08Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s ride-hailing market in 2025 is undergoing a profound transformation as competition intensifies among Xanh SM, Grab, and Be. Xanh SM’s rapid nationwide expansion with a fully electric fleet is reshaping pricing norms and accelerating the shift toward green mobility, while Grab leverages its super-app ecosystem and data-driven personalization to maintain scale and user loyalty. Be, Vietnam’s homegrown contender, focuses on competitive pricing and operational sustainability to strengthen its market position. Together, these dynamics are redefining service quality, technology adoption, and strategic differentiation in one of Southeast Asia’s fastest-evolving digital mobility markets.

Market Overview

Market size and Growth dynamics

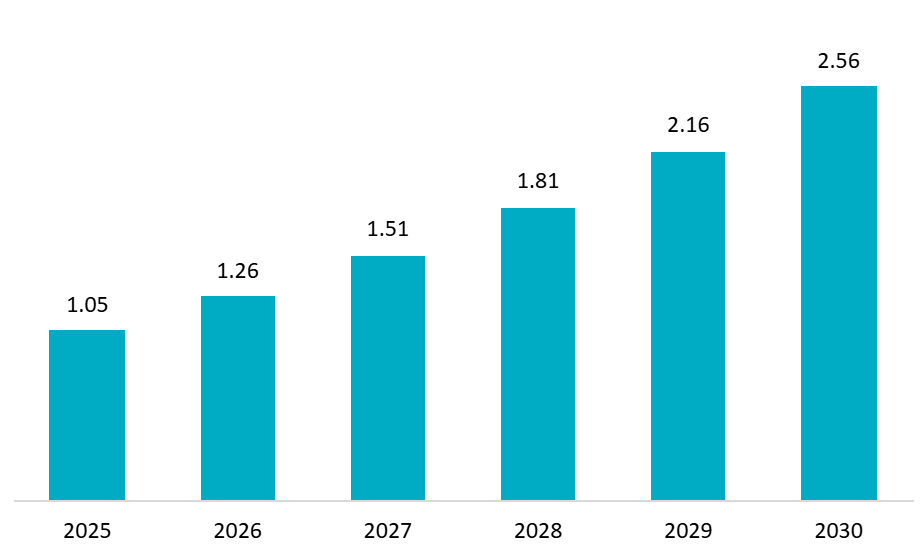

As of early 2025, Vietnam’s ride-hailing market size is estimated at USD 1.05 billion, recovering robustly from post-pandemic fluctuations. Industry forecasts project the market to expand to USD 2.56 billion by 2030, driven by a compound annual growth rate (CAGR) of approximately 19.5%[1]. Revenue generation has diversified beyond core passenger transport to include food delivery, logistics, and digital payments, effectively turning top platforms into “super-apps” that command high user retention.

Market size of Vietnam’s Ride-hailing market

Unit: USD Billion

Source: Mordor Intelligence

User penetration and Adoption patterns

Consumer adoption of ride-hailing services has accelerated substantially, with the user base expanding from 22.8 million in 2017 to approximately 28.1 million in 2024. Projections indicate that the market will serve 37 million users by 2029, corresponding to a penetration rate of 36.2%[2]. Notably, 77% of users utilize these services at least three times monthly, indicating strong behavioral integration into daily transportation patterns[3].

Urban consumers in major cities demonstrate particularly high engagement, with residents of Hanoi and Ho Chi Minh City spending an average of VND 252,000 (USD 9.7) per month on car-hailing services and VND 105,000 (USD 4) on motorbike rides. This spending level is approximately 15% higher than in secondary cities such as Can Tho, Hai Phong, and Da Nang, highlighting the concentration of demand in primary urban centers[4].

Market Trends: Electrification, Consolidation, and AI-powered Personalization

Electric Vehicle revolution transforms Competitive landscape

The most transformative trend reshaping Vietnam’s ride-hailing market is the rapid adoption of electric vehicles, driven by government mandates and environmental consciousness. According to Decision No. 876/QĐ-TTg, which approves Vietnam’s Green Energy Transition Action Plan for the transport sector, from 2025 onward, all newly invested or replacement buses must run on electric or green energy, and by 2030, at least 50% of all vehicles and 100% of new taxis must be electric or green-powered. The policy ultimately targets a fully electric taxi and bus fleet by 2050, ensuring a long-term, nationwide shift toward zero-emission transport[5].

Private users accounted for the largest share of EV sales volume in 2024 at 78.29%, while commercial and government segments made up the remainder. However, the commercial fleet segment is expected to grow the fastest, with EV orders projected to expand at a 32.21% CAGR through 2030. Meanwhile, the government and public-transportation segment is set to grow steadily, driven by policies mandating the gradual transition to electric buses across provincial networks[6]. Ho Chi Minh City has announced plans to convert approximately 400,000 ride-hailing motorcycles to electric vehicles, representing a comprehensive transformation of urban mobility infrastructure[7].

Local electric vehicle manufacturers, particularly VinFast, have partnered extensively with ride-hailing platforms to introduce cleaner, lower-emission fleets across major cities. Electric vehicle adoption has become a key competitive differentiator, with Xanh SM’s 100% electric fleet positioning the company as a sustainability leader.

Platform Consolidation and Super App evolution

Surviving platforms have evolved toward super app ecosystems, integrating multiple service categories to increase user engagement and lifetime value. Be Group actively pursues the vision of becoming a digital consumer platform serving all daily needs, expanding beyond initial services like Be Ride (motorbike/taxi) and Be Delivery to include Be Food, car rental, and flight/bus ticket bookings. Grab remains competitive by promoting frequent use across its ecosystem, integrating GrabCar, GrabBike, GrabFood, and GrabMart, along with financial services via the Moca e-wallet[8]. Meanwhile, Xanh SM differentiates itself with a focus on sustainability through its dedicated electric taxi service, while also diversifying into delivery (Xanh Express) and food ordering (Xanh SM Ngon), and offering utility services such as packaged tours (Xanh Chu Du).

AI-powered Personalization & Loyalty programs

AgileTech Vietnam (2025) notes that companies now use machine-learning algorithms to analyze user behavior and deliver targeted promos, dynamic discounts, and personalized ride suggestions[9]. At the same time, platforms are launching monthly subscription plans, cashback incentives, and point-based rewards, such as subscription models priced around 25,000 – 40,000 VND per month and point-based loyalty programs such as GrabRewards. In addition, all three platforms utilize targeted membership programs (like GrabUnlimited, BeLoyal, and Xanh SM’s offerings) to foster loyalty and offer savings.

Platforms have also invested heavily in safety and security features, including driver background checks, GPS tracking, in-app emergency buttons, and surveillance cameras. Xanh SM has implemented the S2S (Secure to Safe) safety monitoring system across its nationwide electric taxi fleet, becoming the first taxi company in Vietnam to adopt comprehensive safety measures aligned with developed nation standards.

Competition Landscape

Vietnam’s ride hailing market has evolved from Grab’s near-monopoly position in 2020, when foreign platforms controlled 99% market share, into a fiercely contested three-player competition featuring Xanh SM, Grab, and Be Group. Earlier challengers such as Uber and Gojek have exited the market due to intense price competition, high customer-acquisition costs, and the difficulty of achieving scale in Vietnam’s subsidy-heavy environment[10]. Against this backdrop, today’s remaining competitors have carved distinct positioning strategies based on vehicle technology, service quality, pricing approaches, and ecosystem breadth, creating a multidimensional competitive landscape that rewards differentiation over pure price competition.

