22Sep2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s informal economy is a significant and complex component of its economic landscape, contributing substantially to GDP and employment. The scale of Vietnam’s informal economy is immense. Characterized by a high prevalence of unregistered businesses and workers lacking formal contracts and social protections, this sector presents both opportunities and challenges. For businesses and investors, understanding the dynamics of Vietnam’s informal economy is crucial for strategic planning. This article provides a comprehensive overview of the regulatory environment, market size, key segments, and prevailing trends, offering actionable insights for navigating this multifaceted market.

Regulation

The Vietnamese government has historically taken a mixed approach to the informal economy, recognizing its role in job creation while also seeking to formalize the sector to expand the tax base and enhance worker protections. Key regulations and policies influencing Vietnam’s informal economy include:

– Labor Laws: The 2019 Labor Code, effective from 2021, governs employment relationships. However, its enforcement is largely limited to the formal sector. A significant development is the Vietnam Employment Law 2025, which, for the first time, will allow non-contract workers (freelancers, gig workers) to voluntarily participate in unemployment insurance. This marks a step towards extending social safety nets to the informal workforce.

– Business Registration: The process for registering a small business or household business is outlined in the Law on Enterprises. While the government has made efforts to streamline procedures through the National Business Registration Portal, many small-scale operations, particularly household businesses, remain unregistered due to a lack of awareness, perceived complexity, or a desire to avoid taxation and regulatory oversight.

– Formalization Policies: The government has implemented various resolutions and policies aimed at encouraging formalization. For instance, Resolution 68 signals a renewed focus on supporting household businesses and SMEs, aiming to provide better access to finance and digital platforms. The government also encourages the formation of cooperatives as a model for mutual support among household businesses. However, makeshift measures, such as banning street vendors from certain areas in major cities, have also been employed, often with disruptive consequences for those relying on informal activities for their livelihood.

Market Overview

Vietnam’s informal economy is a substantial part of the nation’s economic fabric.

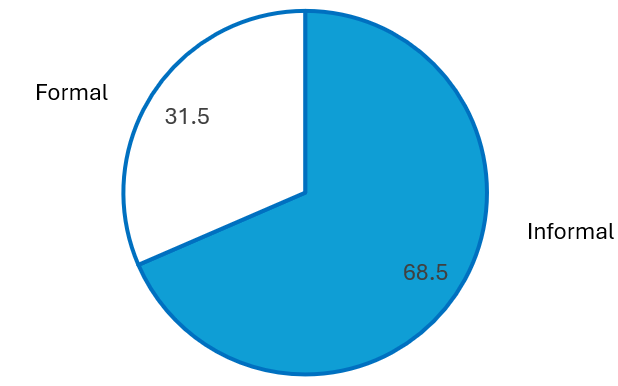

– Size and Scale: In 2021, Vietnam had an estimated 33.6 million informal workers, accounting for approximately 68.5% of the total employed population[1]. The majority of these workers, nearly three-quarters, reside in rural areas[2].

Percentage of Formal and Informal Labour in Vietnam (%)

100%= 49.1 million people

Source: General Statistics Office, 2021

– Contribution to GDP: While precise figures are difficult to ascertain, estimates suggest the informal economy contributes between 15% and 27% to Vietnam’s GDP[3]. This significant contribution highlights the sector’s importance in generating income and supporting livelihoods, particularly for those with limited access to formal employment.

– Informal Labor by Sector: The vast majority (over 90%) of informal workers are concentrated in three main sectors[4]:

-

- ▪ Agriculture, Forestry, and Fishery (AFF): This sector has the highest concentration of informal labor, especially in rural areas.

- ▪ Construction: A significant employer of informal and seasonal labor.

- ▪ Services: This includes a wide range of activities, from street vending and transportation to household businesses.

Data from 2023 shows the sectoral breakdown of the total employed population of 51.3 million people: 13.8 million in AFF, 17.2 million in industry and construction, and 20.3 million in services[5]. Within the AFF sector, an estimated 99% of the workforce is informal, underscoring the deep-rooted nature of informal work in rural Vietnam[6].

A key characteristic of informal workers in Vietnam is their limited professional and technical qualifications, with a high percentage engaged in elementary occupations. Their average monthly earnings are significantly lower than those of formal workers, often falling below the regional minimum wage.

Key Segments

| Segment | Estimated number of workers/businesses | Key characteristics | Common challenges |

| Street Vendors | Millions (part of the 5 million+ household businesses) | Highly visible in urban areas, selling food, beverages, and various goods. Often mobile and operate with minimal capital. | Lack of legal recognition, subject to periodic crackdowns, unhygienic conditions, and competition. |

| Unregistered Household Businesses | Over 3 million | Small-scale, family-run enterprises operating from home, such as small shops, food stalls, and repair services. | Limited access to credit, lack of business management skills, and vulnerability to economic shocks. |

| Freelance Gig Workers | A growing number, especially in urban areas | Includes ride-hailing drivers, delivery workers, and online freelancers. Driven by the rise of digital platforms. | Lack of social protection (pension, health insurance), income instability, and dependence on platform algorithms. |

| Small-Scale Agriculture | Millions of farmers | Predominantly in rural areas, often subsistence farming or selling surplus in local markets. | Vulnerability to climate change, price volatility, and limited access to modern farming techniques and markets. |

| Construction Day Laborers | Significant portion of the construction workforce | Hired on a daily or short-term basis for construction projects. Often migrant workers. | Unsafe working conditions, lack of formal contracts, and wage disputes. |

| Domestic Workers | Large, but difficult to quantify | Predominantly female, providing cleaning, cooking, and caregiving services in private households. | Hidden and unregulated nature of work, long working hours, low pay, and vulnerability to abuse. |

| Informal Manufacturing | Significant portion of the 8.4 million informal household businesses | Small, unregistered workshops producing goods like textiles, furniture, and handicrafts. | Lack of access to technology, competition from larger firms, and challenges in meeting quality standards. |

Source: B&Company’s synthesis

These segments, while diverse, share common threads of vulnerability and resilience. They are integral to the daily life and economy of Vietnam, providing essential goods and services and creating a safety net for a large portion of the population.

Market Trends

Several key trends are shaping Vietnam’s informal economy:

– Impact of Technology: The rise of digital platforms and mobile technology is creating new opportunities for informal workers, particularly in the gig economy. Ride-hailing, food delivery, and e-commerce platforms have provided new avenues for income generation. However, this has also led to new forms of precarity, with workers dependent on platform companies that often do not provide traditional employment benefits.

– Government’s Formalization Efforts: The government is increasingly focused on formalizing the informal economy to broaden the tax base, improve worker protections, and create a more level playing field for businesses. The new Employment Law 2025 is a key example of this trend, aiming to extend social insurance to a wider range of workers.

– Urbanization: Rapid urbanization is leading to a growing urban informal sector, with migrants from rural areas often finding work in informal construction, services, and street vending. This puts pressure on urban infrastructure and services and creates challenges for municipal governments.

– COVID-19 Pandemic: The pandemic highlighted the vulnerability of informal workers, who were often the first to lose their jobs and lacked access to social safety nets. This has increased the urgency for policies that provide better protection for this segment of the workforce.

Implications for Businesses and Investors

For businesses and investors, Vietnam’s informal economy presents a dual landscape of opportunities and challenges.

Opportunities

– Large Consumer Base: The informal economy represents a vast and largely untapped consumer market. Businesses that can offer products and services tailored to the needs and purchasing power of this demographic can find significant growth opportunities.

– Flexible Labor: The informal sector provides a large and flexible pool of labor, which can be an advantage for businesses with fluctuating labor needs.

– Partnership and Sourcing: Formal businesses can partner with informal enterprises for sourcing raw materials, manufacturing components, or distributing products. This can create more inclusive and resilient supply chains.

Challenges

– Lack of Data: The absence of reliable data on the informal economy makes it difficult to assess market size, consumer preferences, and creditworthiness.

– Regulatory Gray Areas: Operating in and with the informal economy can involve navigating a complex and often ambiguous regulatory environment.

– Competition: Formal businesses may face competition from informal enterprises that do not have the same tax and regulatory burdens.

– Logistics and Distribution: Reaching consumers and businesses in the informal economy can be challenging due to a lack of formal addresses and infrastructure.

