25Mar2024

Industry Reviews / Latest News & Report

Comments: No Comments.

The market potential for dairy products in Vietnam remains significant as Vietnamese people are increasingly concerned about nutrition and health issues. It is predicted that in the coming years, the average milk consumption per capita will continue to rise and reach 40 liters per person per year by 2030. According to the Vietnam Dairy Association (VDA), the average milk consumption per capita in Vietnam was 15 liters per year in 2010 . In 2021, this figure increased to 27 liters of milk/person/year, currently this level is still low compared to Thailand (35 liters/person/year) and Singapore (45 liters/person/year) .

Additionally, Vietnam’s population is steadily increasing, leading to increasing of total milk consumption. On average, Vietnam produces about 12 liters of fresh milk per capita, with total production exceeding 1.2 million tons, meeting only about 42% of consumers’ milk consumption needs . However, contrary to the market’s development potential, enterprises are facing difficulties from the consequences of the Covid-19 epidemic, the impact of the economic crisis and fierce competition among brands, requiring dairy enterprises to exert even greater efforts to gain market share.

The price of raw milk in the world is increasing by 60%, causing domestic enterprises to struggle, having to increase prices and find ways to balance costs. The reason is partly due to the consequences of the Covid-19 epidemic causing disruptions in the global supply chain, leading to increased supply of animal feed and rising transportation costs. Additionally, the impact of the Russia-Ukraine war has also contributed to a significant increase in input materials for the dairy processing industry. Most dairy companies have adjusted their selling prices in the market, but the rate of price increase is relatively low compared to the increase in input costs. Therefore, the profit margin for the dairy industry this year is predicted by securities companies to be lower than in previous years .

After the pandemic, the economy was expected to recover, but in reality, it became complicated with multi-dimensional crises from political conflicts, epidemics and climate change. These issues have pushed inflation to its highest level in decades, forcing countries to tighten monetary policies and reducing both income and consumer demand. Inflation has led to reduced consumption; dairy products are currently a highly sensitive product because most Vietnamese consumers do not consider milk to be an essential nutritional product. Therefore, demand for dairy market products will weaken as consumers have to tighten their spending habits .

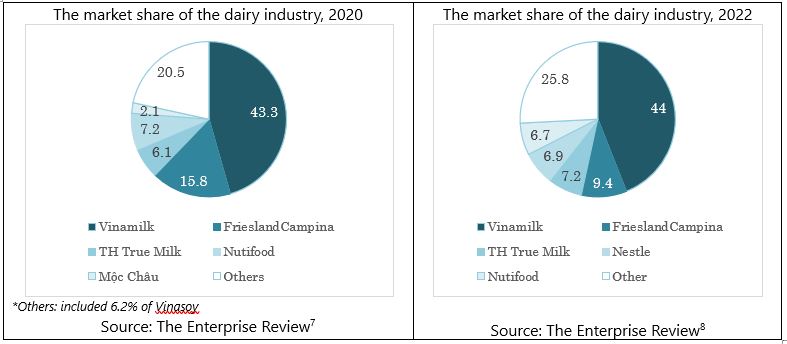

Vietnam’s dairy market currently has about 200 enterprises operating, including 40 enterprises that produce and distribute milk. Domestic enterprises account for about 75% of the market share, while foreign enterprises account for about 25%. The attractiveness of the Vietnamese dairy market not only stimulates domestic enterprises to expand production but also attracts many foreign investors to invest capital in the industry. Enterprises have created raw material areas to be more proactive in product development. These enterprises continuously launch new products to attract consumers . Although Vinamilk always holds the main market share in the market, Vinamilk always strives to improve to increase its market share.

Vietnam’s dairy market is posting strong growth in consumption as well as further expansion in product types. With strong competition from brands, Vietnamese consumers can be optimistic about a market that is more beneficial for consumers.

B&Company

This article has been published in the column “Read Vietnamese trends” of ASEAN Economic News. Please see below for more information

|

B&Company, Inc. The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

[/vc_column_text][/vc_column][/vc_row]

- All

- Business

- Economic

- Energy

- Environment

- Exhibition

- Human Resources

- Investment

- IT & Technology

- M&A

- Manufacturing

- Multi-country Research

- Retail & Distribution

- Seminar

- Temporarily closed

- Tet

- Trade