09Jun2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

In recent years, Vietnam’s fruit and vegetable export industry has recorded significant progress, especially in 2023. However, in the first 4 months of 2025, the industry is facing many challenges, especially in the Chinese market.

Vietnam’s fruit and vegetable exports from 2020 to Q1 2025

According to data from the General Department of Customs, Vietnam’s fruit and vegetable exports have grown steadily in the 2020–2022 period, ranging from 3.3 to 3.5 billion USD per year. In 2023, fruit and vegetable exports reached 5.6 billion USD, up 70% compared to 2022, mainly due to the surge in durian. In 2024, Vietnam’s fruit and vegetable exports reached a record high, estimated at 7.1 billion USD, up 27.1% compared to 2023.[1] Durian accounted for the highest export proportion, with 42% in 2023 and 47% in 2024, respectively. Most vegetables and fruits have experienced an increase in export turnover, except for dragon fruit. In particular, many varieties (durian, banana, jackfruit, mango, coconut, watermelon, longan, etc.) recorded double-digit growth.

However, in the first quarter of 2025, Vietnam’s fruit and vegetable export turnover faced signs of stagnation. By the end of March 2025, Vietnam’s fruit and vegetable exports reached 1.1 USD, down 10% over the same period last year.

Vietnam’s fruit and vegetable exports in the period 2015 – Q1/2025

Unit: Billion USD

Source: General Department of Customs

Weaknesses of Vietnam’s vegetable industry

The Vietnam Fruit and Vegetable Association has pointed out that dependence on the Chinese market and the staple product durian are major weaknesses of Vietnam’s vegetable industry

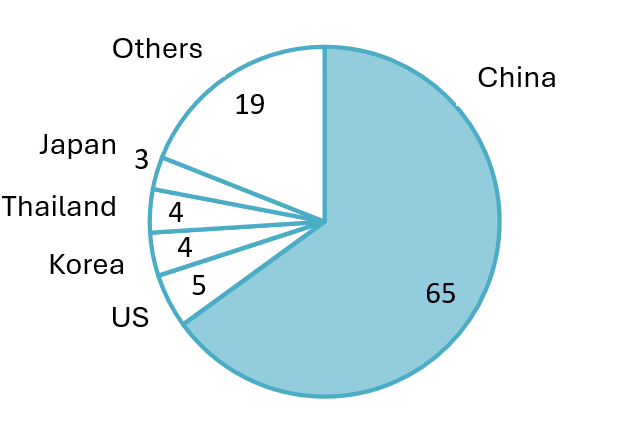

China is Vietnam’s largest fruit and vegetable export market, accounting for about 65% of total export turnover in 2024, reaching 4.6 billion USD. Vietnam also ranked second in fruit and vegetable exports to China with a turnover of more than 4 billion USD, surpassing Chile and narrowing the gap with Thailand[2].

Especially, in 2024, China imported 736,720 tons of durian from Vietnam, worth 2.9 billion USD, accounting for about 68% of Vietnam’s total durian export turnover. This growth is mainly due to the increasing demand for durian in China, where this fruit is considered a high-end and popular item. However, the heavy dependence on this market also poses many risks for the Vietnamese fruit and vegetable industry.

In the 1st quarter of 2025, exports to China only reached 521 million USD, down nearly 32% over the same period last year. The main reason is that China tightened regulations on quarantine and quality, causing many substandard shipments to be returned. Especially for Durian, which used to be a key export item, in 2025, due to China’s increased quality control, especially standards on chemical residues and traceability, export output will decrease significantly[3].

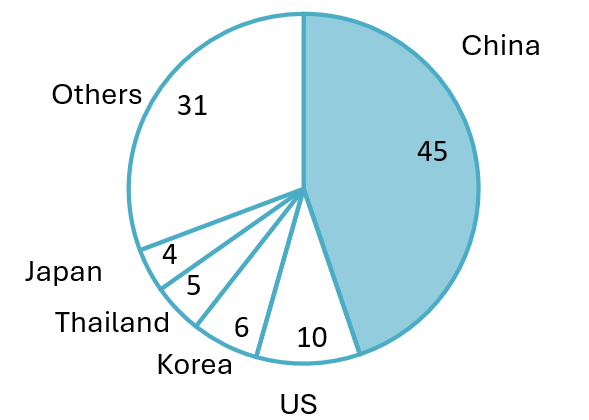

| Fruit and vegetable export turnover in 2024 (%) | Fruit and vegetable export turnover in Q1/2025 (%) |

| 100% = 7.1 Billion USD | 100% = 1.1 Billion USD |

|

|

Source: General Department of Customs

Bright spots from other markets

Currently, there are still many other potential markets in the world that Vietnam can focus on developing. In the first quarter of 2025, exports of fruits and vegetables to other markets besides China showed positive signs, typically the US increased by 64%, and Japan increased by 14% compared to 2024. Vietnam’s 19 free trade agreements (FTAs) is regarded as a huge advantage for the Vietnamese fruit and vegetable industry[4].

However, one of the biggest challenges for the Vietnamese fruit and vegetable industry when expanding the market is the increased inspection of export goods from demanding countries such as Europe, the United States, and South Korea. These countries are increasing the frequency of inspection and strict requirements with other quality proof results. Meanwhile, the volume of fresh fruits and vegetables being processed remains low, despite the large annual harvest output. This is one of the reasons why Vietnam’s fruit and vegetable export turnover still accounts for a low proportion in markets and market regions with high demand for processed products such as Europe, the United States, and South Korea[5].

Conclusion

Vietnam’s fruit and vegetable export industry has achieved remarkable achievements in recent years, especially thanks to strong growth in the Chinese market. However, heavy dependence on a single market also poses many risks. To maintain and develop sustainably, Vietnam’s fruit and vegetable industry needs to diversify markets, improve product quality, and strictly comply with regulations on quarantine and food safety.

[1]Ministry of Industry and Trade, Agriculture, Forestry and Fisheries Market News < Access >

[2] VnExpress, Vietnam ranks second in exporting fruits and vegetables to China <Access>

[3] VnEconomy, Fruit, and vegetable export value in the first quarter decreased by 11.3% <Access>

[4] VnEconomy, Fruit, and vegetable export value in the first quarter decreased by 11.3% <Access>

[5] Ministry of Industry and Trade, Agricultural, Forestry and Fishery Market News <Access>

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |