Introduction: A New Era for Vietnam’s Automotive Landscape

The hybrid vehicle market in Vietnam stands at the cusp of a remarkable transformation, heralding a new era of sustainable transportation and green growth. This shift not only reflects changing consumer preferences but also aligns with the nation’s broader goals of environmental stewardship and technological advancement. Through this article, B&company will explore how hybrid vehicles are becoming a driving force for sustainable development in Vietnam’s automotive sector.

Expanding trend of the Hybrid Vehicle Market in Vietnam

While the COVID-19 pandemic briefly interrupted this momentum, the market has since rebounded with remarkable vigour. According to the Vietnam Automobile Manufacturers Association (VAMA), hybrid car sales in Vietnam saw a significant increase from 546 units in 2020 to 2,285 units in 2021. Sales continued to grow, with around 1,954 units sold in the first eight months of 2022[1] and 4,142[2] cars in the first 7 months of 2024. The figures indicate a shift in Vietnam’s auto market toward more fuel-efficient and environmentally conscious options.

Diverse Offerings

Today’s market boasts over 10 popular Hybrid Electric Vehicle (HEV) models, catering to a diverse array of consumer preferences and needs. From sleek B-C-D-size[3] SUVs and crossovers to spacious C-D-size sedans and versatile MPVs (Multi-Purpose Vehicles), the hybrid market offers for every type of driver. This variety extends to pricing as well, with hybrid vehicles available at price points ranging from 500 million to 1.3 billion VND, with both mainstream and luxury segments.

To illustrate, in November 2022, Nissan launched the Kicks with its innovative e-Power engine, utilizing a series hybrid system where the gasoline engine solely powers a generator without directly driving the wheels, leaving the propulsion task to the electric motor. In addition, December 2022 saw the introduction of the Kia Sorento in both HEV and PHEV (Plug-in Hybrid) variants, followed by the Hyundai Santa Fe HEV in March 2023. Haval, a Chinese brand, also made its mark in August 2023 with the H6 hybrid and is poised to expand its offerings with the upcoming B-segment CUV, the Jolion, imported from Thailand. The Jolion will be available in both gasoline and hybrid versions, marking Haval’s second hybrid offering in the Vietnamese market.

Nissan’s Kicks and Kia Sorento

Luxury brands have also been particularly committed to this technology, with all of Volvo’s current products offering hybrid versions. Lexus applies hybrid technology to five of its models: the ES, LS, NX, RX, and LM. In addition, Mercedes-Benz is implementing mild-hybrid technology across many of its products, blending performance with improved fuel efficiency. BMW, not to be left behind, has introduced the high-performance XM hybrid, priced at nearly 11 billion VND. This ultra-luxury offering demonstrates how hybrid technology creates environmentally conscious vehicles with exhilarating performance.

Plug-in Hybrid Cars of Lexus

Source: Lexus

Japanese Brands Lead the Charge

According to the revenue of hybrid cars estimated up to July 2024 in Vietnam, Japanese automakers, such as Toyota or Suzuki, are leading the way in Vietnam’s hybrid vehicle market, bringing their extensive experience in hybrid technology to drive innovation and capture market share.

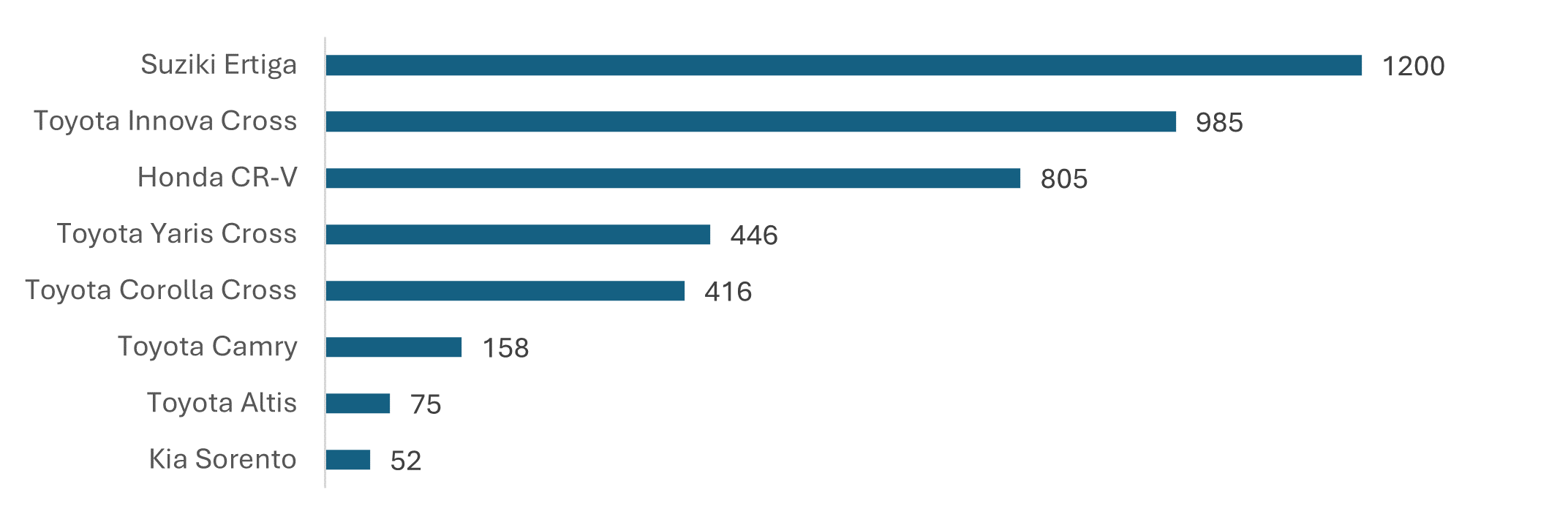

Figure 1. Sales figures for some hybrid car models in Vietnam, as of July 2024

Unit: Units

Source: VAMA

As can be seen from Figure 1, the Ertiga Hybrid with a 1.5L mild-hybrid engine for improved fuel efficiency launched in 2022 by Suzuki also accounted for the highest sales revenues. In addition, Toyota, a long-time leader in hybrid technology, has offered and sold an impressive lineup of hybrid vehicles, including the popular versatile Innova Cross (985 units), the compact Yaris Cross (446 units), Corolla Cross (416 units), the luxurious Camry (158 units) and the sleek Altis (75 units). This diverse range allows Toyota to cater to various market segments, from budget-conscious consumers to those seeking high-end hybrid options.

Drivers of Growth and Remaining Challenges

The growth of the hybrid vehicle market in Vietnam is being propelled by several key factors. Firstly, environmental consciousness plays a significant role, with increasing awareness of climate change and air pollution driving many Vietnamese consumers to seek more environmentally friendly transportation options. Hybrids, with their lower emissions and improved fuel efficiency, align well with this growing eco-consciousness, allowing consumers to reduce their carbon footprint without sacrificing mobility.

Secondly, hybrid vehicles are emerging as a compelling alternative to both traditional combustion engine cars and fully electric vehicles, since they offer environmental benefits without the infrastructure challenges of electric vehicles. In particular, unlike electric vehicles, which are hindered by the scarcity of charging stations in Vietnam, hybrid electric vehicles do not require on-site charging, which makes them particularly well-suited to Vietnam’s current infrastructure.

Hybrid cars also achieve their energy efficiency by ingeniously combining internal combustion and electric engines. This seamless interplay between the two power sources not only reduces emissions but also significantly improves fuel economy. As a result, hybrid vehicles offer a practical and environmentally friendly option for Vietnamese consumers who are eager to reduce their carbon footprint but are not yet ready to commit to fully electric vehicles due to charging infrastructure limitations.

Despite the promising growth, the hybrid vehicle market in Vietnam faces several challenges that need to be addressed for continued expansion. Price concerns remain a significant barrier for many consumers. The higher upfront cost of hybrid vehicles compared to traditional models can be a deterrent, even with the promise of long-term savings on fuel costs. This price differential is particularly impactful in a market where cost is often a primary consideration for vehicle purchases. Moreover, the lack of government incentives specifically for hybrid vehicles presents another hurdle. While fully electric vehicles benefit from reduced registration fees and special consumption taxes in Vietnam, hybrid vehicles currently don’t receive these advantages.

Future Outlook

Despite these challenges, the future looks bright for the hybrid vehicle market in Vietnam. The market is poised for continued growth, driven by several factors. Firstly, government policy and incentives are likely to play a crucial role in this growth. There are ongoing discussions about potential incentives for hybrid vehicles, with the Vietnam Automobile Manufacturers Association (VAMA) proposing a reduced special consumption tax rate for these vehicles. If implemented, such measures could significantly boost adoption rates, making hybrids more financially accessible to a broader range of consumers.

Secondly, the growth of the hybrid market aligns closely with Vietnam’s national goals for sustainable development and environmental protection. The country’s commitment to achieving net-zero emissions by 2050 will likely drive further support for and adoption of hybrid and electric vehicles as part of a broader sustainability strategy.

Thirdly, the increasing variety of hybrid models is a key factor in the promising future of hybrids in Vietnam. As more manufacturers introduce hybrid options across different vehicle segments, consumers will have more choices, potentially leading to lower prices through increased competition.

Conclusion

The expanding hybrid vehicle market in Vietnam represents more than just a shift in consumer preferences; it symbolizes the country’s broader journey towards sustainable development and green growth.

While challenges remain, particularly in terms of pricing and policy support, the trajectory points towards sustained growth and increasing acceptance of hybrid technology. As Vietnam progresses towards its sustainability goals, hybrid vehicles are likely to play an increasingly important role in the country’s automotive landscape, serving as a bridge between traditional combustion engines and the fully electric future that lies ahead.

[3] Classifications of vehicles based on their dimensions and market segment: B: Subcompact; C: Compact and D: Mid-size

| B&Company, Inc.

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles