://www.fhs.com.tw | 钢 |

| 雀巢越南 | 瑞士 | 1995 | 同奈 | https://www.nestle.com.vn | 食品和饮料 |

来源: B&Company企业数据库

结论

越南制造业是国民经济的基石,其快速增长、外商投资以及日益多元化的产业基础为其提供了强劲动力。制造业融入全球供应链,并得到强有力的政策支持,使越南成为东南亚领先的生产中心之一。然而,制造业仍存在诸多限制:严重依赖进口投入、由于集中于装配环节导致国内附加值较低、基础设施受限以及先进制造业技能短缺。通过加强供应链本地化、基础设施升级和劳动力发展来应对这些挑战,对于越南保持竞争力并进一步提升其在全球价值链中的地位至关重要。

[6] 越南简报,越南制造业追踪:更新至2025年7月评估>

[8] 越南简报,越南制造业追踪:更新至2025年7月评估>

*如果您想引用本文中的任何信息,请注明来源以及原始文章的链接,以尊重版权。

| B&Company

自 2008 年以来,日本第一家专门从事越南市场研究的公司。我们提供广泛的服务,包括行业报告、行业访谈、消费者调查、商业配对。此外,我们最近还开发了一个包含越南 900,000 多家公司的数据库,可用于搜索合作伙伴和分析市场。 如果您有任何疑问,请随时与我们联系。 信息@b-company.jp + (84) 28 3910 3913 |