15Jul2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Transshipment and origin fraud have become major concerns in U.S.–Vietnam trade, especially after the U.S.–China trade war intensified. Higher U.S. tariffs on Chinese goods created a tariff gap that encouraged circumvention via Vietnam. The new U.S. tariff policy—particularly the punitive rates on transshipped goods—signals a turning point, pushing Vietnamese firms to reevaluate and restructure their supply chains.

Detected Fraudulent Practices

The United States has initiated the highest number of trade defense investigations against Vietnamese exports, with 64 cases recorded as of 2024. Notably, anti-circumvention investigations are increasingly prevalent. Common fraudulent tactics include:

– Establishing superficial production lines in Vietnam, conducting only basic assembly or minor processing that does not meet the criteria for substantial transformation.

– Importing semi-finished products and performing only final-stage assembly.

– Importing fully finished Chinese products and relabeling them as “Made in Vietnam” for export.

A notable example occurred in 2020, when customs authorities uncovered widespread origin fraud. In inspections covering bicycles (4 companies), solar panels (5), and wooden furniture (12), 100% were found in violation. These firms primarily imported components or semi-finished goods and conducted only minimal processing, which did not alter the essential character of the products, thus disqualifying them from Vietnamese origin status.

Evolution of US Tariff Policy on Vietnamese Goods (April–July 2025)

The US–Vietnam Trade Agreement, announced on July 2, 2025, concluded the negotiation phase by formalizing a 20% general tariff on most Vietnamese goods and implementing a 40% punitive transshipment tariff. This policy shift marks a transition from initial pressure measures to a more structured approach focused on combating origin fraud while sustaining diplomatic cooperation.

Progress of the US tariff on Vietnamese goods

| Date | Policy Action | Tariff on Vietnamese Goods | Tariff on Transshipped Goods | Rationale |

| April 2, 2025 | Tariff Announcement | Threat of 46% retaliatory tariff | Not specified, but circumvention cited as key issue | To address large trade deficits and perceived unfair practices |

| Apr 9 – Jul 9, 2025 | 90-Day Negotiation Suspension | Reduced to the base rate of 10% | Not specified | To facilitate bilateral trade negotiations, including circumvention concerns |

| July 2, 2025 | US–Vietnam Trade Agreement | General tariff of 20% on most goods | Tariff of 40% | Bilateral agreement outcome aimed at curbing circumvention via Vietnam |

Source: B&Company compilation

Affected Industries and Export Data

The 40% anti-circumvention tariff is poised to impact all key Vietnamese exports to the US, particularly those reliant on Chinese inputs and components. The most vulnerable sectors include electronics, machinery, textiles, furniture, and footwear. Heavy dependence on the US market amplifies the risks associated with new origin and transshipment regulations.

In 2024, Vietnam’s exports to the US totaled nearly USD 120 billion, up 23% year-on-year (an increase of USD 22.5 billion), accounting for 30% of the country’s total exports.

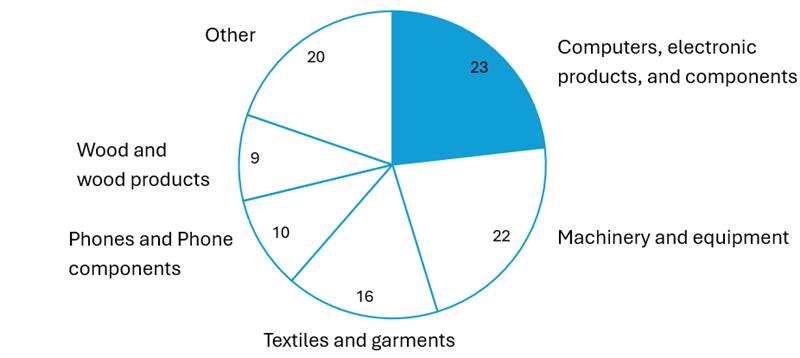

Vietnam’s export structure to the US in 2024

100%= USD 120 billion

Source: General Department of Vietnam Customs

Key Risks for Vietnamese Enterprises

– Profitability and competitiveness: The 40% tariff could severely erode profit margins and render products uncompetitive in the US market, potentially forcing firms to exit.

– Compliance burden: Exporters now bear full responsibility for substantiating “Made in Vietnam” claims. Any ambiguity in documentation may result in punitive tariffs.

– Supply chain restructuring costs: Firms dependent on Chinese inputs must seek alternative suppliers, a costly and complex process that could disrupt operations.

– Uncertainty in enforcement: A lack of clear and transparent enforcement guidelines may lead to arbitrary implementation, creating an unstable business environment.

Overall, while the 40% anti-circumvention tariff presents a significant challenge, it also offers an opportunity for Vietnamese companies and the broader economy to enhance capabilities, increase transparency, and pursue more sustainable growth models in the long term.

Opportunities for Japanese Enterprises in Vietnam

In this shifting policy environment, Japanese-invested firms in Vietnam are uniquely positioned to benefit due to four key advantages:

– Deep manufacturing capabilities: Japanese firms typically invest in advanced technology and sophisticated production processes, ensuring substantial transformation of products within Vietnam. This supports a strong case for genuine Vietnamese origin.

– Transparent supply chains: Japan’s rigorous supply chain governance allows for clear traceability of materials and added value generated in Vietnam, critical evidence in countering transshipment allegations.

– Reputation for compliance: Japanese companies enjoy a global reputation for regulatory compliance, offering a credibility advantage in dealings with US customs authorities.

– Substantive investment strategy: Their relocation to Vietnam aligns with long-term diversification strategies (i.e., “China +1”) rather than opportunistic tax avoidance. This is evident through substantial and sustained investment commitments.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |