23Apr2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam has rapidly emerged as a top destination for foreign investors, thanks to its stable political environment, strong economic growth, strategic trade agreements, and competitive workforce. Major cities like Ho Chi Minh City and Hanoi are transforming into thriving economic hubs, offering distinct advantages for businesses expanding their operations across Southeast Asia.

Vietnam economic situation in recent years

In 2024, Vietnam’s GDP is estimated to grow by approximately 7% compared to 2023, reaching 476 billion USD. Over a decade from 2014 to 2024, Vietnam’s economy has experienced substantial economic expansion, achieving a CAGR of 9%. The services sector continues to dominate, accounting for 42% of the GDP, followed by the industrial and agricultural sectors at around 38% and 12%, respectively. The economic structure is gradually shifting, with the country increasingly investing in the growth of the services and industrial sectors, while the share of agriculture has significantly declined.

Vietnam GDP from 2014 to 2024 by sector

Source: General Statistics Office of Vietnam

In addition, Vietnam is gradually shifting its focus toward investing in and expanding several key industries, such as semiconductors, energy, and construction. These sectors are being supported by large-scale projects, with investments reaching into the billions of dollars:

– North–South High-Speed Railway: Connect Hanoi and Ho Chi Minh City with a high-speed rail line designed for speeds up to 350 km/h. The estimated cost is approximately 67 billion USD, with construction expected to commence by 2030 and completion targeted for 2035[1].

– Nuclear Power Plants: Vietnam plans to construct its first nuclear power plants by 2031 to meet growing energy demands and reduce greenhouse gas emissions. The government has signed agreements with Russia’s state-owned nuclear energy company, Rosatom, to enhance cooperation in nuclear energy[2].

– Semiconductor Manufacturing: Vietnam is investing in its semiconductor industry, with projects like Viettel’s 100 million USD chip factory set to launch in 2025[3]. The government has introduced policies to support this sector, including a funding package of up to 400 million USD, covering 30% of total project investment costs for semiconductor manufacturing plants operational by December 31, 2030[4].

Labor force market in Vietnam

Vietnam remains in its “golden population structure” phase[5], with the labor force aged 15 and older reaching 53 million in 2024, maintaining a stable level of 67% of the total population over the past five years since 2019. The unemployment rate remained low at approximately 2% throughout the year, with workforce allocation is mainly from rural and suburban areas, accounting for 61%, while urban workers comprise the remaining 39%[6].

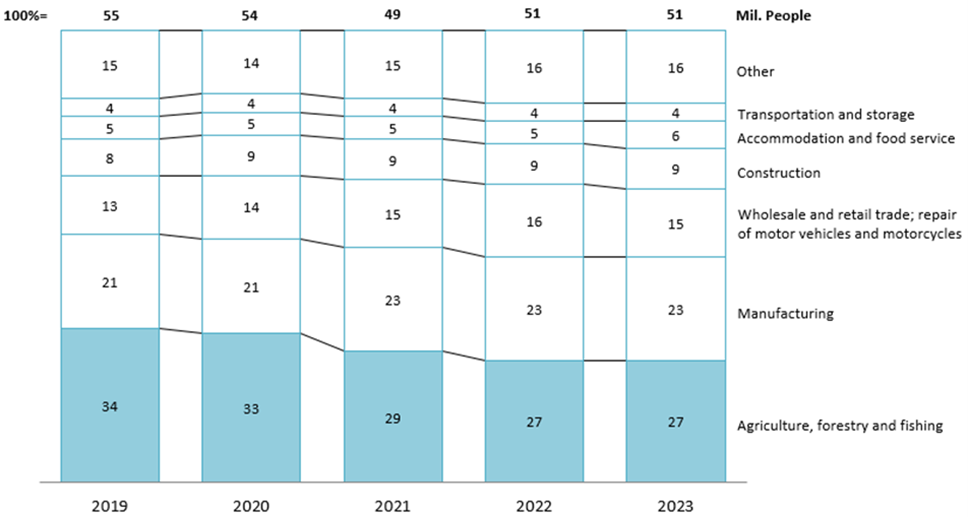

By the end of 2023, the agriculture, forestry, and fisheries sector continued to dominate Vietnam’s employment structure, accounting for 27% of total jobs. This was followed by the processing and manufacturing industry at 23%, retail and automobile repair at 15%, and construction at 9%[7].

Vietnam’s number of employed people by economic activity from 2019 to 2023

Source: General Statistics Office of Vietnam

Additionally, in 2024 the proportion of highly skilled workers in Vietnam remains relatively low, with only 28% of the workforce holding formal training or certification[8]. Conversely 62% of the workforce have not undergone any formal training or obtained recognized credentials. This reflects a modest improvement – a subtle 1% increase compared to 2023 and a 5% growth since 2019[9]. Notably, the workforce saw a significant improvement in sectors like semiconductors and technology, where the supply of qualified professionals is expanding[10]. The increase in skilled workers has contributed to the average monthly wage in Vietnam rising to nearly 315 USD—an 8% increase from 2023[11]. This demonstrates that wages, while competitive, continue to attract companies seeking cost-effective labor solutions.

Situation of FDI investment in Vietnam

Over the past decade, from 2014 to 2024, Vietnam’s FDI has experienced notable expansion in both newly registered investment and project numbers, with a CAGR of approximately 6%. By the end of 2024, the total accumulated registered FDI is projected to reach nearly 503 billion USD, encompassing over 42,000 active projects. Newly registered FDI for 2024 is estimated at around 38 billion USD, representing a 4% decrease compared to 2023. However, this figure indicates a gradual recovery following the economic downturn in 2020[12].

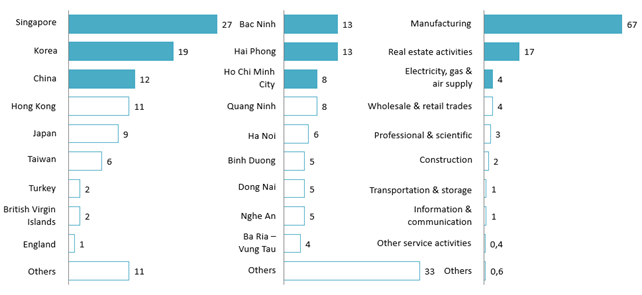

In terms of capital allocation by sector, the manufacturing and processing industry remains the leader, with the total investing amount reaching nearly 26 billion USD, accounting for 67% of the total registered investment. The real estate sector follows with 6 billion USD, accounting for 17%. Next are sectors such as energy, wholesale & retail, each accounting for 4%[13].

Vietnam newly registered FDI in 2024 by investment countries, provinces and sectors

Unit: 100% = 38.2 billion USD

Source: Ministry of Planning and Investment

Singapore remains the leading country in terms of investment value in Vietnam, with newly registered FDI reaching 10 billion USD, accounting for 27%. Korea and China follow in second and third place, with investment values of approximately 7 and 5 billion USD, respectively. Japan ranks fifth among the countries investing in Vietnam, with an investment value of around 4 billion USD. Bac Ninh, Hai Phong, and Ho Chi Minh City are the top three cities and provinces that receive the most investment, while the remaining provinces and cities also see an evenly distributed investment value.

Several notable FDI projects in Vietnam in recent years

| Sector | Main funding source | Project name | Country | Investment value

(million USD) |

Investment year | Location |

| Energy | Japan Bank for International Cooperation and private companies | Investment for renewable, low-carbon energy projects in Vietnam | Japan | 20,000 | 2025 | N/a |

| Manufacturing | Hana Micro Vina | Raising investment to manufacture semiconductor products | Korea | 400 | 2025 | Bac Giang |

| Manufacturing | Victory Giant Technology | Constructing a semiconductor factory | China | 206 | 2025 | Bac Ninh |

| Manufacturing | LG Display | Increase investment for the production of electronic products | Korea | 1,000 | 2024 | Hai Phong |

| Manufacturing | LITEON Technology | Construction of a manufacturing factory for electronic components | Taiwan | 690 | 2025 | Quang Ninh |

Source: B&Company Compilation

In addition, the Vietnamese government also offers various investment incentives, especially in sectors that have gained recent attention, such as semiconductors and energy.

Investment support policies in some sectors in Vietnam

| Policy | Sector | Issued date | Invesment support |

| Decree No. 182/2024/NĐ-CP | Semiconductor and high technology | 2024 | Offer support funding in various sector[14]

· Human resource development: Up to 50% · Research and Development: Up to 30% · Investment in fixed asset: Up to 10% · Product manufacturing: Up to 3% Social infrastructure: Up to 25% |

| Decree No. 58/2025/NĐ-CP | Energy | 2025 | Wind energy

· Exemption from sea area usage fees during construction for up to 3 years, with a 50% reduction for the next 12 years · Exemption from land use and rental fees during the basic construction period, but not exceeding 3 years from the start date · Minimum electricity production contract of 80% during the loan principal repayment period, not exceeding 15 years Rooftop solar energy · Individuals and households with electricity capacity under 100kW are not required to register a business · Allowed to sell surplus electricity, but not exceeding 20% of the total electricity generated Renewable and new energy · Exemption from sea area usage fees during construction for up to 3 years, with a 50% reduction for the next 9 years · Exemption from land use and rental fees during the basic construction period, but not exceeding 3 years from the start date · Minimum electricity production contract of 70% during the loan principal repayment period, not exceeding 12 years |

Source: Vietnam Government Portal

Practical Advice for Foreign Investors

Despite its advantages for expansion and investing in emerging markets like Vietnam, investors should be aware of certain challenges. Vietnam is undergoing significant bureaucratic reforms to streamline its administrative processes, including reducing the number of ministries and agencies. While these changes aim to enhance efficiency, they may temporarily affect the pace of project approvals[15]. Additionally, while the government is transitioning to online platforms for business-related administrative procedures by the end of 2025, regional disparities in implementation may still pose challenges[16]\. Cultural nuances and language barriers remain pertinent; effective communication often requires understanding indirect expressions and non-verbal cues, which can vary across regions. Being attuned to these cultural dynamics and administrative transitions will be crucial for navigating the Vietnamese business environment effectively.

Conclusion

Vietnam is a favorable destination for many investors expanding their businesses and investing in the region’s long-term growth. While the country’s economy is gradually growing, global trade tensions have somewhat impacted both the economy and the Vietnamese market. In addition to the investment advantages, there are still several challenges that investors need to be aware of. However, if these challenges can be navigated, Vietnam remains an ideal investment location for those seeking to expand their market in the Southeast Asian region.

[1] VietnamPlus (2024). North – South High-speed Rail Price Tag Estimated at 67.34 billion USD <Access>

[2] Lao Dong News (2025). Russia Continue to Support Vietnam in Develop Nuclear Power <Access>

[3] Nguoiquansat (2024). Vietnam Planning to Construct a Domestic Semiconductor Manufacturing Factory <Access>

[4] Linkedin (2025). Vietnam’s Semiconductor Policy: Opportunities & Strategic Challenges <Access>

[5] Golden population structure is characterized by the highest proportion of the working-age population (15-64 years old) compared to the dependent population (under 15 years old and over 64 years old)

[6] Portal of Ministry of Planning and Investment (2025). Vietnam’s Labor and Employment Situation in 2024 <Access>

[7] General Statistics Office of Vietnam (2024). Number of Employed Persons by Kinds of Economic Activity in 2023 <Access>

[8] A person aged 15 or older who is employed or unemployed, who has studied and graduated from a vocational or technical training program within the national education system and has been awarded one of the following degrees or certificates: elementary (vocational), intermediate, college, university (bachelor’s), master’s, doctoral, or doctor of science.

[9] General Statistics Office of Vietnam (2025). Vietnam’s Employment Report <Access>

[10] Vietnam Briefing (2024). Vietnam Labor Market Report for H1 2024 <Access>

[11] Source of Asia (2024). Vietnam Labor Market 2024 Onwards <Access>

[12] General Statistics Office of Vietnam (2024). Foreign Direct Investment Projects Licensed in Vietnam <Access>

[13] Ministry of Planning and Investment (2025). Situation of Foreign Direct Investment in Vietnam in 2024 <Access>

[14] The level of support funding will vary depending on each company’s expenditure, with stricter conditions required to qualify for higher levels of funding

[15] VnExpress (2025). Vietnam to Merge 63 Localities into 6 Cities and 28 Provinces Under Major Restructuring Plan <Access>

[16] Vietnam Law & Legal Forum (2025). All Business-related Administrative Procedures to be Done Online by the end of 2025 <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |