25Dec2025

Latest News & Report / Vietnam Briefing

Comments: No Comments.

Vietnam’s logistics sector is emerging as a key growth engine, supported by strong manufacturing activity, rapid e-commerce expansion, and large-scale infrastructure investment. Valued at over USD 52 billion in 2025, the market is projected to grow steadily toward 2030, underpinned by improving logistics performance and rising demand for value-added services. However, high logistics costs, infrastructure bottlenecks, workforce skill gaps, and regulatory complexity remain significant challenges.

Market Overview

According to the Vietnam Logistics Business Association (VLA) in 2024, there are currently more than 30,000 enterprises engaged in providing logistics services, of which around 70% are headquartered in Ho Chi Minh City. Approximately 89% are fully domestic-owned enterprises, while the remainder are foreign-invested companies. It is estimated that the logistics sector employs nearly 1.2 million workers nationwide[1].

Market size and Growth trajectory

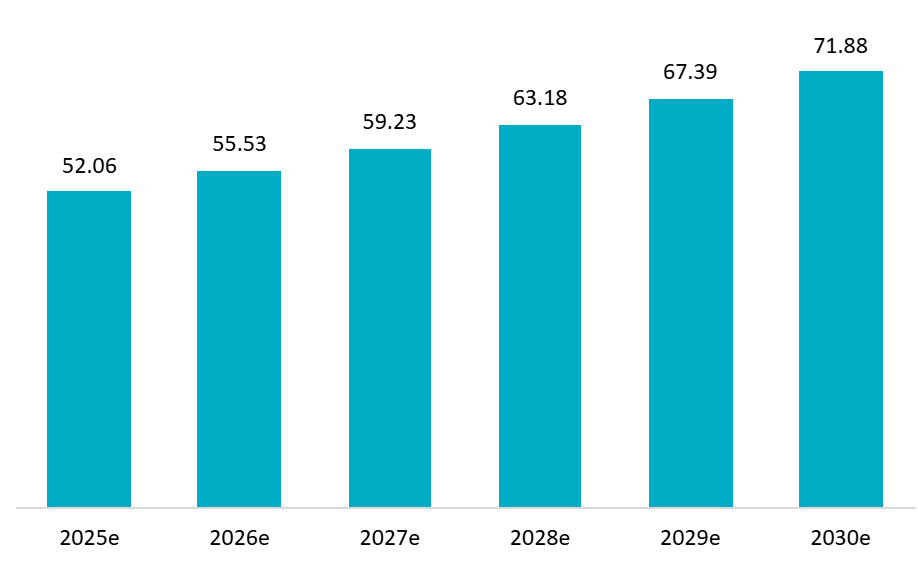

Vietnam’s logistics sector has emerged as a critical pillar of economic growth, demonstrating remarkable expansion despite global economic uncertainties. The sector’s market size is estimated at USD 52.06 billion in 2025, and is expected to reach USD 71.88 billion by 2030, at a CAGR of 6.67% during the forecast period (2025-2030)[2]. The sector has demonstrated clear advancement, as Vietnam’s Logistics Performance Index (LPI) improved to 3.3 in 2023, ranking 43rd among 139 economies worldwide and fifth across ASEAN countries[3]. It also contributes directly around 5-7% of GDP annually during 2025 – 2035 period[4].

Vietnam Freight And Logistics Market Size

Unit: USD billion

Source: Mordor Intelligence

Investment situation

As of the end of 2024, Vietnam had a cumulative total of 1,238 FDI projects invested in the logistics sector, generating employment for 63,515 workers, including nearly 30 of the world’s leading logistics groups such as DHL, Schenker, Expeditors[5]. The five countries with the largest number of investment projects in Vietnam’s logistics sector include South Korea and Singapore, each with 221 projects, jointly accounting for the highest share at 17.9%; Hong Kong (China) with 177 projects (14.3%); and Japan and China, each with 140 projects, representing 11.3% apiece.

Logistics enterprises landscape

Although the number of newly established logistics enterprises increased by 13.5% (with approximately 6,503 companies formed, accounting for 5.33% of all newly established enterprises in the first nine months of 2024), the industry continues to face significant cost challenges, as logistics costs still account for around 16.5%-16.8% of GDP, well above the global average of 11.6%[6]. At the same time, 4,519 transport and warehousing enterprises temporarily suspended operations. Overall, while several logistics companies have achieved stable and impressive growth, small and medium-sized logistics firms have experienced declining business performance, incurred losses, and, in some cases, exited the market altogether.

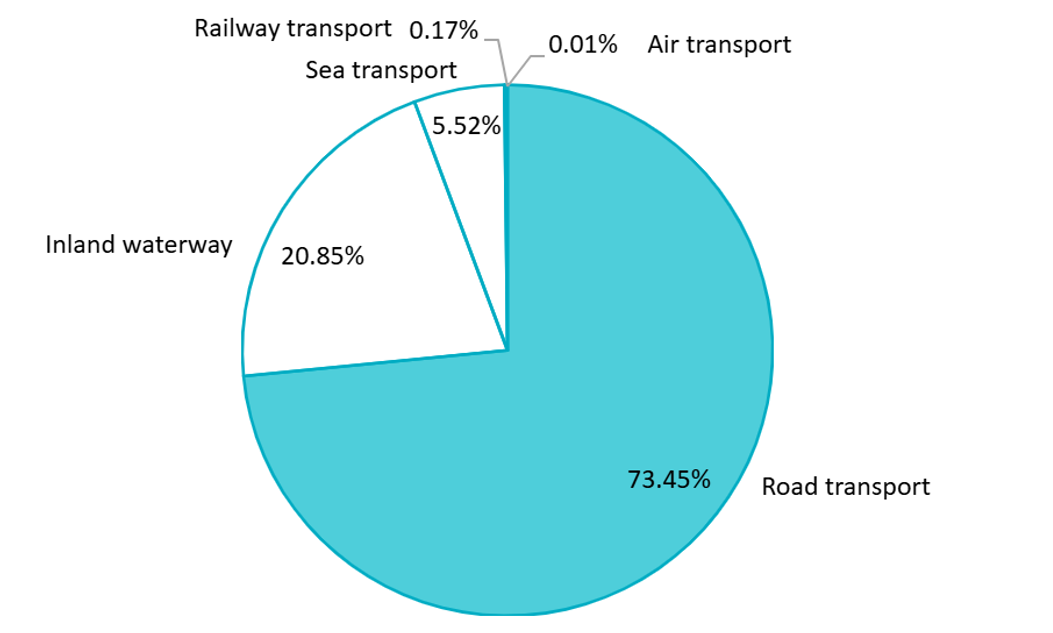

Structure of freight transportation modes

At present, Road transport remains the dominant freight mode by volume, handling 525.8 million tons, or 73.5% of total freight, representing a 16.2% year-on-year increase. A notable highlight in Q1/2025 was the recovery of rail freight, which reached nearly 1.45 million tonnes, up 11.8% year-on-year. Nevertheless, rail transport continued to play a marginal role, accounting for only 0.2% of freight volume[7].

Structure of freight transportation modes in Vietnam (Q1 2025)

100% = 715,8 million tonnes

Source: General Statistics Office of Vietnam

Key Market Characteristics

Functional Breakdown

By logistics function, freight transport generated 64.68% of market share in 2024, while courier, express, and parcel (CEP) services are projected to expand at 7.66% CAGR between 2025-2030. Road freight hauled 78.23% of revenue share in 2024, though air freight is positioned for rapid growth at 8.16% CAGR during the forecast period[8].

End-User Segmentation

Manufacturing drove 35.48% of market share in 2024, anchored by electronics and garment hubs requiring precise inventory synchronization with overseas buyers. Wholesale and retail trade is projected to rise at 7.13% CAGR (2025-2030) as modern grocery chains, direct-to-consumer brands, and cross-border marketplaces expand. The explosive growth of e-commerce, expected to reach USD 52 billion by 2025, is fundamentally reshaping logistics demand patterns, particularly in last-mile delivery infrastructure.

Infrastructure Breakthroughs and Regional Hubs

Vietnam is undergoing a major infrastructure transformation, with the total length of operational expressways exceeding 2,000km by May 2024[9]. Key projects such as the Long Thanh International Airport and the expansion of deep-water ports like Cai Mep – Thi Vai (ranked 19th in the world) are central to the sector’s development. Regions like Ba Ria – Vung Tau, Binh Duong, and Dong Nai are being developed into specialized logistics centers to serve industrial clusters and global supply chains.

Emergence of Free Trade Zones (FTZ)

A significant strategic shift in 2024 is the formal push toward establishing Free Trade Zones (FTZs) to attract high-quality investment. In June 2025, the National Assembly approved the pilot establishment of the Da Nang Free Trade Zone covering approximately 1,881 hectares across non-contiguous functional areas and attached to the Lien Chieu deep-water port, with specialized zones for production, logistics, trade and services, digital technology, and innovation. The project has officially entered the initial implementation phase following the Prime Minister’s Decision No. 1142/QĐ-TTg announced on 22 June 2025, with memoranda of understanding signed with major domestic and international investors, including Terne Holdings Group, BRG Group, and Saigon Da Nang Investment JSC[10]. These zones are designed to offer zero-tax incentives, streamlined customs procedures, and integrated manufacturing-logistics ecosystems

Expanding Warehouse and M&A Activity

The warehouse market is expanding rapidly, with a 23% annual growth rate from 2020 to 2023, reaching a total scale of approximately 4 million square meters by the end of 2023[11]. Foreign investors such as Mapletree, SLP, and JD Property now dominate the market, with the top three players holding 46% of the market share by area[12]. Mergers and Acquisitions (M&A) have become a key trend as global corporations seek to expand their footprint in Vietnam quickly. For example, Maersk has partnered with Vietnam’s Hateco Group to develop two deep-water berths at Lach Huyen Port in Hai Phong.

Investment Opportunities

High-Growth Segments

E-Commerce Fulfillment Infrastructure: With online retail projected to grow at 8.35% CAGR and already generating over half of B2C parcel flows, demand for automated warehouses, last-mile delivery networks, and order fulfillment centers represents a compelling opportunity[13]. The fragmented nature of last-mile delivery, where per-parcel costs remain 28% above Thailand[14], creates openings for efficient operators with technology-enabled solutions.

Cold Chain Logistics: Expanding healthcare, pharmaceutical, and food processing sectors require GDP-certified cold chain capabilities. Regulatory requirements for pharmaceutical traceability are raising barriers to entry, creating premium pricing opportunities for qualified operators. Japanese investor Yokorei’s USD 52 million cold storage project in Long An Province exemplifies the scale of opportunity in this segment[15].

Green and Digital Transformation

The market is increasingly prioritizing sustainability and technology. Based on a survey of the Ministry of Natural Resources and Environment, approximately 53% of medium and large logistics enterprises have adopted energy-saving solutions, and 38% have invested in clean energy vehicles (electric or gas-powered)[16]. Vietnam’s National Strategy on Green Growth for 2021-2030 identifies logistics services as one of 18 key focus areas, creating opportunities for investors in sustainable logistics solutions.

Technology adoption represents a defining trend across the sector. Companies are implementing warehouse management systems, data-driven optimization platforms, and transportation management systems. ViettelPost’s deployment of 2,000 smart lockers embedded within urban micro-malls exemplifies how digital solutions are reshaping urban logistics. Industry 4.0 technologies are increasingly adopted in Vietnam’s logistics management, improving efficiency and reducing costs. Survey conducted by Vietnam Logistics Business Association shows that around 68% of medium and large logistics firms use IoT for warehousing and transport, 52% apply Big Data and AI for demand forecasting and route optimization, and 35% have piloted blockchain for traceability[17].

Geographic Expansion Opportunities

Foreign investors should consider Vietnam’s regional development disparities. While Ho Chi Minh City and Hanoi dominate current logistics activities, emerging industrial zones in central and northern Vietnam present first-mover advantages. New seaport developments in Hai Phong, Da Nang, and southern provinces are creating logistics hubs requiring supporting infrastructure and services.

Strategic Policy-Driven Opportunities

Vietnam’s newly approved National Logistics Service Development Strategy 2025-2035 (Decision 2229/QD-TTg, October 2025) creates unprecedented opportunities for foreign investors aligned with government priorities[18].

Logistics Center Development: The government prioritizes establishing at least 5 world-class modern logistics centers by 2035, increasing to 10 centers by 2050. Priority locations include Hanoi, Ho Chi Minh City, Hai Phong, and Da Nang, integrated with seaports and international airports. Foreign investors with expertise in large-scale logistics hub development can partner with Vietnamese entities to capture first-mover advantages in these strategic locations.

Digital Customs and Smart Logistics: The strategy emphasizes building digital customs and smart customs models to shorten clearance times and reduce costs. The target of 80% digital adoption by 2035 (100% by 2050) creates substantial opportunities for technology providers offering customs automation, electronic documentation systems, and blockchain-based supply chain solutions.

Specialized Logistics Services: The strategy specifically encourages specialized logistics for agricultural products, processed industrial goods, and cross-border e-commerce. Foreign investors with cold chain, pharmaceutical logistics, or e-commerce fulfillment expertise can leverage government support programs designed to develop these high-value segments.

Investment Challenges

High Operating Logistics Costs

Vietnam’s logistics costs at nearly 17% of GDP substantially exceed regional competitors, driven by multiple factors. Road transport dominates freight movement, accounting for over 73% of total freight volume, which increases fuel consumption and congestion-related costs. Furthermore, the lack of synchronization between deep-water ports and the surrounding road or rail networks creates severe bottlenecks for “last-mile” connectivity.

Sector fragmentation further limits efficiency. More than 90% of logistics firms are small and medium-sized enterprises[19], restricting economies of scale and investment in automation. Consequently, labor-intensive operations remain prevalent, while automation adoption is uneven despite evidence that digitalized firms can reduce logistics costs by over 20%[20].

Shortage of High-Quality Human Resources

A fundamental challenge for foreign investors is the lack of professionally trained personnel. While the sector employs about 1.2 million people, only 5% to 7% have received formal logistics training[21]. Investors struggle to find staff proficient in English, international maritime law, and advanced digital technology, forcing many firms to invest heavily in internal retraining or hire expensive foreign experts.

Legal Framework and Administrative Hurdles

The regulatory environment remains complex and, in some areas, incomplete. Although Vietnam is piloting Free Trade Zones (FTZs) in regions like Da Nang, there is currently no comprehensive national legal framework specifically governing the procedures, approval authority, investment policy decisions, establishment, management models, operational mechanisms, and decentralization of management for free trade zones (FTZs).

Currently, this sector is governed through a complex framework of interrelated legal instruments, including the Law on Road Traffic, various Government Decrees (e.g., Decree No. 68/2016/ND-CP on warehousing and customs procedures), Prime Ministerial Decisions (such as the master plan for the development of the logistics centre system), and Circulars issued by the Ministry of Transport and the Ministry of Finance; more recently, a draft Strategy for the Development of Vietnam’s Logistics Services to 2035, with a vision to 2045, has been introduced, aiming to enhance competitiveness, promote digital transformation, and accelerate the greening of the logistics sector.

Infrastructure Bottlenecks

Despite significant government investment, infrastructure constraints persist as major obstacles. Urban congestion in major cities drives last-mile delivery inefficiencies, while underdeveloped rural road networks limit market access beyond core industrial hubs. Seasonal congestion at key ports increases dwell times and costs, and weak multimodal integration, particularly between road, rail, and waterways, keeps logistics expenses elevated. In parallel, insufficient warehousing capacity in strategic locations near ports and industrial zones creates persistent supply-chain bottlenecks.

Additionally, Vietnam’s infrastructure is vulnerable to extreme weather, as evidenced by Typhoon Yagi in 2024, which caused over 80,000 billion VND in economic damage and severely disrupted transport networks in the north.

Conclusion

Vietnam’s logistics sector presents compelling opportunities for foreign investors willing to navigate regulatory complexities, infrastructure challenges, and competitive intensity. Success requires moving beyond traditional logistics models toward technology-enabled, specialized, and sustainable operations. Foreign investors bringing capital, advanced systems, and international expertise to partnerships with capable Vietnamese companies can capture disproportionate value in this rapidly evolving market.

* If you wish to quote any information from this article, please kindly cite the source along with the link to the original article to respect copyright.

| B&Company

The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

[1] Vietnam Logistics Association (VLA), Vietnam Logistics Report 2024

(https://valoma.vn/)

[2] Mordor Intelligence, Vietnam Freight and Logistics Market – Growth, Trends, and Forecasts

(https://www.mordorintelligence.com/industry-reports/vietnam-freight-logistics-market)

[3] World Bank, Logistics Performance Index – Vietnam

(https://data.worldbank.org/indicator/LP.LPI.OVRL.XQ?locations=VN)

[4] Industry and Trade Magazine (Vietnam), Opening New Space to Attract Investment and Develop Vietnam’s Logistics Services

(https://tapchicongthuong.vn/mo-ra-khong-gian-moi-thu-hut-dau-tu–phat-trien-dich-vu-logistics-viet-nam-299419.htm)

[5] Communist Review (Vietnam), Attracting Foreign Direct Investment into Vietnam’s Logistics Sector: Current Situation and Policy Recommendations

(https://www.tapchicongsan.org.vn/web/guest/kinh-te/-/2018/1089502/thu-hut-dau-tu-truc-tiep-nuoc-ngoai-vao-linh-vuc-logistics-tai-viet-nam–thuc-trang-va-mot-so-khuyen-nghi-chinh-sach.aspx)

[6] Vietnam Logistics Association (VLA), Vietnam Logistics Report 2024

(https://valoma.vn/)

[7] Vietnam FDI Portal, Rail Freight Accelerates in Q1 2025

(https://vnfdi.vn/van-tai-quy-i-2025-duong-sat-but-toc/)

[8] Mordor Intelligence, Vietnam Freight and Logistics Market – Growth, Trends, and Forecasts

(https://www.mordorintelligence.com/industry-reports/vietnam-freight-logistics-market)

[9] KPMG Vietnam, Vietnam Economic Outlook 2026

(https://assets.kpmg.com/)

[10] VnEconomy. (https://vneconomy.vn/le-cong-bo-quyet-dinh-thanh-lap-khu-thuong-mai-tu-do-da-nang.htm)

[11] Vietnam Briefing, Vietnam’s Warehouse Market: Foreign Investment Outlook

(https://www.vietnam-briefing.com/news/vietnams-warehouse-market-foreign-investment-outlook.html/)

[12] VietnamPlus, Foreign Developers Dominate Vietnam’s Modern Warehouse Market

(https://en.vietnamplus.vn/foreign-developers-dominate-modern-warehouse-market-in-vietnam-post288791.vnp)

[13] Mordor Intelligence, Vietnam Courier, Express, and Parcel (CEP) Market – Growth and Forecast

(https://www.mordorintelligence.com/industry-reports/vietnam-courier-express-and-parcel-cep-market)

[14] Mordor Intelligence, Vietnam Freight and Logistics Market – Growth, Trends, and Forecasts

(https://www.mordorintelligence.com/industry-reports/vietnam-freight-logistics-market)

[15] The Investor, Yokorei builds $52 mln Vietnam cold storage facility as sector set to soar (https://theinvestor.vn/yokorei-builds-52-mln-vietnam-cold-storage-facility-as-sector-set-to-soar-d6136.html)

[16] Vietnam Logistics Portal, Logistics Service Enterprises Undergoing Digital Transformation to Reduce Costs

(https://logistics.gov.vn/doanh-nghiep/doanh-nghiep-dich-vu-logistics-chuyen-doi-so-de-giam-chi-phi)

[17] Vietnam Logistics Portal, Logistics Service Enterprises Undergoing Digital Transformation to Reduce Costs

(https://logistics.gov.vn/doanh-nghiep/doanh-nghiep-dich-vu-logistics-chuyen-doi-so-de-giam-chi-phi)

[18] Industry and Trade Magazine (Vietnam), Official Approval of Vietnam’s Logistics Service Development Strategy for 2025-2035, Vision to 2050

(https://tapchicongthuong.vn/chinh-thuc-phe-duyet-chien-luoc-phat-trien-dich-vu-logistics-viet-nam-thoi-ky-2025-2035–tam-nhin-den-2050-261784.htm)

[19] Vietnam Logistics Portal, Green Supply Chains: Identifying Challenges for Vietnamese Logistics Enterprises

(https://logistics.gov.vn/elogistics/chuoi-cung-ung-xanh-diem-ten-cac-thach-thuc-cua-doanh-nghiep-logistics-viet)

[20] Vietnam Logistics Portal, Logistics Service Enterprises Undergoing Digital Transformation to Reduce Costs

(https://logistics.gov.vn/doanh-nghiep/doanh-nghiep-dich-vu-logistics-chuyen-doi-so-de-giam-chi-phi)

[21] Vietnam Logistics Association (VLA), Vietnam Logistics Report 2024

(https://valoma.vn/)