21Feb2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s packaging paper industry is experiencing rapid growth, fueled by increasing domestic demand, expanding e-commerce, and rising foreign investment. The market is projected to continue its upward trajectory, driven by sustainability trends and the country’s role as a key manufacturing hub in Southeast Asia. However, challenges such as raw material dependency, environmental concerns, and the need for technological advancements must be addressed to ensure long-term sustainability and competitiveness.

Market Overview of the Vietnam Packaging Paper Market

Vietnam’s packaging paper market has experienced significant expansion over the past decade. In 2024, the market was valued at approximately $2.6 billion and is projected to reach $4.14 billion by 2029, growing at a compound annual growth rate (CAGR) of 9.73%. [1] This growth is largely fueled by the increasing demand for sustainable packaging materials and Vietnam’s emergence as a major exporter of paper-based packaging products.

In the first 4 months of 2024, Vietnam’s packaging paper export turnover reached $774 million, marking a 16.3% increase compared to the same period in the previous year. The primary export products include carton boxes, kraft paper, paper bags, and paper boxes, which are highly sought after in international markets.

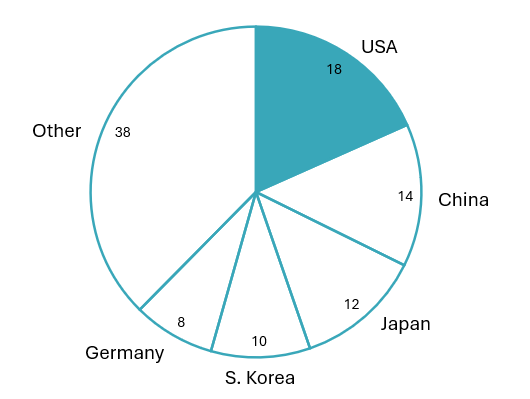

The United States remains the largest importer of Vietnamese packaging paper, with a turnover of $142 million in the first 4 months of 2024. Other major export destinations include China, Japan, South Korea and Germany. [2] The steady demand from these markets underscores Vietnam’s growing prominence in the global packaging industry.

Main export market of Vietnam paper packaging

100% = 774 million USD

Source: Research Institute of Pulp and Paper Industry [3]

Key Growth Drivers of the Vietnam Packaging Paper Market

Vietnam’s packaging paper market is expanding rapidly, supported by various economic and industrial factors. The increasing demand for sustainable packaging, the rapid growth of e-commerce, and the country’s emergence as a major manufacturing hub are driving the market forward.

E-Commerce Expansion

Vietnam’s e-commerce sector has witnessed exponential growth in recent years, significantly impacting the demand for packaging materials. Between 2020 and 2024, the industry grew by 16–30% annually. In 2024, the Gross Merchandise Value (GMV) from the top major e-commerce platforms reached approximately $12.6 billion, a 37.3% rise from 2023 [4].

The booming e-commerce industry has led to increased demand for sturdy, lightweight, and cost-effective packaging materials. Paper-based packaging solutions, particularly corrugated boxes and paper bags are preferred due to their recyclability and eco-friendly nature. As more Vietnamese consumers shift to online shopping, the demand for high-quality packaging paper is expected to grow further.

Sustainability Trends and Regulations

The global shift toward sustainability has influenced Vietnam’s packaging paper industry to adopt eco-friendly practices. With stricter regulations on plastic usage, many companies are seeking sustainable alternatives, such as biodegradable and recyclable paper packaging.

The Vietnamese government has introduced several policies to promote sustainable packaging solutions and curb plastic waste. Among them, Decree No. 08/2022/NĐ-CP sets a clear roadmap for restricting the production and import of single-use plastics, non-biodegradable packaging, and microplastic-containing products. Under this regulation, beginning January 1, 2026, Vietnam will ban the production and import of non-biodegradable plastic bags smaller than 50cm x 50cm. Furthermore, from January 1, 2031, a complete nationwide ban will take effect on the production and import of single-use plastics, non-biodegradable plastic packaging, and products containing microplastics. [5]

Growth in Manufacturing and Retail Sectors

Vietnam has positioned itself as a key manufacturing hub in Southeast Asia, attracting multinational companies in sectors such as electronics, textiles, and consumer goods. These industries require high-quality packaging materials for their products, leading to increased demand for paper-based solutions.

Image of a carton factory in Vietnam

Source: Vnexpress.net [6]

Additionally, the expansion of retail chains and supermarkets across Vietnam has created a strong market for packaging paper. With more consumers opting for packaged goods, companies are focusing on innovative packaging solutions that enhance product appeal and sustainability.

