Over the last decade, Vietnam has witnessed a remarkable transformation in its retail sector, driven by rapid urbanization, rising incomes, and shifting consumer preferences. Among the most notable trends is the increasing presence of Japanese supermarkets and stores across the country. Japanese retailers have successfully established a foothold in Vietnam’s competitive market, offering a wide range of products, from food and beverages to household goods, cosmetics, and apparel.

The Current Landscape: Growth of Japanese Supermarkets in Vietnam

Vietnam’s retail sector is one of the most dynamic in Southeast Asia, and Japanese retailers have been quick to capitalize on its potential. In 2024, the Vietnam retail market is estimated to value 276 Bil USD and forecast to reach 499 Bil USD in 2029, corresponding with annual growth rate (CAGR) of 12% from 2024 to 2029 [1]. In the over past decade, Japan’s retail giants have been expanding their presence in major Vietnamese cities like Hanoi, Ho Chi Minh City, and Da Nang. For example, Aeon launched their first shopping mall in 2014 in HCMC. In 2018, Sumimoto group has cooperated BRG group to established Japanese supermarket chain Fujimart in Hanoi.

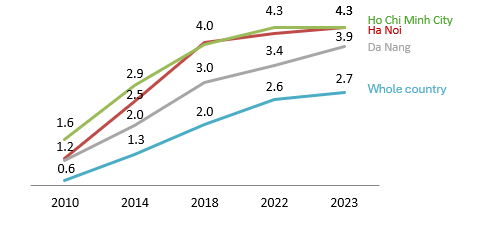

This expansion is fueled by the growing growing demand for high-quality products, a key strength of Japanese retailers. According to the General Statistics Office (GSO), Vietnam’s per capita income has increased nearly three to four times since 2010, especially in the five cities directly under the central government: Hanoi, Ho Chi Minh City, Hai Phong, Da Nang, and Can Tho. As income levels rise, consumers are more willing to spend on healthier, premium, and convenient products. Furthermore, the core segment of Japanese goods – middle class group is also expanding, particularly in urban area. In 2023, the middle class group is approximately 13 million people (13% of population) and is expected to reach 26% of the population by 2026 [2] This shift in demand plays directly into the strengths of Japanese products, which are known for their reliability, safety, and high-quality standards.

Average monthly income per capita by central cities

Unit: Million VND

Source: GSO Statistic Book 2023

Moreover, Japan’s strong diplomatic and economic relationship with Vietnam has facilitated smoother market entry for its retailers. Trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) (signed in 2019) and the Japan-Vietnam Economic Partnership Agreement (JVEPA) (signed in 2008), have provided favorable conditions for the import of Japanese goods, making the products more accessible to Vietnamese consumers.

Key Players in the Market

Several key players have successfully tapped into Vietnam’s supermarket scene, each bringing unique strategies and a diverse array of offerings. Some significant player can be called out such as AEON, Fujimart, Sakuko, etc.

AEON

Source: AEON MALL VIETNAM

| Homepage | https://www.aeon.com.vn/ |

| Introduction | A subsidiary of the Japanese retail giant AEON Group, entered the Vietnamese market in 2014. It offers a diverse range of high-quality Japanese and local products, catering to Vietnam’s growing middle class. |

| Number of store | 10 shopping malls with 200+ minimarket |

| Main area | HCMC, Hanoi |

| Main products | Groceries, apparel, household goods |

Fujimart

Source: Fujimart Vietnam

| Homepage | https://fujimart.vn/ |

| Introduction | A joint venture between Japanese retailer Sumitomo and local partner BRG Group, opened its first store in Hanoi in 2018. It focuses on providing fresh, high-quality groceries. FujiMart offers a blend of Japanese and local products |

| Number of store | 15 supermarkets |

| Main area | Hanoi |

| Main products | Groceries, household goods |

Sakuko

Source: Sakuko Vietnam

| Homepage | https://sakukostore.com.vn/ |

| Introduction | A retail chain in Vietnam that specializes in offering a wide range of Japanese products. Established in 2011, Sakuko aims to bring authentic and high-quality Japanese goods to Vietnamese consumers |

| Number of store | 33 stores |

| Main area | HCMC, Hanoi, Hai Phong, etc. |

| Main products | Groceries, household goods |

Opportunities for Japanese Products in Vietnam

The growing number of Japanese supermarkets and convenience stores in Vietnam presents numerous opportunities for Japanese products. From consumer preferences , e-commerce, etc. multiple factors create a favorable environment for these products to thrive.

- Health-Conscious Consumer Trends

The rising awareness of health and wellness in Vietnam offers significant potential for Japanese products. Japanese supermarkets in Vietnam are well-positioned to introduce health-oriented food items, such as organic products, low-calorie snacks, and functional beverages. Additionally, beauty and personal care products from Japan, known for their effectiveness and quality ingredients, are increasingly sought after by Vietnamese consumers. - E-commerce Expansion

While physical stores remain important, there is a growing trend toward online shopping in Vietnam. E-commerce platforms have experienced a surge in popularity, particularly during the COVID-19 pandemic. This shift presents a new avenue for Japanese retailers to reach a wider audience. Major players like AEON have already introduced online shopping options, allowing Vietnamese consumers to purchase Japanese products from the comfort of their homes. Expanding online distribution channels could further boost sales of Japanese products, especially in regions where physical stores are not yet present. - Localization Strategies

Another opportunity lies in the localization of Japanese products for the Vietnamese market. While maintaining the Japanese identity of their brands, many retailers have adapted their product offerings to suit local tastes and preferences. For instance, AEON has localized its food products by offering Vietnamese-style dishes prepared with Japanese techniques and ingredients. This fusion approach helps Japanese retailers appeal to a broader consumer base while still retaining the trust associated with Japanese quality.

Challenges for Japanese products in Vietnam

- High Competition: Vietnam’s retail market is highly competitive, with numerous local and international players from foreign countries like China, Thailand, etc., which is also offering a wide variety of similar products. Japanese supermarkets must compete not only with established local stores but also with other foreign brands that may offer comparable goods at lower prices. This makes it difficult for Japanese stores to differentiate themselves and capture significant market share.

- Price Sensitivity: Vietnamese consumers tend to be price-sensitive, often favoring affordable products over premium offerings. While Japanese goods are known for their high quality and reliability, they are usually priced higher than locally produced or other international alternatives. This price difference can limit the customer base for Japanese supermarkets, especially in a market where many shoppers prioritize cost over brand reputation.

- Supply Chain Issues: Japanese supermarkets face considerable logistical challenges in maintaining a consistent and efficient supply of imported goods. Import regulations in Vietnam can be complex, leading to potential delays in customs clearance. Additionally, high shipping costs and long delivery times from Japan to Vietnam further increase the cost of products and complicate inventory management. These supply chain difficulties can result in higher prices for consumers and impact the availability of goods on store shelves.

Conclusion

The growth of Japanese supermarkets in Vietnam reflects the strong demand for high-quality, reliable products among Vietnamese consumers. The opportunities for Japanese products are vast as Japanese products store are expanding steadily. By continuing to expand their presence, adapt to local market conditions, and leverage trade agreements, Japanese retailers can further solidify their position in Vietnam’s retail landscape. As Vietnamese consumers become more discerning and health-conscious, Japanese products, known for their safety and quality, are poised to thrive in this burgeoning market.

[1] https://vietnam.incorp.asia/retail-industry-in-vietnam/

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles