In recent years, the beverage industry in Vietnam has witnessed a transformative shift, with increasing interest in health-conscious products reshaping the market. As consumers prioritize well-being and lifestyle improvements, the demand for healthy products, especially healthy drinks such as functional beverages, organic teas, and cold-pressed juices, fruit smoothies and plant-based milk has surged. This trend reflects broader global movements toward wellness and preventive health, with Vietnam quickly catching up as both local and international brands work to cater to these growing healthy drinks market segment.

Vietnam beverage market in recent years

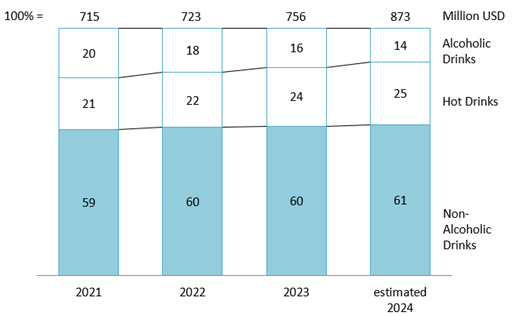

In 2023, Vietnam’s beverage market reached a total revenue of $756 million, a slight increase of 5% compared to 2022, and is projected to grow even further in 2024, with $873 million. In 2023, non-alcoholic drinks (such as bottled water, juices, ready-to-drink coffee & tea, and soft drinks) accounted for 61% of total revenue, followed by 25% for hot drinks (like coffee, cocoa, tea) and the remaining 14% from alcoholic drinks (namely beer, cider, perry, rice wine, spirits, hard seltzer, wine).

Beverage market in Vietnam by Revenue

Source: Statista

Overall, the Vietnamese beverage market has shown a clear shift, with a consistent decline in revenue from alcoholic drinks over recent years. One of the reasons is due to the Vietnamese government has taken decisive steps to increase penalties for traffic violations involving alcohol by ten folded, from 24 USD to 315 USD[1] as set forth in Decree No. 100/2019/NĐ-CP[2].

Trending in healthy drinks among Vietnamese people

With the rapid growth of the beverage market in Vietnam, especially in non-alcoholic and hot drinks, the market for healthy drinks is also predicted to experience strong growth due to several factors: (1) Average monthly incomes in Vietnam have steadily improved, with urban residents’ average income rising from 5.6 million VND in 2018 to 6.3 million VND in 2023. Rural incomes have also increased significantly, reaching 4.2 million VND per month—a 40% increase from 2018[3]. This income growth has allowed consumers to improve their purchasing habits, increasingly opting for health-focused products as healthy drinks have become a growing trend. (2) Vietnam is currently undergoing a health matter related to obesity in children and diabetes in adults. The rate of overweight and obesity has more than doubled, increasing from 8.5% in 2010 to over 19% by 2020[4]. For adults, diabetes rates have doubled in just a decade, from 3.2% in 2011 to 6.1% in 2021[5]. This has led many Vietnamese people to turn to healthier drink options as a substitute and reduce consumption of sugary beverages to maintain better health.

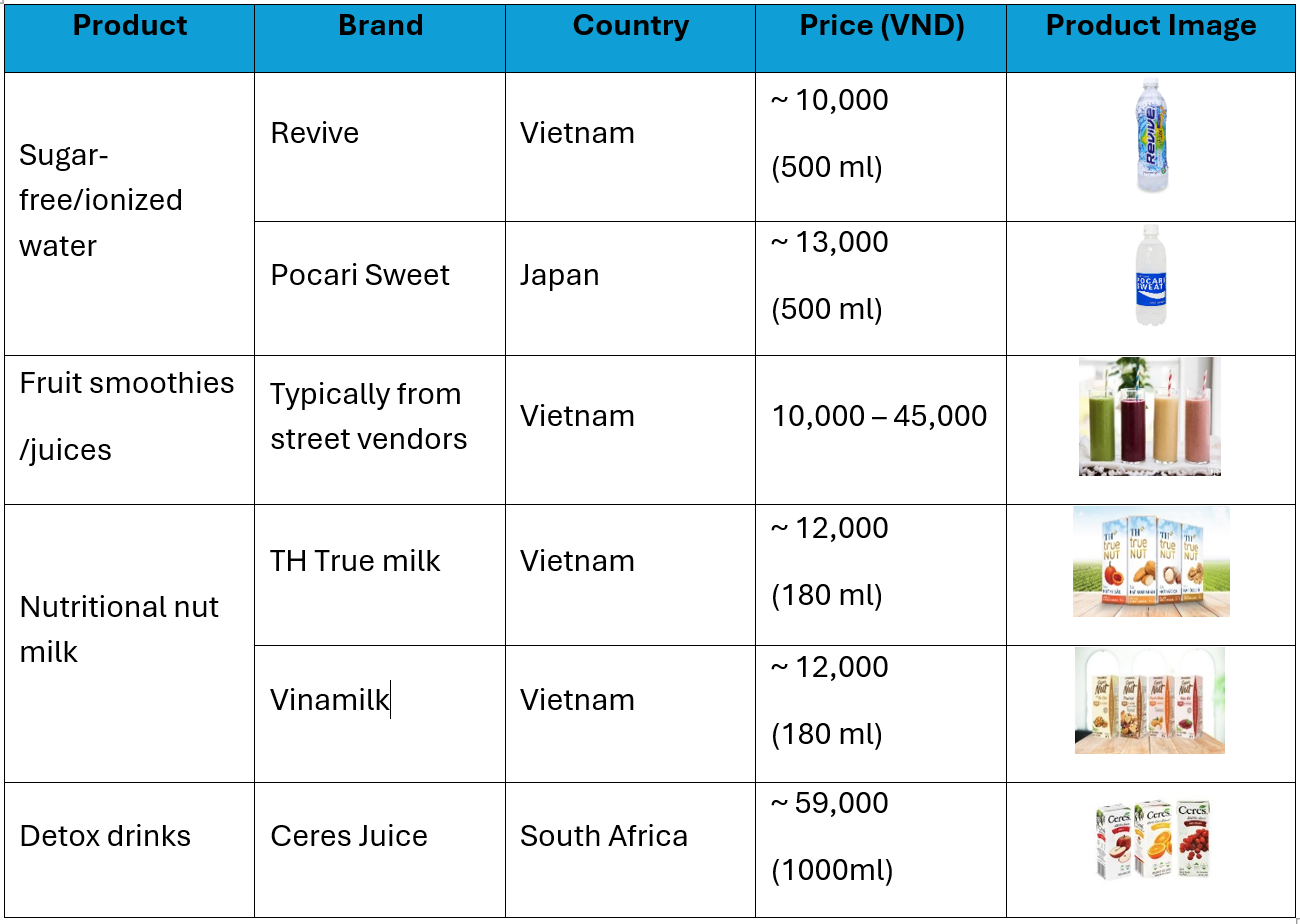

The popular healthy drinks in Vietnam can be listed such as sugar-free/ionized water, fruit smoothies/juices, nutritional nut milk, detox drinks, with a diverse range of products, not only from domestic companies but also from many foreign firms, participating in this highly promising market.

Some popular brands of healthy drinks in Vietnam

Source: B&Company compilation

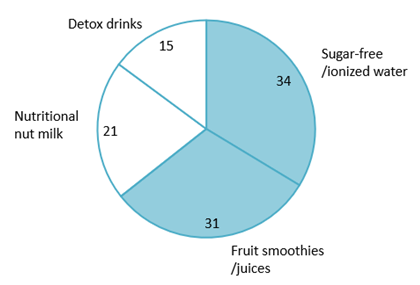

Regarding consumer preferences, Vietnamese youth are increasingly interested in healthy drinks over other beverage options. In a recent survey on popular healthy drinks, 34% of respondents under 25 chose sugar-free or ionized water, 31% selected fruit smoothies and juices, 21% opted for nutritional nut milk, and the remaining 15% were familiar with detox drinks (beverages flavored with fresh fruits, vegetables, or herbs). Young people are also willing to spend more—about $10 per month—on health-boosting products, despite these options being priced 20% to 200% higher than conventional drinks.

Popular healthy drink products among young people (2023)

100%= 300 respondents

Source: Healthy Drink Consumption Among Vietnamese Youth

Additionally, urban residents, especially families with young children, tend to avoid sugary products to limit sugar intake for their kids. As a result, healthy drinks have become a staple in many households, often used as alternatives to sugary beverages. Education level also influences awareness of sugar intake within household, families where parents have higher levels of education tend to avoid sugary beverages compared to other families[6].

Relating to distribution channel, healthy drinks are now widely accessible in Vietnam such as in large supermarkets to small convenience stores and street stalls. Depending on the type of product they seek, consumers can choose a distribution channel that fits their needs. For instance, those looking for detox drinks, packaged fruit juices, or plant-based milks often visit convenience stores or supermarkets. For fresh products, like fruit and vegetable smoothies, market stalls or restaurants are more suitable options.

Healthy beverages in supermarkets

Source: Vietnam Women Newspaper

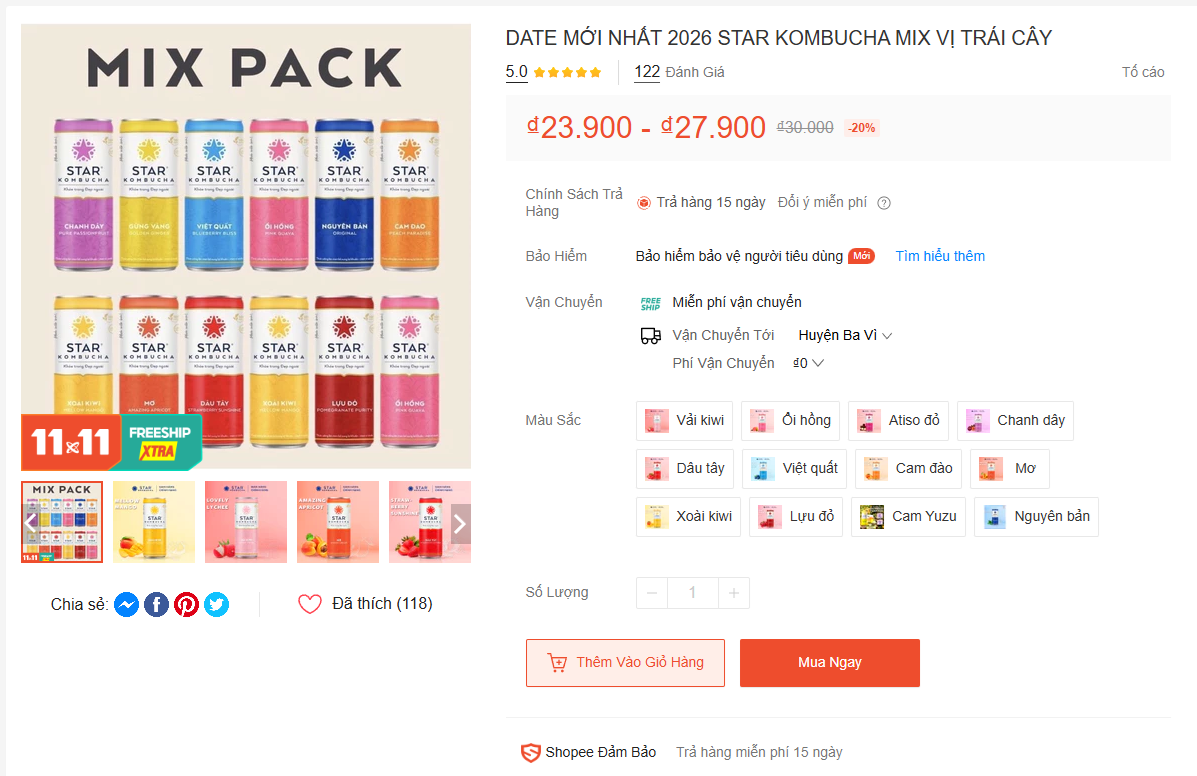

Additionally, E-commerce platforms such as Shopee, Tiki, Lazada have also become popular distribution channels due to their convenience, allowing consumers to access a wide range of healthy products without needing to visit physical stores. Prominent delivery platforms, such as Shopee Express and Be, have surged in popularity, further fueling the healthy drink trend by making it easier to access nutritious options like fruit and vegetable smoothies from stores, regardless of geographic location.

Example of healthy drinks on Shopee (E-commerce platform)

Source: Shopee E-commerce platform

Government support and policies

The National Assembly approved a resolution on formulating the 2025 law and ordinance-making program, which includes a new special consumption tax of 10% on sugary drinks under Vietnamese standard TCVN 12828:2019[7]. This law will apply to soft drinks with a sugar content exceeding five grams per 100ml but will exempt milk and dairy products, nutritional liquid products, pure vegetable and fruit juice, and nectars. This initiative aims to promote healthy drinks and reduce sugar-related diseases, including obesity and cardiovascular issues.

With the government’s policy distinguishing high-sugar drinks from healthier alternatives, there is potential for companies to innovate and introduce a variety of healthy drinks focused on low or no added sugars, natural ingredients, and nutrition. This shift offers a prime opportunity for healthy drink companies to create innovative recipes using ingredients like herbs, tropical fruits, and superfoods to appeal to a growing health-conscious market.

Opportunities and challenges

Vietnam’s healthy beverage market is poised for significant growth as consumer awareness of health issues rises and incomes continue to improve. This trend presents an excellent opportunity for foreign brands focused on health-oriented products, particularly in categories like plant-based milk, low-sugar drinks, and nutrient-enriched beverages. The Vietnamese government’s commitment to encouraging low-sugar products adds further momentum, supporting a market increasingly aligned with wellness trends.

Alongside traditional healthy drinks such as juices and nut milk, the functional beverage market also shows strong potential for growth with products that can boost immune system, complement collagen, aid digestion, and supplement calcium. This emerging category provides an opening for foreign companies with expertise in these areas to serve an underserved yet increasingly interested consumer base.

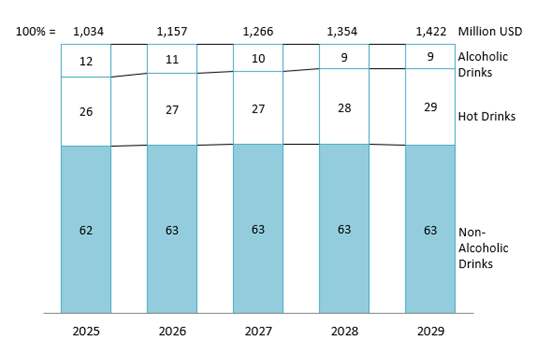

Predicted beverage market in Vietnam by revenue

Source: Statista

However, foreign companies should also be prepared for certain challenges, particularly the intense competition from established domestic brands. In the plant-based milk sector, for example, well-known Vietnamese companies like TH and Vinamilk already have a strong presence. Similarly, the electrolyte beverage market is dominated by brands from Pocari Sweat and Revive. To succeed, foreign companies will need to adopt a long-term development strategy and carefully select products that can stand out in a competitive landscape. Tailoring offerings to meet local preferences and focusing on niche or premium health benefits can be effective strategies for gaining a foothold in this dynamic market[8].

Conclusion

Vietnam’s beverage market is undergoing a health-focused transformation, driven by increased consumer awareness, rising middle-class incomes, and an increase in health problems and obesity. Demand for healthy drinks like functional beverages, organic teas, and smoothies is growing, reflecting a global shift toward wellness and preventive health. To address competition and resonate with health-conscious Vietnamese consumers, international brands can focus on clear labeling, transparent nutritional information, and educational campaigns that emphasize the benefits of healthy drinks. Foreign companies should also consider partnering with established retail chains such as supermarkets, mini-marts, and convenience stores. Additionally, leveraging e-commerce platforms is an effective strategy to expand distribution networks and boost brand visibility among Vietnamese consumers. This approach allows for a broader reach and strengthens brand recognition, both essential in a rapidly growing market focused on health and wellness

[1] Exchange rate on 01/11/2024: 1 USD = 25,307 VND

[2]Government Documents (2019). Decree 100/2019/NĐ-CP <Assess>

[3] General Statistics Office of Vietnam (2023). Vietnamese average monthly salary by region <Assess>

[4] VietnamNews (2022). Obesity in children <Assess>

[5] International Diabetes Federation (2021) Vietnam diabetes report <Assess>

[6] Nguyen-Anh D, Umberger WJ, Zeng D. (2020) Understanding Vietnamese Urban Consumption of Food and Beverages with Added Sugars <Assess>

8 Vietnam Chamber of Commerce and Industry (2024) Vietnam to act on surge of sugary drinks <Assess>

[8] Vietnam Credit News (2019) Vietnam top beverages companies <Assess>

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

Summary of the 10 most read articles on BC website in 2024 - B-Company