Market Share evolution and Current positioning

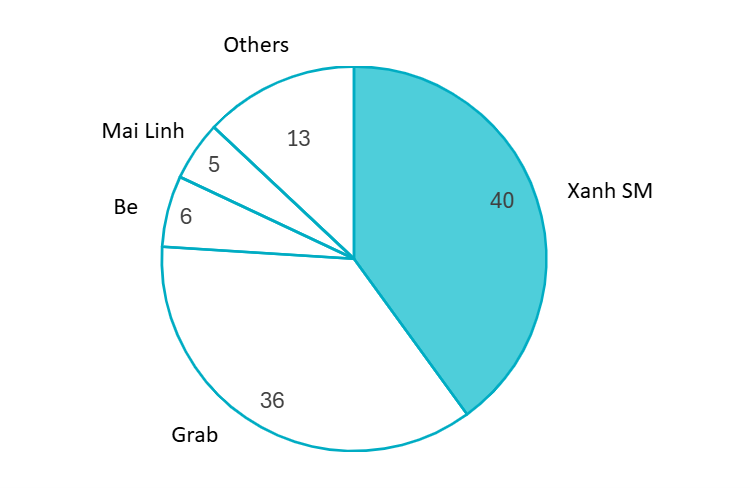

Xanh SM captured 40% market share by the second quarter of 2025, according to Rakuten, compared to Grab’s 36%, Be Group’s 6%, Mai Linh (5%), Vinasun, Maxim and others accounting for 13%. This represents a stunning reversal from 2024, when Grab commanded nearly 60% of both car and motorcycle segments, demonstrating the velocity of competitive disruption in Vietnam’s digital mobility sector, according to Decision Lab 2024[11].

Vietnam’s Ride-hailing market shares Q1 2025

Unit: %

Source: Mordor Intelligence

Geographic coverage and Expansion trajectories

Geographic footprint varies considerably across competitors, influencing service availability and market penetration in different urban densities. Xanh SM operates across 34 provinces and cities, demonstrating rapid nationwide expansion from its April 2023 launch. The company has begun international expansion, entering Indonesia with 1,000 VinFast electric vehicles[12] and launching services in two Laotian cities in November 2023[13], signaling regional ambitions despite domestic market primacy.

Grab maintains the most extensive Southeast Asian presence, operating across multiple countries including Vietnam, Singapore, Thailand, Malaysia, and the Philippines. This regional scale provides advantages in technology development costs, best practice sharing, and investor confidence, though local competitors argue that centralized decision-making sacrifices responsiveness to Vietnamese market nuances. The company’s first-mover advantage established deep roots in major urban centers, creating network effects that newer entrants struggle to overcome despite superior service propositions.

Be Group focuses primarily on the Vietnamese market, with particularly strong penetration in Hanoi, where it effectively competes with Grab for market leadership. The company’s localized strategy emphasizes understanding Vietnamese consumer preferences, cultural norms, and purchasing behaviors, positioning it as the authentic domestic alternative to foreign platforms.

Fleet & Operations

Xanh SM operates an exclusively electric vehicle fleet sourced from sister company VinFast, encompassing over 100,000 vehicles, including approximately 20,000 cars and 80,000 motorcycles across 61 provinces and cities. This 100% electric commitment creates multiple competitive advantages, including lower fuel costs, reduced maintenance expenses, preferential regulatory treatment, and strong environmental credentials resonating with sustainability-conscious consumers.

In contrast, Grab and Be Group operate asset-light platform models connecting independent drivers who own their vehicles, predominantly gasoline-powered motorcycles and cars. Grab maintains an estimated driver network of 300,000, while Be Group claims the largest driver supply with approximately 400,000 registered drivers[14]. This freelance driver approach provides operational flexibility and eliminates vehicle acquisition costs but sacrifices consistency in vehicle quality, driver behavior, and brand experience across transactions. The dichotomy between Xanh SM’s closed-loop fleet model and competitors’ open marketplace approaches creates fundamentally different economic structures, with Xanh SM bearing higher fixed costs but capturing operational efficiencies through vertical integration.

Pricing strategies and Promotional intensity

Pricing remains one of the most visible differentiators among Vietnam’s major ride-hailing platforms. Grab typically has the highest fares, especially during peak hours or sudden demand spikes, as its dynamic pricing model adjusts in real time; however, subscription packages, promo codes, and GrabRewards points help soften overall costs for frequent users. For example, the company has responded by introducing a budget-focused service tier,s including Grab Economy, providing up to 20% discounts in select cities to defend against value-focused competitors. Recently, Grab has targeted student segments with up to 25% discounts on rides starting or ending at educational institutions in Hanoi.

Be generally prices 5-10% lower than Grab under similar conditions and relies heavily on discount codes, point accumulation, and reward redemptions, making it an attractive choice for price-sensitive riders. Xanh SM maintains stable, clearly listed fares and stands out for not increasing prices during peak hours, providing strong price predictability. Across all three platforms, promotional intensity remains high, with frequent vouchers, targeted discounts, and rider-specific incentives shaping the true out-of-pocket cost more than the base fare itself.

Table 1: Ride fares in Ho Chi Minh City for major ride-hailing apps in Vietnam

| No. | Services | Vehicle | Minimum fare for the first

2 km (Unit: VND) |

Fare per additional km

(Unit: VND/km) |

| 1 | GrabBike | Two-wheeler

|

11,700 – 16,000 | 4,300 – 5,300 |

| 2 | beBike | 13,2000 – 14,500 | 4,328 – 5,000 | |

| 3 | Xanh SM Bike | 12,200 – 15,700 | 4,200 – 5,200 | |

| 4 | GrabCar | Four-wheeler | 26,700 – 34,200 | 9,100 – 13,000 |

| 5 | beCar | 30,500 – 36,400 | 10,300 – 12,400 | |

| 6 | Xanh SM GreenCar | 20,000 (Base fare) | 12,000 – 15.500 |

Source: B&Company synthesis from Grab, Be, Xanh SM, [15]

Financial performance and Profitability trajectories

Financial sustainability varies dramatically across competitors, with implications for long-term competitive staying power. In 2024, Xanh SM contributed 240 million USD to parent company Vingroup’s[16]. However, profitability remains elusive given substantial vehicle acquisition costs, driver salaries, and aggressive market share to capture investments. The company benefits from patient capital provided by Vietnam’s wealthiest entrepreneur, Pham Nhat Vuong, who publicly committed to continue investing “until running out of money.”

Grab achieved a positive adjusted EBITDA of 228 million USD for the full year 2024 – a 23% increase from 2023[17], marking an inflection point after years of heavy losses pursuing growth. This profitability milestone reflects maturing operations, reduced promotional intensity, and successful super app monetization. However, the company faces strategic tensions between defending market share against aggressive domestic competitors and maintaining newfound financial discipline valued by public market investors.

Although the company does not disclose its revenue, Be’s earnings increased eightfold between 2021 and 2024. Starting in 2025, Be also began reporting positive EBITDA, marking a sustainable shift toward stronger operational efficiency. Be Group raised approximately 30 million USD from VPBank Securities in 2024, targeting 20 million users, 1 billion rides, and 200 million USD annual gross revenue by 2026. These ambitious growth targets suggest continued prioritization of scale over near-term profitability, typical of venture-backed platforms pursuing market leadership in winner-take-most digital marketplaces[18].

Emerging competitors and market entry dynamics

Despite consolidation around three primary players following Gojek’s September 2024 exit, the market continues attracting new entrants drawn by growth potential and perceived vulnerability of incumbent positions. European unicorn Bolt began recruiting operations and customer support specialists in Ho Chi Minh City in January 2025, signaling potential market entry. Bolt’s proven low-cost strategy in Europe, Thailand, and Malaysia, featuring driver commission waivers during launch periods and fares 20% to 30% below competitors’, could disrupt existing pricing equilibria if executed effectively in Vietnam[19].

Lalamove expanded from delivery services into passenger transportation in August 2024, leveraging existing driver networks and logistics infrastructure. Traditional taxi operators, including Mai Linh and Vinasun, have launched digital booking platforms, though most struggle to compete against app-native competitors with superior technology and user experience.

Despite frequent new entrants, building a ride-hailing business that can scale sustainably and turn a profit is extremely challenging – a reality experienced by the exits of Uber (2018), Gojek (2024), and several domestic startups.

Conclusion

Vietnam’s ride-hailing market in 2025 is entering a transformative phase, driven by electrification, ecosystem expansion, and rising competitive intensity. Xanh SM, Grab, and Be are reshaping mobility through distinct strategies, while new entrants further accelerate market dynamism. For investors, the sector offers strong long-term potential, but success depends on partnering with local players, leveraging technology, and aligning with Vietnam’s green-mobility agenda. The platforms that balance innovation with sustainable operations will be best positioned to lead the next chapter of Vietnam’s digital mobility growth.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Mordor Intelligence (2025). Ride-hailing Market In Vietnam Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030). https://www.mordorintelligence.com/industry-reports/vietnam-ride-hailing-market

[2] https://b-company.jp/vietnam-ride-hailing-market-current-landscape-and-bolts-potential-entry/#_ftn2

[3] https://insight.rakuten.com/2025-ride-hailing-app-landscape-in-vietnam/

[4] https://hanoitimes.vn/grab-and-xanh-sm-dominate-vietnam-s-ride-hailing-market-report.714437.html

[5] https://thuvienphapluat.vn/van-ban/Giao-thong-Van-tai/Quyet-dinh-876-QD-TTg-2022-chuyen-doi-nang-luong-xanh-giam-khi-cac-bon-nganh-giao-thong-523057.aspx

[6] https://www.mordorintelligence.com/industry-reports/vietnam-electric-vehicle-market

[7] https://vietnamnews.vn/society/1718081/hcm-city-plans-to-convert-ride-hailing-motorcycles-to-electric-vehicles.html

[8] https://phuhieuvantai.com/so-sanh-grab-be-va-xanh-sm-ung-dung-taxi-cong-nghe-nao-dang-dung-nhat/

[9] https://agiletech.vn/vietnam-ride-hailing-app-market/

[10] https://tino.vn/blog/tai-sao-gojek-dung-hoat-dong/

[11] https://markettimes.vn/grab-giua-muon-trung-vay-suc-ep-tu-he-sinh-thai-xanh-sm-vingroup-o-thi-truong-viet-nam-va-mot-loi-the-qua-lon-grab-khong-the-co-duoc-75099.html

[12] https://vietnamnet.vn/en/electric-taxis-reshape-vietnam-s-ride-hailing-market-as-xanh-sm-rises-2361690.html

[13] https://apea.asia/vietnam/hall-of-fame-vn-2024/inspirational-brand-vn-2024/xanh-sm-ib-2024/

[14] https://cuuchienbinh.vn/thi-truong-xe-cong-nghe-tiem-nang-tang-truong-va-thach-thuc-quyen-loi-lao-dong-d37697.html

[15] https://b-company.jp/vi/vietnam-ride-hailing-market-current-landscape-and-bolts-potential-entry/

[16] https://vietnamnet.vn/en/electric-taxis-reshape-vietnam-s-ride-hailing-market-as-xanh-sm-rises-2361690.html

[17] https://vneconomy.vn/phat-trien-cong-nghe-ai-se-la-chien-luoc-dai-han-cua-grab-tai-viet-nam.htm

[18] https://www.businesstimes.com.sg/international/asean/grabs-vietnam-rival-be-group-secures-7395-billion-dong-fresh-funding-boost?

[19] https://www.reuters.com/article/technology/estonian-ride-hailer-bolt-launches-in-thailand-with-better-rates-idUSKCN24U0JF/