26Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam – Japan trade and supply chain has proved to be strong and growing throughout the year, and it can be facilitated further when new technologies such as blockchain emerge, promising an enhancement in transparency, traceability, and efficiency. While Vietnam’s current blockchain adoption in logistics remains limited, early successes in agricultural traceability have been shown. This article also outlines key challenges for future application into the bilateral supply chain network, including regulatory gaps, high implementation costs, fragmented data and security issues. Under this context, implications and recommendations are provided.

Vietnam–Japan Trade and Supply Chain

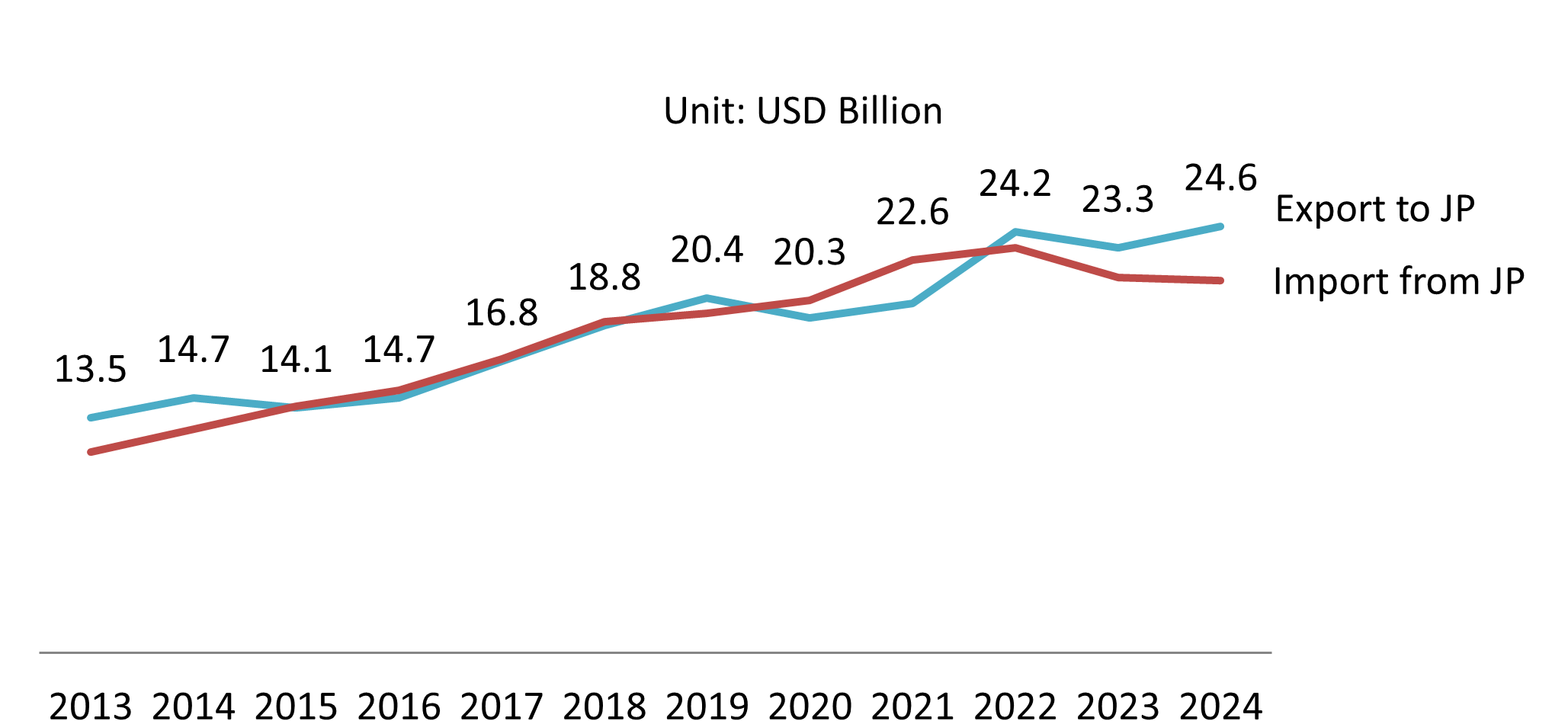

Vietnam and Japan maintain a strong bilateral trade relationship, with total goods trade between the two nations estimated at around USD 46.2 billion in 2024, up roughly 2.8 % year-on-year[1]. Of that, their total goods trade turned over around USD 46.2 billion, with Vietnam exporting approximately USD 24.61 billion to Japan and importing about USD 21.62 billion in return.

Vietnam – Japan Export and Import Value from 2013 – 2024

Source: ITC Trade Map

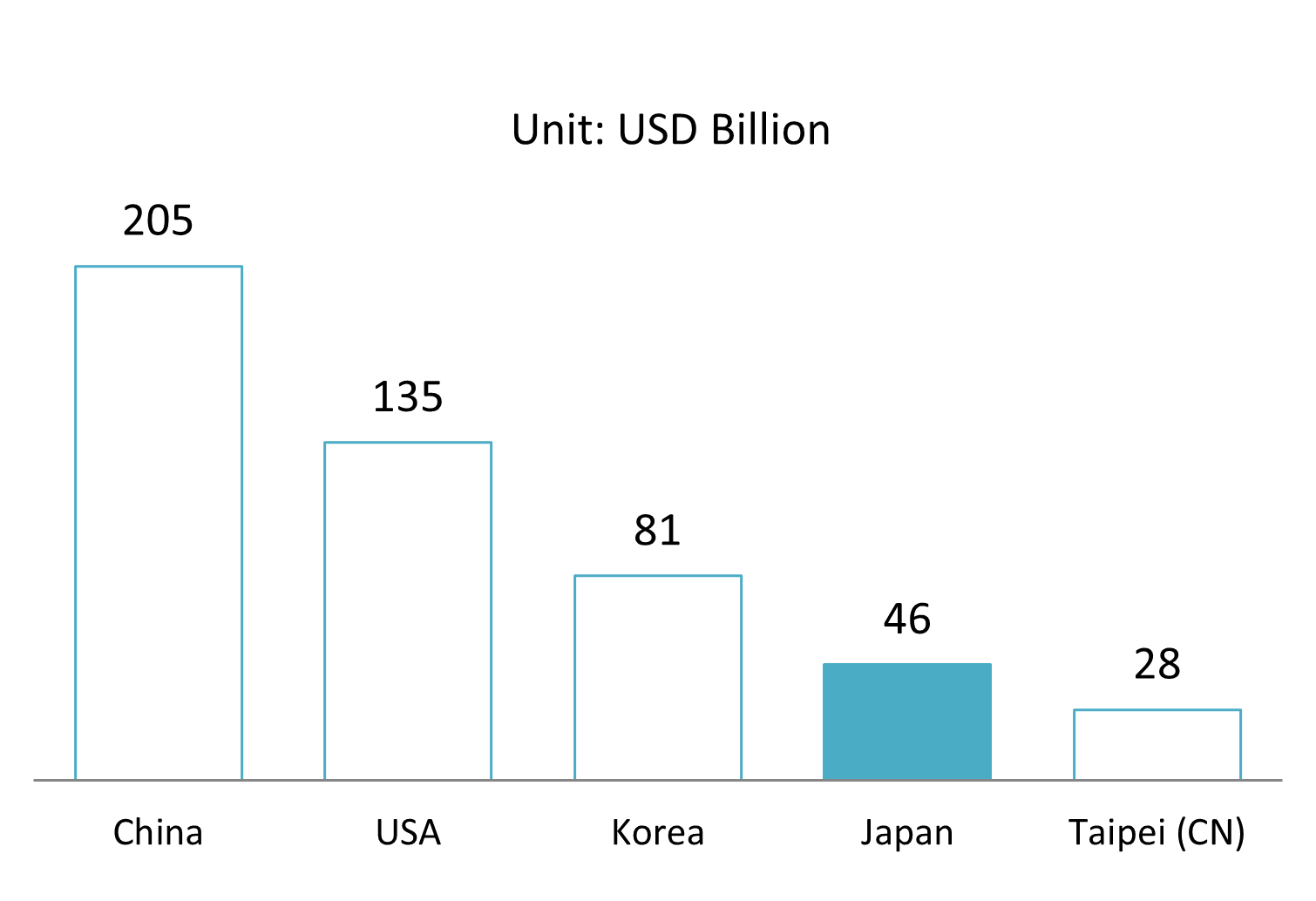

Globally, Japan is Top 4 trade partner of Vietnam. Vietnam’s main exports to Japan include textiles and garments, machinery and spare parts, wooden products, seafood, and agricultural goods, while Japan exports machinery, electronics, iron and steel, and high-value industrial components to Vietnam[2].

Top 5 Vietnam’s Trade Partners in 2024

Source: ITC Trade Map

Japan is also among Vietnam’s largest investors, contributing significantly to infrastructure, industrial zones, and logistics modernization. Recent initiatives include a strategic partnership between Vietnam’s Toan Phat Logistics JSC and Japan’s Kawanishi Warehouse and MOL Logistics to establish a cold-chain logistics hub in the Mekong Delta—enhancing export efficiency for perishable goods[3].

As both nations pursue greater supply-chain transparency, efficiency, and sustainability, digital transformation has become a shared priority. This is where blockchain technology is emerging as a promising catalyst. By offering secure, immutable, and real-time tracking of goods and documentation, blockchain can help address long-standing challenges in cross-border logistics.

Blockchain and its usage in Vietnamese logistics activities

Blockchain is a decentralized, immutable ledger technology that records transactions, movements and documentation in real time, offering visibility to all authorised participants in the network[4]. It can address key issues in cross‑border logistics: the fragmentation of data across multiple parties, weak traceability of goods (especially perishables or high‑value items), risk of document fraud or counterfeiting, and slow/manual hand‑offs in documentation and customs.

In Vietnam logistics industry, not until 2017 did companies start to notice the potentials of blockchain technology[5]. Currently, blockchain technology is gradually being adopted in Vietnam’s logistics service industry, primarily by large enterprises. Approximately 10-15% of companies have experimented with or implemented blockchain, notable names include VNL, Sapo Logistics, and BHL Logistics. The adoption rate of 10-15% is considered a modest level of engagement, with applications largely limited to specific processes rather than comprehensive system integration, including goods tracking, document management and smart contracts[6].

In terms of import and export activities, blockchain has proved its role in traceability of Vietnamese agricultural products. Some notable projects have successfully brought Vietnamese products to strict global markets, namely Agridential and FruitChain:

Agridential, developed by Vietnam Blockchain Corporation, is a blockchain-based platform designed for traceability and production management of agricultural products such as rice. It addresses key challenges in Vietnam’s rice supply chain including counterfeit products, lack of transparency, and inefficiencies. The platform digitally records every stage of the ST25 rice production process and assign a unique digital identifier to each batch. This enables real-time supply chain monitoring, fraud prevention, and compliance with stringent international standards required in export markets like the US, EU, and Japan[7].

Similarly, FruitChain focuses on the mango supply chain in Dong Thap province, utilizing blockchain technology to ensure the traceability and quality of mangoes from farm to international consumers[8]. By tracing every step of the supply chain on blockchain, it increases confidence among export partners and consumers, enabling Vietnamese mangoes to enter demanding global markets and reducing losses associated with spoilage, fraud, or logistical inefficiencies.

QR Code attached to each mango helps ensure transparency of the supply chain

Source: Vietnam Trade and Industry Review

Challenges for further blockchain application

While blockchain promises to offer significant potential for enhancing supply chain transparency, its application in Vietnam remains limited and not widespread. Many projects are only for optimizing a part of the supply chain and focusing on certain product type. To integrate blockchain across the whole import and export network, especially to bilateral relationship between Vietnam and its strategic partner – Japan, a lot challenges must be overcome.

Regulatory & legal uncertainty

Vietnam’s blockchain regulatory framework remains underdeveloped, particularly regarding cross-border data sharing and integration with existing trade laws. Vietnamese customs regulations have not fully adapted to accommodate blockchain-based documentation, requiring businesses to maintain parallel paper-based systems. This regulatory gap creates hesitation among logistics providers and exporters who fear non-compliance risks. Without mutual legal standards between the two countries governing blockchain transactions, companies could face uncertainty that discourages investment in the technology.

High implementation costs and adoption barrier

Establishing blockchain infrastructure demands substantial upfront investment in software, hardware, IoT sensors for real-time monitoring, and workforce training that many Vietnamese SMEs cannot readily absorb. Most Vietnamese logistics companies operate on legacy systems including manual paperwork, traditional ERPs, and fragmented databases. Integrating blockchain with these existing systems presents significant technical complexity and compatibility issues. Vietnam also faces a critical shortage of blockchain specialists, with many organizations still associating the technology primarily with cryptocurrencies rather than supply chain applications[9].

Data quality and standardization

Blockchain’s effectiveness depends entirely on accurate data input from all supply chain participants. However, Vietnamese supply chains suffer from fragmented data management, with information stored in isolated silos across farmers, processors, exporters, and logistics providers. Many upstream actors lack digital literacy and proper systems for recording production data systematically. In a cross-border scenario between Vietnam and Japan, all parties would need to agree on what data is entered, by whom, and when.

Security, privacy and cross border governance

Since trade between Vietnam and Japan crosses national boundaries, issues of data governance, interoperability, privacy (especially for commercial sensitive information), and cybersecurity become more significant. Even though blockchain is tamper-resistant, it still faces security threats such as smart contract bugs and network vulnerabilities, which must be carefully managed. Being aware of the issues, Vietnam’s government has eemphasized building safe blockchain ecosystems to protect digital assets and enhance user trust to make ways for widespread blockchain application in the future[10].

Business Implications for Vietnam-Japan Trade Stakeholders

Despite the current limited application in Vietnamese logistics and the absence of established blockchain applications specifically for Vietnam-Japan logistics, the potentials of blockchain technology is widely recognized and embraced by businesses and governments. This leaves potential for partnership between companies of two countries to establish early stage projects, set foundation for the future supply chain. The pilot projects could start with product types already prominent in bilateral trade (textiles, electronics components, agricultural goods), which allows stakeholders to test system integration, validate data accuracy, and demonstrate concrete benefits before scaling.

To improve adoption readiness, logistics firms in both countries should invest in data standardization and shared protocols. By aligning data formats, product identifiers, and reporting requirements, risk of inconsistent inputs to the blockchain system can be mitigated. Other digital readiness is encouraged, including training staff in digital documentation and upgrading inventory systems to capture accurate data. This preparation phase is critical for enabling transparent and verifiable information flows once blockchain platforms are fully deployed.

The role of regulation is also important, and companies can contribute to stimulating the regulatory improvement through industry associations, chambers of commerce, and public–private dialogue platforms to help shape upcoming standards for digital trade and blockchain governance. Companies can also participate in regulatory sandbox programs, where new technologies are tested under controlled conditions. By taking an active role, firms can align early with future requirements, reduce compliance risks, and accelerate the readiness of the Vietnam–Japan supply chain for large-scale blockchain integration.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Vietnam.vn, Promoting Vietnam – Japan economic cooperation (https://www.vietnam.vn/en/thuc-day-hop-tac-kinh-te-viet-nam-nhat-ban)

[2] Vietnam Plus, Seminar discusses expanding Vietnamese exports to Japan (https://en.vietnamplus.vn/seminar-discusses-expanding-vietnamese-exports-to-japan-post321626.vnp)

[3] VNExpress, The first integrated cold logistics center in Vietnam (https://vnexpress.net/trung-tam-logistics-lanh-tich-hop-dau-tien-tai-viet-nam-4940843.html)

[4] Investopia, Blockchain Facts (https://www.investopedia.com/terms/b/blockchain.asp)

[5] Journal of Science And Technology Policies and Management, Applying blockchain technology in Vietnamese logistics service providers: Current situation and development solutions (https://vietnamstijournal.net/index.php/JSTPM/article/view/560)

[6] International Journal of Engineering Inventions, Application Of Blockchain Technology in Vietnamese

Logistics Enterprises: Current Situation and Solutions (https://www.ijeijournal.com/papers/Vol14-Issue6/1406158161.pdf)

[7] Vietnam Blockchain Corporation, A Blockchain Traceability Pilot has potential to protect ST25 Rice Brand – USAID LinkSME Project (https://vietnamblockchain.asia/post/5667776/blockchain-traceability-st25-rice)

[8] Can Tho Science and Technology, ‘Vietnam Blockchain Country’ – positioning Vietnam on the world Blockchain map (https://sokhcn.cantho.gov.vn/default.aspx?pid=57&nid=14736)

[9] VN Economy, Blockchain industry faces talent shortages (https://en.vneconomy.vn/blockchain-industry-faces-talent-shortages.htm)

[10] Vietnam.vn, Vietnam creates a safe and transparent blockchain ecosystem (https://www.vietnam.vn/viet-nam-kien-tao-he-sinh-thai-blockchain-an-toan-minh-bach)