03Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s logistics sector is rapidly digitalizing, driven by policy momentum and industry demand. As one of the eight industries prioritized in the National Digital Transformation Programme to 2025 (vision 2030), logistics is expected to leverage advanced technologies to reduce operational costs, critical in a market where logistics expenses remain a substantial burden for businesses. Against this backdrop, the current application of domestic TMS platforms, GPS tracking systems and AI-powered route-optimization tools in Vietnam is expanding quickly. Adoption is strongest among large 3PLs and e-commerce players, while data-quality issues and fragmented fleets continue to constrain full-scale implementation.

Organizational structure of the Ministry of Transport

Source: Luat Viet Nam

Market overview: size, characteristics and digital adoption

Vietnam’s logistics and freight market is already sizeable and expanding. The industry has made notable progress, with Vietnam’s Logistics Performance Index (LPI) rising to 3.3 in 2023, placing the country 43rd out of 139 economies compared to its 53rd position in 2010[1]. In 2023, Vietnam also ranked 5th within the ASEAN region, sharing the same position as the Philippines and trailing behind Singapore, Malaysia, and Thailand. Recent estimates put the total logistics market value at USD 80.65 billion in 2024, with expected CAGR of around 6.40%, reaching a value of USD 149.98 billion by 2034[2].

Currently, Vietnam has more than 3000 logistics companies, 89% of which are domestic and mostly SMEs (around 95%), however, they control only about 30% of the market. Foreign players dominate the remaining share, particularly in high-value segments like cold-chain logistics. Vietnam’s logistics costs also remain elevated at roughly 18% of GDP, well above the global average of 14% and higher than countries such as Singapore (8.5%) and Thailand (15.5%)[3].

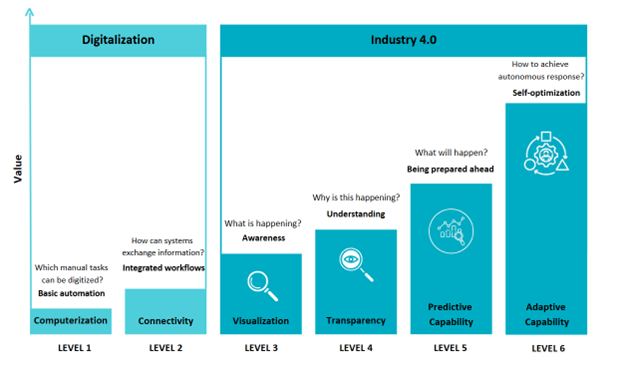

Six Digital Maturity Levels of Logistics businesses

Source: B&Company compilation from the Ministry of Industry and Trade’s Report

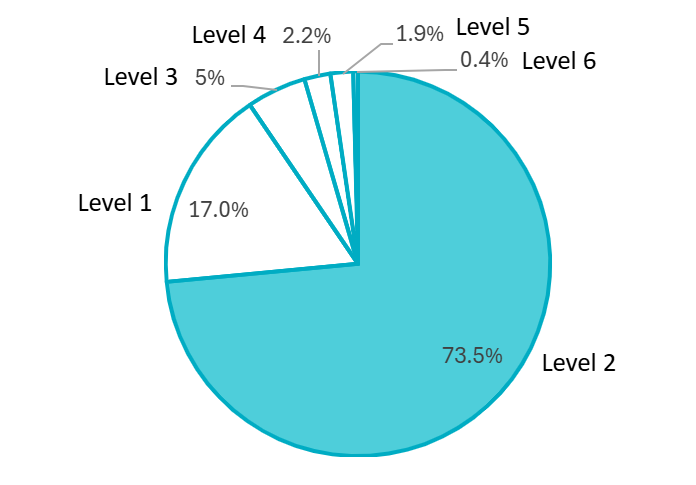

A nationwide survey of 464 logistics companies reveals that Vietnam’s logistics sector remains at an early stage of digital transformation. Over 90% of firms are still in basic digitization (Levels 1-2), with Level 2 – Basic connectivity accounting for 73.5%. Only a small minority have progressed to advanced phases: 5% (Level 3 – Visualization) and a very limited 0.4% achieving Level 6 – Adaptive capability[4]. These findings highlight a significant digital-maturity gap that logistics firms must bridge to enhance competitiveness and adopt technologies such as AI, GPS-based optimization and Transport Management Systems (TMS), which is a software platform that helps companies plan, execute, and optimize the movement of goods by managing transportation operations, routing, carrier selection, freight booking, tracking, and shipment documentation.

Current digital-transformation levels of logistics service enterprises in Vietnam

100% = 464 logistics companies

Source: Vietnam Logistics Report 2023

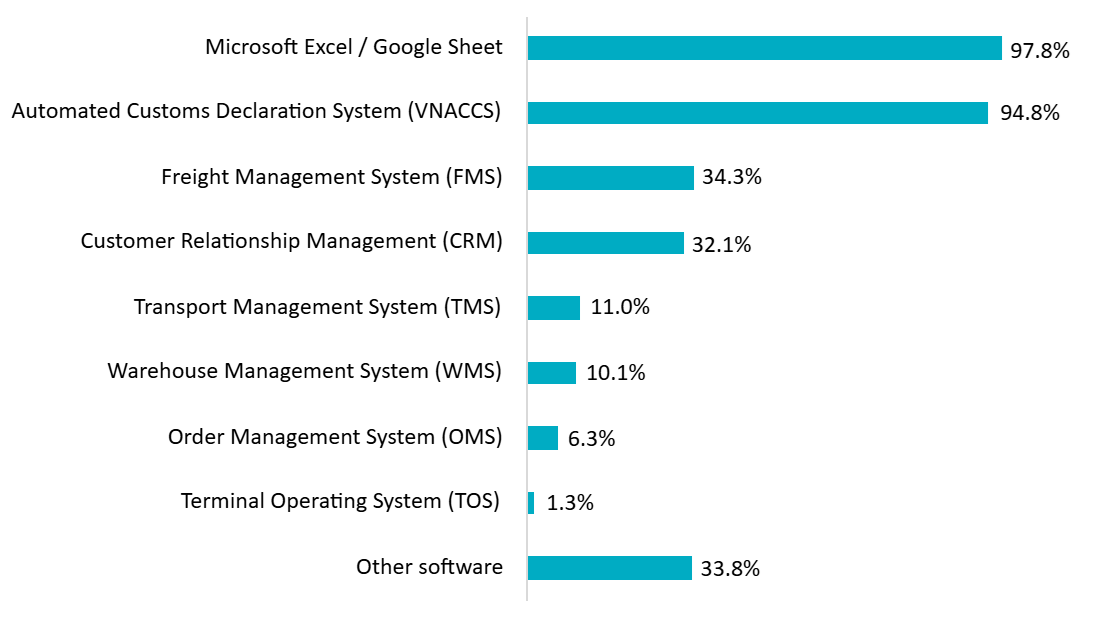

In addition, although Transport Management Systems (TMS), Warehouse Management Systems (WMS), and Order Management Systems (OMS) offer strong development potential, their adoption remains limited, with only 11.0%, 10.1%, and 6.3% of surveyed firms use them, respectively.

Software currently used by logistics service enterprises in Vietnam

100% = 464 logistics companies

Source: Vietnam Logistics Report 2023

Status of TMS adoption in road transport

Road transport accounts for the largest share of Vietnam’s logistics sector, representing more than 70% of total domestic freight volume. In Q1/2025, road freight transport was estimated at 525.8 million tons, up 16.2%, while freight turnover reached 31.9 billion ton-km, up 5.9% year-on-year[5]. Furthermore, road transport remains the primary segment where TMS, GPS and AI route optimization are applied.

TMS adoption in Vietnam began with large 3PLs and international forwarders but is gradually expanding to local trucking firms, distributors and retailers. It is shown that TMS-based loading, dispatching and route-planning solutions significantly reduce planning time, fleet size and total route distance while supporting functions such as electronic proof of delivery and detailed operational reporting[6].

Whereas interest in TMS in Vietnam’s road-transport/logistics sector is growing, adoption remains modest and uneven, largely concentrated in larger fleets or 3PLs rather than fragmented small carriers. According to a survey released by the Ministry of Science and Technology in March 2024, 73% of medium and large logistics enterprises have adopted Transport Management Systems (TMS), up from 58% in 2021[7]. Nevertheless, many SMEs remain at early digital stages (e.g., GPS tracking and spreadsheets) rather than full TMS with route-optimization, analytics, and system integration.

GPS Tracking and Telematics Penetration

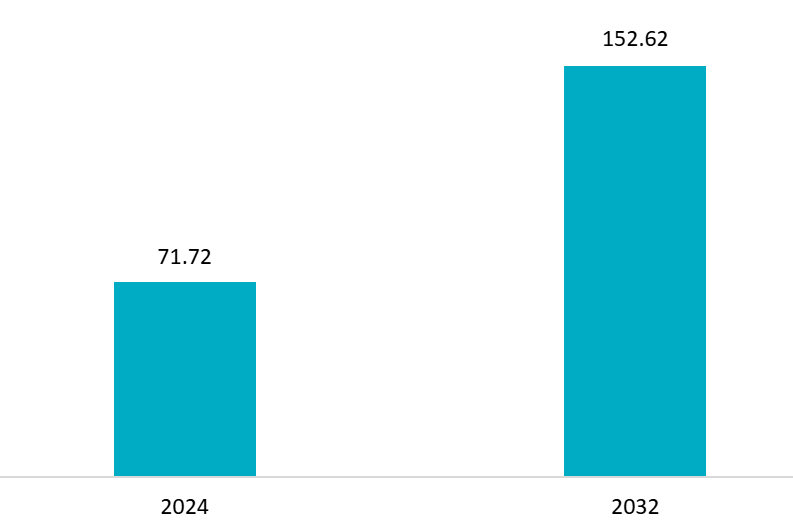

The Vietnam Fleet Management market was valued at USD 71.72 million in 2024 and is likely to grow at a CAGR of 11.39% from 2024 to 2032[8]. A model of Vietnam fleet management – the GPS tracking device market is expanding rapidly, driven by rising transport and logistics activity, growing demand for fleet management, and the wider digital transformation of e-commerce and infrastructure. GPS technology has become essential for route optimization, real-time visibility, and operational control across sectors. The GPS tracking device market was valued at approximately USD 28.65 million in 2024, accounting for 40% of the Vietnam fleet management market value and is projected to grow at a strong CAGR of 11.98 % from 2025 to 2032.

Vietnam Fleet Management Market (2024 – 2032)

Unit = USD Million

Source: Data Bridge

The GPS tracking market is featured by both global brands (Teltonika, Queclink, etc.) and domestic suppliers such as Vietmap, Taris and Khanh Hoi, supported by software providers like Smartlog and EMDDI. GPS tracking is now standard on most long-haul and urban fleets, enabling real-time monitoring, driver-behavior analysis, fuel management and seamless integration with TMS and AI routing engines. Road-transport regulation in Vietnam requires commercial vehicles to install journey-monitoring devices and GPS trackers, driving the growth of a strong local telematics ecosystem. Besides, as Vietnam is dominated by SMEs, many road-transport operators are small fleets or owner-drivers who still manage dispatch with phones, spreadsheets and basic GPS.

Emerging Role of AI in Route Optimization

Vietnam is also becoming an active hub for smart-logistics innovation, with platforms like Abivin vRoute delivering AI-driven vehicle-routing solutions that reduce distance, planning time and fuel consumption. The Ministry of Science and Technology has publicly recognized Abivin vRoute as a leading smart-logistics innovation contributing to reduced emissions and more efficient road transport.

However, AI route optimization is used only by leading 3PLs, large shippers and tech-savvy players, but not yet widely adopted across the fragmented trucking market. The main limitations are structural and organizational rather than purely technical. Studies on factors affecting digital transformation in Vietnamese logistics highlight capital constraints, lack of specialized IT/AI talent, low digital skills in many SMEs, and weak system integration as key barriers[9].

Overall, the use of domestic TMS, GPS and AI in optimizing road-transport routing is moving rapidly from pilot projects to widespread adoption among larger fleets, although digital maturity among smaller trucking companies remains limited.

Key Adopters of TMS, GPS and AI in optimizing road-transport routing

AI-driven route optimization is most advanced among fast-growing e-commerce logistics players such as Viettel Post, GHN, Shopee Express, Ninja Van, J&T Express, and global operators like DHL and FedEx, all of which combine TMS, GPS telematics, and AI to manage complex, high-volume delivery networks. Traditional 3PLs, including Transimex, Gemadept, Vinafco, and AL,S have widely adopted TMS and GPS but are only beginning to integrate analytics or AI-based routing. This shows a clear pattern: AI adoption is strongest where delivery density and time sensitivity are highest, while conventional road-transport providers remain focused on foundational digital tools.

| No. | Company | Year Founded | Country | Short Profile & Technology Adoption |

| 1 | Viettel Post / Viettel Logistics | 1997 | Vietnam | One of Vietnam’s largest logistics and express delivery groups. Uses TMS, nationwide GPS-telematics, and AI-based route optimization for last-mile and line-haul planning. Strong digitization driven by Viettel Group’s tech ecosystem. |

| 2 | Vietnam Post (VNPost) | 2005 | Vietnam | State-owned postal and logistics provider. Applies TMS and telematics across its national trucking & delivery network; pilots AI-powered routing to optimize mail & parcel flows. |

| 3 | Scommerce (GHN, AhaMove) | 2012 | Vietnam | Leading e-commerce logistics network in Vietnam. GHN uses real-time GPS, TMS, and AI-driven route planning to optimize thousands of daily last-mile deliveries. |

| 4 | Ninja Van Vietnam | 2014 | Singapore | Major Southeast Asian express logistics firm. Deploys AI-based dynamic routing, GPS fleet tracking, and automated load planning across its Vietnam operations. |

| 5 | J&T Express Vietnam | 2013 | Indonesia | Operates an extensive road-based parcel network in Vietnam. Uses TMS, scanning/telematics systems, and algorithmic routing to manage high-volume e-commerce deliveries. |

| 6 | Shopee Express (SPX Vietnam) | 2020 | Singapore | E-commerce delivery arm of Shopee. Heavy user of AI for route sequencing, driver allocation, and real-time GPS monitoring to support nationwide high-density last-mile operations. |

| 7 | Transimex Corporation | 1983 | Vietnam | Leading logistics & 3PL provider. Uses TMS, GPS fleet management, and data-driven route scheduling for domestic trucking and container drayage services. |

| 8 | Gemadept Logistics | 1990 | Vietnam | Large integrated logistics company. Applies TMS, GPS telematics, and optimization tools for inland transport (trucks, ICD-port moves), improving routing and asset utilization. |

| 9 | Vinafco | 1987 | Vietnam | 3PL with strong FMCG distribution network. Uses TMS + GPS for route planning and delivery visibility; applies analytics-based optimization to enhance delivery routes. |

| 10 | ALS (Aviation Logistics Services) Road Transport Division | 2007 | Vietnam | Provides airport-relate trucking and inland transport. Uses TMS, GPS fleet management, and automated routing to meet strict time windows for air logistics. |

| 11 | DHL Vietnam | 1989 (Vietnam operations) | Germany | Uses global TMS, telematics, and AI optimization engines in its Vietnam domestic-road distribution, especially in DHL Supply Chain’s FMCG and retail networks. |

| 12 | FedEx Vietnam | 1994 | USA | Applies FedEx’s global AI routing and optimization systems in Vietnam’s ground operations, including GPS-connected delivery fleets. |

B&Company’s synthesis

Key Drivers of Digital Transformation

E-commerce and same-day delivery are pushing route-optimization demand

Vietnam’s rapidly expanding e-commerce sector, expected to reach USD 57 billion by 2025[10] has intensified demand for efficient route planning. The surge in parcel volumes has created denser last-mile networks, more frequent returns, and increasingly complex urban delivery routes. In this environment, large 3PLs, express carriers and online retailers have become early adopters of domestic TMS platforms and AI-driven route-optimization tools to reduce failed deliveries and minimize empty mileage.

Digital transformation and green logistics

At the same time, national logistics development goals for 2030 emphasize reducing logistics costs to 16-18% of GDP[11], increasing outsourcing, and improving sectoral efficiency. This policy direction encourages logistics enterprises to accelerate digital transformation, especially through AI, data analytics and automated route-planning systems that reduce fuel use and support Vietnam’s green logistics and net-zero commitments. Such measures position TMS, GPS and AI as central enablers of both operational savings and environmental objectives.

Tightening regulations and enforcement via GPS data

Regulatory tightening also shapes market behavior. Stricter rules on driving hours, overspeeding and vehicle load limits increasingly rely on GPS-derived journey-monitoring data for enforcement. This pushes transport companies to adopt more reliable telematics and TMS solutions capable of generating compliant digital records. It also strengthens interest in intelligent scheduling and route-optimization engines that help fleets meet legal requirements while still achieving on-time delivery performance.

Growing local software ecosystem

Finally, Vietnam’s software ecosystem is expanding, with new domestic vendors offering cloud-based TMS/FMS platforms tailored to local trucking operations. These systems feature affordable SaaS pricing, integration with common Vietnamese GPS devices, and compatibility with e-invoicing and ERP/WMS platforms. Industry analyses highlight rising demand for integrated fleet-management and route-planning solutions, particularly among 3PLs and large shippers facing cost pressures and service-level demands.

Key Obstacles of Digital Transformation

High Costs and Limited Capital

The majority of Vietnam’s logistics companies are SMEs with tight financial capacity, making digital transformation a significant burden. With two-thirds holding under VND 3 billion in capital[12] and a lack of funding, many firms view TMS, telematics, and AI-powered routing as too expensive compared with short-term operational needs. Comprehensive systems require substantial upfront spending covering software, hardware, training, and ongoing maintenance, which many companies find difficult to justify. As a result, digital transformation is often perceived as something only large enterprises can pursue, leaving smaller operators slower to adopt modern optimization technologies.

Shortage of Skilled Workforce and Limited IT Capability

AI-driven optimization requires strong IT capability, project management skills, and a digitally literate workforce – capabilities many logistics firms lack. Vietnam Logistics report 2024’s findings show 66.6% lack internal digital experts and 53.7% struggle to find employees with adequate technical skills. Without qualified staff to manage and integrate new systems, companies hesitate to deploy advanced technologies like predictive routing or automated dispatch.

Weak Technical Infrastructure and Cybersecurity Concerns

Technical limitations also hinder the adoption of AI-based route optimization. Many logistics firms still operate on outdated or fragmented IT infrastructure, making it difficult to support real-time data exchange, system integration, or high-performance analytics. Concerns about cybersecurity and data protection further discourage companies from adopting cloud-based or AI-enabled platforms, as they fear potential breaches or operational risks.

Operational Disruption, Customer Readiness, and Regulatory Barriers

Many logistics firms remain hesitant to adopt advanced routing technologies because digital transformation can disrupt day-to-day operations and requires significant time and organizational adjustment. Customer readiness is another constraint, as many shippers and partners still operate on manual processes, reducing the incentive for transport companies to upgrade their own systems. In addition, frequent changes in technology and evolving customer expectations make it difficult for firms to commit to long-term digital tools. Regulatory frameworks can also be unclear or slow to adapt, creating uncertainty around compliance and limiting the speed at which new digital solutions can be deployed.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] https://lpi.worldbank.org/international/global

[2] https://www.expertmarketresearch.com/reports/vietnam-logistics-market

[3] https://vie10.vn/2025/05/26/cong-bo-top-10-doanh-nghiep-doi-moi-sang-tao-va-kinh-doanh-hieu-qua-nam-2025-nganh-logistics/

[4] https://valoma.vn/wp-content/uploads/2023/12/Bao-cao-Logistics-Viet-Nam-2023.pdf

[5] https://www.nso.gov.vn/tin-tuc-thong-ke/2025/04/hoat-dong-van-tai-soi-dong-trong-quy-i-nam-2025/

[6] https://vynncapital.com/wp-content/uploads/2024/11/Vietnam-Logistics-Report.pdf

[7] https://valoma.vn/wp-content/uploads/2024/12/Sach-Bao-cao-Logistics-2024-full-ngay-7-12.pdf

[8] https://www.databridgemarketresearch.com/nucleus/vietnam-fleet-management-market

[9] https://www.mdpi.com/2079-9292/12/8/1825

[10] https://intech-group.vn/forecast-of-logistics-market-in-vietnam-in-the-second-half-of-2025-bv1251.htm

[11] https://logitrackvn.com/en/digital-transformation-in-vietnams-logistics-sector-2025

[12] https://www.quanlynhanuoc.vn/2024/05/14/chuyen-doi-so-trong-linh-vuc-logistics-o-viet-nam/