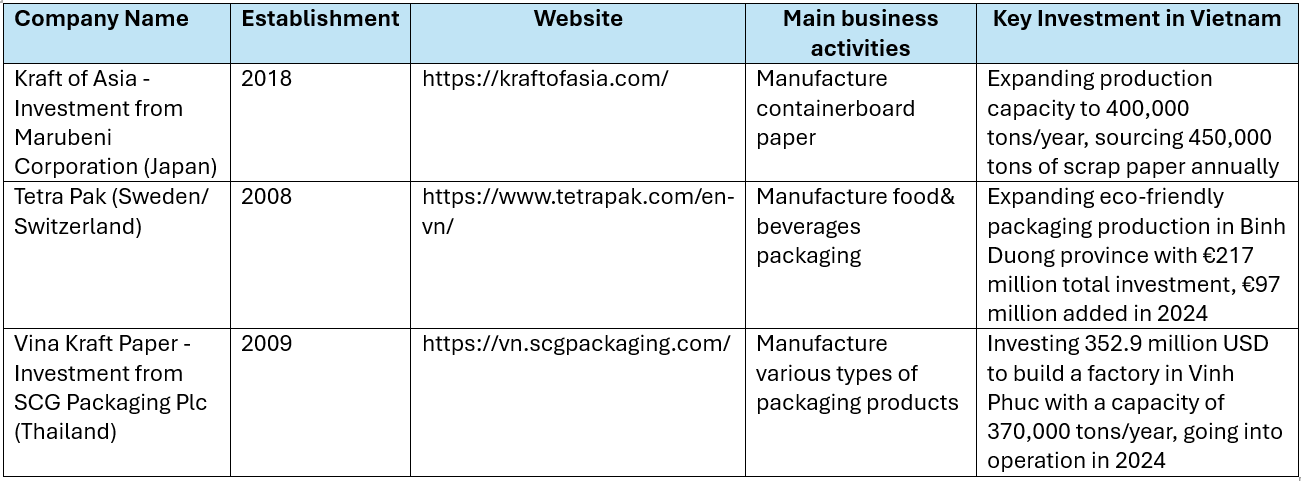

Foreign Investment in Vietnam’s Packaging Paper Industry

Foreign direct investment (FDI) has played a crucial role in the development of Vietnam’s packaging paper market. Several multinational corporations have established operations in the country, leveraging its strategic location, low production costs, and skilled workforce.

Challenges and Future Outlook

While Vietnam’s packaging paper industry is on a strong growth trajectory, it faces several challenges. One of the key issues is its reliance on imported pulp and recycled paper, making it vulnerable to fluctuations in global raw material prices. Additionally, despite the increasing emphasis on sustainability, the industry must take further steps to reduce its carbon footprint and improve waste management practices. Another significant challenge is the need for technological advancements, as local manufacturers must adopt advanced production technologies and automation to remain competitive, enhance efficiency, and improve product quality.

Conclusion

Vietnam’s packaging paper market is poised for substantial growth, driven by strong domestic demand, a thriving e-commerce sector, and increasing foreign investment. With multinational corporations investing in production facilities and sustainable packaging solutions, the industry is expected to expand rapidly in the coming years.

However, challenges such as raw material dependency and environmental concerns must be addressed to ensure long-term sustainability. By embracing innovation and adopting eco-friendly practices, Vietnam’s packaging paper industry can continue to thrive and maintain its position as a key player in the global market.

[1] https://trungtamwto.vn/chuyen-de/27539-thi-truong-bao-bi-viet-nam-tri-gia-hon-4-ty-usd-truoc-ap-luc-xanh-hoa-va-nguy-co-mat-don-hang-vao-tay-doi-thu-ngoai

[2] https://rippi.com.vn/tiem-nang-mo-rong-va-doi-moi-nganh-bao-bi-giay-viet-nam-nua-dau-nam-2024-bid1213.html

[3] https://rippi.com.vn/tiem-nang-mo-rong-va-doi-moi-nganh-bao-bi-giay-viet-nam-nua-dau-nam-2024-bid1213.html

[4] https://vir.com.vn/gross-value-of-vietnams-main-e-commerce-platforms-hit-126-billion-in-2024-122333.html

[5] https://moitruong.net.vn/chinh-sach-moi-va-lo-trinh-giam-thieu-chat-thai-nhua-55451.html

[6] https://vnexpress.net/kinh-doanh-thung-carton-co-the-tang-vot-nho-thuong-mai-dien-tu-4788251.html

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |