25Jul2024

Highlight content / Industry Reviews / Latest News & Report

Comments: No Comments.

Functional foods- An immerging market, but yet a very modest online encounter

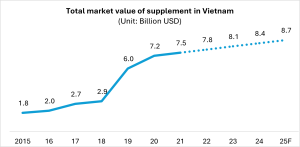

Vietnamese people are becoming more health conscious, especially after the outbreaks of COVID-19. Besides paying attention to a healthy lifestyle (such as maintaining a balanced routine and a good diet), using supplements is one increasing solution that consumers are seeking frequently. Statistics show that the total market doubled in 2019 (the year when the pandemic started) and kept a steady growth over the years.

(Source: L.E.K Research & Analysis, Viet Nam Association of Functional Food (VAFF), Euromonitor’s research)

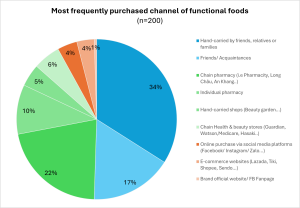

Obviously, e-commerce does not step away from this boom. A report published by British Chamber of Commerce pointed out that back to 2021, up to 30% of supplement sales were distributed via direct sales or online channels (website, SNS, EC platforms). With O2O (Offline-to-Online) trends, many traditional store-based distributors are also opening their virtual points of sales. And yet, consumers are still reluctant to purchase online supplements. A survey conducted early 2024 by B&Company Vietnam revealed that less than 10% of functional foods buyers consider online channels as reliable purchase sources, while over a half prefer to buy hand-carried products through their friends or acquaintances, and the rest 42% stick to physical stores (pharmacies, healthcare shops).

(Source: Consumer survey conducted 01/2024 among 200 functional foods consumers in Hanoi and HCMC – by B&Company Vietnam)

It poses a big question: Despite its popularity and considerable transaction amount, selling supplements online is not trustworthy. Why is that?

There are several factors to explain for the question:

(a) Functional food and supplement market in Vietnam is still very fragmented. According to the Vietnam Association of Functional Foods (VAFF), as of 2021, there were total 12.77 thousands products being sold in Vietnam, and in 2022, it escalated to nearly 30 thousand products with certificate for circulation (reported by the Vietnam Food Safety Authority). The huge number of products easily drives consumers confused and lost in the forest due to the insufficiency of public information and appropriate advertisements from brand manufacturers.

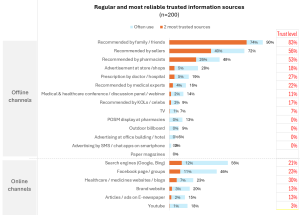

(b) Not only the lack of promotion, but massively false advertisements also put consumers at doubts and skepticism. Unlike prescript medicines with clear instructions by doctors, functional foods are mostly bought spontaneously, so consumers are much afraid of fake or low-quality products that may bring harmful effects to their body and health. Therefore, they turn to recommendations from family, friends and people around as the safest sources of information. Online channels, on the other hand, are also widely used to gain information, but the trust level is quite lower. However, it should not be overlooked that most familiar online channels (search engines, SNS) and KOLs still seize a noticeable influence (nearly equal to advices of medical experts).

(Source: Consumer survey conducted 01/2024 among 200 functional foods consumers in Hanoi and HCMC – by B&Company Vietnam)

Social commerce and online advertising are a double-edged sword

Sadly, this fear of consumers is resulted by many scams and false advertising, of which a majority are rooted from online advertising and social commerce. There are two most popular and severe kinds of false advertising that have been raised strongly and constantly by related organizations such as Ministry of Health and VAFF:

(1) Providing untrue, misstating or exaggerating advertising about functional foods, as attempts to hook buyers’ attention to boost sales

(2) Manipulating real or fake images of famous people / celebrities / KOLs to promote about the products without actual proven evidences of efficacies

These pain points start from the too hot explosion of social commerce like Facebook or Tik Tok, where individual sellers and livestreaming sales are emerging nonstoppable. It raises the pressure and exploits many loopholes in management policies. For instance:

– By regulations, legit advertising for functional foods must obtain relevant certificates (certificate of quality, hygiene and safety for functional foods and permit for functional food advertisement) before publication; while uploading a video to personal account is too easy and uncontrollable

– For KOLs with 500,000 followers or more, the rules bound that they need to show concrete evidences of having actually used the products. But in reality, the monitoring faces numerous challenges, such as what qualifies for the evidences; or how to distinguish which is an advertisement or a personal opinion sharing

– At livestreaming sessions, products are advertised and sold directly, where no one can validate the information immediately

Realizing those severe problems, the Prime Minister has strongly requested the Ministry of Health to work with other departments in reviewing and proposing stricter legislations upon functional food advertisement. It can be seen that social commerce and online advertising are expected to be on the hot pan with many new rulers in the future.

Which paths for EC sellers of functional foods?

Apparently, to create a sustainable growth, the market needs to get into framework, where the government plays a vital management role, information becomes transparent and suppliers do the business with ethical manners. The potential of selling functional foods online is undeniable, but it is critical to gain the lost trust of consumers. In order to do that, instead of laying eyes on immediate profits, EC players should look at a longer term prospects and approach buyers more carefully, systematically. Some recommended steps include:

– Study thoroughly about consumer demand and behavior, which criteria they are looking for and what are key touchpoints

– Learn about each typical consumer segments and how to effectively get close to them

– Ensure to provide quality, traceable products to satisfy and protect consumers’ rights

– Comply with regulations and contribute to building a safe, transparent online business environment

Hopefully, those efforts will gradually improve the current alert. As the market is still fragmented, earlier pioneers may struggle but be promised to stand out of the crowd with profound rewards. Otherwise, if the problems continue unsolved, the market of EC for functional foods will be seriously threatened in the long run.

B&Company, Inc.

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

[/vc_column_text][/vc_column][/vc_row]

- All

- Business

- Economic

- Energy

- Environment

- Exhibition

- Human Resources

- Investment

- IT & Technology

- M&A

- Manufacturing

- Multi-country Research

- Retail & Distribution

- Seminar

- Temporarily closed

- Tet

- Trade