Actionable Implications

To successfully engage with Vietnam’s informal economy, businesses and investors should consider the following strategies:

– Develop Inclusive Business Models: Design products, services, and distribution channels that are accessible and affordable for low-income consumers and small, informal businesses. The food and beverage franchise industry, as analyzed by b-company.jp, provides an excellent case study[7]. Low-cost, turnkey franchise models can be particularly effective. For an informal household business owner, the prospect of formalizing on their own is daunting due to the perceived complexity and cost[8]. A franchise model de-risks this transition by providing a pre-packaged formal structure, standardized processes for accounting and regulatory compliance, brand recognition, and operational support. This transforms a formidable leap into a manageable step. For the franchisor, it is a highly scalable market entry strategy that taps into a vast pool of experienced, grassroots entrepreneurs. This model is replicable in other sectors such as retail, education, and personal services.

– Leverage Digital Technology: Use mobile payments, e-commerce platforms, and other digital tools to reach and transact with the informal sector. For example, a financial technology company could develop a simple, mobile-first bookkeeping and inventory management application tailored to the needs of household businesses. By offering this tool for free or on a freemium basis, the company can gain invaluable, real-time data on the cash flows, sales cycles, and creditworthiness of a previously invisible market segment. This data can then be used to develop and offer tailored micro-loans, insurance products, or digital payment solutions, effectively bringing these businesses into the formal financial system in a way that provides them with tangible value. This approach uses technology not just for sales, but as a data-gathering and formalization-facilitating platform.

– Build Trust and Relationships: Establish strong relationships with community leaders, local associations, and informal business owners to gain a better understanding of the market and build trust.

– Advocate for a More Enabling Environment: Support policies and initiatives that promote the formalization of the informal economy in a way that is beneficial for both businesses and workers. This includes advocating for simplified business registration, improved access to finance, and expanded social protection. For example, instead of divesting from informal suppliers, leading firms can invest in them. This involves proactively mapping supply chains to identify informal links, providing targeted capacity-building programs (e.g., training on quality standards, financial literacy, occupational safety), and actively assisting them in the formalization process by facilitating access to credit or simplifying registration procedures. In an era of increasing global scrutiny of supply chain ethics and transparency, a company that can demonstrate it has invested in formalizing and upgrading its local supplier base turns a potential liability into a powerful brand asset and a more resilient, loyal, and higher-quality supply chain

– Due Diligence: Conduct thorough due diligence to understand the legal and reputational risks associated with engaging with the informal sector.

By adopting a strategic and nuanced approach, businesses and investors can not only tap into the economic potential of Vietnam’s informal economy but also contribute to a more inclusive and sustainable economic development path for the country.

[1] informal employment – Economica Vietnam, accessed September 15, 2025, https://www.economica.vn/Content/files/PUBL%20%26%20REP/Informal%20Employment%20in%20Vietnam.pdf

[2] WORKERS IN INFORMAL EMPLOYMENT IN VIET NAM, accessed September 15, 2025, https://www.gso.gov.vn/wp-content/uploads/2023/06/LAO-DONG-CO-VIEC-LAM-PHI-CHINH-THUC-O-VIET-NAM-Eg-final.pdf

[3] How large is Vietnam’s informal economy? – ResearchGate, accessed September 15, 2025, https://www.researchgate.net/publication/331525802_How_large_is_Vietnam’s_informal_economy

[4] WORKERS IN INFORMAL EMPLOYMENT IN VIET NAM, accessed September 15, 2025, https://www.gso.gov.vn/wp-content/uploads/2023/06/LAO-DONG-CO-VIEC-LAM-PHI-CHINH-THUC-O-VIET-NAM-Eg-final.pdf

[5] Employment numbers rise but labour market quality yet to improve: GSO, accessed September 15, 2025, https://vss.gov.vn/UserControls/Publishing/News/BinhLuan/pFormPrint.aspx?UrlListProcess=/content/english/tintuc/Lists/EnNews&ItemID=11893&IsTA=True

[6] WORKERS IN INFORMAL EMPLOYMENT IN VIET NAM, accessed September 15, 2025, https://www.gso.gov.vn/wp-content/uploads/2023/06/LAO-DONG-CO-VIEC-LAM-PHI-CHINH-THUC-O-VIET-NAM-Eg-final.pdf

[7] Vietnam’s F&B Franchising Industry: From expansion to consolidation – B-Company, accessed September 15, 2025, https://b-company.jp/vietnams-fb-franchising-industry-from-expansion-to-consolidation/

[8] Why are millions of home-based businesses in Vietnam ignoring registering as companies?, accessed September 15, 2025, https://hanoitimes.vn/why-are-millions-of-home-based-businesses-in-vietnam-ignoring-registering-as-companies.659867.html

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |