13Nov2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s waste-to-energy (WtE) market is emerging as a vital solution to the country’s waste and energy challenges. With landfill capacity nearing its limit and power demand surging, WtE technologies are gaining traction as a sustainable means of converting municipal solid waste into electricity. This article provides an overview of the market landscape, growth drivers, key WtE players or projects, and the opportunities and risks facing foreign investors seeking to enter Vietnam’s waste-to-energy sector.

Market Overview

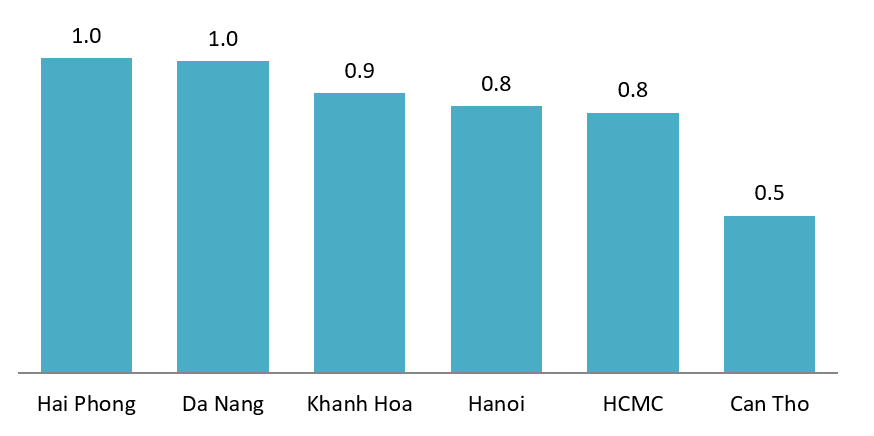

Vietnam is facing one of the most pressing waste-management challenges in Southeast Asia. According to the Ministry of Natural Resources and Environment, tons of municipal solid waste (MSW) are generated every day. Urban areas alone contribute to over 60% of this volume[1]. In big cities such as Hanoi, Ho Chi Minh City, Hai Phong, or Da Nang, the waste generated per day by 1 person is over 0.8 kg, leading to a huge amount of waste being generated daily.

Waste generation in Vietnamese cities in 2023

Unit: kg/capita/day

Source: VMOST Journal of Social Sciences and Humanities

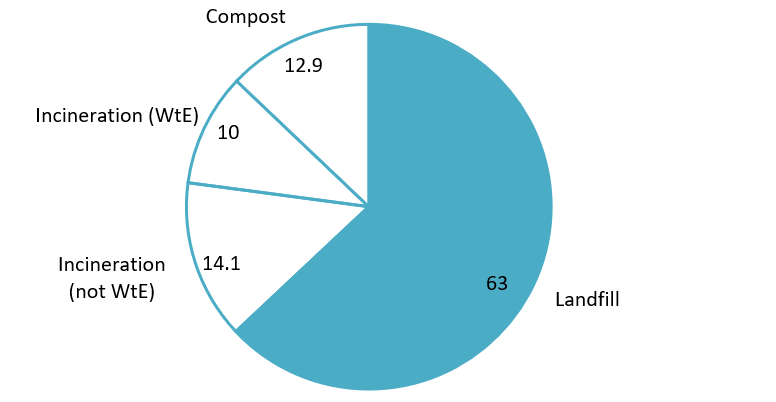

In terms of waste treatment, about 63 percent of the waste generated end up in landfill, many of which is unclean and pollutes the environment[2]. Therefore, there is a need to explore alternative MSW management options, such as Waste-to-energy (WtE), which can reduce the volume of waste sent to landfills, recover valuable resources, and generate electricity or heat from waste.

Waste Treatment Methods in Vietnam (2023)

Unit: %, 100% ~ 25 million tons of solid waste

Source: Journal of Construction

The Waste-to-energy (WtE) market in Vietnam is relatively small but has significant growth potential. According to the International Finance Corporation, Vietnam has an estimated potential of about 1,400 MW for energy recovery from solid waste, which could significantly contribute to the country’s electricity supply. However, only a small portion of this potential has been harnessed so far, with the current waste-to-energy capacity in Vietnam being around 300 MW[3]. This highlights a considerable gap between available resources and actual utilization in the waste-to-energy sector.

Growth drivers of Vietnam’s Waste-to-energy market

Environmental pressures

Vietnam’s rapid economic growth and urbanization are generating mounting volumes of waste. Urban centers like Hanoi and Ho Chi Minh City produce thousands of tons of refuse daily, while industrial parks contribute additional non-recyclable plastics, textiles, and biomass residues suitable for energy recovery. Traditional landfills, however, are approaching saturation: many operate beyond designed capacity and fail to meet sanitary standards, leading to air, soil, and groundwater pollution. These issues have raised community opposition and government pressure to adopt cleaner, more sustainable waste-treatment options.

At the same time, Vietnam’s transition toward a circular economy and net-zero carbon goals by 2050 underscores the importance of recovering energy and materials from waste. WtE technologies support these aims by reducing landfill methane emissions, displacing fossil-fuel-based power generation, and converting non-recyclable waste into renewable energy. It is also essential in a circular economy that WtE alone cannot fully address waste management challenges; reducing waste generation at the source, followed by reuse and recycling, plays a crucial role and should be carried out alongside[4]. The government’s National Strategy on Environmental Protection (to 2030, vision 2050) explicitly prioritizes modern waste treatment, including WtE and resource recovery, as a core pathway to achieve sustainability and decarbonization, specifically the goal of being carbon neutral by 2050 [5].

Technological Advances

Rapid technological progress and increased international cooperation are accelerating Vietnam’s adoption of WtE solutions. Modern high-efficiency incineration systems, refuse-derived fuel (RDF) technologies, and flue-gas treatment innovations have significantly improved environmental performance and reduced operational costs[6]. These advances make WtE more attractive to investors.

Foreign investors and technology providers are playing a critical role in this transition. For example, Valmet Oyj of Finland supplied advanced boiler systems for the Thang Long Energy Environment JSC project in Bac Ninh[7], Korean and Belgian companies are likewise entering the market with co-processing solutions for industrial waste. These collaborations not only bring capital and technical expertise but also facilitate the transfer of operational knowledge and environmental compliance standards essential for long-term project success.

Vietnam’s largest WtE Plant – Soc Son WtE Plant in Hanoi

Source: VNExpress

Policy and Governmental Support

Vietnam’s policy landscape is becoming increasingly supportive of waste-to-energy development. The government has introduced regulations that promote waste sorting at source, improved environmental standards for waste treatment, and incentives for renewable energy generation. Several national and local initiatives aim to reduce landfill dependency and encourage the integration of WtE technologies into municipal waste-management systems. In addition, electricity produced from waste is now recognized within Vietnam’s renewable and clean-energy portfolio, and authorities are working toward establishing tariff mechanisms and investment frameworks that make WtE projects more financially attractive[8].

At the local level, major urban centers have adopted ambitious waste-management targets: Ho Chi Minh City aims for at least 80 percent of urban waste to be treated by recycling or WtE technologies by 2025[9], while Hanoi and several provinces are pursuing similar initiatives. National development plans also emphasize renewable energy expansion and greenhouse gas reduction, with WtE classified as a strategic clean energy sector. Together, these regulatory measures, economic incentives, and administrative directives form a strong foundation for accelerating WtE deployment across Vietnam.

Key projects in the Vietnamese WtE market

As there is increasing attention to sustainable waste management and renewable energy, several waste-to-energy projects have been initiated across Vietnam. These developments reflect ongoing efforts by both domestic and foreign stakeholders.

| No. | Name | Location | Owner | Partner | Status (updated till 11/2025) | Power Capacity per day |

| 1 | Soc Son Waste-to-Energy Plant | Hanoi | Thien Y Hanoi Environment Energy JSC | Waterleau Group (Belgium) | In operation | 90MW |

| 2 | High–Technology municipal WtE plant | Bac Ninh | Thang Long Energy Environment JSC | Valmet Oyj (Finland), Siemens Energy (India) | In operation | 11.6MW |

| 3 | Can Tho Solid Waste Treatment Plant | Can Tho | EB Environmental Energy Company Ltd. | Everbright Environment (China) | In operation | 7.5MW |

| 4 | Ngoi Sao Xanh WtE Plant | Bac Ninh | Ngoi Sao Xanh Environment Ltd. | Chosun Refractories Eng Co. Ltd (Korea) | In operation | 6.1MW |

| 5 | BIWASE WtE plant | Binh Duong | Binh Duong Water and Environment JSC (BIWASE) | N/A | In operation | 5MW |

| 6 | Phu Son WtE Plant | Thua Thien – Hue | EB Environmental Energy Company Ltd. | Everbright Environment (China) | Pilot operation | 12MW |

| 7 | BIWASE 12MW WtE plant | Binh Duong | Binh Duong Water and Environment JSC (BIWASE) | Cnin Martin (Germany) | Under construction | 12MW (planned) |

| 8 | Vietstar waste-to-energy plant | HCMC | Vietstar Environmental JSC | N/A | Under construction | N/A |

B&Company’s synthesis

Implications for foreign investors

Vietnam’s waste-to-energy market presents significant potential for foreign investors seeking to enter an emerging, policy-supported clean-energy sector. The country’s growing volumes of municipal and industrial waste, increasing energy demand, and shift toward circular-economy models create a large, long-term market for WtE projects. With ongoing government support, advancing technology, and demand for international expertise in high-efficiency incineration and environmental management, foreign partners can play an essential role in bridging Vietnam’s infrastructure and capability gaps while achieving sustainable returns.

Despite its promise, Vietnam’s waste-to-energy market presents several challenges that investors must address carefully. The regulatory environment remains complex, with multiple layers of approval and often lengthy licensing procedures that can delay project implementation. Feedstock quality and supply consistency also pose risks, as waste sorting at source is not yet fully practiced nationwide, requiring investors to establish reliable collection and pre-treatment systems. Additionally, tariff structures and waste-treatment fees are still evolving, leaving some uncertainty over long-term financial returns. Environmental standards are becoming more stringent, especially for emission control and ash disposal, demanding high-quality technology and robust operational management.

Recommendations for investors include:

– Partner with reliable local entities: Collaborating with Vietnamese waste-management firms, municipalities, or industrial-park operators helps navigate local regulations, improve community acceptance, and secure waste supply.

– Adopt flexible technology configurations: Combining municipal solid waste with industrial or RDF feedstock can stabilize calorific value and improve plant efficiency, while allowing adaptation to varying local conditions.

– Integrate financial and policy engagement early: Successful WtE projects often hinge early coordination with local authorities, financiers, and grid operators to align tariffs, environmental permits, and infrastructure connections.

– Invest in community and stakeholder relations: Public concerns about emissions and odors can slow project progress. Transparent communication, environmental monitoring, and local benefit-sharing initiatives enhance social licenses to operate.

Overall, Vietnam’s waste-to-energy sector is entering a decisive growth phase where early, well-prepared investors can help shape the industry’s direction. Those who combine technological expertise with long-term commitment, local partnerships, and environmental responsibility are best positioned to succeed as Vietnam transitions toward a cleaner and more circular economy.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Vietnam News, Việt Nam turns to waste-to-energy as landfills reach capacity

(https://vietnamnews.vn/society/1689692/viet-nam-turns-to-waste-to-energy-as-landfills-reach-capacity.html)

[2] Journal of Construction, Waste-to-Energy in Vietnam: Potential and Challenges of Incineration Technology (https://tapchixaydung.vn/dien-rac-tai-viet-nam-tiem-nang-va-thach-thuc-cua-cong-nghe-thieu-dot-20201224000032946.html)

[3] UNDP, Things That You Burned Cannot Be Destroyed (https://www.undp.org/vietnam/blog/things-you-burned-cannot-be-destroyed)

[4] UN Environment Programme & IGES, CCET guideline series on intermediate municipal solid waste treatment technologies: Waste-to-Energy Incineration (https://www.iges.or.jp/en/publication_documents/pub/policysubmission/en/10877/WtEI_guideline_web_200615.pdf)

[5] Vietnam Circular Economy, Decision No. 450/QD-TTg of the Prime Minister: Approving the National Environmental Protection Strategy to 2030, with a vision to 2050 (https://vietnamcirculareconomy.vn/quyet-dinh-so-450-qd-ttg-cua-thu-tuong-chinh-phu-phe-duyet-chien-luoc-bao-ve-moi-truong-quoc-gia-den-nam-2030-tam-nhin-den-nam-2050/)

[6] Vietnam Net, Investors eye Waste-to-Energy projects (https://vietnamnet.vn/en/investors-eye-waste-to-energy-projects-2285524.html)

[7] Valmet, Valmet to supply a waste-to-energy boiler to Thang Long Energy Environment Joint Stock Company in Vietnam (https://www.valmet.com/media/news/press-releases/2022/valmet-to-supply-a-waste-to-energy-boiler-to-thang-long-energy-environment-joint-stock-company-in-vietnam/)

[8] Vietnam Law and Legal Forum, Waste-to-energy projects need to be accelerated to address environmental pollution (https://vietnamlawmagazine.vn/waste-to-energy-projects-need-to-be-accelerated-to-address-environmental-pollution-72113.html)

[9] People’s Army Newspaper, Vietnam promotes circular economy in waste recycling (https://en.qdnd.vn/economy/special-reports/vietnam-promotes-circular-economy-in-waste-recycling-569249#)