29/01/2026

Tin tức & Báo cáo mới nhất / Vietnam Briefing

Bình luận: Không có bình luận.

Thị trường M&A của Việt Nam năm 2025 cho thấy khả năng phục hồi mạnh mẽ và sự trưởng thành về chiến lược, đánh dấu một năm chuyển mình trong bức tranh đầu tư của Đông Nam Á. Một loạt các giao dịch mang tính bước ngoặt đã làm nổi bật vai trò ngày càng tăng của Việt Nam như một điểm đến quan trọng cho đầu tư trực tiếp nước ngoài, trải rộng trên các lĩnh vực như ô tô, hàng tiêu dùng, công nghệ, bất động sản, y tế, sản xuất và năng lượng tái tạo. Bài viết này điểm lại những thương vụ quan trọng nhất năm 2025 và xem xét cách chúng đã định hình câu chuyện M&A và đầu tư đang phát triển của Việt Nam.

Tổng quan thị trường và các xu hướng chính

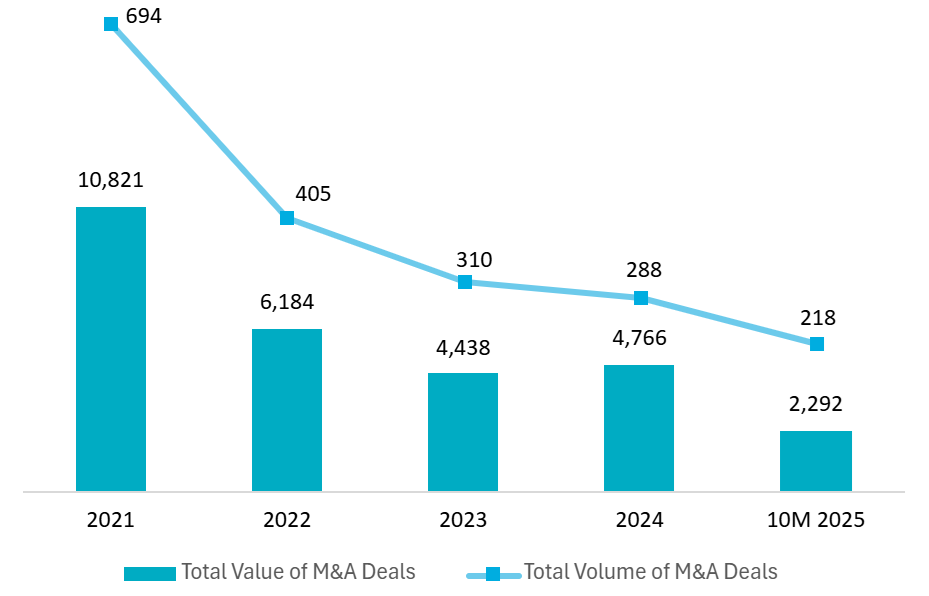

Tính đến hết 10 tháng đầu năm 2025, thị trường M&A Việt Nam ghi nhận 218 giao dịch với tổng giá trị 2,3 tỷ USD.[1] so với hơn 220 giao dịch trị giá 3,2 tỷ USD trong cùng kỳ năm 2024.[2]Ngoài ra, theo Grant Thornton, chỉ riêng trong tháng 12 năm 2025, thị trường đã ghi nhận tổng cộng 31 giao dịch, với giá trị giao dịch được công bố và ước tính đạt khoảng 1.306 triệu USD.[3]Bất chấp những khó khăn trong lĩnh vực mua bán và sáp nhập (M&A) tại Đông Nam Á như điều kiện tài chính thắt chặt và rủi ro địa chính trị gia tăng, Việt Nam vẫn duy trì được đà phát triển ổn định, được hỗ trợ bởi một loạt các giao dịch được lựa chọn kỹ lưỡng.

Tổng giá trị và tổng khối lượng các thương vụ M&A tại Việt Nam (2021 – 10 tháng đầu năm 2025)

Đơn vị = Triệu USD

Nguồn: Capital IQ, Refinitiv, KPMG

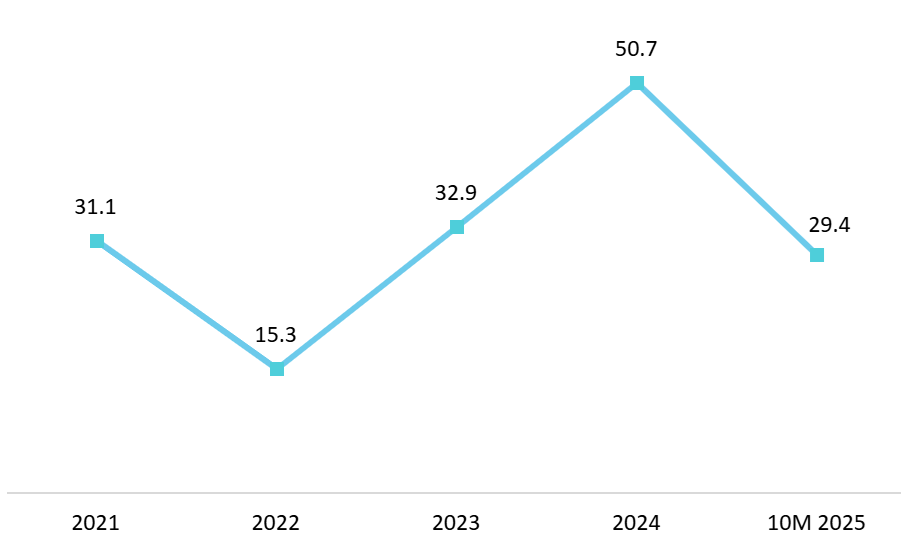

Sau mức giá trị giao dịch trung bình cao bất thường lên tới 50,7 triệu USD vào năm 2024, giá trị giao dịch trung bình đã giảm xuống còn 29,4 triệu USD trong mười tháng đầu năm 2025, phản ánh sự trở lại với quy mô giao dịch thông thường hơn và hoạt động gia tăng ở phân khúc thị trường tầm trung. Sự sụt giảm về quy mô giao dịch trung bình không phải là dấu hiệu của sự chậm lại trong hoạt động M&A, mà là sự dịch chuyển cấu trúc hướng tới một thị trường có kỷ luật và chọn lọc hơn, nơi các nhà đầu tư ưu tiên sự phù hợp chiến lược, kiểm soát rủi ro và tạo ra giá trị bền vững hơn là các giao dịch lớn, mang tính cơ hội.

Average disclosed transaction value

Đơn vị: Triệu USD

Nguồn: Capital IQ, Refinitiv, KPMG

Sự sụt giảm về khối lượng và giá trị các giao dịch M&A tại Việt Nam trong năm 2025 và những năm gần đây có thể liên quan đến sự bất ổn kinh tế vĩ mô toàn cầu. Trong bối cảnh này, căng thẳng thương mại leo thang, bao gồm cả các biện pháp thuế quan trả đũa được đề xuất dưới thời chính quyền Trump, được cho là đã ảnh hưởng đến tâm lý nhà đầu tư và làm gián đoạn hoạt động M&A và IPO toàn cầu. Bên cạnh đó, chi phí tài chính cao hơn và sự không chắc chắn về định giá cũng có thể góp phần vào việc thực hiện các giao dịch thận trọng hơn, dẫn đến việc hoãn hoặc hủy bỏ một số giao dịch. Đồng thời, thị trường M&A của Việt Nam đang trải qua quá trình điều chỉnh cơ cấu: trong khi khối lượng giao dịch giảm so với giai đoạn 2020-2022, chất lượng giao dịch đã được cải thiện. Các nhà đầu tư nước ngoài, đặc biệt là từ Nhật Bản, Hàn Quốc và Singapore, tiếp tục thể hiện sự quan tâm mạnh mẽ đến các lĩnh vực thiết yếu như y tế, dược phẩm, năng lượng tái tạo và công nghệ.

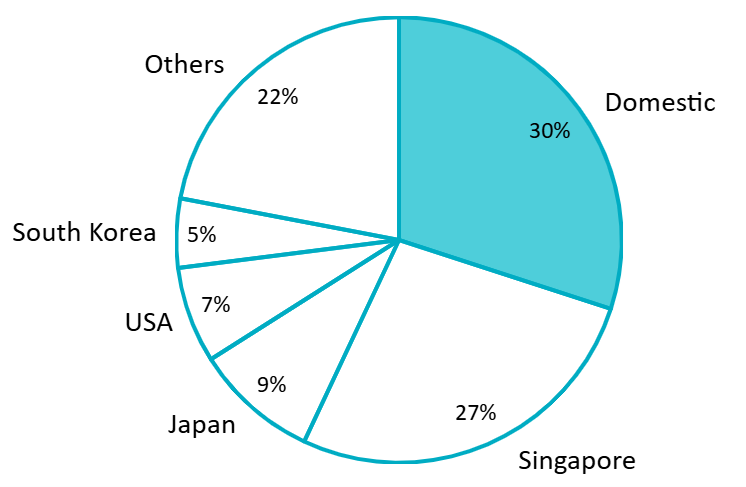

Các nhà đầu tư trong nước tiếp tục đóng vai trò then chốt, đóng góp hơn 30% tổng giá trị giao dịch được công bố, mặc dù khoảng cách với các nhà đầu tư nước ngoài đã thu hẹp đáng kể khi Singapore chiếm khoảng 27%, tiếp theo là Nhật Bản với 9% và Hoa Kỳ đóng góp dòng vốn đáng kể.[4]Nhiều doanh nghiệp tư nhân lớn trong nước đang hình thành cấu trúc kiểu tập đoàn thông qua hoạt động mua bán sáp nhập (M&A) thay vì tăng trưởng nội tại, tạo ra một cơ sở người mua trong nước ngày càng mạnh mẽ.

Giá trị giao dịch M&A theo nguồn gốc nhà đầu tư (10 tháng đầu năm 2025)

100% = 2,3 tỷ USD

Nguồn: Tạp chí Diễn đàn Kinh doanh

Các giao dịch mang tính bước ngoặt năm 2025

Trong bối cảnh này, lĩnh vực tiêu dùng tiếp tục dẫn đầu thị trường, đứng đầu cả về số lượng giao dịch và tổng giá trị công bố. Các giao dịch chiến lược đáng chú ý bao gồm việc Kokuyo mua lại Thien Long và Fraser and Neave (F&N) của Thái Lan, tiếp tục gia tăng cổ phần của mình tại Vinamilk. Những thương vụ này phản ánh rõ ràng xu hướng M&A tập trung vào mở rộng quy mô và củng cố vị thế thị trường.[5].

Tóm tắt các thương vụ mua bán và sáp nhập lớn trong năm 2025

| Ngành | Người mua / Nhà đầu tư | Người bán | Giá trị ước tính của giao dịch (USD) | Quyền sở hữu / Chi tiết |

| Hàng bán lẻ và hàng tiêu dùng | Kokuyo (Nhật Bản) | Tập đoàn Thiên Long | $178 triệu | Mua lại cổ phần 65.01% |

| Fraser và Neave (F&N) | Vinamilk | $228 triệu | Mua thêm 4,61 TP3T, tổng số cổ phần nắm giữ là 24,991 TP3T. | |

| Công ty cổ phần Berli Jucker (BJC) | Siêu thị MM | $715 triệu | 100% mua lại quyền sở hữu | |

| Pico Holdings | Nguyễn Kim | $36 triệu | Không có | |

| Tập đoàn Golden Gate | Dịch vụ Thương mại Trà và Cà phê Việt Nam | $108 triệu | Mua lại cổ phần trị giá 99,981 TP3T của The Coffee House. | |

| Ô tô | Phạm Nhật Vượng (Nhà sáng lập VinFast) | Công ty cổ phần nghiên cứu và phát triển Novatech | $1,5 tỷ | VinFast vẫn giữ 37,651 cổ phần TP3T; tách riêng tài sản nghiên cứu và phát triển. |

| Bất động sản | Bất động sản Birch | Công ty Bất động sản phía Đông (công ty con của Tập đoàn Masterise) | $365 triệu | 100% mua lại công ty con |

| Ba nhà đầu tư trong nước | Vinaconex ITC (Tập đoàn Vinaconex) | $250-300 triệu | Mua lại cổ phần 70% | |

| Công ty Cổ phần Gateway Thu Thiem | Công ty TNHH South Rach Chiec City | $99 triệu | Mua lại cổ phần 42% | |

| Tập đoàn UOA | Công ty đầu tư Ruby Strip | $68 triệu | Sở hữu danh mục bất động sản cao cấp tại TP.HCM (2.000 m2) | |

| Nguyên vật liệu

& Công nghiệp |

Công ty TNHH Hyosung Vina số 1 | Công ty Hóa chất Hyosung Vina | $277 triệu | Cổ phần 49% được chuyển nhượng trong nội bộ tập đoàn. |

| Công ty đóng tàu HD Korea | Doosan Vina (Doosan Năng Lượng) | $210 triệu | 100% mua lại nhà sản xuất công nghiệp | |

| Năng lượng | Công ty TNHH EnQuest | Mảng kinh doanh Harbour Energy Việt Nam | $85,1 triệu | 53.121 cổ phần TP3T tại các mỏ Chim Sao & Dua |

| Công ty TNHH Levanta Holding | Công ty Cổ phần Điện gió Gia Lai HBRE | $33,1 triệu | Tập đoàn Super Energy Group nắm giữ cổ phần 80%. | |

| OCI Holdings | Tấm wafer năng lượng mặt trời Elite | Không có | Mua lại cổ phần 65% | |

| Sumitomo | Công ty tư vấn và phát triển kỹ thuật điện Cuu Long | Không có | Mua lại cổ phần 49% | |

| Công nghệ/Trí tuệ nhân tạo | Vòng | Các ứng dụng không phải trò chơi tại Việt Nam | $20 triệu | Cam kết mua sắm và hỗ trợ |

| Công ty Appirits (Nhật Bản) | Công ty Cổ phần Bunbu | $241 triệu | Thương vụ mua lại 100% ($66,6 triệu tiền mặt + $174,4 triệu khoản thanh toán bổ sung) | |

| Chăm sóc sức khỏe & Dược phẩm | Tập đoàn dược phẩm Livzon | Imexpharm (Tập đoàn SK) | $220 triệu | 64.81% mua lại cổ phần |

| Công ty Cổ phần Đầu tư Dale | Y khoa Tâm Trí | $31 triệu | Mua lại cổ phần 73.15% |

Tổng hợp của B&Company

Lĩnh vực bán lẻ và tiêu dùng

Kokuyo mua lại Tập đoàn Thiên Long

Tháng 12 năm 2025, tập đoàn văn phòng phẩm và nội thất văn phòng Nhật Bản Kokuyo đã công bố kế hoạch mua lại tới 65,01% cổ phần của Tập đoàn Thiên Long với giá khoảng 1 tỷ 4 tỷ 178 triệu đồng, đánh dấu một trong những thương vụ mua bán sáp nhập hàng tiêu dùng xuyên biên giới đáng chú ý nhất trong lịch sử Việt Nam. Giao dịch này bao gồm việc Kokuyo mua lại toàn bộ cổ phần do Công ty Cổ phần Đầu tư Thiên Long An Thịnh nắm giữ, đơn vị kiểm soát 46,82% vốn điều lệ của tập đoàn, cùng với việc chào mua công khai thêm 18,19% cổ phần.[6].

Thành lập năm 1981, Thiên Long đã phát triển từ một xưởng sản xuất nhỏ bé trở thành nhà sản xuất văn phòng phẩm hàng đầu Việt Nam, cung cấp hơn 1.000 sản phẩm dưới các thương hiệu như Thiên Long, FlexOffice, Colokit và Flexio, xuất khẩu sang 74 quốc gia trên toàn thế giới. Đối với Kokuyo, thương vụ này mở ra cánh cửa chiến lược vào thị trường Đông Nam Á và định vị Thiên Long là trụ cột thứ tư trong hoạt động kinh doanh quốc tế của tập đoàn, bổ sung cho các thị trường trọng điểm hiện có tại Nhật Bản, Trung Quốc và Ấn Độ. Thỏa thuận này phù hợp với tầm nhìn chiến lược của Kokuyo nhằm trở thành thương hiệu văn phòng phẩm hàng đầu châu Á vào năm 2030 và mở rộng thương hiệu Campus trên toàn cầu.

Central Retail thoái vốn khỏi thương vụ bán cổ phần của ông Nguyễn Kim cho Pico Holdings.

Tập đoàn Central Retail của Thái Lan đã ký thỏa thuận thoái vốn toàn bộ cổ phần tại Công ty Cổ phần Thương mại Nguyễn Kim, một trong những nhà bán lẻ điện tử tiêu dùng lâu đời nhất Việt Nam, cho Công ty Cổ phần Pico Holdings với giá trị ước tính 36 triệu USD. Kết quả là, sau khi đầu tư hơn 200 triệu USD trong gần một thập kỷ để mua lại Nguyễn Kim, giá trị thoái vốn của Central Retail chỉ bằng khoảng một phần sáu so với khoản đầu tư ban đầu.[7].

Bên cạnh đó, Tập đoàn Golden Gate đã thâu tóm The Coffee House thông qua việc mua lại 99,98% cổ phần của Công ty Cổ phần Thương mại Dịch vụ Trà và Cà phê Việt Nam với giá khoảng 1 tỷ 4 tỷ 108 triệu đồng, đưa chuỗi cà phê nổi tiếng của Việt Nam hoàn toàn vào hệ sinh thái của Golden Gate.

Ngành công nghiệp ô tô

VinFast tái cấu trúc Novatech: Thương vụ lớn nhất năm.

Một trong những giao dịch quan trọng nhất năm 2025 là việc VinFast Auto Ltd. tái cấu trúc chiến lược thông qua Công ty Cổ phần Nghiên cứu và Phát triển Novatech, trị giá khoảng 14 tỷ đồng. Thương vụ mang tính bước ngoặt này đã chứng kiến nhà sản xuất xe điện Việt Nam tách các tài sản nghiên cứu và phát triển của mình thành một thực thể Novatech mới thành lập, sau đó được nhà sáng lập kiêm CEO Phạm Nhật Vượng mua lại vào tháng 8 năm 2025.[8].

Việc tái cấu trúc đã tách Novatech ra khỏi Công ty Cổ phần Thương mại và Sản xuất VinFast, với công ty mới nắm giữ các tài sản liên quan đến các dự án nghiên cứu và phát triển đã hoàn thành cùng quyền sở hữu trí tuệ của chúng. VinFast vẫn giữ 37,65% cổ phần trong Novatech cùng với quyền biểu quyết chi phối, trong khi VFTP tiếp tục tập trung vào sản xuất xe điện tại Việt Nam và các sáng kiến nghiên cứu trong tương lai. Giao dịch này thể hiện khoản đầu tư vốn mới nhất của ông Vương vào nhà sản xuất đang thua lỗ này, vốn đã đặt ra các mục tiêu đầy tham vọng là giao 200.000 xe vào năm 2025 và đạt điểm hòa vốn vào cuối năm 2026.

Lĩnh vực Bất động sản

Bất động sản nổi lên là lĩnh vực năng động nhất trong năm 2025, tăng từ 36% tổng giá trị giao dịch năm 2024 lên 44% trong quý đầu tiên năm 2025, và duy trì đà tăng trưởng mạnh mẽ suốt cả năm. Lĩnh vực này ghi nhận thương vụ lớn nhất được công bố trong mười tháng đầu năm với việc Birch Real Estate (thuộc Ngân hàng Singapore United Overseas Bank) mua lại Eastern Real Estate Investment and Trading LLC, một công ty con của Masterise Group, với giá 1.443.650 triệu yên. Giao dịch này nhấn mạnh sự quan tâm liên tục của nhà đầu tư đối với các quỹ đất chất lượng cao và các tài sản phát triển cao cấp.[9].

Các giao dịch bất động sản quan trọng khác bao gồm việc Gateway Thu Thiem JSC mua lại 42% cổ phần của South Rach Chiec City LLC với giá $99 triệu.[10]và việc UOA Việt Nam mua lại Công ty Đầu tư Ruby Strip với giá $68 triệu đồng vào tháng 8 năm 2025.[11]Bổ sung thêm các tài sản quan trọng tại Thành phố Hồ Chí Minh vào danh mục đầu tư của mình. Ngoài ra, Tập đoàn Vinaconex đã bán 70% cổ phần của Vinaconex ITC cho ba nhà đầu tư trong nước với giá trị ước tính từ 1.400 đến 250.300 triệu nhân dân tệ vào tháng 7.[12]Sự phát triển mạnh mẽ của lĩnh vực này được hỗ trợ bởi điều kiện thanh khoản được cải thiện, việc thực thi Luật Đất đai sửa đổi năm 2024 và nhu cầu phát triển nhà ở và thương mại do quá trình đô thị hóa thúc đẩy.

Công nghệ và nền kinh tế số

Lĩnh vực công nghệ đã thể hiện đà tăng trưởng đáng kể, chiếm 5% tổng giá trị giao dịch trong quý I năm 2025, tăng từ chỉ 2% trong năm 2024. Sự mở rộng này phản ánh quá trình chuyển đổi số đang tăng tốc của Việt Nam và khung pháp lý hỗ trợ của chính phủ, đặc biệt là Luật Công nghiệp Công nghệ Số được thông qua vào tháng 6 năm 2025.

Vào tháng 8 năm 2025, công ty Appirits Inc. của Nhật Bản đã thông báo về thương vụ mua lại mang tính đột phá, thâu tóm 100% cổ phần của Công ty Cổ phần Bunbu từ các cổ đông cá nhân với giá khoảng 1 tỷ 400.000 USD, bao gồm 1 tỷ 400.000 USD tiền mặt và 1 tỷ 400.000 USD thanh toán dựa trên hiệu quả kinh doanh. Được thành lập vào năm 2010, Bunbu chuyên phát triển các hệ thống web, di động và trí tuệ nhân tạo (AI) cho khách hàng Nhật Bản, với doanh thu đạt 1 tỷ 400.000 USD và lợi nhuận ròng đạt 1 tỷ 410.000 USD vào năm 2024.[13]Nền tảng học máy Rounds đã cam kết đầu tư 14.200 triệu nhân dân tệ để mua lại và hỗ trợ các ứng dụng phi game tại Việt Nam trong suốt năm 2025, nhắm đến thị trường ứng dụng di động đang phát triển mạnh.

Ngành năng lượng

Lĩnh vực năng lượng đã chứng kiến hoạt động hợp nhất đáng kể, phù hợp với cam kết của Việt Nam về việc đạt mục tiêu phát thải carbon ròng bằng 0 vào năm 2050. Vào tháng 7 năm 2025, EnQuest PLC đã hoàn tất việc mua lại mảng kinh doanh tại Việt Nam của Harbour Energy với giá trị danh nghĩa là 1 tỷ 400.851.000 nhân dân tệ, với giá trị thực tế được thanh toán khoảng 1 tỷ 400.257.000 nhân dân tệ sau khi điều chỉnh dòng tiền trong kỳ. Thương vụ này đã mang lại cho EnQuest 53,12% cổ phần và quyền điều hành các mỏ Chim Sao và Dua.[14].

Trong lĩnh vực năng lượng tái tạo, tập đoàn OCI Holdings của Hàn Quốc đã mua 65% cổ phần của Elite Solar Power Wafer, một dự án sản xuất tấm bán dẫn năng lượng mặt trời đang được phát triển tại Việt Nam.[15]Công ty Levanta Holding Pte. Ltd. đã đầu tư 1.400.331.000 USD để mua 80% cổ phần của Công ty Cổ phần Điện gió HBRE Gia Lai từ Tập đoàn Super Energy, trong khi Sumitomo mua 49% cổ phần của Công ty Cổ phần Tư vấn và Phát triển Kỹ thuật Điện Cửu Long từ Tập đoàn GreenSpark. Việc Sembcorp mua lại nhà máy thủy điện 49 megawatt thông qua Sembcorp Solar Vietnam, một phần của danh mục đầu tư năng lượng tái tạo lớn hơn 245MW mua từ Tập đoàn Gelex JSC, đang bị trì hoãn do dự kiến phải nhận được sự chấp thuận của chính phủ vào cuối năm 2025.

Chăm sóc sức khỏe và Dược phẩm

Sự phát triển nhanh chóng của lĩnh vực y tế và dược phẩm tư nhân tại Việt Nam, được hỗ trợ bởi các chính sách cởi mở hơn, đã thu hút nhiều thương vụ lớn và đưa đất nước lên bản đồ M&A y tế khu vực. Điều này được thể hiện rõ qua việc Tập đoàn Dược phẩm Livzon ký kết thỏa thuận mua lại 64,811 tỷ cổ phần của Imexpharm từ Tập đoàn SK và hai cổ đông khác, với giá trị giao dịch hơn 220 triệu USD vào tháng 5 năm 2025. Vào tháng 7, Dale Investment Holdings, một công ty có trụ sở tại Singapore trực thuộc Quadria Capital (một trong những quỹ đầu tư tư nhân tập trung vào y tế lớn nhất châu Á), đã mua lại 73,151 tỷ cổ phần của chuỗi bệnh viện Tam Trí. Giao dịch này bao gồm việc mua lại 37,81 tỷ cổ phần từ Quỹ Cơ hội Việt Nam (VOF) của VinaCapital, phần còn lại được mua từ các cổ đông khác.[16].

Kết luận và triển vọng tương lai

Thị trường M&A của Việt Nam năm 2025 đã chuyển từ các giao dịch dựa trên số lượng sang các thương vụ mua lại mang tính chiến lược và tập trung vào giá trị hơn. Mặc dù quy mô giao dịch trung bình giảm so với năm 2024, chất lượng giao dịch và tầm quan trọng chiến lược đã được cải thiện, phản ánh hành vi đầu tư trưởng thành hơn và sự tinh tế hơn của nhà đầu tư. Nhìn về năm 2026, tăng trưởng dự kiến sẽ được hỗ trợ bởi nguồn vốn dài hạn, sự thu hẹp khoảng cách định giá, nhu cầu kế thừa trong các doanh nghiệp gia đình và quá trình tư nhân hóa doanh nghiệp nhà nước đang diễn ra, với các lĩnh vực y tế, giáo dục, logistics và các dịch vụ thiết yếu khác vẫn là những lĩnh vực trọng điểm.

* Lưu ý: Nếu bạn muốn trích dẫn thông tin trong bài viết này, vui lòng ghi rõ nguồn và kèm theo link bài viết để đảm bảo tôn trọng bản quyền.

| B&Company, Inc.

Công ty nghiên cứu thị trường của Nhật Bản đầu tiên tại Việt Nam từ năm 2008. Chúng tôi cung cấp đa dạng những dịch vụ bao gồm báo cáo ngành, phỏng vấn ngành, khảo sát người tiêu dùng, kết nối kinh doanh. Ngoài ra, chúng tôi đã phát triển cơ sở dữ liệu của hơn 900,000 công ty tại Việt Nam, có thể được sử dụng để tìm kiếm đối tác kinh doanh và phân tích thị trường. Xin vui lòng liên hệ với chúng tôi nếu bạn có bất kỳ thắc mắc hay nhu cầu nào. info@b-company.jp + (84) 28 3910 3913 |

[1] https://vcci.com.vn/news/xu-huong-nao-se-dinh-hinh-cac-hoat-dong-ma-trong-nam-2026

[2] https://diendandoanhnghiep.vn/tram-lang-sau-10-thang-2024-thi-truong-m-a-duoc-du-bao-se-soi-dong-tro-lai-10146319.html

[3] https://mekongasean.vn/von-ngoai-do-manh-vao-ma-viet-nam-trong-thang-cuoi-nam-2025-51064.html

[4] https://diendandoanhnghiep.vn/thi-truong-m-a-viet-nam-trien-vong-cung-cac-thuong-vu-lon-ty-do-10167188.html

[5] https://mekongasean.vn/von-ngoai-do-manh-vao-ma-viet-nam-trong-thang-cuoi-nam-2025-51064.html

[6] https://mekongasean.vn/von-ngoai-do-manh-vao-ma-viet-nam-trong-thang-cuoi-nam-2025-51064.html

[7] https://cafef.vn/dai-gia-thai-cat-lo-dau-don-sau-10-nam-mua-nguyen-kim-bi-dai-gia-viet-dien-may-xanh-fpt-shop-ep-nghet-tho-188251224003205766.chn

[8] https://www.dnse.com.vn/senses/tin-tuc/vinfast-va-gelex-hoan-tat-loat-thuong-vu-ma-lon-35129635

[9] https://vietstock.vn/2025/12/cach-uob-am-tham-nhay-vao-thi-truong-bat-dong-san-viet-nam-4222-1378975.htm

[10] https://vcci.com.vn/tin-tuc/ma-bat-dong-san-nua-dau-nam-no-nhieu-thuong-vu-lon-khoi-noi-dan-dat-thi-truong

[11] https://cafef.vn/thuong-vu-1700-ty-tai-loi-trung-tam-tphcm-cuoc-san-dat-vang-cua-dai-gia-bat-dong-san-malaysia-sau-su-xuat-hien-cua-cac-ga-khong-lo-bytedancemarvell-188250815234136123.chn

[12] https://cafef.vn/chi-trong-1-thang-gia-tri-mua-ban-sap-nhap-cac-du-an-bat-dong-san-ca-nuoc-dat-gan-nua-ty-do-188250814180212846.chn

[13] https://vietstock.vn/2025/09/18-thuong-vu-ma-viet-nam-trong-thang-8-tri-gia-hon-22-ty-usd-764-1353361.htm

[14] https://www.enquest.com/media/press-releases/article/acquisition-of-harbour-energys-vietnam-business-july-25?

[15] https://vcci.com.vn/news/loat-thuong-vu-lon-lam-nong-thi-truong-ma

[16] https://vietstock.vn/2026/01/ma-y-duoc-2025-lan-song-thau-tom-tu-cac-quy-tu-nhan-764-1387410.htm