In recent years, there has been a significant shift in consumer preferences in Vietnam towards natural cosmetics. These beauty products for the face, eyes, and nails are made completely or partially from natural ingredients and contain low or minimal amounts of synthetic chemicals. This trend is in line with the global movement towards clean beauty and sustainable living. Although still in its early stages, the Vietnamese natural cosmetics market has been experiencing rapid growth, driven by increasing awareness of the potential harmful effects of synthetic ingredients and a growing desire for environmentally friendly products.

Cosmetic Market Overview and Natural Cosmetics Trends

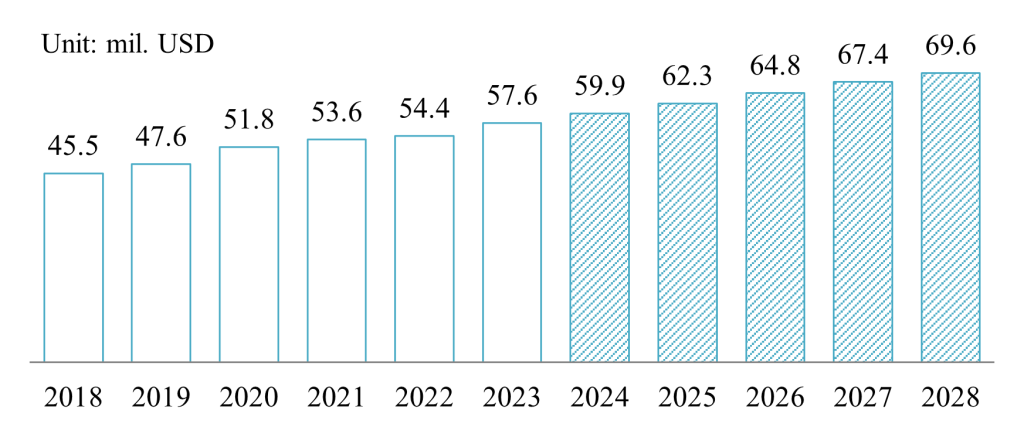

Vietnam’s cosmetics market is experiencing a surge in demand for natural products (CAGR 2018-2023 at 4.8%) and reached about 58 Mil USD in 2023. This market accounted for 10.9% of the revenue of the total cosmetic market and is growing significantly. This growth is particularly notable in urban areas, where consumers are more exposed to international trends and have higher disposable incomes. In which, key trends in the natural cosmetics market include rising demand for organic cosmetics products. To illustrate, an increasing popularity of herbal and traditional ingredients, with products incorporating local ingredients such as green tea, aloe vera, and rice bran gaining traction. In addition, growing interest in multi-functional organic products is another trend, as time-pressed consumers gravitate towards products that offer multiple benefits in one application. For instance, an organic facial moisturizer that also provides sun protection and anti-ageing properties would appeal to consumers looking for convenient, all-in-one solutions.

Revenue of natural cosmetics market in Vietnam from 2018-2028

Source: Statista

The distribution of cosmetics in general, and natural cosmetics in particular, has seen a clear change. In addition to traditional stores, supermarkets, and cosmetic store chains, consumers can also purchase products through online channels such as e-commerce platforms (such as Shopee, Lazada, and Tiki), and social commerce platforms (such as Tiktok, and Facebook). This provides convenience for consumers and opens up new opportunities for businesses.

The growing popularity of natural cosmetics in Vietnam can be attributed to several key factors. Firstly, there’s an increasing awareness of the potential harmful effects of synthetic ingredients commonly found in conventional cosmetics. Vietnamese consumers, particularly in urban areas, are becoming more educated about the ingredients in their personal care products and are seeking safer alternatives. Secondly, there’s a rising concern for environmental sustainability. Natural cosmetics, often associated with eco-friendly production methods and packaging, appeal to environmentally conscious consumers. Thirdly, there’s a growing perception that natural and organic ingredients are more effective and gentler on the skin, particularly among those with sensitive skin or those looking to address specific skin concerns.

Players in the market

The Vietnamese natural cosmetics market is characterized by a mix of local and international players. Local brands have been quick to capitalize on the trend, leveraging their understanding of Vietnamese consumers and traditional ingredients. There are quite a few Vegan Cosmetics brands that are popular among users, creating excitement for the domestic cosmetics market. For instance, the soap bars from Herb n’ Spice or BareSoul adhere to 4 factors: handmade products, not tested on animals, no grey wastewater, and no use of palm oil. The NauNau brand also follows this process with product lines ranging from skincare, and makeup, to bathroom products, perfumes, essential oils, and fragrances…

Examples of natural cosmetic brands in Vietnam (Cỏ mềm)

Source: Enterpriseasia

International brands, particularly those from South Korea, Japan, and Europe, have also made significant inroads into the Vietnamese market. These brands often benefit from a perception of higher quality and stricter organic certification standards. Japanese brands, in particular, have found success in the Vietnamese organic cosmetics market given their high quality and innovative formulations. Some popular Japanese organic cosmetics brands in Vietnam include F Organics, Ruhaku and THREE. These brands have established a presence through various channels, including standalone stores, department store counters, and e-commerce platforms.

Examples of products from Ruhaku and THREE

Source: Myphamnga

Outlook for the Future

Looking to the future, the outlook for the organic cosmetics market in Vietnam appears promising, with an expected CAGR from 2024 to 2028 is approximately 4%[1]. Increasing consumer awareness about the benefits of organic cosmetics and the potential risks of synthetic ingredients is likely to drive continued demand growth. In addition, rising disposable incomes, fueled by Vietnam’s economic growth, are expected to drive increased spending on premium beauty products, including organic cosmetics. Accordingly, the middle class and young consumers, particularly Generation Z, are poised to become the primary target customers for organic cosmetics, given their higher purchasing power and increased awareness of health and environmental issues.

However, the market also faces some challenges. Firstly, price sensitivity remains an issue, as organic cosmetics are often more expensive than conventional alternatives. Secondly, competition from conventional cosmetics brands with strong marketing budgets may also pose a challenge to natural cosmetics companies. Thirdly, the perception of the effectiveness of vegan and organic cosmetics is also a problem for the natural cosmetic market. The emerging trend of vegan skincare products in Vietnam has raised concerns among consumers about their effectiveness. Many people feel that these products are too “mild” and may not provide quick results for specific skin conditions compared to conventional cosmetics.[2]

Insights for business

To leverage these opportunities, businesses in the organic cosmetics sector should focus their research and development (R&D) efforts on several key areas. Companies should prioritize developing products that cater specifically to the middle class and Generation Z consumers, incorporating sustainable packaging solutions to appeal to environmentally conscious customers. Exploring the potential of local Vietnamese ingredients could lead to unique product offerings, while investing in technology integration, such as smart beauty devices or personalization tools, could attract tech-savvy younger consumers. Additionally, companies should offer samples and trials to overcome initial doubts about effectiveness.

Moreover, collaborating with local institutions for market research and creating educational content about organic cosmetics can further enhance a company’s competitive edge. By aligning R&D initiatives with these trends, businesses can position themselves to capitalize on the growing organic cosmetics market in Vietnam, meeting consumer demands for health-conscious, sustainable, and effective beauty products.

[1] Statista: https://www.statista.com/outlook/cmo/beauty-personal-care/cosmetics/vietnam#revenue

[2] https://vneconomy.vn/xu-huong-my-pham-thuan-chay-lam-thay-doi-thi-truong-lam-dep.htm

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

Summary of the 10 most read articles on BC website in 2024 - B-Company