The convenience store market in Vietnam has seen robust growth, supported by urbanization, changing consumer lifestyles, and increased demand for convenience products. As of 2024, the retail sector in Vietnam, including convenience stores, is expected to grow significantly, reaching USD 276.37 billion[1] and continuing its rapid expansion over the next few years. Convenience stores in Vietnam cater to a broad spectrum of consumer needs, from daily essentials to quick meals, making them an essential part of urban life.

In addition, Vietnam has many favorable conditions to develop convenient shopping channels, with an urbanization rate of 30% and a young population of 57% in 2024. In particular, the middle class in Vietnam is expected to increase nearly 3 times by 2030 compared to today, creating the main driving force for the development of the convenience store model.

Market Size and Trends

The convenience store market in Vietnam is projected to grow by USD 226.4 billion at a CAGR of over 13% from 2023 to 2028. Urbanization, rising disposable incomes, and growing demand for convenience among young, tech-savvy consumers are key drivers. In 2024

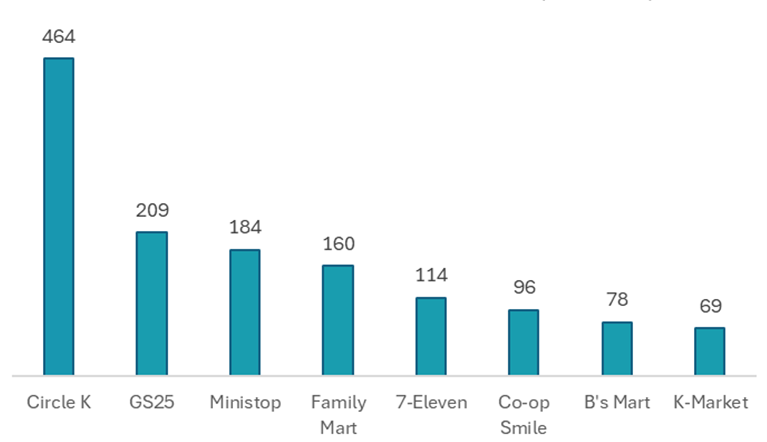

Number of convenience stores in Vietnam (7/2024)

Source: Cafef.vn[2]

While domestic enterprises focus on developing mini supermarkets such as WinMart+, Bach Hoa Xanh or Co.op Smile, international players (from America, Japan, Korea, etc) dominate the Vietnam’s convenience store market.

Key trends driving the convenience store market include the integration of mobile payment platforms and other digital technologies like Artificial Intelligence (AI), the Internet of Things (IoT), etc. Additionally, the COVID-19 pandemic reshaped shopping behaviors, pushing consumers to opt for smaller, more localized stores, often closer to home. The rise of mobile commerce, enabled by high smartphone penetration, has also impacted convenience store operations, with stores adapting to offer online ordering and home delivery services.

Japanese Convenience Store Chains in Vietnam

Japanese convenience store chains have played a crucial role in this market. Notable entrants include 7-Eleven, FamilyMart, and Ministop, which have expanded aggressively, bringing modern retail concepts, premium services, and a broad product range to Vietnam. These Japanese players have successfully differentiated themselves from local competitors through superior store design, diverse offerings, and enhanced customer experiences.

Currently, Japanese convenience stores are primarily concentrated in major urban centers like Hanoi and Ho Chi Minh City. However, there is a growing trend towards expanding into suburban areas, as these regions present new opportunities for development and market growth.

Factors Contributing to the Success of Japanese Convenience Stores:

– Quality and Safety: Japanese products are often perceived as being of high quality and safe, which has attracted Vietnamese consumers.

– Customer Service: Japanese convenience stores are known for their excellent customer service, with staff who are friendly, helpful, and efficient.

– Cleanliness and Organization: Japanese stores are typically clean and well-organized, creating a pleasant shopping experience for customers.

– Product Variety: Japanese chains offer a wide range of products, including fresh food, beverages, snacks, and household items, catering to the diverse needs of Vietnamese consumers.

7- Eleven

| Homepage | https://7-eleven.vn/ |

| Introduction | The first 7-Eleven convenience store in Vietnam opened in 2017. 7-Eleven’s presence in Vietnam is through an exclusive franchise to Seven System Vietnam Joint Stock Company (SSV). |

| Number of stores | 114 (in 2024) |

| Main area | HCM city |

| Main products | ready-to-eat meals and snacks |

Source: 7 Eleven Vietnam

Family Mart

| Homepage | https://famima.vn/ |

| Introduction | FamilyMart is a Japanese convenience store chain that entered the Vietnamese market in 2009. It offers a wide range of products including snacks, beverages, groceries, personal care items, and freshly prepared meals |

| Number of stores | 160 (in 2024) |

| Main area | HCM city |

| Main products | Ready-to-eat meals and snacks |

Source: Familymart

Ministop

| Homepage | https://www.ministop.vn/ |

| Introduction | MINISTOP is a convenience store chain, with strategic small scale store business, MINISTOP is a member of AEON Group – the Retailer in Japan. |

| Number of stores | 184 (in 2024) |

| Main area | HCM city, Hanoi |

| Main products | Ready-to-eat meals and snacks |

Source: Ministop Vietnam

Opportunities

In recent years, the rise of modern retail channels like supermarkets and convenience stores has surged, especially in urban areas. Many consumers now favor these outlets over traditional markets due to their convenience, variety, and enhanced shopping experience.

– Urbanization and Lifestyle Shifts: The rapid urbanization and fast-paced lifestyle of Vietnamese consumers create demand for quick, easy access to food, drinks, and household items, particularly in cities like Hanoi and Ho Chi Minh.

– Digital Integration: As consumers become more tech-savvy, integrating digital platforms for mobile payments and delivery services represents a significant opportunity for growth. Many retailers are investing heavily in technology to enhance the customer experience and streamline operations.

– Product Diversification: There is an increasing focus on health and wellness products, driven by growing consumer awareness of healthy living. Convenience stores offering a mix of organic, low-sugar, and plant-based products could capture a larger market share.

Challenges

Despite its potential, the convenience store market in Vietnam also faces several challenges:

– High Competition: The market is highly competitive, with brands like Circle K, FamilyMart, Ministop, as well as supermarkets/mini markets run by domestic players like WinMart, Bach Hoa Xanh.

– Supply Chain Complexities: Vietnam’s logistics and supply chain infrastructure still face developmental hurdles, complicating the efficient distribution of goods. Managing multiple store locations and ensuring a steady supply of fresh and diverse products remains a challenge, particularly for international brands.

– Regulatory Environment: Retailers must navigate Vietnam’s evolving regulatory landscape, including restrictions on foreign investments and challenges around operational permits for new stores. Moreover, the government closely monitors competition to protect local businesses, which could pose difficulties for foreign entrants like 7-Eleven and FamilyMart.

Conclusion

Vietnam’s convenience store market is set for sustained growth, supported by urbanization, digital innovation, and changing consumer behavior. With the fastest-growing middle class in Southeast Asia, Vietnam has enjoyed phenomenal growth in the retail sector. This trend is set to continue in the future, driven by its young demographics and strong consumer spending. Japanese chains like 7-Eleven, FamilyMart, and Ministop are well-positioned to capitalize on this growth, though competition, supply chain issues, and regulatory challenges must be managed effectively. With strategic planning, both international and domestic convenience store chains can thrive in this rapidly evolving market.

[1] https://www.mordorintelligence.com/industry-reports/retail-industry-in-vietnam

[2] https://cafef.vn/the-tran-shop-tien-loi-tai-viet-nam-doanh-thu-hon-1000-ty-nam-nhung-gs-25-family-mart-7-eleven-ngap-trong-thua-lo-duy-nhat-1-dn-viet-mac-han-lai-lien-tiep-3-nam-188240801184305643.chn#img-lightbox-1

https://www.technavio.com/report/retail-market-industry-in-vietnam-analysis

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |