24Jul2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

While the country remains an attractive FDI destination with growing investment, challenges such as bureaucratic barriers, lack of transparency, and land access persist. The ongoing administrative consolidation causes temporary disruptions. This report analyzes Vietnam’s administrative reforms and their impact on the FDI environment.

Vietnam’s FDI Attraction Landscape

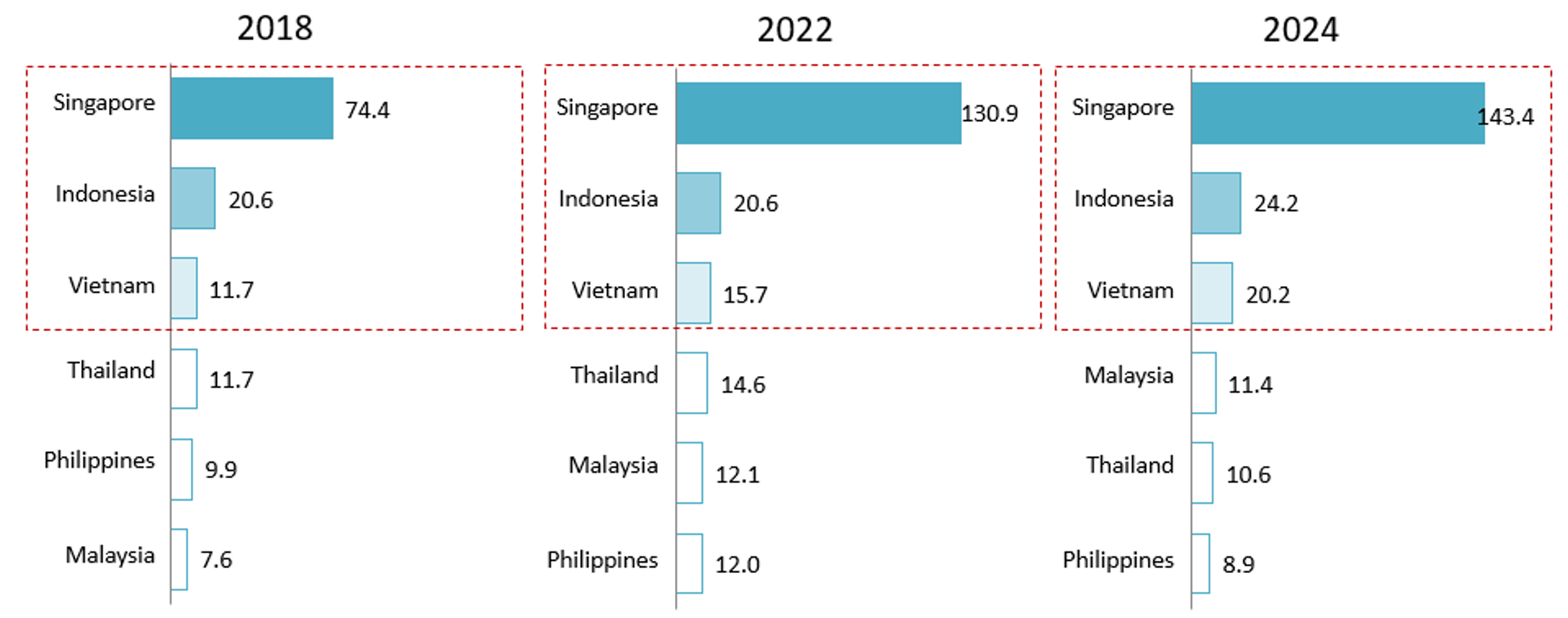

On both regional and global levels, Vietnam has firmly established itself as one of the most attractive destinations for foreign direct investment (FDI). Despite global economic volatility, FDI inflows into Vietnam continue to show robust growth. In 2024, record-high disbursed FDI of USD 20.1 billion USD was recorded, marking a 9.4% increase compared to the previous year. Beyond headline figures, Vietnam has consistently ranked among the top three FDI recipients in ASEAN-6. While FDI inflows into countries like Malaysia, Thailand, and the Philippines have plateaued, Vietnam has maintained impressive momentum, ranking 3rd, behind Singapore and Indonesia. At the same time, Vietnam’s global competitiveness has significantly improved, with a 10-place jump in the World Economic Forum’s Global Competitiveness Index in 2019—reflecting the success of economic reforms and overall macroeconomic stability.

FDI inflow in ASEAN 6 – 2018, 2022, and 2024

Source: ASEAN stats

Vietnam’s FDI attraction strategy has shifted from focusing on the number of projects and labor- or land-intensive sectors to prioritizing capital quality, economic efficiency, and high-tech, high value-added, and environmentally friendly industries. Vietnam now emphasizes investment in core sectors. These include high technology, high-tech supporting industries, semiconductors, artificial intelligence (AI), research and development (R&D), digital economy, renewable energy, and advanced manufacturing projects with modern management and global supply chain integration.

Vietnam’s Administrative Reform

Key Administrative Barriers Facing Businesses in Vietnam

Complex administrative procedures and regulatory challenges remain significant obstacles for foreign businesses operating in Vietnam. JETRO’s 2023 survey shows that Japanese companies see complex administrative procedures as a major risk, especially in fast-moving sectors like e-commerce, where slow licensing can lead to lost business [1]. EuroCham reports similar concerns from European firms, including heavy bureaucracy, unclear rules, and work permit challenges for foreign experts—often due to unrealistic qualification requirements [2]. In Vietnam, VCCI’s 2023 PCI report also highlights these issues. Over 10,000 businesses reported problems with land access, policy inconsistency, and a disconnect between provincial leaders’ intentions and how local departments carry them out [3]. These gaps reduce trust in the transparency and stability of the local investment environment.

Administrative Reform Agenda and Structural Overhaul

To address these challenges, the Vietnamese government is implementing the Master Program on State Administrative Reform for the 2021–2030 period, aimed at creating a leaner, more modern public administration. This effort is built on six key pillars: institutional reform, administrative procedures, organizational restructuring, civil service reform, public finance, and digital government. Ambitious goals—such as reducing compliance costs by 20% and fully digitizing administrative procedures—reflect a strong commitment to building a transparent, efficient, and business-friendly environment [4]. However, in practice, a significant gap remains between central policy direction and local-level implementation, which continues to shape the real experience of foreign direct investors (FDI) in Vietnam.

A tangible outcome of this reform is the ongoing merger of district- and commune-level administrative units from 2023 to 2030. The goal is to streamline bureaucracy, reduce redundancy, and expand development space. At the commune level, several neighboring communes may be combined to form a single, larger commune. Similarly, at the district level, multiple smaller districts may be merged into a bigger district. For example, Hanoi carried out a wide-ranging ward-level merger after 2025, reducing the number of wards in its 12 urban districts from 153 to just 51 [5]. Ho Chi Minh City restructured its administrative units by merging multiple wards and communes across various districts, cutting the total number from 273 to 102 [6] This reduces the total number of administrative units, helping to simplify governance structures. The roles and responsibilities of local officials may be adjusted, with some positions eliminated or combined. The restructuring aims to create more efficient and capable administrative units that can better manage resources, deliver public services, and support local development.

From 2026 to 2030, the reform agenda will shift from “streamlining” to “upgrading” the quality of governance. Key priorities include the completion of a coherent legal and institutional framework, expansion of digital transformation, and building a more capable, professional civil service. A flexible, results-oriented management approach is also being adopted, with midterm evaluations and policy adjustments expected to play a central role.

Transitional Issues in Administrative Reform

Short-term effect

In the short term, this merger process poses several practical challenges for businesses, particularly for foreign direct investment (FDI) projects that are already operating in directly affected areas. First, businesses risk losing their established stable administrative relationships with local authorities due to changes or transfers of officials, forcing them to rebuild their networks from scratch. Second, during the transition phase, confusion over authority may occur, causing delays in the processing of dossiers, permits, and project-related procedures. Third, at the newly formed administrative units, existing policies may be altered or discontinued, risking the invalidation of previously committed investment incentives. Additionally, changes in place names and administrative boundaries can create instability among local communities, indirectly affecting the investment environment and business operations.

Long-term effect

In the long term, the goal of the program is to establish larger administrative units with stronger capacities and more professional apparatuses, thereby simplifying the relationship between investors and authorities through a more unified and efficient single point of contact. Administrative reform in Vietnam is expected to deliver substantial benefits over time. These include the elimination of overlapping responsibilities, greater transparency in public service delivery, and the creation of larger, more viable economic zones attractive to industrial investment. Regional coordination is also likely to improve, especially as provinces with similar economic strengths are grouped under unified planning strategies. Notably, the reorganization will result in 21 coastal provinces nationwide, providing inland areas with new growth opportunities in tourism, logistics, and transportation.

Recommendation

Facing these challenges, FDI firms should proactively build adaptive strategies. For new or expanding projects in merger-affected areas, enhanced due diligence is essential. This includes not only assessing infrastructure and labor but also understanding merger timelines, future leadership, and policy stability.

Once new administrative units are formed, companies should promptly meet local leaders to reconfirm all permits, incentives, and agreements in writing, ensuring legal continuity. If issues arise at the district or commune level during transition, firms should escalate to provincial authorities like the People’s Committee or Department of Planning and Investment, who have the authority to resolve administrative hurdles.

Beyond short-term actions, Japanese investors need to adjust medium- and long-term strategies to the evolving legal environment. Building an internal “provincial competitiveness scorecard” based on VCCI’s PCI report will help evaluate investment locations with concrete data, including unofficial costs, government dynamism, and time costs. Firms should also develop strong government relations and actively monitor policy changes.

Mastering the new Land Law for 2024 is crucial. Companies should hire specialized legal consultants to understand its impact, especially the shift to market-based land rental costs. For M&A and strategic partnerships, dual due diligence—covering both legal-administrative and financial-business aspects—is vital, given that administrative boundary changes may affect permits, land rights, or environmental obligations.

Finally, to secure sustainable human resources, Japanese firms should invest in local talent development. Training Vietnamese professionals not only eases visa and work permit challenges for foreign experts but also leverages Vietnam’s demographic advantage and lowers mid- to senior-level labor costs.

Conclusion

Vietnam’s administrative reform is a long-term structural shift, not just a temporary policy change. While the country has improved its “hard infrastructure” like transport, ports, and energy, the key challenge for investors now lies in navigating the “soft infrastructure” — governance, legal systems, and bureaucracy. There is still a gap between macro-level reform goals and micro-level implementation issues, but the reform direction remains clear and consistent. The government has shown a strong commitment to improving the business environment. For business, building internal capacity to navigate regulations, engage local authorities, and manage uncertainty is the most practical and strategic approach for investors.

Reference

[1] Vietnam Finance, Bureaucratic and complex administrative procedures represent the most significant risk to the investment environment in Vietnam <Access>

[2] EuroCham, Business Confidence Index Report Q2/2025 <Access>

[3] VCCI, PCI 2023 Report <Access>

[4] Bộ Nội Vụ, Decision no 76/NQ-CP <Access>

[5] Vietnam Plus, Hanoi announces restructuring plan for administrative units <Access>

[6] Dai bieu Nhan dan, Details of the 168 commune-level administrative units of Ho Chi Minh City after the merger. <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |