The fast food industry in Vietnam has experienced strong growth in recent years, reflected in the increase of chain stores and changes in people’s consumption habits. This article analyze the current situation and trends of the fast food market in Vietnam, and evaluate the potential of Japanese enterprises when participating in this market.

Current situation of fast food industry in Vietnam

The fast food market in Vietnam has witnessed significant growth over the past decade. According to a report by iPOS, the Vietnamese F&B industry market in 2024 is expected to increase by 10.9% compared to 2023, with a value of more than VND 655 trillion in 2024. [1]This growth is driven by many factors, including rising incomes, busy lifestyles, and the popularity of online food delivery apps.

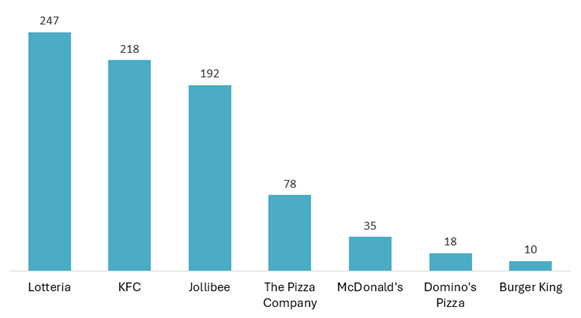

International brands such as KFC, Lotteria, McDonald’s and Burger King have been present in Vietnam since the 1990s and continue to expand their network of stores. As of October 2024, Lotteria leads with 247 stores, followed by KFC with 218 stores and Jollibee in third with 192 stores. The remaining chains include The Pizza Company with 78 stores, McDonald’s with 35 stores, Domino’s Pizza with 18 stores.

Number of fast food chain stores in Vietnam as of October 2024

Source: znews.vn

Fast food brands in Vietnam are focusing on different core products. KFC stands out with its traditional fried chicken, along with burgers and side dishes. Lotteria also prioritizes fried chicken, while also offering burgers and hot dogs. McDonald’s mainly serves burgers, fries and fried chicken. Meanwhile, Pizza Hut and Domino’s Pizza focus on a variety of pizzas, with pasta and salads as side dishes. Jollibee stands out with fried chicken, burgers and spaghetti, while Burger King specializes in burgers. The Pizza Company also focuses on pizza, pasta and side dishes such as salads and chicken wings .

Customer behavior on fast food market in Vietnam

According to Coc Coc’s “Unlocking the Fast Food Industry” report in October 2023 and surveying 973 respondents, the fast food market in Vietnam is growing strongly, with 45% of consumers using it at least once a week, mainly in the age group from 18 to 34 [2].

Key factors that determine customers’ choices include quality, affordability and convenience. In addition to direct purchases, consumers are increasingly opting to order via food delivery apps. Lunch and dinner are the most popular times to consume fast food, indicating that convenience is playing an increasingly important role in eating habits.

McDonald’s adds new dishes to its menu to suit Vietnamese people

Source: Mqflavor.com

Fast food market trends in Vietnam

Some prominent trends in the fast food market in Vietnam include:

- – The rise of online food delivery services : Apps like ShopeeFood, GrabFood and GoFood have become popular ways for consumers to order fast food. According to a report by Momentum Works, in 2023, the online food delivery market in Vietnam reached a total transaction value (GMV) of US$1.4 billion, up 27% year-on-year. In terms of market share, Grab leads with 47%, followed by ShopeeFood with 45%, Baemin with 5% and Gojek with 3%.[3]

- – Diversifying menus and flavors : Fast food brands are making efforts to adapt their menus to local tastes, including introducing Vietnamese-inspired dishes or fusions of Western and Vietnamese cuisine. For example, McDonald’s has launched the Pho Burger, combining the traditional pho flavor with its signature burger [4]. Similarly, KFC has introduced fried chicken dishes with garlic fish sauce, with a strong Vietnamese flavor, to meet the culinary preferences of domestic consumers.[5]

- – Focus on health and quality : Consumers are increasingly health conscious, so fast food chains are focusing on providing healthier options, using fresh ingredients and minimizing preservatives. For example, KFC has introduced fresh salads and grilled chicken instead of focusing on traditional fried chicken, to reduce fat and calories in the diet [6]. Similarly, McDonald’s has added natural fruit juices and yogurt to the menu, providing more nutritional options for customers.[7]

Potential of Japanese enterprises in the Vietnamese market

Although Japanese fast food chains have not yet developed strongly in Vietnam, supermarkets such as Fuji mart or convenience stores such as 7-Eleven, FamilyMart and Ministop have contributed to bringing Japanese culinary flavors to Vietnamese consumers. At these stores, you can easily find typical fast foods such as rice balls (onigiri), boxed rice (bento), cold noodles (soba), and many types of Japanese cakes. These products are not only convenient but also suitable for Vietnamese tastes, helping to diversify daily culinary choices.

Convenience store rice balls are fast food that are very popular with young people

Source: Kenh14.vn

Potential of fast food industry in Vietnam in the context of internationalization and opportunities for Japanese enterprises

Currently, many Japanese enterprises are paying attention to the consumer culture of Vietnam. Japanese food, with its outstanding healthiness and freshness, is popular not only among young consumers but also among Vietnamese families. Dishes such as sushi, ramen and Japanese-style rice dishes have become popular trends, and this is a strength that helps Japanese brands easily enter the market and build brand reputation.

In addition, Japanese convenience store chains such as 7-Eleven have successfully exploited the Vietnamese market, creating a large and accessible distribution channel for customers. The presence of these chains not only helps to enhance the image of Japanese brands but also facilitates Japanese fast food products to reach Vietnamese consumers more easily. Combining fast food sales at convenience stores is becoming a trend, and Japanese brands can take advantage of this channel to expand the market.

Conclusion

The fast food industry in Vietnam is growing strongly, with many international and domestic brands entering the market. However, Japanese businesses have not focused on building specialized fast food chains, but instead, they bring fast food products to convenience store chains (combini) such as FamilyMart, Ministop and supermarkets, meeting the demand for dishes such as onigiri rice balls, bento and many other Japanese dishes. The increase in preferences for Japanese cuisine along with the love of Japanese culture opens up great potential for Japanese fast food chains in Vietnam. In the future, if Japanese businesses develop fast food chains with the right strategy, they can completely achieve sustainable success, and at the same time become a bridge to bring Japanese culinary culture closer to Vietnamese consumers.

[1] https://mqflavor.com/thi-truong-thuc-an-nhanh-viet-nam-dau-hieu-khoi-sac-trong-boi-canh-binh-thuong-moi/

[2] https://qc.coccoc.com/vn/news/bao-cao-thi-truong-mo-khoa-nganh-do-an-nhanh

[3] https://vietnambiz.vn/nguoi-viet-chi-14-ty-usd-de-dat-do-an-online-tren-grab-shopeefood-202413015153925.htm

[4] https://mcdonalds.vn/news/burger-vi-pho-su-ket-hop-doc-dao-tu-mcdonalds-21.html

[5] https://kfcvietnam.com.vn/menu

[6] https://maneki.marketing/kfc-marketing-strategy/

[7] https://bepos.io/blogs/thi-truong-thuc-an-nhanh-viet-nam/

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles