Vietnam’s coffee industry, which is the world’s second-largest coffee exporter, contributes significantly to the country’s economy. This article focuses on analyzing the current market trends, challenges, and future growth potential of the Vietnamese coffee industry, and also examines the opportunities for Japanese companies entering the market.

Current Market Situation and Trends

Vietnam is the world’s second-largest coffee producer, with the main variety being Robusta. In addition, there are other varieties of coffee such as Arabica, Culi, Cherry, and Moka, each with its own flavor and characteristics [1]. Vietnam’s main coffee growing areas are concentrated in the Central Highlands, especially Dak Lak, which is considered the “coffee capital” of Vietnam with the largest area and output in the country [2]. In the 2023-2024 crop year, Vietnam will export about 1.45 million tons of coffee, reaching a value of more than 5.4 billion USD, the highest ever. Vietnamese coffee is now present in over 80 countries and territories, with a large market share in Europe (48%), Asia (21%) and the US (6%).

In 2023, Vietnam exported about 1.62 million tons of coffee, down 8.7% compared to 2022. However, export turnover reached a record of more than 4.24 billion USD, up 4.6% compared to the previous year. The average export price of coffee in 2023 reached 2,614 USD/ton, up 14.5% compared to 2022. [3]In 2024, Vietnam’s coffee output continued to be negatively affected by climate change and increased production costs. According to the Vietnam Coffee and Cocoa Association (VICOFA), coffee output in the 2023-2024 crop year decreased by 10% compared to the previous crop year, down to about 1.6 million tons, due to the impact of climate change and farmers’ conversion to more economically efficient crops [4].

Vietnam is the world’s second-largest coffee producer

Source: Chinhphu.vn

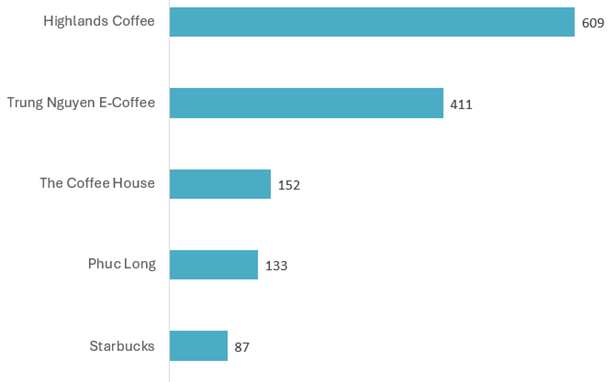

The Vietnamese coffee market is witnessing the strong growth of coffee shop chains and the increase in specialty coffee consumption. According to data from Vietdata, the number of coffee shops in Vietnam has increased from 816 in 2019 to 1,657 in 2023, showing the rapid expansion of domestic coffee chains [5]. This trend reflects consumers’ demand for unique flavors and high quality coffee. In addition, take-away and home-brewed coffee models are also increasingly popular among young people, thanks to their convenience and suitability for modern lifestyles [6].

Leading coffee shop chain in Vietnam as of March 2023, by number of stores

Source: Statista.com

Coffee Market Opportunities in Vietnam

Vietnam’s coffee industry still has great growth potential despite facing many challenges. First of all, domestic coffee demand is growing strongly, especially as the middle class expands and the economy recovers from the pandemic. Many domestic and international coffee chains continue to invest in expanding their scale and improving their products. Large enterprises such as Trung Nguyen, Intimex, and Louis Dreyfus have invested in instant and specialty coffee production to meet new consumer needs [7].

Vietnam also has the opportunity to develop a sustainable coffee industry, especially in the Central Highlands – the country’s main coffee-producing region, with production linkage models and high technology in supply chain management. These initiatives aim to enhance the position of Vietnamese coffee in the international market, meeting the quality requirements of markets such as Japan and Europe [8].

The application of high technology in coffee production and processing helps increase efficiency, ensure quality that meets international standards, and enhance competitiveness in the global market. Vietnamese enterprises are investing in automation lines and expanding production scale to meet export requirements for demanding markets, thereby promoting sustainable development and increasing the value of the Vietnamese coffee industry.

Coffee chains are constantly expanding, especially in prime locations

Source: Theleader.vn

On the other hand, Vietnam also has the opportunity to develop a sustainable coffee industry with joint production models, especially in the Central Highlands – the coffee-growing capital of the country. Sustainable coffee production and the application of high technology in supply chain management are increasingly being promoted to strengthen the position of Vietnamese coffee in the international market [9].

