30Dec2024

Industry Reviews / Latest News & Report

Comments: No Comments.

Market overview of Japanese retail situation

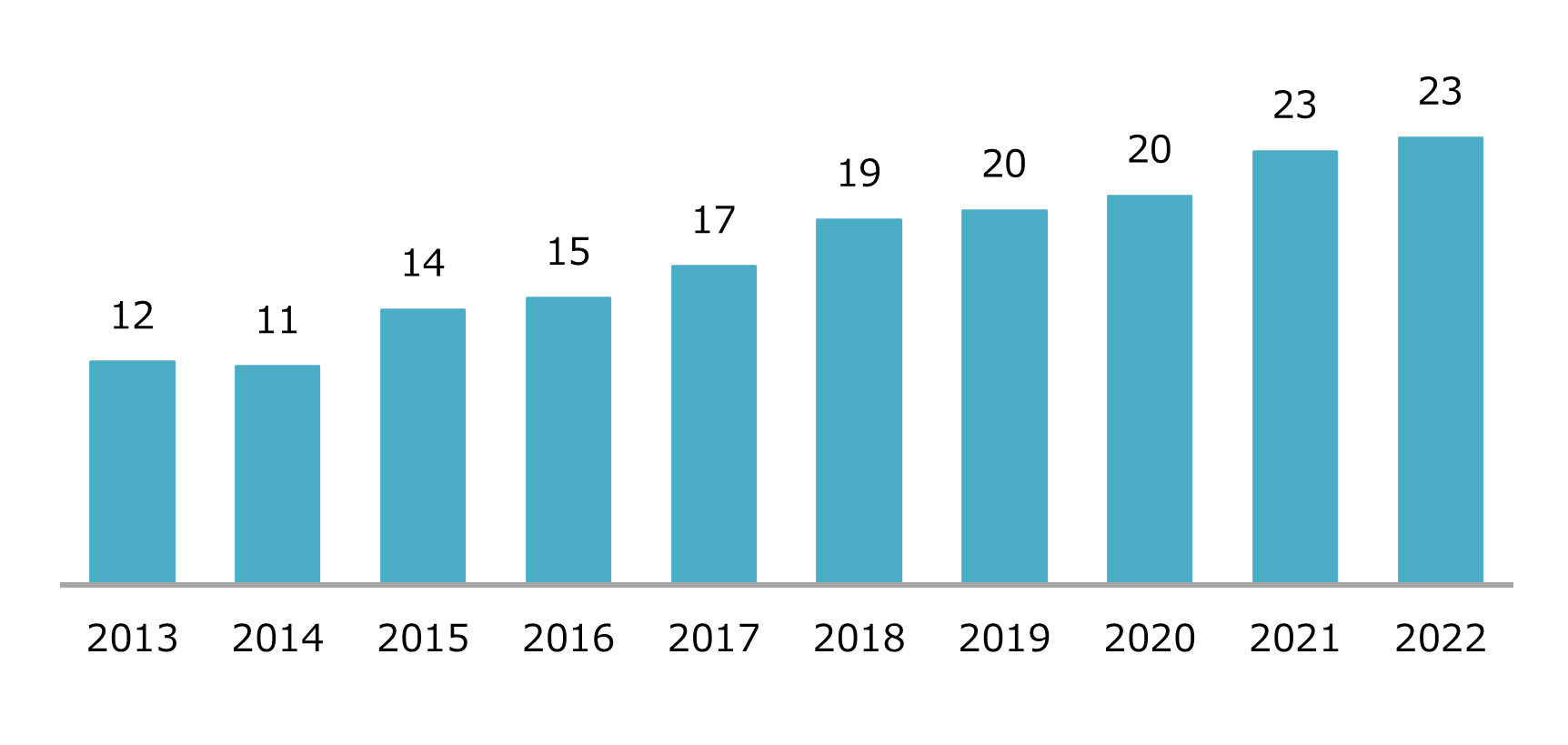

Japan has established a significant presence in Vietnam’s retail market over the past few decades, reflecting the growing economic ties between the two countries. As one of the fastest-growing economies in Southeast Asia, Vietnam has become an attractive destination for foreign investment, particularly in retail. The chart below shows how retail goods imported from Japan in Vietnam has continued to increase in recent years.

Export value of Japanese retail goods to Vietnam (2013-2022)

Unit: Bil USD

Source: Statista

This article mostly focuses on convenience store chains, malls and apparel chains as a reflection on the situation of Japanese retail products in Vietnam.

The history of Japanese consumer goods retail started with convenience stores. The introduction of Japanese convenience stores in Vietnam began with MiniStop, which opened its first store in 2011[1], following the successful case of Circle K. This marked the start of Japanese retail presence in the country, setting off a competitive wave in the convenience store sector. MiniStop’s entry established a foundation for Japanese-style convenience shopping in Vietnam, paving the way for other chains like FamilyMart or 7-Eleven to become familiar names in the market. This initial success created opportunities for additional foreign brands to enter and contribute to the vibrant convenience store landscape. In July, 2024, it is recorded that there are 1,374 convenience stores across the country[2]. The table below presents the most popular convenience stores in Vietnam, including three well-known Japanese store chains MiniStop, Family Mart and 7-Eleven.

The most popular convenience stores in Vietnam

| Chain | Origin | Vietnam entry year | No. stores (2024) |

| Circle K | US | 2008 | 400 |

| GS25 | South Korea | 2018 | 300 |

| MiniStop | Japan | 2011 | 178 |

| Family Mart | Japan | 2013 | 160 |

| 7-Eleven | Japan | 2017 | 66 |

Source: B&Company’s synthesis

Building on the momentum of FamilyMart’s entry, AEON – representing the mall segment – launched its first retail center in Vietnam in 2014[3]. This marked a major milestone, as AEON not only brought a modern retail format but also emphasized high standards in product quality, customer service, and a broad selection of fresh foods, grocery, home appliances and other consumer goods. AEON now operates 11 shopping centers[4], with the newest one recently developed in Hue[5].

As Japanese products continued to establish a strong presence in Vietnam, consumers gradually shifted their interest from essential goods to branded products, premium goods and discretionary items. This shift is particularly evident in the fashion sector, with Japanese brands like Uniqlo and Muji entering the Vietnamese market. Uniqlo has now established 25 stores[6] and Muji has opened 10 stores[7] across the country, making the market more vibrant.

Alongside Japanese-origin enterprises, Vietnamese-owned businesses focusing on importing Japanese goods have also found their place in the market. Of which, Hachi Hachi and Sakuko are two prominent names, specializing in imported Japanese products in the retail chain models. Established in 2007 with around 05 stores in Ho Chi Minh City, Hachi Hachi follows a fixed-price model, offering affordable household items, food, and cosmetics[8]. In contrast, Sakuko, founded in 2011 and operating over 40 stores across the country, exclusively imports 100% of Japanese products, including health supplements, cosmetics, and baby care items, catering to higher-end consumer needs[9]. These chains have brought Japanese style and quality closer to Vietnamese consumers.

Factors influencing the rise of Japanese products in Vietnam

The trend of e-commerce affecting retail sales

Along with the development trend of information technology, driven by smartphone adoption and internet access, e-commerce has become a common way for consumers to shop. Initially focused on books and electronics, the sector expanded with platforms like Lazada, Tiki, and Shopee, covering from home appliances, fashion to even fresh foods. The COVID-19 pandemic further accelerated this shift, with 51 million Vietnamese shopping online by 2022. It is forecasted that Vietnam’s e-commerce will grow by an average of 25% per year and reach USD 35 billion by 2025, accounting for 10% of the country’s total retail and consumer service revenue[10].

Rising consumer awareness for quality products

Alongside exposure to a wide variety of foreign products through e-commerce platforms, Vietnamese consumers’ purchasing standards have also steadily risen. According to the results of the 2023 survey “Vietnam High-Quality Goods Chosen by Consumers”, conducted by the Vietnam High-Quality Goods Business Association with 61,000 votes, consumers are now focused not only on fundamental factors like quality and price but are increasingly concerned with product safety and origin[11].

Vietnamese people’s increasing preference for Japanese products

As mentioned above, Vietnamese consumers are actively looking for products that meet both safety and quality standards, of which, Japanese products – which are famous for their high quality and durability – are becoming more and more popular within Vietnamese consumers. According to statistics from the top 30 popular keywords in four major product categories on Shopee – the largest e-commerce platform in Vietnam – as of September 2024, search keywords for brands from Japan accounted for 17%. Not counting Japanese products appearing in general categories, this highlights a particular interest in Japanese products among Vietnamese consumers[12].

According to an analysis by the research firm Q&Me, the origin of a product is one of the most important factors when making a purchase. Products labeled “Made in Japan” are one of the top two origins prioritized by consumers. In a survey among younger customers, 58% of respondents preferred Japanese cars and electronics, while 22% showed interest in Japanese fashion[13].

Upcoming potential for Japanese retail chains in Vietnam

According to the General Statistics Office, in 2023, retail sales of goods are estimated to reach VND 4,859 trillion, an increase of 8.6% compared to the previous year[14]. The retail consumer market in Vietnam is predicted to grow strongly in the upcoming years and is expected to become a fertile ground for foreign brands, particularly Japanese brands. Some Japanese companies like AEON have leveraged this potential. In its long-term vision, AEON continues to view Vietnam as its second key market after Japan in its investment strategy. In the retail sector, AEON Vietnam reported growth with sales rising by 4-5% compared to the previous year, and customer traffic increasing by 3-4%[15]. On April 2, 2024, AEON Vietnam officially launched its first Super Supermarket model in Ho Chi Minh City, following Hanoi and Binh Duong, as part of AEON’s strategy to diversify retail formats in Vietnam[16].

Additionally, the emphasis on customer service and product quality that Japanese retailers bring can significantly enhance the overall shopping experience, further solidifying their presence in the market. As they adapt to local tastes and preferences, Japanese retail chains are well-positioned to become key players in Vietnam’s dynamic retail sector, contributing to both their growth and the broader economic development of the region.

In conclusion, the landscape for Japanese consumer goods retail chains in Vietnam is vibrant and full of potential. The growth of e-commerce, the strong preference for Japanese products among Vietnamese consumers, and the opportunities for more approach from Japanese retail chains in the near future all contribute to a promising business landscape for Japanese brands in Vietnam. By leveraging innovative marketing strategies, establishing local partnerships, and adapting to consumer preferences, Japanese retailers can continue to thrive in this dynamic market.

[1] VOV (2024). The first G7-Ministop store in Vietnam. <Access>

[2] CafeF (2024). Convenience store battle in Vietnam. <Access>

[3] AEON. Establishment history <Access>

[4] AEON (2024). Branch list. <Access>

[5] AEON Press release (2024). AEON Mall Hue project – The largest shopping center in the Central region. <Access>

[6] Uniqlo (2024). Branch list. <Access>

[7] Muji (2024). Branch list. <Access>

[8] HachiHachi website <Access>

[10] Industry and Trade Magazine (2023). The online shopping behavior trends of Vietnamese consumers. <Access>

[11] Ministry of Industry and Trade (2023). Consumers increasingly prefer products that that meet quality standards and are environmentally friendly. <Access>

[12] Lookers Studio (2024). Top 30 most popular keywords in September on Shopee. <Access>

[13] Q&Me (2023). Analysis of the origin of items from import data. <Assess>

[14] Ministry of Finance (2024). Sustainable e-commerce remains a difficult problem. <Assess>

[15] AEON Press release (2024). Vietnam continues to be a key market for AEON’s investment expansion. <Assess>

[16] AEON Press release (2024). AEON Vietnam launches a comprehensive shopping center and compact supermarket model in Ho Chi Minh City – AEON Nguyen Van Linh. <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

- All

- Business

- Economic

- Energy

- Environment

- Exhibition

- Food & Beverage

- Healthcare

- Human Resources

- Investment

- IT & Technology

- Manufacturing

- Multi-country Research

- Retail & Distribution

- Seminar

- Temporarily closed

- Tet

- Trade