10Sep2024

Highlight content / Industry Reviews / Latest News & Report

Comments: 1 Comment.

Overview of the Agricultural Sector in Vietnam

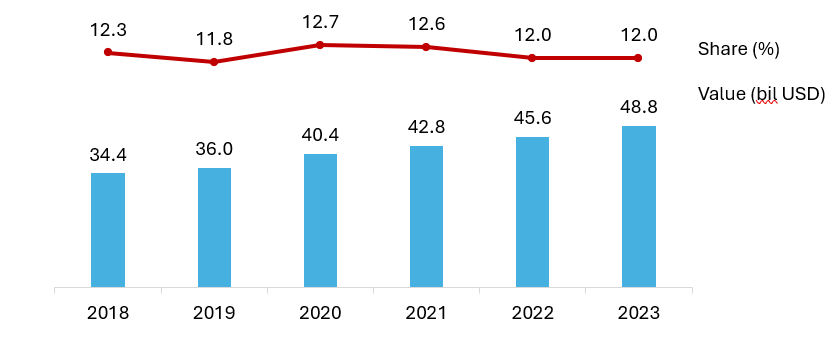

The agricultural[1] sector is one of the main pillars of the economy in Vietnam. Although there are still some limitations and the contribution to GDP tends to slightly due to Vietnam’s shift from agriculture to industry and services, this sector has continued to grow, with a CAGR of 7.2% from 2018-2023, reaching 48.8 billion USD and accounting for 12% of GDP in 2023.

Figure 1. Contribution to GDP of Agriculture in Vietnam

Source: GSO (2024)

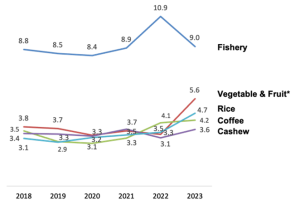

In addition, the significant role of this sector is also reflected in Vietnam’s agricultural products export situation. Vietnam is currently ranked 2nd in Southeast Asia and 15th globally in agricultural exports[2]. In 2023, Vietnam’s agricultural products recorded a trade surplus of over $12 billion[3], with major items such as fishery products, fruits and vegetables, coffee, cashews, rice, etc.

Figure 2. Some key agricultural export products

Unit: Tril. USD

Source: GSO (2024)

Alongside the bright points, Vietnam’s agriculture sector still faces certain limitations. Firstly, the agricultural sector is still managed in a small-scale farming manner, leading to high risks and low efficiency, as well as low added value and competitiveness of goods. Currently, agricultural exports are mainly based on price competitiveness in the low-quality segment, not on the advantage of quality competitiveness. This requires changes in production, especially in the context of increasingly high standards for food safety, traceability, and technical barriers related to the environment (e.g. Japan, EU, etc.) in both domestic and foreign markets[4].

Secondly, Vietnam’s agriculture is facing major challenges from climate change. It is forecasted that if the sea level rises by 1 meter, the productivity of rice cultivation in the Mekong River Delta could decrease by 40.5%. Furthermore, most of the Red River Delta and Mekong River Delta could be submerged by rising sea levels by 2070, affecting the fisheries sector[5].

Thirdly, there is a shortage of high-quality labor in the agricultural sector. As by MARD in 2021, 57%[6] of the labor force is still unskilled, working based on experience and seasonality, lacking highly skilled workers. Regarding the working age, the majority are still elderly, with the number of workers aged 50 and above accounting for 42.8%[7] in 2021. This leads to difficulties in training, technology transfer, etc.

The Trend of Smart Agriculture in Vietnam

Smart agriculture can be considered as one optimal solution to address the aforementioned challenges of agriculture sector in Vietnam. There is currently no official concrete definition but smart agriculture can be widely perceived as the application of ICT technologies such as precision devices, IoT, sensors, big data management, etc. into agricultural processes. Applying smart agriculture helps related stakeholders to (1) add value by making more effective exploitation and management decisions, (2) increase the connectivity between producers and information, and better manage production; and (3) improve investment efficiency and reduce environmental harm.

Specifically, some applications of smart agriculture include the application of high technology (e.g. IoT, automation, etc.) in production and cultivation to optimize each part of the production process (fertilizers, irrigation, plant protection treatment, etc.), or reducing environmental pollution, as well as automatically responding to climate change. In addition, the smart agriculture model can also be applied to enhance supply chain integration and information connectivity. For example, the establishment of digital platforms to connect with production input services such as seeds, fertilizers, pesticides, weather forecasting services, market demand and standards, etc. can provide farmers with more information to make accurate production decisions. Furthermore, technologies such as blockchain, IoT, AI, etc. can also be applied to manage the value chain and trace origin from farm to table.

Regarding policy directions, smart agriculture has been identified as one optimal solution for the agriculture sector in the Strategy for Sustainable Agricultural and Rural Development for the period 2021-30, with a vision to 2050 (Resolution 19/NQ-TW/2022). Additionally, the strategy document also states that Vietnam promotes the establishment of a national agricultural database and its integration with the national database on demographics, economy, environment, meteorology and hydrology, as a basis for analyzing, developing strategies, planning, and investment plans for the transition to smart agriculture.

In terms of practical examples, there have already been efforts to apply smart agriculture in certain localities. For instance, Da Lat has implemented a greenhouse system for cultivation using LED lights, and automated hydroponic vegetable farming, contributing to providing clean agricultural products as well as serving the tourism industry. Moreover, there are fully automated irrigation systems for flower gardens, with sensor devices providing information on humidity, irrigation amount, and timing. Additionally, there are initiatives to apply smart water management solutions in paddy production in the Mekong Delta. In particular, Tra Vinh University, with World Bank support, piloted IoT-based alternate wet and dry irrigation to reduce methane emissions in paddy fields.

Regarding smart agriculture in supply chain integration and information connectivity, it is evident in VN Check’s initiative – a traceability platform applying IoT and Blockchain technology for traceability of agricultural products and medicinal products. This initiative has been supported by technology from large corporations such as Google, FPT, Vietnam Academy of Agricultural Sciences, Univer Farm Organics and SotaNext. VNCheck provides data and traceability solutions for agricultural and food enterprises, using IoT technology to collect real-time data processed through a secure, transparent smart contract system. Moreover, product tracking for domestic and export markets is enabled with the company’s QR code and barcode system.

Vietnam also has recorded positive foreign investment, including from Japan, into this field. According to a [10] by Seiko Ideas Corp[11], with the CPTPP agreement, Japan has decided to accelerate its investment projects in Vietnamese agriculture as a member of the CPTPP and a country with great agricultural production potential. By doing that, Japanese companies can produce goods and export agricultural products back to Japan to enjoy a 0% import tariff. At the same time, Japanese companies can meet the TPP requirement that exported products must have 70% of their raw materials originating from within the TPP bloc[12]. There are some notable cooperative projects including the deployment of Fujitsu’s Akisai cloud services by Fujitsu IT and the FPT Group in 2014 to support Vietnam’s agricultural management in 2015-2016[13]; projects with the Lam Dong provincial government include the high-quality flower market development project with an efficient distribution system by OTA Kaki company, and the high-quality development project by company.

Challenges

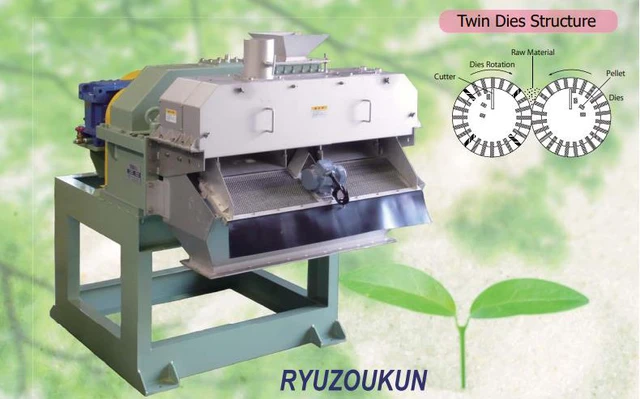

While there have been initial efforts, the smart agriculture sector in Vietnam still faces major challenges. Firstly, the ability to supply technology for smart agriculture is still limited[14]. As , domestic mechanical enterprises can only meet 32% of the demand for agricultural machinery, while around 60-70%[15] market share is currently being supplied by foreign manufacturers. Secondly, the agricultural database has not been designed and digitized synchronously, leading to challenges in applying data-based tools. Thirdly, given the low-quality labors, it is hard for farmers to access information and use advanced technologies. Therefore, there is a need for solutions that are simple, easy to use, and suitable for the cultivation practices and educational level of farmers[16]. Fourth, there are financial difficulties in investing in technology applications in agricultural enterprises. to the Ministry of Science and Technology, 43% of agricultural enterprises still face difficulties in investing in digital transformation. This is due to the small-scale, primarily household-based nature, so when investing, they will bear high costs and low margins[17].

Outlook in the future

Given all the aforementioned points, this market can still be seen to have a lot of room for development and opportunities. Firstly, the demand for technology applications, with a priority on smart agriculture adapted to climate change, is believed to be one of the urgent solutions in the context of the severe impacts of climate change, the increasingly complex and unpredictable environment[18]. According to the Food and Agriculture Organization, climate-smart agriculture (CSA) is a method of agricultural production that can respond to the negative impacts of climate change to stabilize food security and achieve sustainable development. CSA is based on three main pillars (1) Sustainable productivity and income growth for producers; (2) Adaptation to climate change and; (3) Reduction (or elimination) of GHG emissions. Accordingly, some CSA’s practices in crop cultivation include smart water management and irrigation, adoption of improved crop varieties, reduction of soil erosion[19], etc. For the livestock sector, examples of CSA applications include the use of biotechnology, concentrated livestock farming in cold storage, livestock-rearing techniques that reduce GH emissions[20], etc. Regarding Vietnam’s corresponding guidelines, Resolution 19/NQ-TW/2022 sets the goal of developing CSA, reducing rural environmental pollution, and striving to reduce GHG emissions by 10% compared to 2020. Additionally, Resolution 20-NQ/TW-2022 emphasizes preferential treatment and support for cooperatives in the application of science and technology, and the development of sustainable production models, including CSA and digital transformation.

Additionally, the application of smart models to meet the demand for safe and high-quality agricultural products is increasing in Vietnam as well as in international market, especially as consumers’ awareness on health and hygiene factors has increased after the COVID-19 pandemic. In response to the demand, opportunities for cooperation between Vietnam and Japan in this field are being strongly promoted. Currently, Japan is supporting Vietnam to implement the agriculture strategy until , through a change in mindset from “agricultural production” to “agricultural economy”, to achieve the goals of “ecological agriculture, modern rural areas, and smart farmers[21].

Another important aspect is the development of smart agriculture towards enhancing effectiveness of agricultural value chains. According to Resolution 19/NQ-TW/2022, Vietnam is promoting the development of smart agriculture by applying digital technologies, developing agricultural product supply chain management using blockchain applications, and managing agricultural products from production, harvesting, processing, storage, transportation, processing, and consumption to create transparency of information and ensure traceability of product origins. This is expected to contribute to increasing the connectivity of information among stakeholders and aligning agricultural production with market demands.

In summary, developing smart agriculture is one of the key pathways for the agriculture sector in Vietnam to respond to climate change risks, improve productivity, and meet evolving consumer demand.

[1] Including crop cultivation, livestock, fishery, and forestry

[2] VOV (2024), Vietnam ranked 15th largest exporting agricultural products in the world <Assess>

[3] ThoibaoTaiChinhVietnam (2023), In 2023, Vietnam’s agricultural, forestry, and aquatic product trade surplus reached a record level. <Assess>

[4] DaiBieuNhanDan (2024), Smart Agriculture is the essential trend. <Assess>

[5] CIAT, World Bank (2017), Climate-Smart Agriculture in Viet Nam. CSA Country Profiles for Asia Series. International Center for Tropical Agriculture (CIAT); The World Bank. Washington, D.C. 28 p. <Assess>

[6] Thuy Hang (2023), Developing a Strategy for Developing Human Resources in the Agricultural and Rural Development Sectors until 2030, with a Vision to 2045. Planning Department, Ministry of Agricultural and Rural Development. <Assess>

[7] Same as note 5

[8] Agridrone (2023), Smart Agriculture in Vietnam. <Assess>

[9] Dao The Anh, Pham Cong Nghiep (2022), Smart Agriculture for Small Farms in Vietnam: Opportunities, Challenges and Policy Solutions. The FFTC Journal of Agricultural Policy. <Assess>

[10] Report on the impact of the TPP (Trans-Pacific Partnership) on the Japanese economy and agricultural cooperation between Japan and Vietnam, cited in VCCI (2016), Japan is rushing to invest capital into Vietnamese agriculture <Assess>

[11] The Japanese investment consulting firm

[12] VCCI (2016), Japan is rushing to invest capital into Vietnamese agriculture <Assess>

[13] Website of foreign investment, Ministry of Planning and Investment (2015). High-tech Agriculture attracts Japan’s FDI. <Assess>

[14] Le Anh (2023), Developing Smart Agriculture in Vietnam in a Sustainable Direction <Assess>

[15] VnEconomy (2024), Vietnam is a potential market for enterprises manufacturing agricultural machinery and equipment <Assess>

[16] VnEconomy (2024), What solutions are there for Vietnamese agriculture to become smart agriculture? <Assess>.

[17] Same as note 16

[18] Ministry of Information and Communications (2020), Smart Agriculture: The Solution to the Productivity, Quality, and Efficiency Challenges of Vietnamese Agricultural Production. <Assess>

[19] Mistry of Natural Resources and Environment (2021), Climate-Smart Agriculture. <Assess>

[20] Mistry of Natural Resources and Environment (2021), Guidelines of Climate-Smart Agriculture. <Assess>

[21] Vietnam+ (2023), Japan Supports Vietnam in Developing a Green Agricultural Economy. <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

- All

- E-Commerce

- Economic

- Food & Beverage

- Healthcare

- Human Resources

- Investment

- IT & Technology

- Logistics & Transportation

- Regulation

- Retail & Distribution

- Seminar

- Temporarily closed

- Tourism & Hospitality

- White Book

Related article

1 Comment

Comments are closed.

Agriculture Technology Startup Trend in Vietnam Market