Current Challenges

The Vietnamese coffee industry is facing a number of major challenges. First is the impact of climate change, which causes erratic weather patterns, reducing crop yields. In addition, the high cost of raw materials for production while world coffee prices fluctuate frequently, causing many financial difficulties for farmers and production enterprises [10]. In addition, fierce competition between international brands such as Starbucks, and Wayne’s Coffee along with domestic brands such as Highlands Coffee, The Coffee House, and Katinat is creating great pressure in the F&B industry [11].

A corner of a coffee farm during harvest season in Dak Lak

Source: Bnews.vn

Market Entry Opportunities for Japanese Businesses

With the increasing trend of consuming high-quality coffee, the Vietnamese market is becoming an attractive destination for international investors, especially Japanese enterprises. Japanese companies such as Marubeni and Intimex have started investing in instant coffee processing plants in Vietnam, aiming to exploit the advantages of abundant raw materials and the growing demand of consumers in the region.[12]

In addition, more and more Vietnamese organic coffee is being exported to Japan, meeting the increasing demand of Japanese consumers for products of natural origin, high quality and environmentally friendly. This trend represents a great opportunity for Vietnam to boost the export of organic and specialty coffee to the Japanese market, expanding the high-end coffee segment and increasing the value of Vietnamese products.[13]

The presence of Japanese enterprises in Vietnam not only brings advanced technology in the production and processing of coffee but also increases the added value of the products. In addition, these enterprises can also act as a bridge between Vietnamese coffee and other demanding markets such as Japan, which is one of the largest coffee-consuming countries in Asia. [14].

Conclusion

Vietnam’s coffee industry is currently in a development stage with many opportunities and challenges. The increasing demand for domestic coffee consumption, along with the presence of many international brands, creates great potential for Vietnam to not only consolidate its position as a major coffee-producing country but also build a high-quality coffee brand. In particular, Vietnam’s coffee export market is expanding, with a turnover of 4.24 billion USD in 2023, the highest level ever. The main export markets include the European Union, the United States and Japan. Notably, Japan is one of Vietnam’s major coffee consumption markets, with increasing demand for high-quality coffee products and organic coffee. The export of organic coffee to Japan has been strongly promoted, demonstrating great potential in enhancing the value and expanding the market for Vietnamese coffee [15].

[1] https://thanhnien.vn/vuot-qua-bat-on-ca-phe-robusta-viet-nam-len-huong-nho-con-duong-canh-tac-huu-co-1851027551.htm

[2] https://tuoitre.vn/ca-phe-viet-nam-dang-o-dau-tren-ban-do-the-gioi-20230304195102693.htm

[3] https://www.vietnam.vn/kim-ngach-xuat-khau-ca-phe-cua-viet-nam-nam-2023-cao-ky-luc-dat-424-ty-usd/

[4] https://mediacdn.vietnambiz.vn/1881912202208555/files/2024/01/26/bao-cao-thi-truong-ca-phe-nam-2023-20240126121521818.pdf

[5] https://cafebiz.vn/nhon-nhip-nhu-thi-truong-coffee-shop-viet-nam-17623092707120274.chn

[6] https://cleverads.vn/blog/thi-truong-ca-phe/

[7] https://www.bsc.com.vn/tin-tuc/tin-chi-tiet/982726-trien-vong-nao-cho-nganh-ca-phe-nam-2023

[8] https://vinanet.vn/nong-san/thong-tin-phan-tich-dac-diem-xu-huong-nganh-va-doanh-nghiep-ca-phe-viet-nam-745574.html

[9] https://vinanet.vn/nong-san/thong-tin-phan-tich-dac-diem-xu-huong-nganh-va-doanh-nghiep-ca-phe-viet-nam-745574.html

[10] https://nld.com.vn/lanh-te/nang-gia-tri-ca-phe-viet-thi-truong-trong-nuoc-dang-len-2023030222305758.htm

[11] https://vinanet.vn/nong-san/thong-tin-phan-tich-dac-diem-xu-huong-nganh-va-doanh-nghiep-ca-phe-viet-nam-745574.html

[12] https://cleverads.vn/blog/thi-truong-ca-phe/

[13] https://trungtamwto.vn/tin-tuc/25859-ca-phe-huu-co-viet-nam-xuat-khau-vao-thi-truong-nhat-ban

[14] https://vinanet.vn/nong-san/thong-tin-phan-tich-dac-diem-xu-huong-nganh-va-doanh-nghiep-ca-phe-viet-nam-745574.html

[15] https://trungtamwto.vn/tin-tuc/25859-ca-phe-huu-co-viet-nam-xuat-khau-vao-thi-truong-nhat-ban

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

Summary of the 10 most read articles on BC website in 2024 - B-Company