15Oct2021

Industry Reviews

Comments: No Comments.

Vietnam’s healthcare at a glance

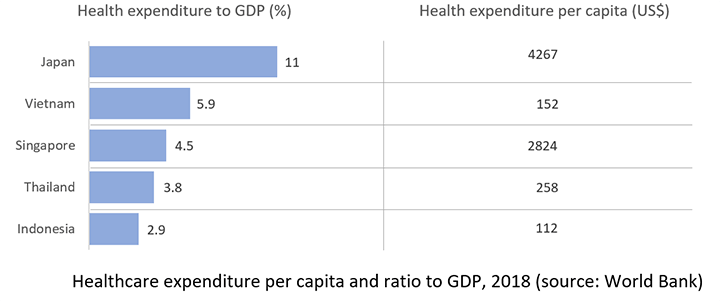

In 2018, the country’s healthcare expenditure to GDP was 5.9%, which was higher than some other markets in the region, yet the real value was comparatively low[1]. Healthcare expenditure per capita is expected to increase 1.7 times from US$150 in 2018 to US$260 in 2025[2].

Despite the growth, insufficient hospital capacity and professional staffing remain major challenges for the industry. As of 2020, there were 28 hospital beds per 10,000 population. In 2018, Vietnam has only 1 physician and 1.3 nurses per 1000 population[3]. In comparision with Singapore, the statistics are 2.4 and 5.8 respectively. The overload of healthcare system together with an aging population would put more pressure on healthcare facilities and raise demand for more choices of health services.

COVID–19 outbreak and the speed–up of telehealth in Vietnam

Smart healthcare has been one of the key themes in Vietnam healthcare development in recent years to utilize limited resources. Four main areas for digital health include: (1) Health Information Technology, (2) Telemedicine, (3) Consumer Health Electronics, and (4) Healthcare Big Data & AI-based products and services. All can be said to be at the early stage[3].

Amid the COVID-19 outbreak with extended social distance time, the Ministry of Health (MOH) has piloted a telemedicine platform connecting more than 1500 healthcare facilites nationwide; providing professional support from central hospitals to provincial and district hospitals, especially in far-flung areas by applying various smart medical solutions, including teleconferencing, electronic medical records, and the cloud-based Picture Archiving and Communication System. The MOH also cooperated with VOV – the National Radio Broadcaster – since April 2020 to launch Bacsi24 (“Doctor24”) application to provide free telemedicine support during the pandemic, where patients can be consulted by doctors via free video calls[4]. Meanwhile, many private hospitals also introduced telemedicine services with an average fee of 10-20USD per one call consultance based on a survey by B&Company.

Looking at the start-up sector, Vietnam increased its share in number of healthtech deals in Southeast Asia. Singapore’s share of deal number, despite being top, seems to shrink as other markets like Indonesia, Malaysia, and Vietnam are becoming more appealing. However, the total deal value in Vietnam was only US$7 million as of 2019, while that amount of Singapore and Indonesia was US$128 million and US$120 million respectively[5]. Based in Vietnam, JioHealth (founded in 2014 by Raghu Rai, American) is a telemedicine startup that enables on-demand healthcare service on the app. Its features allow doctors to access patients remotely in real-time through live video calls. It can also connect with wireless medical devices like blood pressure cuff, glucometers or fitness bands. JioHealth raised US$5 million in a Series A funding round in 2019[6]. Meanwhile, Doctor Anywhere, a Singapore-based startup with more than 1.5 million users in Southeast Asia, secured US$65.7 million in a Series C funding round, one of the largest private funding rounds ever raised by a healthtech company in the region in 2021[7]. In Vienam, the company has developed a strong ecosystem with high-profile local hospitals and insurance companies. This is an example for a large value deal recorded for Singapore but the business model can be applied in multi-markets thanks to the digital platform.

Opportunities and Challenges

The Government’s direction emphasizing national digital transformation is one key driver for Vietnam digital health. Besides, increasing competition between public and private healthcare facilities would promote more technology innovation. Lastly, a young population structure with favour for tech-adoptation and growing demand for more affordable healthcare services would be a potential market for healthtech players.

However, Vietnam still lacks clear regulation framework for telemedicine, which mainly outlines approved telemedicine activities. There is no regulation supporting the reimbursement of telemedicine from social or private insurance. Moreover, undeveloped infrastructure in rural areas and change in behavior for medical staff and patients are two pending issues for the country to handle.

Source:

[1]https://data.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG?locations=ID

[2]https://www.amchamvietnam.com/wp-content/uploads/2021/02/ENG-AmCham-Healthcare-Committee-Whitebook-25082020.pdf

[3]https://assets.kpmg/content/dam/kpmg/vn/pdf/publication/2021/digital-health-vietnam-2020-twopage.pdf

[4] http://hanoitimes.vn/vietnam-applies-telemedicine-platform-to-avoid-community-infection-311954.html

[5]http://www.healthtec.sg/wp-content/uploads/2020/08/2019-Healthtech-Investment-Trends-in-Asia_20-Jan-2020.pdf

[6] https://www.businesstimes.com.sg/garage/news/vietnam-based-startup-jio-health-raises-us5m-in-series-a-funding-round [7]https://doctoranywhere.vn/blogs/tin-tuc-noi-bat/doctor-anywhere-goi-von-thanh-cong-series-c-tri-gia-88-trieu-dola-sing

|

B&Company, Inc. The first Japanese company specializing in market research in Vietnam since 2008. We provide a wide range of services including industry reports, industry interviews, consumer surveys, business matching. Additionally, we have recently developed a database of over 900,000 companies in Vietnam, which can be used to search for partners and analyze the market. Please do not hesitate to contact us if you have any queries. info@b-company.jp + (84) 28 3910 3913 |

Read other articles

[/vc_column_text][/vc_column][/vc_row]

- All

- Business

- Economic

- Energy

- Environment

- Exhibition

- Food & Beverage

- Healthcare

- Human Resources

- Investment

- IT & Technology

- Manufacturing

- Multi-country Research

- Retail & Distribution

- Seminar

- Temporarily closed

- Tet

- Trade